Learn how to download, verify, and update your GST certificate online. Ensure tax compliance, avoid penalties, and maintain accurate business records.

GST Certificate is an official document issued to businesses registered under India’s Goods and Services Tax (GST) system. Available as Form GST REG-06, it includes a unique 15-digit GSTIN, essential for tax compliance, filing GST returns, and claiming Input Tax Credit (ITC). Every registered business must download and verify its GST certificate to ensure legal compliance and smooth operations.

Downloading the GST registration certificate from the GST portal is a straightforward process. Businesses can access it through the “View/Download Certificate” section after logging in with their GSTIN and credentials. Verifying the certificate online through the GST taxpayer search tool confirms its authenticity, helping businesses prevent fraud and ensure supplier compliance.

Regular verification of GST certificates is crucial to avoid penalties, prevent tax-related fraud, and maintain accurate business records. If errors are found in the certificate, businesses can request amendments through Form GST REG-14. Ensuring an up-to-date and verified GST certificate enhances credibility and facilitates seamless business transactions under the GST regime.

In this blog, we will provide a step-by-step guide on downloading, verifying, and updating a GST certificate, along with troubleshooting common issues.

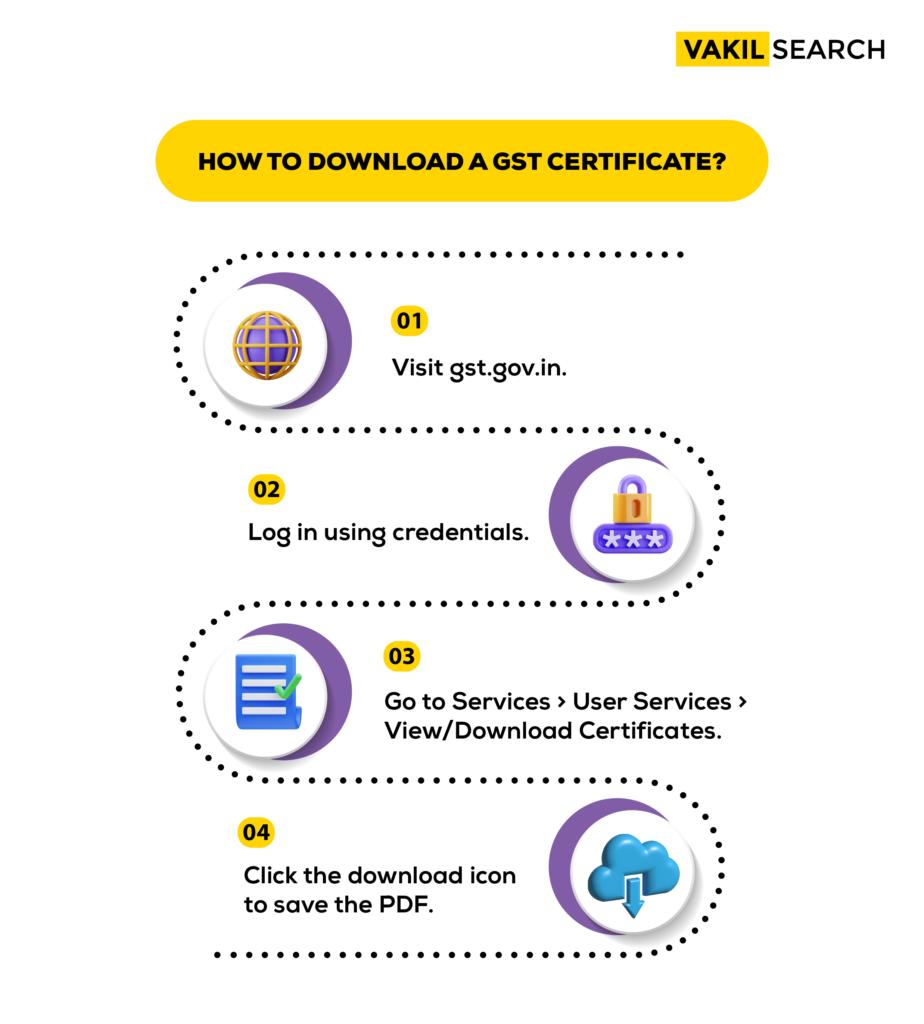

How to Download GST Certificate?

Follow these steps to download your GST Certificate:

- Step 1: Access the GST Portal using your valid credentials.

- Step 2: Navigate to Services > User Services > View/Download Certificates.

- Step 3: Find your GST Certificate and click the download icon.

The Registration Certificate will be downloaded in PDF format. Save the PDF for future reference.

- You can download the certificates by clicking the icon in the Download column.

- The updated address format will only be available in newly generated registration certificates, sequenced as follows: Floor No., Building No./Flat No., Name of Premises/Building, Road/Street, Nearby Landmark, Locality/Sub Locality, City/Town/Village, District, State, PIN Code.

- If there are amended details, the updated/amended Registration Certificate will also be displayed.

Who Needs a GST Registration Certificate?

Businesses with an annual turnover more than the prescribed threshold of a state. E-commerce operators, service providers and businesses supplying goods. All registered societies, charitable organisations and other non-profit entities are also liable to obtain GST registration if they conduct any taxable activities.

How to Verify GST Certificate Online?

Verifying a GST (Goods and Services Tax) certificate online ensures the authenticity of a taxpayer registered under GST. The Indian government provides an easy-to-use online portal for verification. Follow these steps:

1. Visit the Official GST Portal

Go to the GST official website: https://www.gst.gov.in/

2. Access the Search Tool

- Click on “Search Taxpayer” in the top menu.

- Select “Search by GSTIN/UIN” from the dropdown.

3. Enter GSTIN or UIN

- Input the 15-digit GSTIN (GST Identification Number) printed on the certificate.

- Enter the captcha code displayed on the screen.

4. Verify the Details

After submitting, the system will display the following details:

- Legal Name of Business

- Trade Name (if applicable)

- GST Registration Status (Active, Suspended, or Cancelled)

- Type of Taxpayer (Regular, Composition, etc.)

- State and Jurisdiction

- Date of Registration

5. Cross-check Information

Compare the details on the certificate with the online data to ensure accuracy.

What to Do if GST Certificate Details Do Not Match?

In case of discrepancies found during verification:

- Double-check the entered GSTIN on the portal.

- Contact the GST customer care number if issues persist.

- Report mismatched details for prompt corrections to maintain compliance.

How to Resolve the “Signature Not Verified” Issue on a GST Certificate?

If you encounter a “Signature Not Verified” message:

- Update your browser settings to support digital signatures.

- Reinstall the DSC (Digital Signature Certificate) software from the GST portal.

- Reach out to technical support if the issue remains unresolved.

Benefits of Obtaining GST Certificate Online

Obtaining a GST certificate online offers multiple advantages for businesses, streamlining compliance and enhancing credibility.

The benefits of GST certificate are as follows,

- Quick Access and Download: Online GST certificates can be accessed instantly from the GST portal, allowing quick downloads for immediate needs like audits or business transactions.

- Proof of Compliance: Possessing a GST certificate is essential for demonstrating tax compliance, helping businesses establish a clear record with tax authorities.

- Eligibility for ITC Claims: A valid GST certificate is required to claim Input Tax Credit (ITC), reducing overall tax liability and ensuring efficient tax management.

- Faster Verification for Business Partners: Displaying a GST certificate can speed up verification processes, making partnerships more seamless and boosting trust with potential clients and suppliers.

- Having an online GST certificate builds trust with customers and suppliers by showcasing the business’s commitment to tax compliance. This transparency enhances business credibility, often influencing customers’ purchasing decisions and fostering stronger partnerships.

Why is a GST Certificate Important?

A GST Certificate is essential for businesses operating under GST regulations. It serves as official proof of GST registration and is required for:

- Filing GST Returns: Ensures compliance with tax regulations.

- Claiming Input Tax Credit (ITC): Helps businesses reduce their tax liability.

- Legal Compliance: Mandatory for businesses exceeding the GST turnover threshold.

- Business Legitimacy: Validates a company’s GST registration, increasing trust with customers and stakeholders.

What is the Validity of a GST Certificate?

The validity of a GST certificate depends on the type of taxpayer. Below is a summary of the validity period and renewal requirements for different taxpayer categories.

| Type of Taxpayer | Validity | Renewal Required? |

| Regular Taxpayer | Indefinite | No |

| Casual Taxable Person | 90 days | Yes |

| Non-Resident Taxable Person | 90 days | Yes |

What Happens if a GST Certificate Expires?

If the GST certificate expires without renewal, the registration is temporarily deactivated, impacting the ability to conduct taxable activities legally. To reactivate:

- Submit an application for renewal or a new registration if required.

- Resolve any outstanding compliance issues.

- Ensure prompt renewal to avoid penalties and maintain uninterrupted business operations.

What Are the Details Mentioned in a GST Registration Certificate?

A GST Certificate (Form GST REG-06) includes the following key details:

- GSTIN: A unique 15-digit Goods and Services Tax Identification Number.

- Legal Name of Business: The registered name as per official records.

- Trade Name: The name under which the business operates (if different from the legal name).

- Business Type: Indicates whether the entity is a sole proprietorship, partnership, or corporation.

- Principal Place of Business: The main location registered under GST.

- Additional Business Locations: Any other locations where the business operates.

- Type of Registration: Specifies whether the business is a regular taxpayer or part of the composition scheme.

- Date of Registration: The date when GST registration became effective.

- Validity Status: Indicates whether the registration is active, cancelled, or suspended.

Annexure A lists additional business locations, while Annexure B provides information about authorized signatories.

How to Make Corrections in Your GST Registration Certificate?

To amend information in non-core fields of GST registration, follow these steps:

- Go to www.gst.gov.in and log in with valid credentials

- Click on Services > Registration > Amendment of Registration Non-Core Fields

- Fill out the application form and make necessary changes in the editable fields. Use the Verification tab to confirm your details.

- Input your address using the search box, pinning your exact location on the map, and confirm.

- Upon submission, you will receive an acknowledgment via email and SMS.

Common Errors That Can Be Corrected in GST Certificate

Common errors in GST certificates include incorrect trade names, wrong addresses, and inaccuracies in the principal place of business. These mistakes can lead to compliance issues and may hinder the smooth operation of business activities.

The amendment process for a GST certificate typically takes 3 to 15 working days, depending on the nature of the changes and the efficiency of the tax authorities in processing the application.

How Long Does It Take to Amend the GST Registration Certificate?

What Changes Can Be Made in the GST Registration Certificate?

Once the applicant is registered under GST, the requirement for amendments in registration might arise due to several reasons such as a change in address, change in contact number, change in business details and so on. In order to amend any information post registration, the taxpayer needs to file an Application for Amendment of Registration. Application for Amendment of Registration, can be categorised in two types:

- Application for modification of the Core Fields of Registration

- Application to modify the Non-Core Fields in the Registration

Core Fields in GST Registration: Core fields of GST registration are the very crucial details that, after an update, require the confirmation of tax officials. In that case, these are given below:

- Business Name or Legal Name without any updation in PAN.

- addition/removal of stakeholders

- Change of the primary or other business addresses, so far as there is no change in state

Non-Core Fields and Rectifications: Under GST, all the non-core fields found in the GST registration undergo fewer formalities and don’t necessarily require official validation when changed. These are all those information except the Legal name, Stakeholders, and the Main business location. All of these are easy to update details auto-populating in the taxpayers’ registrations.

Amendment Restrictions and Timeline: There are a number of amendments that can never be altered such as change in PAN, constitution of the business, or shifting the company to some other state, for which new registration would be required. Any type of amendment has to be filed within 15 days of the date of alteration. The application is current for 15 days in total and then gets purged if not filed within that duration.

Conclusion on GST Certificate

A GST Certificate (Form GST REG-06) is essential for businesses registered under India’s GST system. It serves as proof of GST registration, enabling tax compliance, GST return filing, and ITC claims. Downloading the certificate from the GST portal ensures easy access, while online verification prevents fraud and confirms legitimacy.

Regularly verifying and updating the GST certificate helps businesses avoid penalties and maintain accurate records. If discrepancies arise, corrections can be made through Form GST REG-14. Ensuring a valid and verified GST certificate enhances business credibility, smooth transactions, and legal compliance under GST regulations.

Need help with GST registration or certificate corrections? Contact Vakilsearch for expert assistance!

Frequently Asked Questions (FAQs) on GST Certificate

What is a GST certificate in India?

A GST Certificate in India is an official document issued upon GST registration via Form GST REG-06. It includes a 15-digit GSTIN, confirming tax compliance. Required for filing returns, claiming ITC, and business legitimacy, it is digitally available on the GST portal (www.gst.gov.in) and must be maintained for verification.

Who needs GST certificate?

Businesses exceeding the GST turnover threshold ₹40 lakh for goods, ₹20 lakh for services need a GST Certificate. It is also mandatory for e-commerce operators, service providers, casual taxable persons, non-resident businesses, and entities involved in inter-state trade to ensure tax compliance and legal operations under GST laws.

Is GST certificate compulsory?

Yes, a GST Certificate is compulsory for businesses exceeding the GST turnover threshold (₹40 lakh for goods, ₹20 lakh for services). It is required for filing GST returns, claiming ITC, and legal compliance. Without it, businesses cannot legally collect GST or avail tax benefits under the GST regime

Can the GST Certificate be used as proof of business registration?

Yes, the GST Certificate serves as valid proof of business registration and GST compliance. It is often required for legal, financial, and contractual transactions

Is it mandatory to display the GST Certificate at business premises?

While not legally mandatory, displaying the GST Certificate at business premises is recommended. It facilitates tax inspections, builds customer trust, and ensures smooth transactions with vendors

How do I download my GST certificate?

To download your GST certificate, visit the official GST portal (www.gst.gov.in) and log in with your credentials. Navigate to the Services tab, select User Services, and click on View/Download Certificates. Your GST registration certificate (Form GST REG-06) will be available for download in PDF format. Ensure your GSTIN is active before downloading.

Is There Any Fee for Downloading the GST Certificate?

No, there are no fees for downloading the GST Certificate from the GST portal. The download is completely free of charge.