What does ITR stand for or what is ITR? Why should you file ITR? With this let's mention how to download the ITR Form? A complete understanding of different ITR forms and ITR Slabs. What are the Documents required to file ITR? A step wise process on how to file ITR in AY 2021- 2022. Let's also give an idea if it's possible to file an ITR without form 16 and steps to do so. Also discuss the penalties for Late ITR Filing.

Overview of eFiling Income Tax Return

The efiling Portal is an online platform provided by the Indian Income Tax Department for individuals and businesses to file their income tax returns electronically. This e-Filing Income Tax Return platform allows taxpayers to submit their returns from the comfort of their homes or offices, eliminating the need for them to visit the tax department physically.

The efiling portal is user-friendly and easy to navigate. It offers various services and tools to help taxpayers understand their tax obligations and fulfill their tax compliance requirements.

Some of the services and tools provided by the eFiling Income Tax Return portal include:

- Preparation and submission of Income Tax Returns (ITR)

- Provision for uploading and e-verification of tax returns

- Online payment of taxes and challans

- Track the status of tax returns and refunds

- Generation of Form 16 (TDS certificate)

- Downloading of tax-related documents and certificates

Using the e-filing portal allows taxpayers to save time, reduce the risk of errors, and have a convenient and secure way of fulfilling their tax obligations.

What is ITR Filing?

It is a process of submitting an Income Tax Return (ITR) to the Income Tax Department. This return includes details of an individual’s income earned in a financial year, along with the deductions and exemptions claimed to reduce the taxable amount. The process of ITR filing can be done both offline and online.

To download the ITR form, you need to visit the official income tax efiling portal and choose the appropriate ITR form as per your income sources. You can then download the form in Excel, Java, or PDF format.

Why Should You File ITR?

- Individuals falling within the specified tax slabs are required to file their returns.

- Companies or firms must file returns regardless of their financial performance in a given financial year.

- When claiming a tax refund, filing returns becomes mandatory.

- If there is a loss under a specific head of income that needs to be carried forward, filing returns is necessary.

- Residents of India having assets or financial interests in entities located outside India must file returns.

- Residents of India serving as signing authorities in foreign accounts are required to file returns.

- Those receiving income from property held under trusts for charitable, religious, political, educational, or medical purposes, among others, must file returns.

- When applying for a loan or a visa, filing returns is necessary.

- Non-Resident Indians (NRIs) earning income from Indian sources are liable to be taxed in India, necessitating the filing of income tax returns.

With the introduction of efiling for Income Tax Returns, the following scenarios specifically require efiling:

- When a refund is due.

- If the gross total annual income exceeds Rs. 5 lakh.

- In case of an income tax refund requirement.

- The forms ITR 3, 4, 5, 6, and 7 must be e-filed as a mandatory requirement.

Types of eFiling Income Tax Returns

Types of Income Tax Returns E-filing refer to the two main ways to file an income tax return online.

- Self-e-Filing: This is a process of filing the Income Tax Return (ITR) on your own through the Income Tax Department’s official efiling website. In this method, the taxpayer has to complete the ITR form with all the required information, attach the necessary documents, and submit it online.

- Assisted ITR Filing: Assisted ITR filing is a process where the taxpayer can file their income tax return through an authorized intermediary, such as a tax consultant, chartered accountant, or tax-filing website. In this process, the intermediary takes care of the complete ITR filing process, from collecting the required information and documents to submitting the ITR online.

Benefits of eFiling Income Tax Return (ITR):

- Convenient: Efiling eliminates the need to physically visit the tax office and reduces the time and effort required to file tax returns.

- Secure: The online process is secure and protects sensitive information from theft or loss.

- Timely Processing: Efiling results in quicker processing and faster refunds compared to paper returns.

- Accurate: The software helps in the accurate calculation of taxes and reduces the chances of errors.

- Environmentally Friendly: Efiling reduces the use of paper and contributes to a greener environment.

Features of eFiling Income Tax Return:

- Easy to Use: The portal has a user-friendly interface that is easy to navigate.

- Instant Acknowledgement: Efiling generates an instant acknowledgment receipt.

- Paperless: The efiling process is completely paperless and reduces the need for the physical storage of tax records.

- Accessible: The portal is accessible from anywhere with an internet connection.

- Electronic Verification: The portal allows for the electronic verification of tax returns.

Documents Required to Fill ITR

To fill out ITR, you need to provide certain documents such as

- PAN card

- Aadhaar card

- Form 16 or salary certificate

- TDS certificates

- Bank statements

- Investment and property details, etc.

Ensure that you have all the required documents in hand before starting to fill out the ITR form.

Filing ITR is a crucial task and needs to be done correctly to avoid penalties and legal complications. It is advisable to take the help of a professional tax consultant or use online tax filing services to ensure error-free and timely filing of your ITR.

How to Download ITR Form?

- Step 1: Access the official website of the Income Tax Department (ITD) by visiting https://www.incometaxindia.gov.in.

- Step 2: On the homepage’s menu bar, locate and click on the ‘Forms/Downloads’ option. This will lead you to a drop-down menu where you can select ‘Income Tax Returns’.

- Step 3: You will be redirected to a new webpage specifically dedicated to the available ITR forms. Here, you will find a list of all the ITR forms provided. To download a specific form, simply click on the ‘PDF’ option next to the respective form.

New Rules for eFiling Income Tax

eFiling Income Tax Return – The Union Budget 2022 has introduced a new income tax structure with a few changes. Taxpayers now have the option to choose between the new tax regime and the old one. The new tax regime offers lower tax rates, but with the removal of certain tax exemptions. This provides taxpayers with the flexibility to make a choice that suits their financial situation best.

Latest Update of the e-filing Portal

| Up to ₹ 3 Lakh | NiL |

| ₹ 3 Lakh – ₹ 6 Lakh | 5% |

| ₹ 6 Lakh – ₹ 9 Lakh | 10% |

| ₹ 9 Lakh – ₹ 12 Lakh | 15% |

| ₹ 12 Lakh – ₹ 15 Lakh | 20% |

| Over ₹ 15 Lakh | 30% |

3 ways to do e-Filing Income Tax Return

- Income Tax Department’s e-Filing Portal: The official e-Filing portal of the Income Tax Department allows taxpayers to electronically file their income tax returns. To use this method, follow these steps: a. Visit the Income Tax Department’s e-Filing portal (https://www.incometaxindiaefiling.gov.in). b. Register yourself on the portal if you are a new user. Existing users can log in using their credentials. c. Choose the relevant income tax return form and assessment year. d. Fill in the required details, including personal information, income details, tax payments, and deductions. e. Validate the information and generate an XML file of the completed return. f. Upload the XML file on the portal and submit it. g. After successful submission, digitally sign the return using Digital Signature Certificate (DSC) or generate an Electronic Verification Code (EVC) to complete the process.

- E-filing through Online Tax Platforms: There are various online tax platforms available that provide e-filing services. These platforms offer user-friendly interfaces and step-by-step guidance to help taxpayers file their returns. Some popular online tax platforms in India include ClearTax, Tax2Win, and H&R Block. To use this method: a. Choose a reliable online tax platform. b. Sign up or log in to the platform. c. Enter the required information and fill out the income tax return form. d. Validate the details and generate the XML file. e. Upload the XML file on the platform and submit it. f. Complete the verification process using DSC or EVC, as guided by the platform.

- E-filing through Authorized Intermediaries: Taxpayers can also avail of the services of authorized intermediaries such as Chartered Accountants (CAs) or Tax Return Preparers (TRPs) to file their returns electronically. These professionals have access to the Income Tax Department’s e-Filing portal and can assist taxpayers in preparing and submitting their returns. To use this method: a. Engage the services of an authorized intermediary like a CA or TRP. b. Provide the necessary documents and information to the intermediary. c. The intermediary will prepare and file your income tax return electronically on your behalf. d. Review the return before it is submitted. e. Complete the verification process using DSC or EVC, as guided by the intermediary.

How to File an eFiling Income Tax Return?

Steps to do efiling ITRs:

- Step 1: Register for e-filing: To begin the e-filing process, individuals or companies need to register themselves on the e-filing portal of the Income Tax Department of India.

- Step 2: Log in to the e-filing portal: Once registered, log in to the e-filing portal using your User ID (PAN), password, and date of birth/incorporation.

- Step 3: Fill in the ITR form: Select the appropriate ITR form based on your sources of income and fill in the required details. You can either fill in the form manually or import the details from tax preparation software.

- Step 4: Upload the required documents: Upload the required supporting documents such as the TDS certificate, rent receipts, etc.

- Step 5: Verify the return: Verify the return either electronically or through a physical form.

- Step 6: Track the e-filing status: You can check the status of your e-filing on the e-filing portal.

How to Register for Income Tax Return e-Filing?

Steps to register for eFiling Income Tax Return:

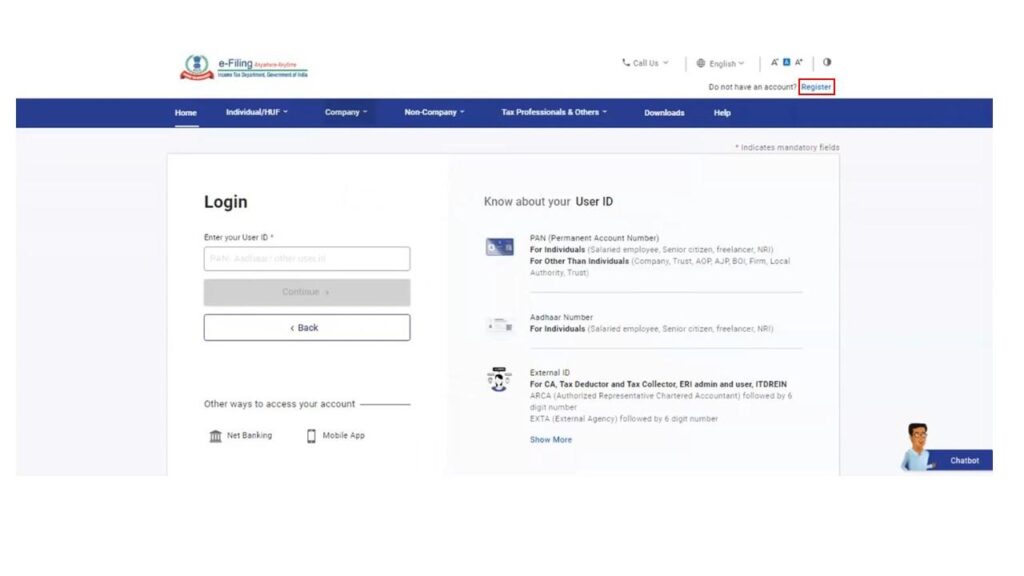

- Visit the e-filing portal of the Income Tax Department of India.

- Click on the ‘Register Yourself’ option.

- Select the type of taxpayer: individual, Hindu Undivided Family (HUF), company, or any other entity.

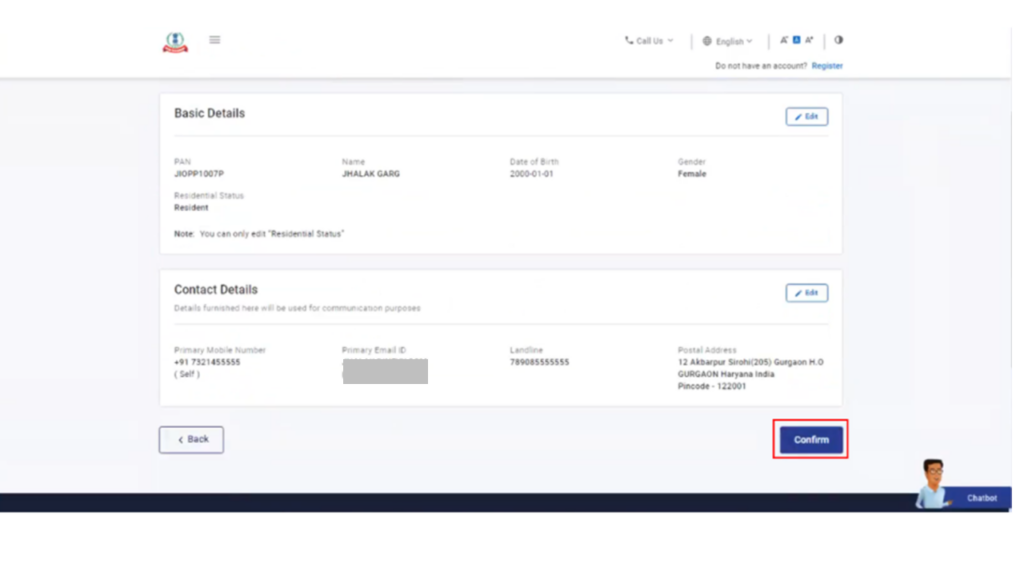

- Fill in the required details such as PAN, name, date of birth, email ID, and mobile number.

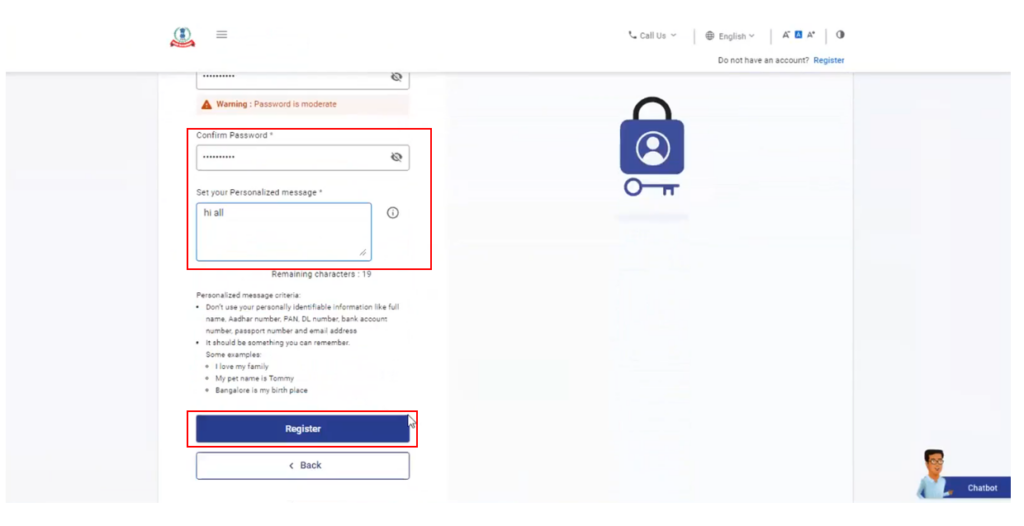

- Create a password and set up a security question.

- Verify your email ID and mobile number.

- Login to the e-filing portal using your PAN, password, and date of birth/incorporation.

How to Register for e-Filing as an Individual?

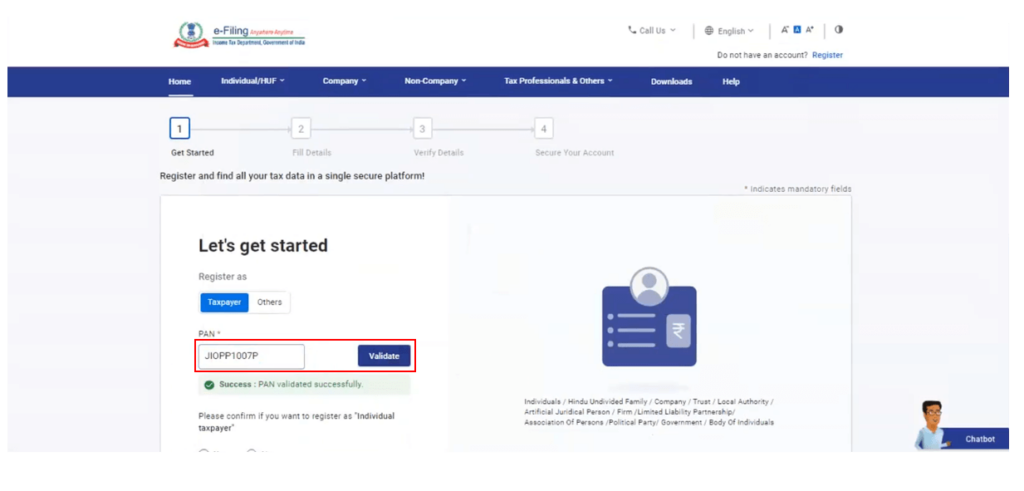

Steps to register for e-Filing Income Tax Return as an individual:

- Visit the e-filing portal of the Income Tax Department of India.

- Click on the ‘Register Yourself’ option.

- Select the taxpayer type as ‘Individual.’

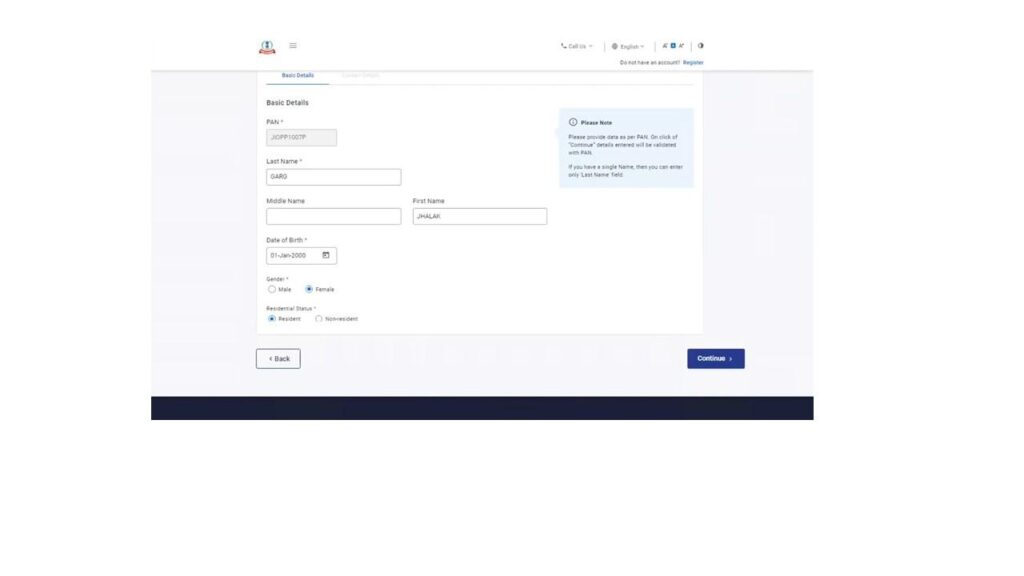

- Fill in the required details such as PAN, name, date of birth, email ID, and mobile number.

- Create a password and set up a security question.

- Verify your email ID and mobile number.

- Login to the e-filing portal using your PAN, password, and date of birth/incorporation.

How to Register for e-Filing for a Company?

Steps to register for eFiling Income Tax Return for a company:

- Visit the e-filing portal of the Income Tax Department of India.

- Click on the ‘Register Yourself’ option.

- Select the taxpayer type as ‘Company.’

- Fill in the required details such as PAN, name, date of incorporation, email ID, and mobile number.

- Create a password and set up a security question.

- Verify your email ID and mobile number.

- Login to the e-filing portal using your PAN, password, and date of incorporation.

How to Check e-Filing Income Tax Status?

Steps to check eFiling Income Tax Return status:

- Login to the e-filing portal of the Income Tax Department of India.

- Click on the ‘My Account’ tab.

- Select the ‘ITR Status’ option.

- Enter the assessment year and the PAN number.

- The status of your e-filing will be displayed on the screen.

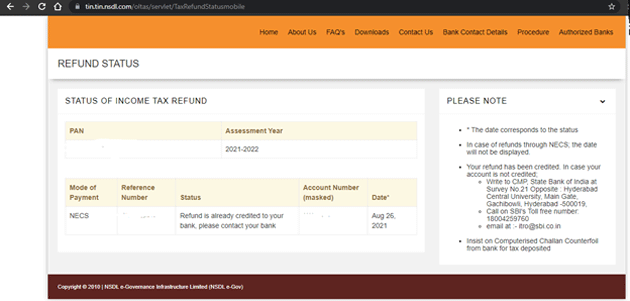

How to Check Refund Status in Income Tax e-Filing?

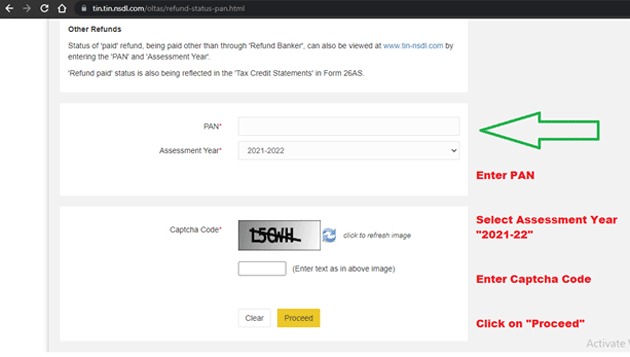

To check the refund status in eFiling Income Tax Return, you can follow these steps:

- Visit the official e-filing website of the Income Tax Department of India (https://www.incometaxindiaefiling.gov.in/)

- Log in to your account using your User ID, password, and date of birth/ PAN number.

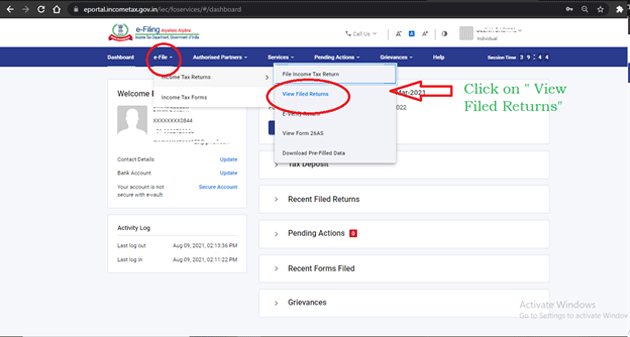

- Go to the ‘My Account’ section and click on the ‘View Returns/ Forms’ option.

- From the list of returns filed, select the relevant assessment year for which you want to check the refund status.

- Click on the ‘View’ button against the selected assessment year.

- In the ‘View Returns’ page, you can find the status of your refund. If the status is ‘Refund Sanctioned’, it means that the refund has been processed and will be credited to your bank account soon.

- You can also track the status of your refund by clicking on the ‘Track Refund’ option in the ‘My Account’ section.

Note: It is advisable to wait for a few days after filing the return to check the refund status as it takes some time for the Income Tax Department to process the refund.

How to Update PAN in eFiling Income Tax Return?

To update PAN details in income tax e-filing, you can follow these steps:

- Log in to the Income Tax e-filing portal using your login credentials.

- Go to the ‘Profile Settings’ section and select ‘PAN Details’.

- On the PAN Details page, you will see your current PAN information. To update it, click on the ‘Edit’ button.

- Enter the correct PAN details and save the changes.

- Verify the updated PAN details and submit the changes.

- You may be asked to upload a scanned copy of your PAN card as proof of the updated information.

- Once you have submitted the updated information, the Income Tax Department will process the request. You can check the status of your PAN update request in the ‘Profile Settings’ section of the e-filing portal.

How to File ITR Online?

Filing ITR online is a convenient and hassle-free process. Here are the steps to file ITR online:

- Register on the income tax e-filing portal using your PAN card details.

- Download the appropriate ITR form based on your income sources and category.

- Fill out the ITR form with accurate details and upload any relevant documents.

- Compute your tax liability and pay any outstanding taxes, if applicable.

- Verify the ITR using one of the available options, such as e-verification, Aadhaar OTP, or sending a signed ITR-V to the CPC.

- An acknowledgment receipt will be generated and sent to your registered email ID upon successful verification.

Which ITR to File?

Choosing the right ITR form to file is important to ensure the accurate and timely filing of your tax return. The appropriate ITR form depends on your income sources and category.

For example,

- ITR-1 is for individuals with income up to ₹50 lakhs

- ITR-2 is for individuals and HUFs with income from capital gains or foreign assets.

It is advisable to consult a tax professional or use an online ITR filing service to determine the correct ITR form for your tax return.

How to File ITR for AY 2023-24

- Gather necessary documents: Collect all relevant documents such as PAN, Aadhaar card, Form 16 (provided by your employer), bank statements, investment statements, and any other supporting documents for income and deductions.

- Choose the appropriate ITR form: Select the relevant ITR form based on your income sources and category. The Income Tax Department may release new forms or update existing ones, so ensure you use the correct form for AY 2023-24. You can find the ITR forms on the Income Tax Department’s e-Filing portal or seek guidance from a tax professional.

- Prepare the return: Fill in the required details in the chosen ITR form. Provide accurate information regarding your personal details, income sources, deductions, and exemptions. Double-check the entries to avoid errors.

- Calculate tax liability: Calculate your tax liability by applying the relevant tax slabs and rates for AY 2023-24. Take into account deductions and exemptions applicable to you. Ensure accurate calculations to avoid any discrepancies.

- Validate and generate XML file: Validate the information provided in the ITR form and generate an XML file using the in-built validation utility available on the Income Tax Department’s e-Filing portal or through tax software approved by the department.

- File the return online: Log in to the Income Tax Department’s e-Filing portal (https://www.incometaxindiaefiling.gov.in). If you are a new user, register on the portal. Then, navigate to the ‘e-File’ section and select ‘Income Tax Return’. Upload the XML file generated in the previous step and submit it. Choose the appropriate verification method.

- Verify the return: After filing the return, verify it within the specified time frame. Verification can be done electronically through Aadhaar OTP, EVC (Electronic Verification Code), or by sending a signed physical copy of the ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

- Keep copies for reference: Once the return is successfully filed and verified, keep copies of the filed return, acknowledgment, and supporting documents for future reference.

Steps to File ITR without Form 16

- Step 1: Evaluate the combined income from various sources such as salary or pension, rent, capital gains from asset sales, interest from fixed deposits and bank accounts, etc.

- Step 2: Compute the Tax Deducted at Source (TDS) by referring to Form 26AS, which can be downloaded from the TRACES website.

- Step 3: Calculate the TDS on your income. If your salary includes House Rent Allowance (HRA), provide your rental receipts to your organization’s payroll department to claim the HRA deduction. If not submitted earlier, you can also claim it while filing your tax return.

- Step 4: Determine your total income for the financial year in which you are filing your tax return. Total income comprises all earned income and the TDS deducted on that income.

- Step 5: Claim eligible deductions on investments and payments while computing your total taxable income. Note that only your own contribution to Provident Fund is deductible, not your employer’s.

- Step 6: Calculate your total taxable income by subtracting the total deductions from your total earned income.

- Step 7: Compute your tax liability for the year based on the applicable tax slab rates.

- Step 8: Determine the tax payable. If the TDS deducted is lower than your calculated tax liability in Step 6, you need to pay the difference. If the TDS exceeds your tax liability, you can claim a refund for the excess tax paid when filing your income tax return.

- Step 9: Proceed to file your income tax return.

Penalty for Late Filing of ITR

In addition to penalties, the following consequences apply if the ITR is filed late:

- Delays in receiving eligible refunds.

- 1% interest on the pending amount for late filing.

| Due Date of ITR Filing | Penalty for Income below Rs.5 lakh | Penalty for Income above Rs.5 lakh |

| Before 31 July | Nil | Nil |

| From 1 September to 31 December | Rs.1,000 | Rs.5,000 |

| From 1 January to 31 March | Rs.1,000 | Rs.10,000 |

e-Filing Portal FAQs

How to reset a password for e-filing Income Tax Return?

To reset your password for e-filing your income tax return, you need to follow these steps: STEP 1: Visit the official e-filing portal of the Income Tax Department of India: https://www.incometaxindiaefiling.gov.in/ STEP 2: Click on the 'Forgot Password' link. STEP 3: Enter the required information such as your PAN number and the registered email address or mobile number. STEP 4: You will receive a link or OTP on your email address or mobile number to reset your password. STEP 5: Follow the instructions to reset your password.

How to change the name in e-Filing Portal Income Tax

To change the name in e-filing of your income tax return, you can do so by following these steps: STEP 1: Log in to the e-filing portal of the Income Tax Department of India using your PAN number and password. STEP 2: Go to the 'Profile Setting' section. STEP 3: Update the details in the 'Personal Details' section. STEP 4: Save the changes.

What is the last date of e-filing Income Tax Return

The last date for e-filing income tax return for the financial year 2022-2023 is 31st July 2023.

How can I file my ITR electronically?

You can file your ITR electronically by following these steps: STEP 1: Visit the official e-filing portal of the Income Tax Department of India: https://www.incometaxindiaefiling.gov.in/ STEP 2: Register on the portal if you are a new user. STEP 3: Log in to the portal using your PAN number and password. STEP 4: Go to the 'e-File' section and select the relevant ITR form for the financial year for which you want to file your return. STEP 5: Fill in the required details and upload the necessary documents. STEP 6: Submit the return and take a print out for your records.

How will the excess tax paid by me be refunded?

If you have paid excess tax, it will be refunded to you by the Income Tax Department through the process of 'tax refund.' You can check the status of your tax refund by logging in to the e-filing portal and going to the 'Refund/Demand Status' section.

What happens if E-filing is not done?

If e-filing is not done, you may be penalized and charged a late fee. Additionally, not filing your ITR on time can lead to tax notices and the possibility of legal action.

Who is exempt from ITR filing?

Not all individuals are required to file an ITR. If your total income for the financial year does not exceed the basic exemption limit, you are exempt from filing an ITR. However, it is advisable to consult a tax professional to determine your ITR filing obligation.

What are the 5 filing statuses?

The five eFiling Income Tax Return statuses for ITR are: Single, Married Filing Jointly, Married Filing Separately, Head of Household, Qualifying Widow(er) with Dependent Child.

Can I file the ITR myself?

Yes, you can file the Income Tax Return (ITR) yourself. The process can be done online through the Income Tax Department's e-Filing portal or using approved tax filing software. However, it is advisable to seek assistance from a tax professional or chartered accountant if you have complex financial situations or need expert guidance.

Is it mandatory to file the ITR?

It is mandatory to file the ITR in certain circumstances, such as if your income exceeds the basic exemption limit, you have earned capital gains, or you have foreign assets. However, individuals falling within specific exemption criteria may not be required to file ITR. It is recommended to check the latest income tax laws or consult a tax professional to determine your filing obligations.

Are there any penalties levied in case the ITR is not filed?

Yes, penalties may be levied if the ITR is not filed within the specified due date. Depending on the delay, penalties can range from Rs.1,000 to Rs.10,000, based on the income level and the time of filing. It is important to file the ITR within the prescribed deadlines to avoid penalties and legal consequences.

Is it mandatory for salaried employees to file the ITR?

Salaried employees are required to file the ITR if their income exceeds the basic exemption limit or if they have income from other sources that need to be reported. It is advisable to review the income tax rules and consult a tax professional to determine your specific filing obligations.

If I have already paid advance taxes and have no dues or refunds, can I skip filing my income tax return?

No, even if you have paid advance taxes and have no dues or refunds, it is generally mandatory to file the Income Tax Return (ITR) if your income exceeds the basic exemption limit. Filing the ITR serves as a declaration of your income and is important for record-keeping and compliance purposes.

Is an ITR useful to me in daily life?

While the Income Tax Return (ITR) itself may not have direct daily implications, filing it accurately and on time is essential for fulfilling your tax obligations and maintaining financial records. An ITR serves as proof of your income, facilitates loan applications, visa processing, and acts as documentary evidence of your financial status. It also helps in claiming tax refunds, if applicable.

What is an Income Tax Return Notice?

An Income Tax Return Notice is a communication from the Income Tax Department to the taxpayer. It can be in the form of an intimation, scrutiny notice, or notice for assessment. It may require the taxpayer to provide additional information, explain discrepancies, or undergo a detailed assessment of their tax return. It is important to respond to such notices within the specified time frame to avoid penalties or legal consequences.

How to Check the Status of Income Tax Return?

You can check the status of your Income Tax Return (ITR) by visiting the Income Tax Department's e-Filing portal (https://www.incometaxindiaefiling.gov.in) and logging into your account. After logging in, navigate to the 'My Account' or 'Dashboard' section and select the option to check the ITR status. You will be able to view the current status of your filed return, whether it is processed, pending, or under scrutiny.