You want your company to be registered with EPF because you want to provide the greatest care and benefits to your employees. We'll walk you through all of the stages and components of EPF.

Essentially, the EPF functions as a benefit programme for employees, ensuring that their life after retirement is financially secure. Employees and employers both contribute to the scheme. Employees are entitled to withdraw the cash in their EPF account at the time of retirement. Further, their EPF accounts will include their contribution, their employer’s contribution, and interest accumulated on both of those amounts. As a result, such a scheme is extremely beneficial to employees in both the commercial and public sectors. The employee provident fund organisation is the entity in charge of the administration of such accounts.

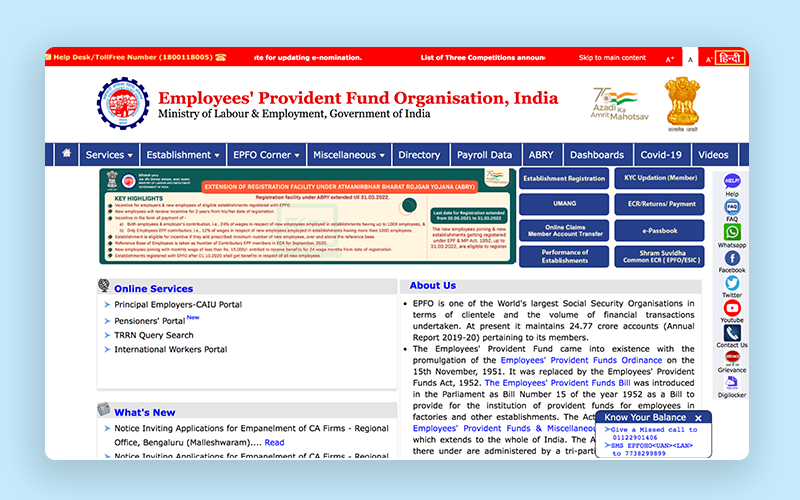

Employees Provident Fund (EPF) could be a theme below the staff’ Provident Funds ANd Miscellaneous Provisions Act, 1952. it’s regulated under the horizon of the Employees’ Provident Fund Organisation (EPFO) that is one in all the world’s largest Social Security organizations in terms of people and therefore the volume of monetary transactions undertaken. Basically, EPF is sort of a profit to an worker throughout the retirement provided by the organization.

Eligibility of EPF Registration

The following establishments have to mandatorily sign up for the EPF scheme:

- Any business with 20 or more employees is obligated by law to deduct EPF

- Organisations with less than 20 employees are eligible under certain conditions

Information Required for Online EPFO Registration

EPF registration can be completed online by submitting an application. The application form is available on the EPFO’s official website – https://www.epfindia.gov.in/site_en/index.php. Companies must also submit Form 5A and Annexure 1. It requires the following information to be filled:

- Name of the company

- Address of the company

- Details of head office and branches

- Date of incorporation or registration

- Total employee strength

- Type of business

- The legal status of the company

- List of names and addresses of directors/partners

- Wage details of employees

- Bank details

- PAN details

- Employees’ basic details.

Documents Required for EPF Registration

- Partnership deed – partnership firms

- Certificate of Incorporation- public/private limited company

- Registration certificate- societies/trusts

- Rules and objectives- societies/trusts

- Income tax related documents

- PAN details

- Memorandum of Association- public/private limited companies

- Articles of Association- public/private limited companies

- Proof of Incorporation – sales invoice/license/salary invoice

- Salary details

- Balance sheet.

How to Upload DSC

For registering under the EPF scheme, you need to upload your Digital Signature Registration Certificate (DSC).

Step 1

Visit the official EPFO website

Step 2

Log in using your ‘Username’ and ‘Password’

Step 3

From the homepage go to the digital certificate tab

Step 4

Select the ‘Register Certificate’ option

Step 5

The page will then display the company details

Step 6

It will contain details of the employer such as name, mobile number, and email ID

Step 7

Once you check everything, click on ‘Next’

Step 8

Then, choose the type of DSC you wish to upload

Step 9

Choose the USB option and click on ‘Run’

Step 10

Click on the ‘USB token’ and then upload or connect your DSC USB token

Step 11

Select this certificate and authenticate by entering your PIN details

Step 12

Once verified, click on ok.

Use Vakilsearch’s EPF Calculator to find out how much money you have left in your EPF account before you retire.

How Does the EPFO Online Registration Process Work?

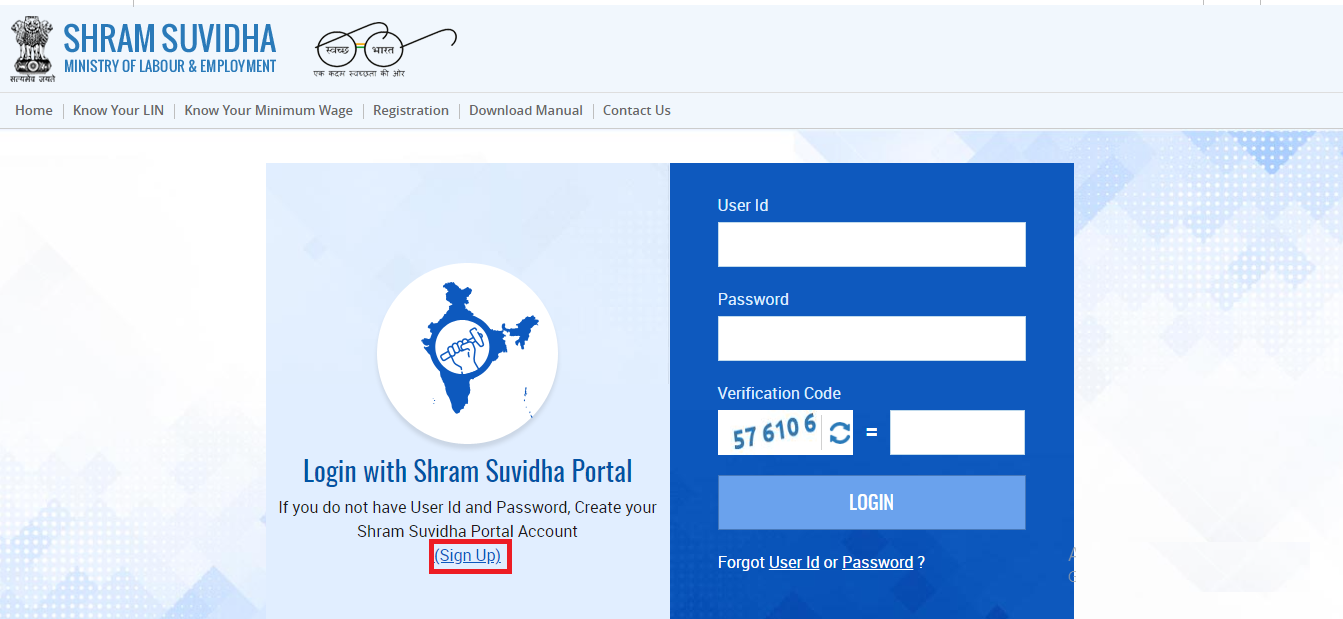

Step 1

Visit the E-Sewa portal

Step 2

Go through the instructions thoroughly to know how to upload the documents

Step 3

Click on the ‘Employer Sign in’ option

Step 4

Next, click on the ‘New Registration’ tab

Step 5

Once you have read all the instructions, click on ‘Register’

Step 6

Fill in all the required details

Step 7

Recheck and then submit the form online

Step 8

Enter the CAPTCHA shown on the screen

Step 9

Next, click on the ‘Get Pin’ option

Step 10

You will now receive an OTP on your registered mobile number or email ID

Step 11

Likewise, enter this OTP and click on the ‘Submit’ button

Step 12

Download the PDF once you are done. This PDF needs to be submitted to the EPF office later.

How Can I Check My EPF Balance?

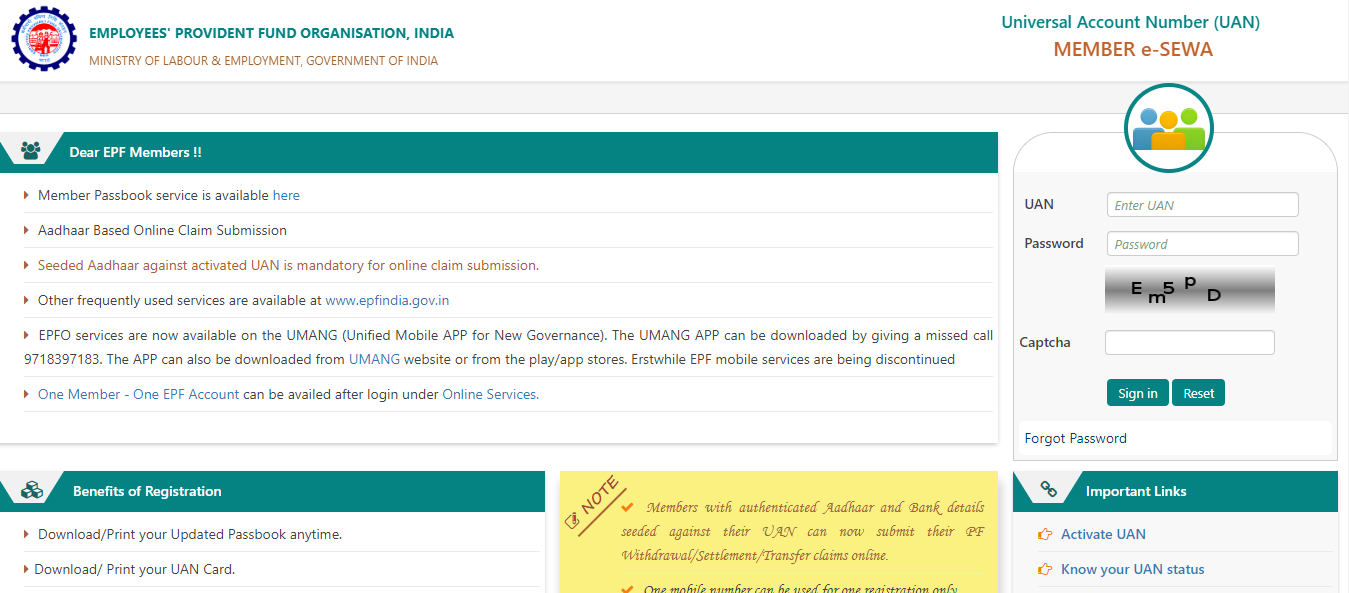

Step 1

Visit the official website of the EPFO

Step 2

Log in to the portal to check the EPF fund balance

Step 3

You can then access your EPF account passbook (this webpage contains details regarding your account and the balance in it).

Conclusion

The provident fund can be a great support, safety, and assurance for employees as it offers a sense of financial security to the employees. It is regulated by the EPFO Claim Status, which is also one of the most well known and biggest social security organisations in India. They handle huge amounts of financial transactions on a daily basis. The process of applying for the provident fund is also not a difficult task as long as you have a professional to help you sort things out.

Our experts will serve as your counsellors and consultants for PF online registration, assisting you in obtaining your PF number within 5 to 10 business days. You will get the gist of our PF process during the initial consultation, which is completely free of charge. When we work on your behalf, we make certain that the PF application for the organisation is submitted in the prescribed format and without any errors.

Also, Read: