Learn how to calculate interest on RD in Excel in India using Microsoft excel. Tips on using excel's built-in functions for RD calculations

Overview: Calculate Interest on RD

Recurring Deposits (RDs) are a popular investment option for individuals looking for a safe and low-risk way to save money while earning interest. An RD in excel is a term deposit offered by banks and financial institutions in India. Investors deposit a fixed sum each month for a predetermined period, typically 6 months to 10 years.

Calculating interest on an RD can be a cumbersome and time-consuming task, but with the help of Microsoft excel, the process can be simplified and streamlined. In this article, we will look at how to calculate interest on RDs in excel in India.

Understanding RDs in India

Before we dive into the nitty-gritty of calculating interest on RDs in excel, it’s important to understand the basics of RDs in India. An RD Calculator is a term deposit where the investor deposits a fixed sum of money each month for a predetermined period. The interest rate offered on RDs varies from bank to bank and can range from 4% to 7% per annum.

RDs are a popular investment option in India as they offer a safe and low-risk way to save money while earning interest. The interest earned on RDs is taxable per the investor’s tax slab rate. However, some banks offer tax-saving RDs, which offer tax benefits under Section 80C of the Income Tax Act.

Calculating Interest on RDs in Excel

Now that we have a basic understanding of RDs in India, let’s look at how to calculate interest on RDs in excel.

Step 1: Open a new excel spreadsheet and create a table with the following columns

- Monthly deposit: The amount deposited each month

- Rate of interest: The interest rate offered on the RD

- Term: The duration of the RD

- Total deposit: The total amount deposited for the RD

- Interest earned: The interest earned on the RD

- Maturity value: The total amount that will be received at the end of the RD term, including interest earned.

Step 2: Enter the monthly deposit amount in cell B2, the rate of interest in cell B3, and the term in cell B4.

Step 3: Calculate the total deposit by multiplying the monthly deposit amount by the number of months in the RD term. For example, if the RD term is 36 months and the monthly deposit amount is ₹ 5,000, the total deposit would be ₹ 1,80,000. Enter this formula in cell B5: =B2*B4

Step 4: Calculate the interest earned on the RD using the formula: (Total Deposit * Rate of Interest * Term) / (12 * 100). Enter this formula in cell B6: =(B5B3B4)/(12*100)

Step 5: Calculate the maturity value of the RD by adding the total deposit and interest earned. Enter this formula in cell B7: =B5+B6

Step 6: You can now copy the formulae in cells B5, B6 and B7 to the entire column to get the total deposit, interest earned, and maturity value for different months or periods.

You can use excel’s built-in functions, such as FV, PV, PMT, and RATE, to calculate RDs with different parameters like varying interest rates, deposit amounts, tenure, and frequency.

“Get accurate results with our Recurring Deposit Calculator. Use our RD Calculator Online Free today!”

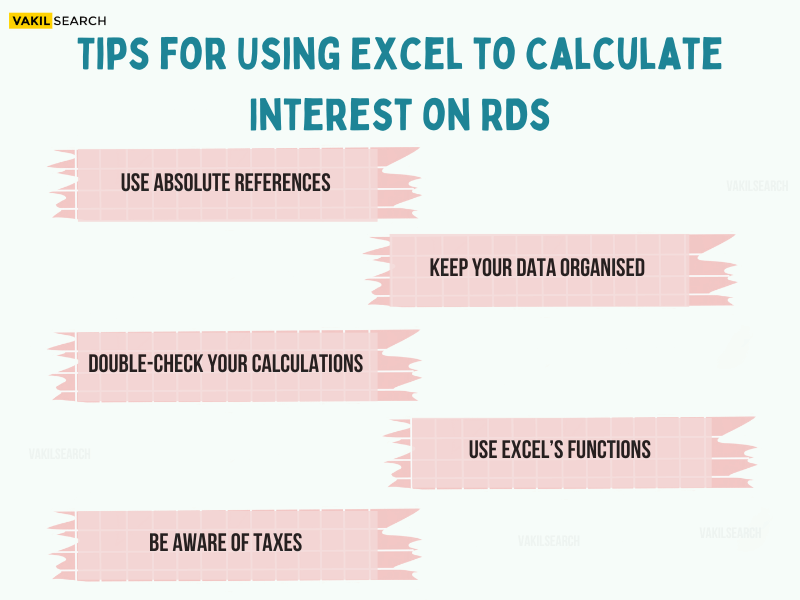

Tips for Using Excel to Calculate Interest on RDs

Here are a few tips to keep in mind when using excel to calculate interest on RDs in India:

-

Use Absolute References

When copying the formula to other cells, use absolute references for the interest rate and term. This will ensure the formula calculates each cell’s interest rate and term correctly.

-

Keep Your Data Organised

Keep your RD data organised in a table with clear column headings. This will help you quickly find the necessary information and ensure accurate calculations.

-

Double-Check Your Calculations

Before finalising your RD calculations in excel, double-check your formulas and make sure that you have entered the correct data in each cell.

-

Use Excel’s Functions

Excel has several built-in functions that can make RD calculations easier, such as FV (future value), PV (present value), PMT (payment), and RATE (interest rate). These functions can calculate RDs with varying parameters like interest rates, deposit amounts, tenure, and frequency.

-

Be Aware of Taxes

Remember that the interest earned on RDs is taxable as per your income tax slab rate. Make sure to include the tax liability in your calculations to estimate the maturity value accurately.

Conclusion

Calculating interest in RDs in India can be tedious, but using excel can simplify and streamline the process. By creating a table with clear column headings and using excel’s built-in functions, you can easily calculate an RD’s total deposit, interest earned, and maturity value.

The RD calculator offered by Vakilsearch is a valuable tool that assists people in computing the interest earned on their recurring deposit investment. It saves valuable time and effort by delivering prompt outcomes, eliminating the need for manual computations.

Users can obtain the final value and complete interest earned by merely entering the deposit amount, duration, and interest rate. This facilitates individuals in making well-informed decisions regarding their investment and selecting the most suitable recurring deposit alternative to meet their financial objectives.