In this article, we shall take a look at the format for an Import Export Code application and what is required from it

Introduction

The Import Export Code is an important document for entering into international purchase and sales transactions. Its significance lies in the fact that it is a government prescribed prerequisite before any commercial shipments can be imported or exported in India. In this post, we highlight the importance of the import-export code and specify the procedure to submit your IEC application online.

Who is Required to Obtain an Import Export Code?

As per the Foreign Trade Policy in India, no import or export can be done without a valid IEC granted by the Director-General of Foreign Trade or an officer authorised by the Director-General. Thus, every importer or exporter of goods (whether Indian or foreign firm) into India has to obtain an Import Export Code.

The IEC may be applied on behalf of a firm – which can be a partnership, LLP, Limited company, trust, HUF or society. A firm needs a valid address, PAN (Permanent Account Number), and a bank account for applying for IEC.

Is IEC Necessary only for Goods and Certain Services?

No, your business would need this not only for import or export but there are other advantages linked to IEC. The IEC number is now necessary for availing advantages under schemes of the DGFT or Ministry of Commerce such as duty drawback, export credit, subsidies on the import of capital equipment, etc.

Is the IEC Application Required for Services?

In the case of the import or export of services or technology, the IEC shall be required only when the service or technology provider is taking benefits under the Foreign Trade Policy or is dealing with specified services or technologies. Thus, it is not mandatory for most service companies to obtain an IEC.

PAN And IEC

After an amendment in tax laws through the Goods and Services Act, the PAN or the Permanent Account Number can function as the IEC of the firm. The IEC is a ten-digit code granted on the Individual PAN or company PAN.

Documents Required for Submitting an IEC Application Online

The following documents must be scanned for upload into the System

- Proof of establishment/incorporation/registration of the Partnership, Registered Society, Trust or HUF

- Proof of Address, which can be any one of the following documents:

- Sale Deed, Rent agreement, lease deed, electricity bill, telephone landline bill, mobile, postpaid bill, MoU, Partnership deed

- Further, other acceptable documents (for proprietorship only): Aadhar card, passport, voter id

- In case the address proof is not in the name of the applicant firm, a no-objection certificate (NOC) by the firm premises owner in favour of the firm along with the address proof is to be submitted as a single PDF document.

- Proof of Firm’s Bank Account

- Cancelled Cheque

- Bank certificate

What are the Other Requirements for Filing an IEC?

- Digital Signatures Token

- PAN

- Mobile Number and Email ID.

- Moreover, Address Details of the Branch Office

- Bank Account in the name of IEC Holder

- Aadhar Card matching the details with PAN Card

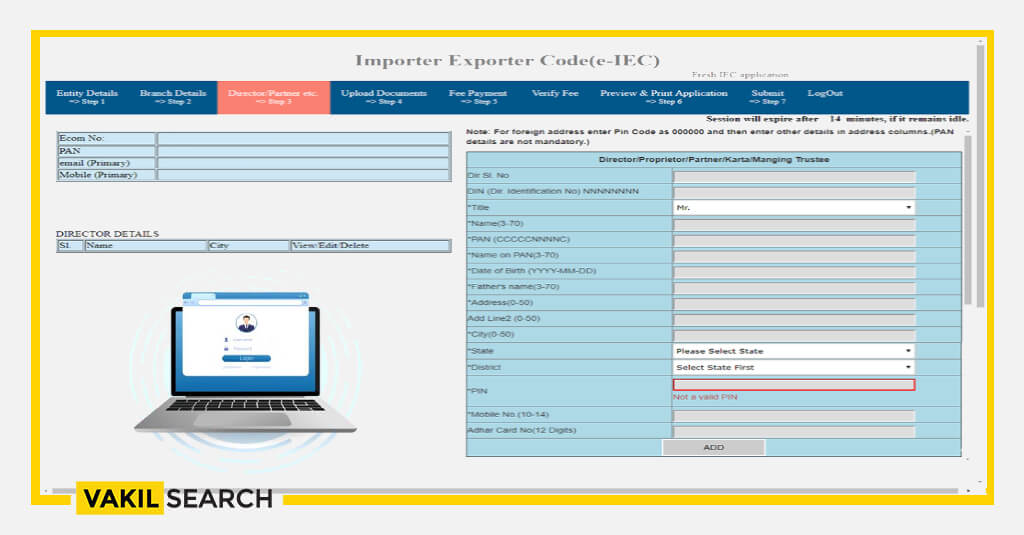

How to Submit an IEC Application Online?

- As a new user, you would have to register on the website of the Directorate General of Foreign Trade. This can be accessed at – https://www.dgft.gov.in/CP/. For this purpose, you would need to enter your email address, mobile number, pin code, district, state, and city. Further, you would also have to choose “Importer/Exporter” in the drop-down menu on the new user creation portal. You’d need to enter the OTP received on the registered mobile number.

- After successful registration, the new details can apply for IEC. To do so, click on the “services” tab from the menu bar and choose “IEC”. Additionally, from this, choose the “Online IEC Application” tab.

- Here, enter your PAN number, name, date of birth, or details of incorporation as applicable. Further, you’d also be required to enter your registered mobile number and click on “Generate OTP”.

- At the landing page, enter the following details – Branch details (if your business has multiple branches), details of directors and partners with their residential proofs and email IDS

- Upload proofs of the above-mentioned documents, cancelled cheque, or bank certificate. Likewise, please note that the IEC application system only accepts PDF format with files up to 5 MB only.

- Click on the “Fee Payment” portal. You can make the requisite fee payment of ₹250 via net banking, debit, or credit card. Further, the portal will also generate a DGFT reference number to check the status of your IEC application.

- Once the application is submitted after paying the fee, you can take a print of the application. Further, at this page, you need to select the “Submit and Generate IEC Certificate”

Format of the IEC certificate issued by the Ministry of Commerce is as follows

- User name

- Address

- Name and Designation of Applicant

- Address of Branch, if any

- IEC Number

- Date of issue

- PAN

Conclusion

Import Export business is what one can call a ‘high priority’ business from the point of view of the economy as it results in deepening the country’s forex reserves and besides improves demand for the Indian Rupee. There are several schemes and incentives available for businesses in this sector. However, as mentioned in this article, you cannot even begin operations for import-export without an IEC number. And the process of IEC, while completely online, still requires some kind of technical knowledge and experienced understanding of how the system works. So it is always advisable to consult with an expert who can ensure that the process of applying for IEC is error-free and smooth. If you have any further queries with regards to IEC, get in touch with us and we will ensure that you receive the right kind of guidance from our team of regulatory experts.