Provident Fund (PF) is an Indian government scheme initiated for employees in India. This scheme helps the employee get benefits during retirement or in emergencies. This scheme is monitored by the ‘Employees Provident Fund and Miscellaneous Provisions Act, 1952’.

Provident Fund (PF), also known as Employees Provident Fund (EPF), is a security scheme for employees working in India. This scheme was started on 4th March, in the year 1952. This scheme serves the employees with their retirement fund. PF helps save a small portion of one’s salary, and this continuous monthly saving process leads to a massive amount after some significant years. Hence, this serves as the retirement fund for an employee. One needs to register for the PF registration certificate to get the benefits of a PF. The Indian government has specified some norms for this purpose. One must follow a straightforward process to apply for a PF certificate. All the required documents must be ready before applying for this certificate.

Importance of PF registration:

The PF not only helps in getting a retirement fund but also helps in many other benefits. As TDS is deducted from an employer’s salary, PF registration is a necessary process. It gives benefits like covering risks, uniformity in the account, emergency fund, long-term investment, protecting pension, and Employee Deposit Linked Insurance Scheme (EDLIS).

PF helps in covering the risks that the employee can face during illness or retirement. The accumulated PF can be used for essential purposes like higher education or marriage. Also, in case of a medical emergency, one can use the PF amount, which can be highly beneficial. The employer contributes 8.33% to the Employee Pension Scheme (EPS) along with the PF.

PF Registration’s Applicability:

PF Registration is essential for establishments that have at least 20 employees. Also, establishments qualified by the prominent Central Government can register for PF. The employer must do the process of obtaining a PF registration certificate wisely.

One must complete the PF registration process within a month; if one fails to do it, one gets penalties. The registered establishments can get the benefits even if there is a decrease in the employee strength, as per the act. The establishments where the maximum employees and the employer have agreed to the fund can apply themselves to the prominent ‘Central Provident Fund (PF) Commissioner.’

The PF Commissioner applies the different provisions from the agreement’s date or any specified date in the contract. The noteworthy responsibility of the prominent deduction of PF amount from the employee’s salary is in the hands of the employer. This responsibility must be carried out correctly.

The Online Process to get a PF registration Certificate

As the world is using the internet for many purposes. Many private and public sector activities are completed online with a rapid flow. The government has also provided an online registration system for a PF certificate. The first step is to start with the establishment’s online registration. The employer has the ability to report the establishment with the help of the below-mentioned details.

Details of establishment:

- One must provide the establishment’s name, PAN, incorporation date, address, and establishment type.

- In the case of a factory, one must provide the significant factory license number, issuing place of a license, and date of the permit.

- In the case of MSME (Ministry of Micro, Small, and Medium Enterprises), one must provide the quite important MSME registration details.

- And, for establishments under the ‘Startup India’ scheme, one must provide the ‘Startup India’ registration details.

Contact persons:

The employer must provide the details of the significant manager, who is the person in contact. These details include the name, gender, PAN, birth date, joining date, and person’s address.

E-mails:

The employer must also provide the authorized person’s emails and mobile numbers.

Employment details:

The employer must also provide the company’s strength, gender, types of services, and employees’ wages.

Division:

The details of the division/branch such as name, address, premise number, and Labour Identification Number (LIN).

Identifiers:

the employer also provides license information which acts as the identifier.

Activities: –

Also, one must provide the NIC (National Industrial Classification) Code to select the nature of the company, industry, and the types of activities performed from a dropdown list available.

Steps to follow while PF registration:

For every registration process, one needs to follow a series of steps. Similarly, in getting the EPF registration certificate as well, one must follow the steps showcased below: –

Use Vakilsearch`s EPF calculator to decide out how an entire lot coins is probably collected for your EPF account even as you retire.

Step 1: – Browsing the EPFO (Employees’ Provident Fund Organisation, India) website:

One must visit the website and click the homepage’s ‘establishment registration’ button.

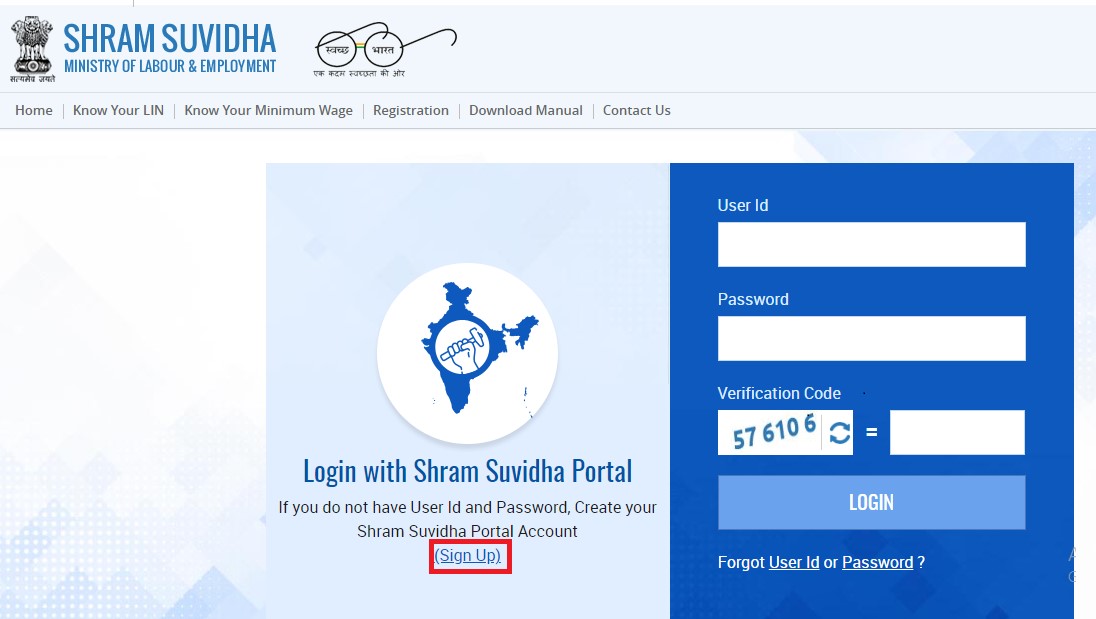

Step 2: – Registering on USSP (Unified Shram Suvidha Portal):

The ‘establishment registration’ button on the homepage of the online portal will take you to the sign-up page – https://shramsuvidha.gov.in/home of the USSP. One must then click on the ‘sign-up button. Then a new window opens, and one must provide the details such as name, mobile number, email, and verification code, and click on the ‘sign-up button, which will eventually create an account.

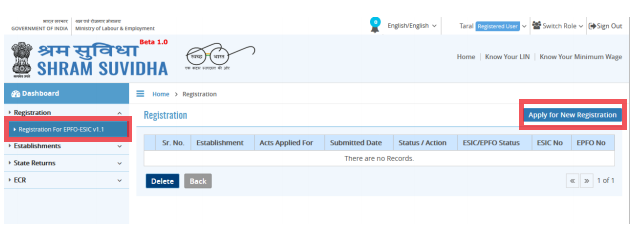

Step 3: – Filling the registration form:

The employer must log in to the US, click the ‘registration for EPFO-ESIC’ button, and proceed further. Then one must select the ‘apply for new registration’ button and get ahead in the process.

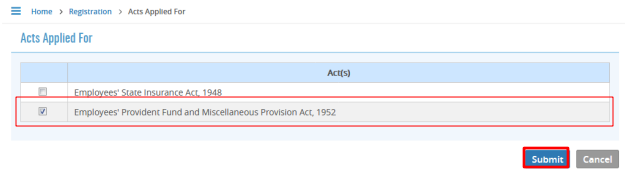

One will see two options: ‘Employees’ State Insurance Act, 1948’ and ‘Employees Provident Fund and Miscellaneous Provisions Act, 1952’. One must then select the ‘Employees Provident Fund and Miscellaneous Provisions Act, 1952’ and submit the form.

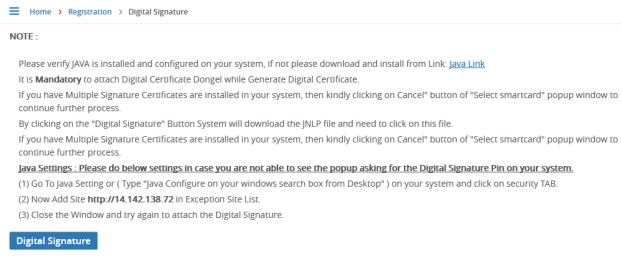

Step 4: – Attaching the DSC (Digital Signature certificate):

After filling in all the details and then notably attaching the documents, the DSC Signature will be attached to the form by uploading it. After securing the DSC, the employer will get a ‘successful registration message on the registered mobile number. Also, one will receive an email from USPS, which will be a confirmation email about the process completion.

Conclusion

Hence, following the above mentioned steps, one can apply for the EPF registration of certificate. The process is not too complex and can be completed quickly if a person has all the required documents. One can complete the registration soon and get the benefits of a provident fund (PF).

One can also get more details about PF, USSP, EPFO, and other scheme-related terms from an online firm called ‘Vakilsearch.’ It is India’s most prominent legal services platform. They also help in completing the registration process quite quickly. They have worked with many big Indian businesses and individuals in the legal and taxation domain.

With a team of highly experienced individuals, they solve many issues rapidly. They have registered 10% of all Indian companies, which is remarkable. They have worked for more than 50,000 customers and are still counting. One can visit their website, and book a call, to solve one’s queries.

Read more,