If you're a registered NGO in India, applying for a PAN Card may seem daunting at first. However, this article will walk you through the process and provide information essential to your application.

In India, a Registered NGO can apply for and receive a PAN Card. This is because the PAN Card is an important document for financial transactions and tax purposes. A NGO needs a PAN Card to open a bank account, receive foreign funds, and file tax returns.

A PAN Card is issued by the Income Tax Department and it contains the Permanent Account Number of the organisation. The PAN number is used to identify the NGO and track its financial transactions. The PAN Card also allows the NGO to avail of certain tax exemptions.

A NGO can apply for a PAN Card by submitting an application form along with supporting documents to the Income Tax Department. The application form can be downloaded from the Income Tax Department website or obtained from a PAN Card agent.

Can NGO Pan card apply online?

If you want to apply for a PAN card for your NGO, there are a few things you need to know. The first is that you need to be registered with the Ministry of Corporate Affairs to be eligible. Secondly, you’ll need to have all the required documents in order – these include your NGO registration, incorporation certificate, and Address Proof. Lastly, you can either apply online or offline – but we recommend going through an agent or an intermediary, as they’ll be able to guide you through the process and help ensure that everything is in order.

Can an NGO Own Shares in Other Parent/Subsidiaries?

Yes, an NGO can own shares in other parent/subsidiary companies. This can help the NGO to diversify its income sources and also protect its financial interests. However, the NGO must ensure that it complies with all the laws and regulations regarding share ownership.

Who Pays Tax on Income Earned by the NGO?

Most NGOs are exempt from paying taxes on their income. However, there are a few exceptions to this rule. For example, an NGO may be required to pay taxes on income if it is engaged in certain types of business activities. Additionally, an NGO may be required to pay taxes on income if it receives funding from certain sources, such as the government.

Offences and Penalties Under the Income Tax Act, 1961

Under section 13A of the Income Tax Act, 1961, every registered charitable or religious trust or institution is exempted from paying tax on its income. However, to avail of this exemption, the NGO must have a valid PAN card.

If an NGO does not have a PAN card, it will be liable to pay a penalty of 10% of the total income from all sources. Additionally, the NGO will also be required to pay income tax at the applicable rate.

It is therefore important for all NGOs operating in India to obtain a PAN card. The process for obtaining a PAN card is quite simple and can be done online.

First, the NGO will need to fill out an application form which is available on the website of the Income Tax Department. Once the form is completed, it should be submitted along with certain documents such as the registration certificate of the NGO and a copy of its bank statement.

After the application is received, the Income Tax Department will issue a PAN number to the NGO. The PAN number will be used for all future transactions undertaken by the NGO.

Does One Have to Be an Indian Citizen to Get a PAN Card for an NGO in India?

No, you don’t have to be an Indian citizen to get a PAN card for an NGO in India. However, you will need to provide proof of identity and residence in India, as well as proof of NGO Registration with the Indian government.

The Process of Registering for a PAN Card as an NGO

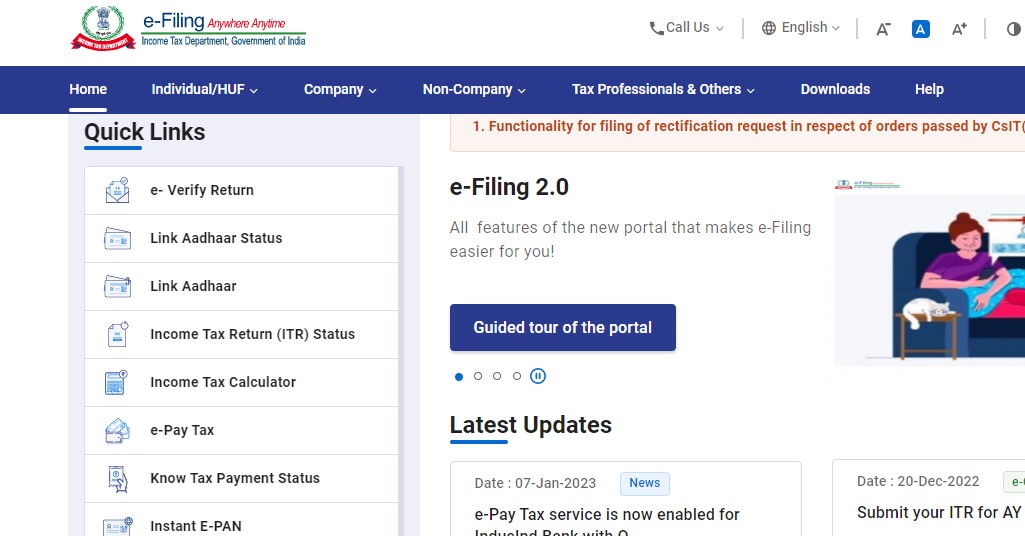

As you may already know, PAN cards are important for financial transactions in India. For NGOs operating in India, a PAN card is essential for carrying out most bank transactions, including receiving foreign donations. Applying for a PAN card is a simple process, and can be done through the Income Tax Department’s website. Here’s how to get started:

- Go to the Income Tax Department’s website: https://www.incometax.gov.in/iec/foportal and click on the ‘PAN’ tab.

- Select ‘NGO’ from the drop-down menu under ‘Type of Applicant’.

- Enter your organisation’s registration number, name, and contact details.

- Upload all the required documents, which include your organisation’s registration certificate and PAN application form.

- Once all the documents have been uploaded, you will be given a confirmation number. Keep this number safe, as you will need it to track the status of your application.

The entire process of applying for a PAN card should take no more than a few weeks. Once you have received your PAN card, you will be able to use it for all financial transactions in India.

Benefits of a PAN Card

A PAN card is an important document for any registered NGO in India. It helps the organisation to keep track of all its financial transactions and also allows it to claim certain exemptions and benefits. Some of the key benefits of having a PAN card are:

1.Allows Exemption from Income Tax: Any NGO that has a PAN card is exempt from paying income tax on donations received from within India. This is a significant benefit as it helps the NGO to save on a significant amount of money which can be used for its various charitable activities.

- Avoids TDS on Donations: If an NGO does not have a PAN card, then any donations received from within India are subject to TDS (Tax Deducted at Source). However, if the NGO has a PAN card, then TDS is not deducted on donations received. This again helps the NGO to save on a significant amount of money.

- Helps in Claiming Foreign Funding: An NGO with a PAN card can easily receive foreign funding as all the required documentation can be easily completed. In addition, foreign donors often prefer to donate to NGOs that have a PAN card as it gives them the assurance that their donation will be used for its intended purpose.

Conclusion

We hope this guide on how to get a PAN card for a registered NGO in India was helpful. Remember, the process can be complicated, but it’s definitely doable as long as you’re following the right steps. If you have any questions or need help with anything, feel free to reach out Vakilsearch and we’ll be more than happy to assist you.