ESIC is a health insurance scheme in India that provides medical benefits and cash benefits to employees earning up to ₹21,000 per month. Here are a few details discussed that you must know about the Employee's State Insurance Scheme of India.

What Is Employees’ State Insurance Scheme?

The main purpose of the ESI scheme initiated by the Government of India is to provide coverage to workers against specific health-related risks that can impact their ability to earn income. These risks include permanent or temporary disability, sickness, death due to employment-related injury, or occupational disease. By offering financial assistance, the scheme helps workers alleviate the financial burden resulting from such unfortunate circumstances. Additionally, the scheme includes provisions for maternity benefits to support the beneficiaries during pregnancy and childbirth. Lets have a look at Employees’ State Insurance Corporation in India.

The ESI scheme serves as a protective cover for workers, ensuring they receive necessary medical care for themselves and their dependents. Moreover, it offers various cash benefits in situations where workers experience wage loss or disability. Furthermore, in the event of death or injury due to occupational hazards at work, the scheme provides a pension, referred to as dependent benefit, to the family members of the insured individual.

Employees State Insurance Act, 1948

The Employees’ State Insurance Act, 1948, commonly known as the ESI Act, was enacted by the Parliament as a significant social security legislation for workers after India gained independence. This act provides crucial benefits, including medical coverage, to employees working in various establishments such as factories, businesses, hotels, transportation services, cinemas, educational institutions, and more, where 10 or more individuals are employed.

The ESI scheme extends its benefits to both workers and their dependents in the event of unfortunate incidents occurring at the workplace. According to the ESI Act, employees working in the mentioned categories and earning monthly wages up to Rs. 21,000 are eligible for this social security program. The primary objective of the ESI Act is to uphold the dignity of individuals during times of crisis by safeguarding them from destitution, deprivation, and social degradation.

ESIC in India: What is Covered Under Employees’ State Insurance Scheme?

The ESI Scheme (Employees’ State Insurance Corporation) was initially introduced in Kanpur and Delhi in 1952, as these were two prominent industrial hubs at the time. As industrialization gained momentum across the country, the scheme gradually expanded its reach. Over the years, with the rapid growth of industrialization, the ESI Scheme has been implemented in 611 Districts in 36 States and Union Territories, which include 503 fully notified districts and 108 partially notified districts

As of 2019, the ESI Act extends its coverage to nearly 12 lakh factories and business establishments, providing essential benefits to over 3 crore workers and their families. This comprehensive scheme has positively impacted the lives of more than 13 crore beneficiaries, offering them valuable medical care and other crucial benefits during times of need.

What Is Not Covered Under Employees State Insurance Scheme?

Under the ESIC (Employees’ State Insurance Corporation) scheme, the coverage is applicable to workers and employees earning up to Rs. 21,000 per month. However, it’s important to note that for individuals with disabilities, the maximum wage limit is set at Rs. 25,000 per month. This means that workers or employees earning above these specified amounts are not covered by the ESIC scheme.

Furthermore, in the states of Maharashtra and Chandigarh, the threshold for coverage under the Employees’ State Insurance Corporation scheme remains at 20 employees, whereas in other states and Union Territories, the threshold for coverage is 10 employees. This means that in Maharashtra and Chandigarh, establishments with 20 or more employees are required to provide ESIC coverage, while in other states and Union Territories, establishments with 10 or more employees are covered by the scheme.

When is ESI Registration Required?

If a company, organization, or business establishment employs 10 or more employees (or 20 or more employees in the case of Maharashtra and Chandigarh), it is required to register with the ESIC (Employees’ State Insurance Corporation). This registration ensures compliance with the ESI scheme.

Regarding workers or employees, they are eligible for coverage under the ESI scheme if their monthly earnings are below Rs. 21,000 (or Rs. 25,000 for individuals with disabilities). Workers contribute 1.75% of their salary towards the scheme, while employers contribute 4.75%. It’s important to note that these contribution rates may be subject to revisions over time. Workers with a daily average wage of up to Rs. 50 are exempted from contributing to the ESI fund, although employers are still required to contribute on their behalf.

Learn about ESI Registration.

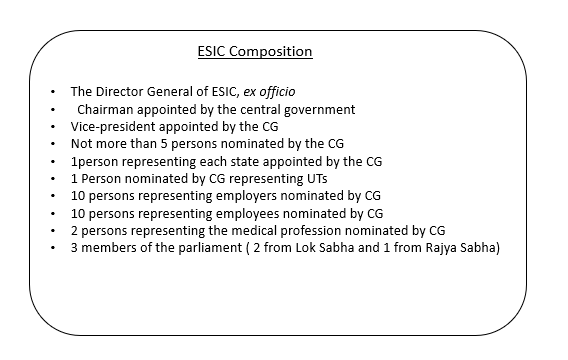

Composition of Employees’ State Insurance Corporation

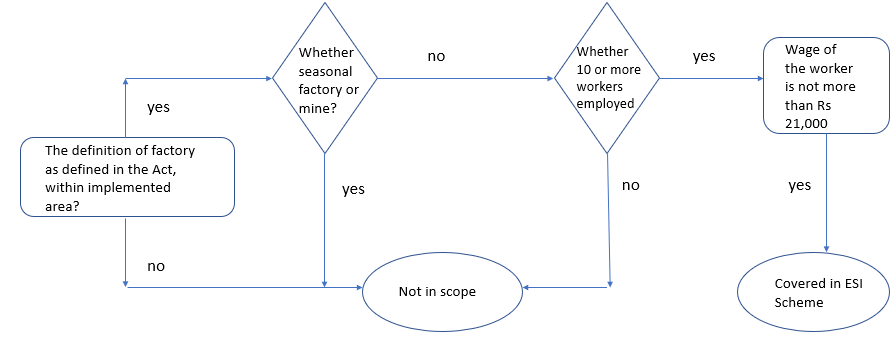

Applicability of the ESI Scheme

The ESI scheme applies to all factories and establishments as defined in the Act that have 10 or more employees, regardless of their salary. The scheme covers employees whose monthly wages do not exceed Rs. 21,000. It is important to note that when determining the applicability of the scheme, all employees employed by the employer, irrespective of their salary, are taken into account. The following flow chart illustrates the applicability of the scheme:

Features of the ESI Scheme

The ESI scheme offers several key features to registered employees under the ESI Act, 1948. These features include:

- Complete Medical Care: The scheme provides comprehensive medical care and attention to registered employees, assisting them in their recovery and restoring their health and working capacity.

- Financial Assistance: Employees receive financial assistance to compensate for wage loss during periods of absence from work due to illness, maternity, or factory accidents.

- Medical Care for Family Members: The scheme extends medical care benefits to the family members of registered employees.

- Extensive Coverage: As of 31 March 2019, the ESI scheme covered approximately 3.14 crore employees, benefiting a total of 13.32 crore beneficiaries.

- Categorization of Benefits: The scheme offers benefits under two main categories: cash benefits and non-cash benefits through medical care. Cash benefits include sickness, maternity, disablement (temporary and permanent), funeral expenses, rehabilitation allowance, vocational rehabilitation, and medical bonus.

- Self-Financing: The scheme operates on a self-financing basis, with contributions primarily coming from both employees and employers. Contributions are made monthly at a fixed percentage of wages paid.

- Contribution Rates: The current employee contribution rate is 0.75% of wages, while the employer contribution rate is 3.25% of wages paid. However, for employees with a daily average wage of Rs 137 or less, the employer contributes on their behalf as they are exempted from their own contribution.

- Contribution Payment: Employers are responsible for paying their own contribution and deducting the employees’ contribution from wages. These contributions must be deposited with the Employees’ State Insurance Corporation within 15 days from the end of the calendar month in which the contribution falls due. Payment can be made online or through designated and authorized public sector banks.

ESIC in India: ESIC Contribution Rates

The contribution rates for the ESI scheme are revised and fixed by the Government of India. The current rates, effective from 1st July 2019, are as follows:

- Employee’s contribution rate: 0.75% of wages

- Employer’s contribution rate: 3.25% of wages paid/payable in every wage period.

Please note that these rates are subject to revision by the government from time to time.

What are the Establishments that are Covered Under the ESI Scheme?

As per the notification issued by the Central Government, the ESI scheme is mandatory for the following establishments employing 10 or more persons:

- Shops.

- Hotels or restaurants that do not have any manufacturing activity but are engaged in sales.

- Cinemas, including preview theaters.

- Road motor transport establishments.

- Newspaper establishments.

- All private educational institutions and medical institutions.

These establishments are required to comply with the provisions of the ESI Act and ensure that their employees are covered under the scheme.

Who Fixes the Rate of Contribution for the ESI Scheme?

The rate of contribution for the ESI scheme in India is revised and fixed by the Government. The rates are subject to periodic revisions. As of June 2019, the government reduced the contribution rates, which became effective from 1st June 2019. Currently, the employee’s contribution rate, effective from 1st July 2019, is 0.75% of the wages. The employer’s contribution rate is 3.25% of the wages paid or payable in respect of the employees in every wage period.

ESIC in India: How to Apply an ESI Card (Pehchan Card)?

The process for downloading the e-Pehchan card is as follows:

- Visit the esic.in portal and log in using the username and password.

- On the new page, navigate to the ‘Employee’ section and click on ‘e-Pehchan Card’.

- Select the unit details and click on ‘View’.

- You can view the details of all the employees, or you can narrow down the search by entering the respective employee’s insurance number and name.

- On the page displaying the employee details, select ‘View Counter Foil’ for the respective employee. This Counter Foil represents the e-Pehchan card.

- On the new page, scroll down and click on ‘Print’ to download the e-Pehchan card as a PDF document.

- The respective employee must sign and affix the photographs of their family or dependents on the printout. The photo should be attested and stamped by the employer or an esic.in official.

- Ensure to obtain the signature and stamp of the employer or the ESIC office on the e-Pehchan Card.

ESIC in India: How are Contributions Made?

The Employees’ State Insurance Corporation Scheme operates on a self-funding basis, where contributions from both employers and employees form the primary source of funding. These contributions are deducted from employees’ salaries on a monthly basis at a fixed percentage. The employer contributes 3.25 percent of the wages, while the employee contributes 0.75 percent, resulting in a total contribution of 4 percent for employees earning Rs 21,000 or less per month.

Additionally, the state governments are responsible for contributing 1/8th of the cost of medical benefits under the ESI Scheme.

An important feature of the Scheme is that an employee’s insurance number remains the same as long as they remain within the wage limit set by Employees’ State Insurance Corporation. Even if an employee changes jobs, their insurance status remains unaffected, and they retain the same insurance number.

Benefits that can be Availed from ESI Scheme

According to the esic.in website, the ESI scheme provides the following benefits:

-

Medical Benefit

- Full medical care for insured persons and their family members.

- No upper limit on treatment expenditure.

- Retired and permanently disabled insured members and their spouses can avail of medical benefits by paying an annual premium.

-

Sickness Benefit

- Cash compensation of 70% of wages during the period of sickness, up to a maximum of 91 days per year.

- The insured person must contribute for 78 days in 6 months.

- Extended benefit of up to two years for 34 malignant and long-term diseases, at 80% of wages.

- Full wages are paid to insured persons undergoing sterilization for family planning for 7 to 14 days (vasectomy and tubectomy respectively).

-

Maternity Benefit

- Maternity benefit for 26 weeks during pregnancy and confinement.

- Extension of one month on medical advice at full wage.

- The insured person must contribute for 70 days in the preceding two contribution periods.

-

Disablement Benefit

- Disability benefit at a rate of 90% of wages is paid as long as the disability continues.

-

Dependents Benefit

- Monthly payment of 90% of the wage to dependents of a deceased insured person due to employment injury or occupational hazards.

-

Other Benefits

- Vocational rehabilitation for permanently disabled members undergoing VR training at VRS.

- Physical rehabilitation for physical disabilities due to employment injury.

These benefits aim to provide comprehensive support and assistance to insured persons and their families in various health-related contingencies and disabilities.

ESIC in India: Steps to Open ESIC Account Online

The procedure for ESI registration by employers can be concluded online. Here are the steps to register your establishment or company with the Employees’ State Insurance Corporation:

- Visit the ESIC Portal and click on ‘Login‘.

- On the new page, click on ‘Sign Up‘.

- Enter your company name, employer name, state, region, email ID (which will be your username), and phone number.

- Confirm that your establishment or factory falls under exclusive labour contract, manpower suppliers, security agencies, or contractors supplying labour categories.

- Click on ‘Submit’. An email will be sent to you with login credentials or details.

- Visit the esic.in Portal and log in using the username and password received via email.

- Click on ‘New Employer Registration‘.

- Select the type of unit and click on ‘Submit’.

- Enter the name and complete postal address of the factory or establishment, as well as the police station jurisdiction.

- Indicate if the building or premises are owned or hired, and click on ‘Next’.

- Provide details about the nature of the business, category, PAN, etc., and click on ‘Next’.

- Enter the date of commencement of the factory or establishment and license details (if applicable).

- Select the constitution of ownership and provide details of the owners. Click on ‘Save’.

- Enter the number of employees in your establishment or factory and the number of employees earning less than Rs.21,000. Click on ‘Save’.

- Enter the date when the first 10/20 employees were employed and click on ‘Employee Declaration Form‘.

- Provide details of the insured person (IP), including IP number, date of joining, name, father’s name, address, date of birth, gender, marital status, family details, and date of joining.

- Confirm whether the insured person is already registered or not, and provide the necessary details. Click on ‘Continue’.

- Check the provided information and click on ‘Submit’.

- On the new page, select the respective ESI branch office and inspection division.

- Declare that the information provided is correct by checking the checkbox, and click on ‘Submit’. You will be redirected to a new page.

- On the new page, click on ‘Pay Initial Contribution‘ and ‘Submit’. A Challan Number will be provided for future reference.

- Proceed to make the payment through the required payment gateway by clicking on ‘Continue‘.

- Once the payment process is completed, you will receive the system-generated ESI Registration Letter (C-11) to your registered email ID. The C-11 serves as proof of registration of your company with the Employees’ State Insurance Corporation.

Progress of 2nd Generation Reforms of ESIC (ESIC: 2.0)

In 2015, Hon’ble Prime Minister Shri Narendra Modi introduced several health reform initiatives under the Employees State Insurance Scheme. The main agenda of these initiatives included:

- Online availability of Electronic Health Records of ESI Holders: This aimed to digitize and make the health records of ESI holders accessible online for efficient healthcare management.

- Medical Helpline: The introduction of a medical helpline provided a dedicated platform for ESI beneficiaries to seek medical advice and assistance.

- VIBGYOR: Operation Indradhanush: This initiative focused on comprehensive immunization of children and mothers to prevent diseases and improve public health.

- Special OPD: Special outpatient departments were established to cater to specific medical needs, ensuring specialized care for ESI beneficiaries.

- Quality Control on Drugs and Medicines: Stringent measures were implemented to ensure the quality and safety of drugs and medicines provided to ESI beneficiaries.

- Pathological and X-Ray in PPP Model: Pathological and X-ray services were incorporated in a Public-Private Partnership (PPP) model, ensuring accessibility and quality diagnostic services.

- Regular Inspection of Hon’ble Member of ESIC to ESIC/ESIC Hospitals: Regular inspections by the Hon’ble Member of Employees’ State Insurance Corporation were conducted to ensure adherence to quality standards and efficient functioning of ESIC hospitals.

- Specialties Being Created (CT, ICU, MRI, CAT-Labs, Dialysis): Specialized medical facilities such as CT scans, ICUs, MRI scans, CAT Labs, and dialysis units were established to provide advanced healthcare services.

- Behavioral Training: For doctors and para-medical staffs, Yoga, Ayush, special child and mother care hospitals, queue management, ‘May I Help You’ counters, etc.: Emphasis was placed on behavioral training for healthcare professionals, promoting alternative medicine practices like Yoga and Ayush, establishing specialized hospitals for child and mother care, implementing efficient queue management systems, and setting up ‘May I Help You’ counters to enhance patient experience and care.

Is ESIC Applicable All Over India?

ESIC is applicable all over India, and it’s mandatory for employers with 10 or more employees to register for ESIC. This means that employees working in an organization with 10 or more employees are eligible for Employees’ State Insurance Corporation benefits, regardless of their location in India.

ESIC in India: Can One Person Have Two ESIC?

No, a person can’t have two ESIC accounts. If a person switches jobs, their new employer will have to update their ESIC details. This ensures that the person continues to receive Employees’ State Insurance Corporation benefits without any interruption or overlap.

What Are the Latest ESI Rules in India?

Employees’ State Insurance Corporation rules in India have changed recently. The new rules affect who can get benefits, how much money employers need to pay, and what benefits are available. Some important changes are that now employees earning up to ₹21,000 a month can get benefits, and employers need to pay more money. There are also some new benefits, like insurance for work-related diseases and money if you lose your job.

| For FY 2023–2024, the ESIC has set the employee contribution rate at 0.75% of wages and the employer contribution rate at 3.25% of wages. |

Who Will Come Under ESIC?

Employees earning up to ₹21,000 per month and working for an organization that comes under the Employees’ State Insurance Corporation scheme are eligible for ESIC benefits. This includes both permanent and temporary employees, as well as contract workers who work on a regular basis.

How Many Years Is PF Eligible?

PF eligibility depends on the company’s policy. However, as per the government rules, an employee is eligible for PF if they have completed at least 5 years of continuous service with the same employer. This means that if an employee leaves the company before completing 5 years, they may not be eligible for PF benefits.

Features of Employees’ State Insurance Corporation

ESIC offers several features and benefits to employees, including:

- Free medical treatment for employees and their dependents

- Cash benefits during sickness, maternity, and disability

- Maternity benefits for female employees

- Rehabilitation allowance for employees with a permanent disability

- Insurance benefits for occupational diseases

- Unemployment allowance for employees who lose their job due to a non-voluntary reason

Impact of ESIC on Employees and Employers

1. Impact on Employees

- Provides free medical treatment to employees and their dependents

- Offers cash benefits during periods of sickness, maternity, and injury

- Provides job security by offering benefits even during long-term absence due to illness or injury

- Encourages employees to seek medical treatment early, which can prevent health conditions from becoming more severe

- Improves the overall health and well-being of employees and their families, leading to greater productivity and job satisfaction

2. Impact on Employers

- Provides an affordable way for employers to offer healthcare benefits to their employees

- Helps to attract and retain skilled workers who value healthcare benefits

- Reduces absenteeism and increases productivity by providing medical treatment and cash benefits to employees who are sick or injured

- Ensures compliance with legal requirements for employee healthcare benefits

- This may result in increased administrative costs and the need for additional resources to manage Employees’ State Insurance Corporation contributions and benefits

ESI Head Office and Helpline Number

ESI Head Office Address:

Conclusion

In conclusion, Employees’ State Insurance Corporation is a health insurance scheme in India that offers several benefits to employees. It’s mandatory for employers with 10 or more employees to register for ESIC.in. Employees earning up to ₹ 21,000 per month are eligible for ESIC benefits. The latest ESIC rules include changes in the eligibility criteria, contribution rates, and benefits offered, and it’s important for employers and employees to stay updated on these changes. For any queries, contact our experts at Vakilsearch.

FAQs

Is ESIC mandatory in India?

Yes, it's mandatory for employers with 10 or more employees to register for ESIC.

Can a person have two ESIC accounts?

No, a person can't have two Employees' State Insurance Corporation accounts. If they switch jobs, their new employer will have to update their ESIC details.

What benefits does ESIC offer?

ESIC offers several benefits, such as, free medical treatment, cash benefits during sickness and disability, maternity benefits, insurance benefits for occupational diseases.

How does the ESI scheme help the employees?

The ESI scheme provides comprehensive medical care to the employees registered with the ESIC during periods of incapacity and working capacity. It offers financial assistance to compensate for the loss of wages during periods of sickness, maternity, and employment injury. The scheme also extends medical care to the family members of the employee.

Who administers the ESI scheme?

The ESI scheme is administered by the Employees' State Insurance Corporation (ESIC), which is a statutory corporate body.

How is the ESI scheme funded?

The ESI scheme is self-financed, primarily relying on monthly contributions from employers and employees. These contributions are calculated as a fixed percentage of the wages paid. Additionally, state governments bear 1/8th share of the cost of medical benefits.

What are the establishments that are covered under the ESI scheme?

As per the notification issued by the Central Government, all factories employing 10 or more persons are mandatorily covered under the ESI scheme. The following establishments employing 10 or more persons are also included: - Shops, hotels or restaurants engaged in sales without any manufacturing activity. - Cinemas, including preview theatres. - Road motor transport establishments. - Newspaper establishments. - All private educational institutions and medical institutions.

Who fixes the rate of contribution for the ESI scheme?

The Government of India revises and fixes the rate of contribution for the ESI scheme.

Is ESIC compulsory for all employees?

Yes, Employees' State Insurance Corporation is compulsory for all employees in establishments covered under the ESI Act. All factories employing more than 10 employees and paying wages below Rs. 21,000 per month (Rs. 25,000 for employees with disabilities) must register with ESIC and contribute towards the scheme. Employees earning more than Rs. 21,000 per month are exempted from ESI contributions.

Is overtime allowance, or bonus considered for the purpose of the coverage of the employee under the Scheme?

No, overtime allowance, bonus, and similar incentives are not considered for the purpose of calculating contributions under the ESI scheme. However, certain payments made in case of layoff are subject to contribution.