Employees must register for ESIC (Employee’s State Insurance Scheme) to get insurance benefits for their family members and the employee themselves. ESIC involves details about the family, and one can update or edit the details with the help of the employer. The employer of the company can change the information in the company’s ESIC portal. The process of modifying and developing the family information of an ESIC registration is quite simple.

The ESIC Registration Act was passed in 1948, and it deals with the security of employees and their family members. This Act was passed to provide security to workers in private sector companies in India. And, the workers and their family members can benefit from the ESIC registration as many times as needed during the working years. Hence, it is an amazing and very helpful scheme for private sector workers, and their family members. Know how to edit esic online through ESIC employee login.

The registration of this scheme has been made online by the government of India; hence, it takes very less time to register for it. However, one must have all the necessary documents ready before applying to register for the ESIC scheme. According to ESI Act, to register for the ESIC registration, there must be ten or more ten employees in the organization. And, workers who get up to INR 15,000 in monthly salary can register for the ESIC scheme.

All the states and union territories in India must adhere to the ESI Act, 1948 except Manipur, Arunachal Pradesh, Sikkim, and Mizoram. More than one crore of employees have registered for the ESIC scheme, and this has helped many workers immensely. Every year, thousands of workers get benefits from this scheme and save money on expensive treatments and other hospital expenses.

Contribution of ESIC Registration – ESIC Employee Login

ESIC is a self-financing health insurance program, that helps to save the amount required for treatment. And, as a result, a predetermined percentage of salary from both employers and employees will be used to support the benefit of this scheme. At the current time, both the employers and employees each contribute 4.75 percent of the wages paid to employees towards the ESIC. Employees who make INR 100 per day are exempt from contributing shares.

The entire ESIC contribution is covered by the employer, for each employee. Within 21 days of the calendar’s final day. And, these deductions are made from the employee’s wage bill at the stipulated rate and submitted with the Employee’s State Insurance Scheme (ESIC). Many banks like the State Bank of India (SBI) and other banks have been designated by ESIC as locations to receive the ESIC contributions deposits.

Eligibility for ESIC Registration

For ESIC Registration eligibility, a factory or any other enterprise must have a minimum of ten full-time employees, and the monthly salary of each employee should not exceed Rs 21,000 to qualify.

Benefits of ESI Registration for Employees

ESIC Registration offers various benefits to employees. It provides coverage for employees who are unable to work due to reasons such as illness, pregnancy, or work-related injuries, offering financial assistance to compensate for lost wages. Additionally, the ESIC plan also covers the medical expenses of the dependents of the employees.

Benefits of ESIC Registration Online for Employers

Employers can benefit from ESIC Registration online by ensuring compliance with India’s rules and regulations. It can serve as a tool to attract the right talent to their business and can be used as an employee perk, contributing to human resource retention.

Is ESIC Registration a legal requirement for all employers?

ESIC Registration is a legal requirement for all employers with more than 10 workers and monthly earnings below Rs.21,000 per month (or Rs.25,000 per month for employees with disabilities). It mandates registration with the ESIC and contribution to the Employees’ State Insurance Scheme (ESI).

Benefits of ESIC registration

There are many benefits of the ESIC scheme for private company workers. Various medical and illness benefits are available to employees who are enrolled in the ESIC scheme. The following four categories represent the main benefits offered by this scheme: –

Health Benefits

Per year an employee can receive a sick benefit of 70% of the salary for a maximum of 91 days registered under the EICI plan. The employee can be eligible for this benefit only if he/she has paid into the system for 78 days within a six-month contribution period. Some employees registered in this scheme, also get enhanced and extended illness benefits.

Healthcare Benefits

The ESIC online registration helps the employees and their families with full medical support right from the first day of the plan. The cost of an insured person’s treatment or his family member’s treatment is not capped. By paying an annual sum of INR 120, it also helps to provide medical treatment to permanently disabled and elderly covered persons and their spouses.

Disability Benefit

ESIC-covered employees are eligible for a temporary disablement benefit at a rate of 90% of the salary, as long as the disability persists. A permanent disablement benefit (PDB) is granted at the rate of 90% of the salary in a monthly payment form, depending on how much one’s earning ability has been lost, and this is determined by the medical board.

Maternity Benefit

Maternity benefits to pregnant women for confinement or pregnancy are paid for three months. However, this leave can be extended by an additional month according to the doctor’s recommendation. These benefits are paid at the rate of the full wage, for the previous year’s 70 days, subject to contribution.

Hence, these were the four categories that can be helped with the help of this scheme. Hence, registering for the ESIC scheme can help you to get many medical benefits for the family.

Steps to edit the details in the ESIC Employee Login online: –

It is possible to edit the family details in your ESIC registration portal with the help of the employer. And, one must follow the following steps to make changes to one’s ESIC registration: –

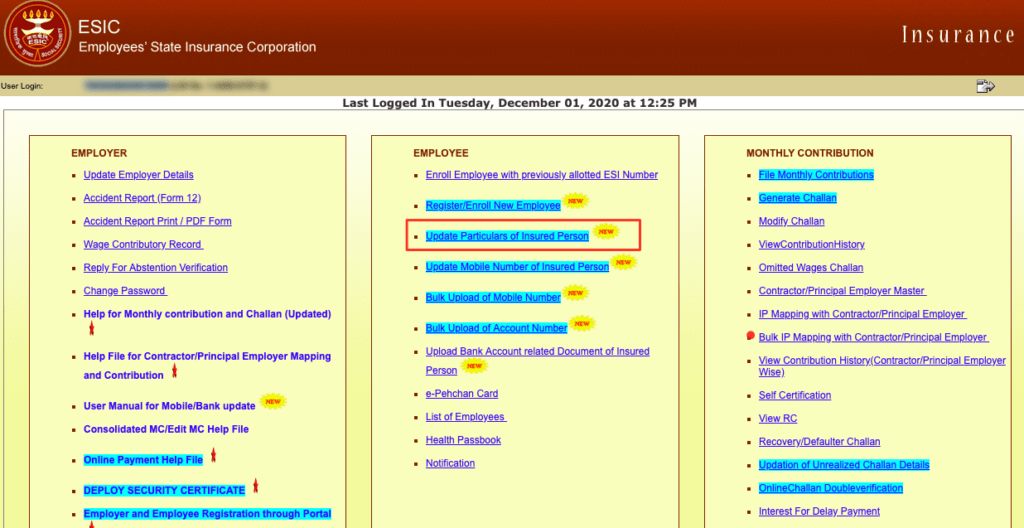

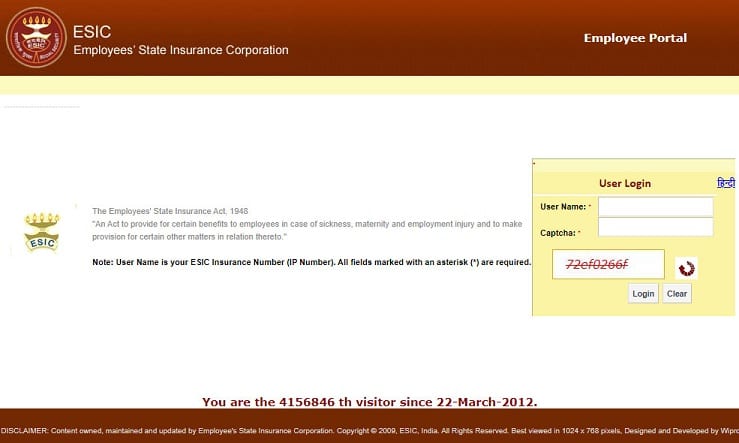

- Firstly, register on the ESIC site using your registered username and password for your specific workplace.

- Then, select the “Update particulars of insured person” under the employee area, on the ESIC portal main page.

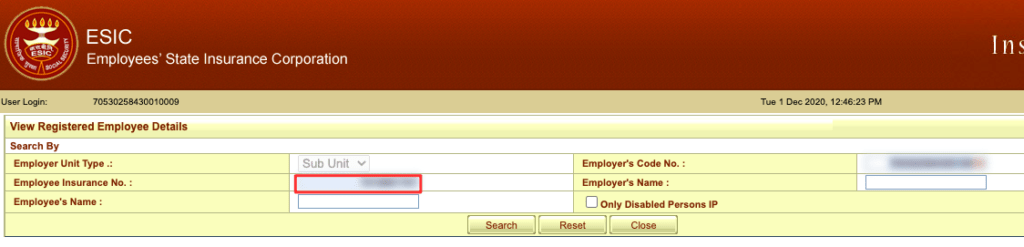

- Now, by clicking on the search button, you can input the insured’s numbered address or IP details. After this, the employee’s name will be shown, then one must select the edit option from the drop-down menu.

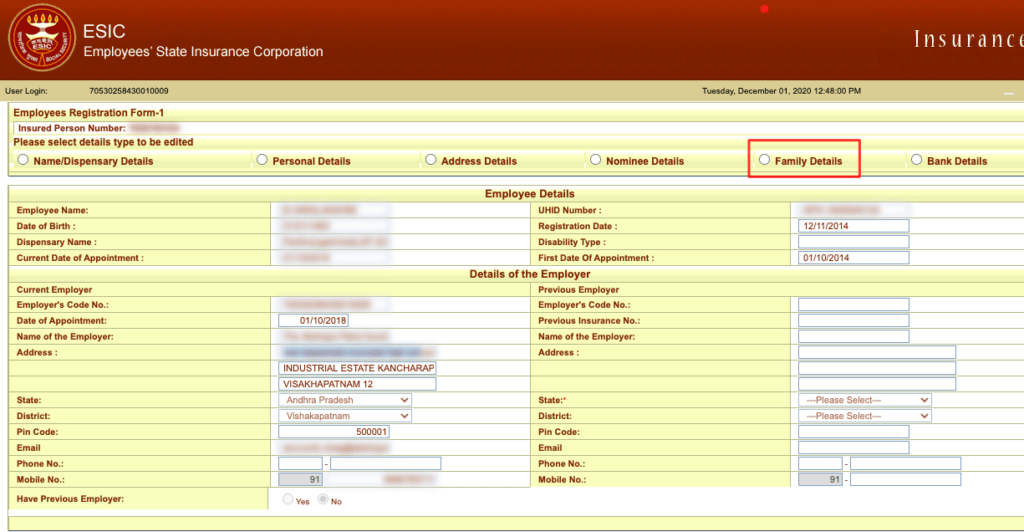

- One can edit the employee’s family data by clicking on the “Family Details” link. One can even make changes to the previously updated information in this step.

- Then the ESIC employee login portal will add your family members to the account if you have accepted and clicked on the submit button on the declaration.

- If the employee wishes to remove a family member from the list of members, he/she can even do so, in the edit option.

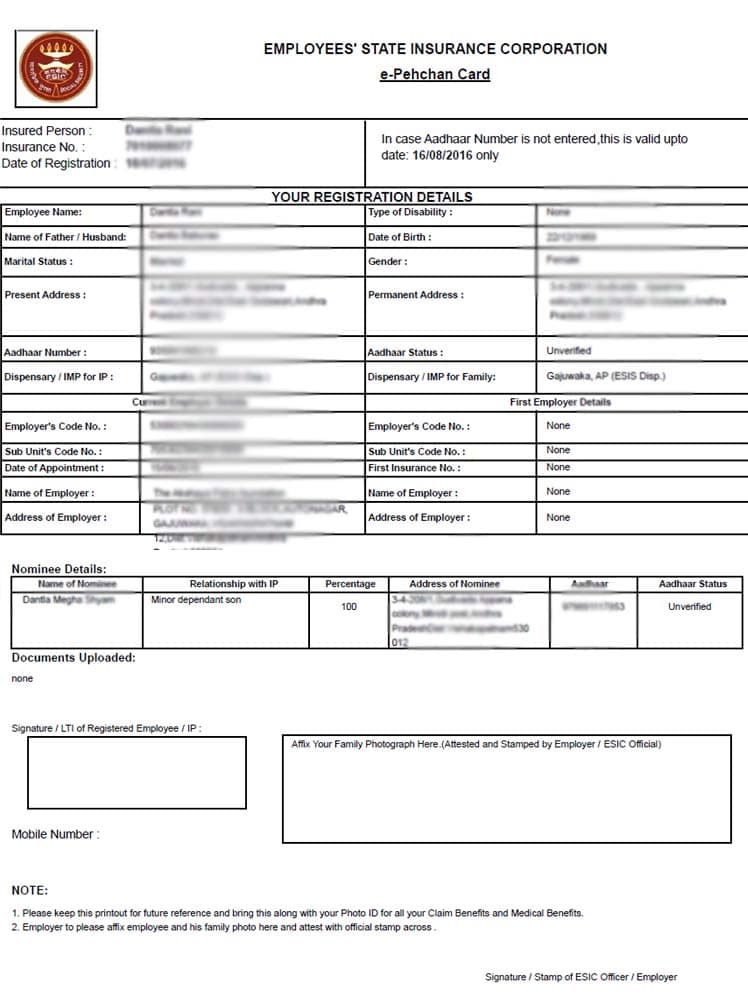

- The employer will issue a new ESIC Pehchan card with the revised information upon completing the update process on ESIC Portal.

- This new Pehchan card will allow the insured person and the family members to receive medical facilities at the local ESIC facilities.

Hence, these were the main eight steps that must be followed to make changes, edit, and update the employee’s family details on the ESIC portal. It is a simple process and doesn’t take a lot of time to do the changes in the ESIC portal.

FAQ’s

Does ESI cover my wife pregnancy?

Yes, ESI coverage includes maternity benefits for pregnant women employees. The ESIC Act provides health and medical benefits to the insured person and their dependents, including pregnant women and newborn children.

How do I delete an employee name in ESIC portal?

Deleting an employee name requires employer action through the company portal.

Who will approve family details in ESIC portal?

The family details in the ESIC portal are typically approved by the employer or the authorized representative. The employer can update the family information online or through the ESIC Employee login portal.

Does ESI coverage family members?

Yes, ESI coverage includes family members, as it provides health and medical benefits to the insured person and their dependents

How many family members we can add in ESIC card?

You can add all eligible family members, but your employer might require specific documents for each addition.

How do I change my family dispensary on ESIC?

Contact your employer or visit the nearest ESIC branch to update your preferred dispensary.

How can I remove ESI from salary?

You cannot opt out of ESI if your salary falls within the mandatory coverage limit.

What is the process of name change in ESIC?

To change your name under ESIC, Inform your employer and provide updated documents (ID proof with new name) for processing the change.

How can I check my ESIC details?

To check your ESIC details, you can log in to the ESIC portal using your registered username and password for your specific workplace.

What is family under ESIC?

Under the ESIC Act, family members include the spouse, children, parents of the insured person. The ESIC coverage provides health and medical benefits to the insured person and their dependents.

What is the maximum claim limit for ESI?

ESI does not specify the maximum claim limit. However, you can contact the ESIC authority or your employer for more information.

What is the maximum salary for ESIC deduction?

Currently, ESI applies to wages up to INR 21,000 per month.

Is ESIC applicable for 25,000 salary?

No, ESI applies to wages up to INR 21,000 per month.

Who is not eligible for ESIC?

Not all employees are eligible for ESIC coverage. Employees who work in certain sectors or have a specific salary bracket may not be eligible for ESIC benefits. To determine eligibility, you should contact the ESIC authority or your employer for assistance.

Conclusion: –

Hence, this was all about ESIC registration and how an employee can make changes in the ESIC Employee Login online. Employers can also make use of the ESIC portal to attract the right talent for their business. Hence, it acts as a perk to retain the human resource for one’s business. Hence, one must create an account on the ESIC portal and get the maximum health and medical benefits for all the family members and oneself.

If you face any issues while registering on the portal you can take help from an expert, or your friend who has already registered on the portal. There is an Indian law firm known as ‘Vakilsearch’ that can help you with many legal, taxation, and compliance processes. Vakilsearch has helped more than 10% of Indian companies in registering themselves, and, they have more than 500,000 trusted customers, who have gained amazing results. Vakilsearch’s team of highly expert advocates, attorneys, and chartered accountants has helped many people to solve their cases.

Also Read,