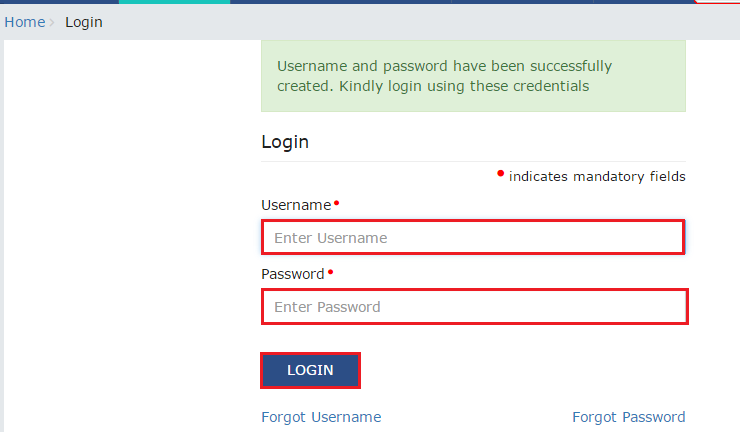

One can create a new GST username and password only once. After you are through with the creation of a new username and password, your Provisional ID gets terminated

Once you have attained the GST registration, what you should do in the initial step is to make a new ID. While on mail, we get a Provisional ID (our GSTIN) and a password for GST login for the first time.

What is the GST e-Way Bill System?

It is an electronic documentation system introduced under the Goods and Services Tax regime in India. It is designed to facilitate the seamless movement of goods across state borders. The e-way bill serves as evidence for the movement of goods and must be generated by registered taxpayers or transporters before transporting goods worth more than a specified value.

The e-way bill contains crucial details such as the goods’ consignment value, the GSTIN (Goods and Services Tax Identification Number) of the parties involved, the place of origin, and the destination of the goods. This system aims to ensure transparency and prevent tax evasion during the transportation of goods, contributing to the efficient implementation of the tax structure.

How to Register for GST?

Registering for GST is a fundamental requirement for businesses engaged in supplying goods or services in India. The process of GST registration can be carried out online through, gst.gov.in. Here is a step-by-step guide to help you through the registration process:

- Visit the official User site at gst.gov.in to gst login.

- Click on the ‘Services’ tab and select ‘Registration’ from the drop-down menu.

- Choose the ‘New Registration’ option to initiate the registration process.

- Fill in the required details, including your name, email address, and mobile number, to create a Temporary Reference Number (TRN).

- After obtaining the TRN, proceed to fill out the registration application form.

- Provide necessary business details such as business name, address, nature of business, and bank account information.

- Upload the required documents, including proof of business ownership, identity, address, and bank account details.

- Once the application is complete, submit it through the site.

- After verification of the application and documents, you will receive the registration certificate along with your unique GSTIN.

It is important to note that registration is mandatory for businesses with an annual turnover exceeding the threshold limit set by the authorities.

Guide to using GST.gov.in before Logging in

gst.gov.in, offers a wide range of services and features that are accessible even before logging in. These pre-login services are beneficial for users who want to explore the site or access specific information without the need to log in. Here are some of the essential pre-login services available on the site:

- Search Taxpayer: This service enables you to search for GSTIN details of any registered taxpayer by providing their name, GSTIN, or state.

- Search HSN/SAC: You can use this feature to find Harmonized System of Nomenclature (HSN) or Service Accounting Code (SAC) for goods or services by typing relevant keywords.

- FAQs: The site offers a comprehensive list of Frequently Asked Questions (FAQs) that cover various aspects of, providing users with quick answers to common queries.

- Taxpayer Services: Pre-login, you can access various taxpayer services such as filing complaints, tracking the status of applications, and updating email and mobile numbers.

- Quick Links: The site provides quick links to essential resources like GST laws, rules, notifications, and circulars.

- News and Updates: Stay up-to-date with the latest news and updates related to GST through the pre-login section of the site.

Here, are the Steps for a Login

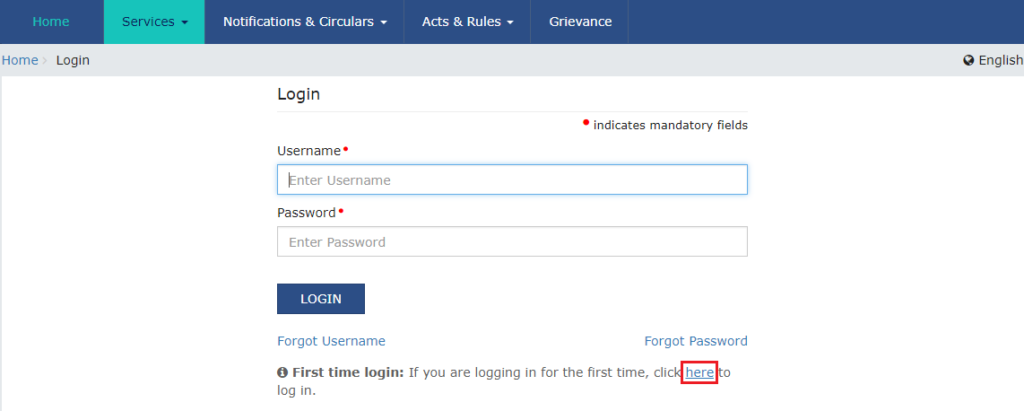

- Step 1: In the initial step, you must go to the official GST login site and click on ‘Login’. You can find the Login button at the top right of the webpage.

- Step 2: After clicking on the Login button, the login page would show up. You’ll see two boxes of username and password. These boxes are only for those who already hold an account. We will log in for the initial time as we have gained Registration site. We have to shift slightly to the bottom, search for the ‘First Time Login’ button, and click on it.

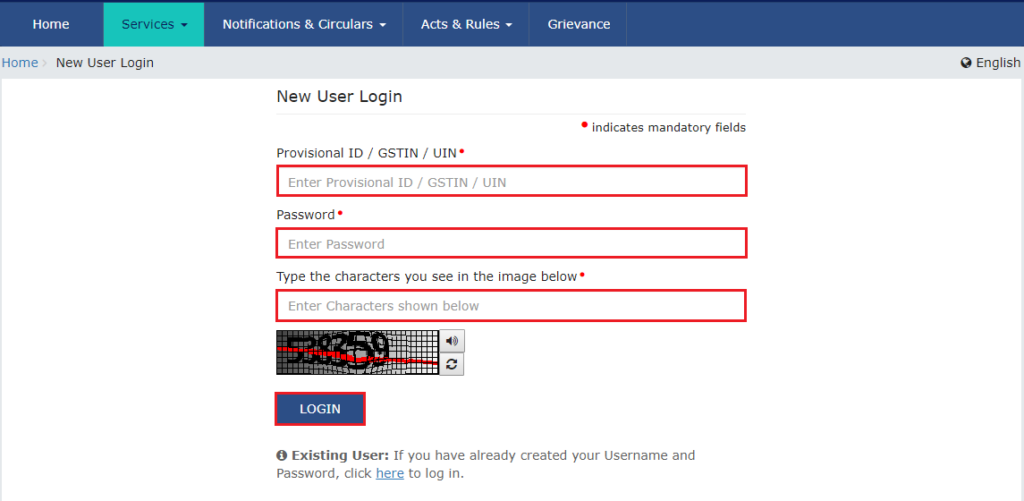

- Step 3: In this step, you need to seek the user credentials that you have got from GST Department via mail. In your mail, you’ll find a GSTIN and your username. The password you’ll get for logging in will be mentioned in the name. Just copy your GSTIN and put it in the username Box. The password can’t be copied; you have to type it in the password box.

- Step 4: Once you have entered the user credentials, you will see a screen showing up. If your ID/password is accurate, you can move further.

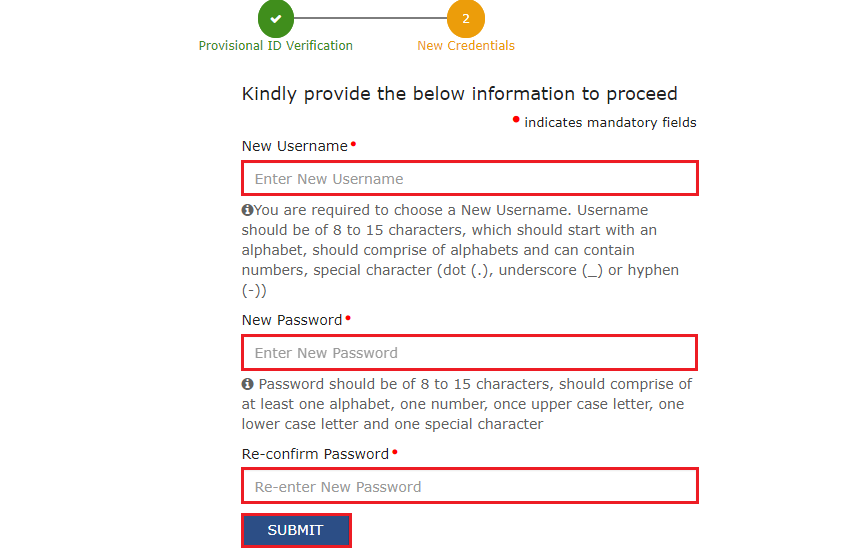

The user must submit the following info to carry on:

- You need to select a new username. Whatever username you decide must include 8-15 characters. The username must begin with an alphabet and can have numbers. It can even have special characters like a dot, an exclamation, a hyphen, an underscore, etc.

- The password you choose must include at least 8-15 characters. Also, it must have at least one number, one alphabet, one lower case letter, one upper case letter, plus a special character.

The new username must be 8-15 characters that must begin with an alphabet, must include alphabets, and can comprise numbers and special characters. Get Online GST Advisory Services Instantly from our Professional team.

Steps to Login for Existing Users

- Step 1: Go to the official GST login website, and click on Login.

- Step 2: Fill up the username and password box with your credentials and click Login again.

- Step 3: You are through with the login process.

Steps for Checking User Status

Goods and Service Tax is a uniform tax on the shipment of goods/services. It replaces every other tax, for instance, state VAT, central sales tax, central excise duty, or purchase tax. For Filing the tax returns, the suppliers or traders must register under GST.

There is a total of 11 applicable returns. Also, every return possesses a distinctive purpose and due date. To file returns, visit the official site register yourself.

Below we have mentioned all the steps involved in the GST returns filing process:

- Step 1: Get registered and receive your 15-digit ID number

- Step 2: Enter your credentials and log in

- Step 3: Go to ‘Services’

- Step 4: Go to ‘Returns dashboard’. Fill up the return filing period and the financial year.

- Step 5: Choose the GST return you wish to file. Then, click on the ‘prepare online’ option.

- Step 6: Provide all the necessary values, which count the amount and late fee

- Step 7: As soon as you have provided every info, click on the ‘Save’ option, and you’ll get a success message on the screen

- Step 8: Click the ‘submit’ button to file your GST System returns

- Step 9: As soon as your GST status transforms to submitted, move down and click on the option of Payment of Tax. After that, click on the check balance option to see your cash to know this info before paying the tax under distinct minor heads. To clear all your liabilities, declare the cash amount you wish to use via the already obtainable credit. Next, click on the ‘Offset liability’ option for making payment. Click on OK when you see the confirmation dialog box on the screen

- Step 10: In the final step, you need to check the box alongside the declaration and choose an unofficial participant you can find in the drop-down list. Click on the Proceed option after clicking ‘File form with EVC’ or ‘File form with DSC’.

E-Way Bill System

E-Way Bill is a bill that haulers must carry while shifting products from state to state or within the state. This bill is utilized for tracking the shipment of things under Login. It is produced on the e-Way bill site and is needed for each delivery of goods worth 50000 INR or more.

While this bill is produced, a unique E-way Bill Number (EBN) is allotted to the hauler, trader, and receiver. One needs all these details or info for producing an E-way bill:

- Transport document number, and transporter ID if the delivery is carried through the ship, air, or rail.

- Transporter ID or vehicle number.

- Supply challan bill of the delivery of products.

Prior to the GST application, e-way bills were produced via state-specific sites and are bound by state regulations. The E way bill is produced via an unvarying set of valid guidelines throughout the country.

Other Information Available on the gst.gov.in Home Page

Once you finished GST login to the site, you gain access to a user-friendly dashboard with a wealth of information and services. Here are some key features and information available on the home page:

- Returns: The dashboard displays details about the upcoming and filed GST returns. You can file your returns directly from this section.

- Payments: Information regarding your tax liabilities and payment history can be viewed in this section. You can also make tax payments through various payment modes available on the gst.gov.in.

- Ledgers: Access your electronic cash ledger, electronic credit ledger, and liability register to keep track of your tax payments and credits.

- Filing of Application: This section allows you to file various applications, including registration, amendment, and cancellation applications.

- Search Taxpayer: Similar to the pre-login service, you can search for GSTIN details of other taxpayers from this section.

- Help Desk: Get support and assistance from the help desk for any queries or issues related to GST Login.

The home page serves as a comprehensive platform that enables businesses to comply with regulations efficiently and access various services seamlessly.

Final Thoughts

GST return Filing digitally can be time-saving and aids a business in concentrating on other aspects of its SME project. To make tax filing and documentation easier, you can rely on Vakilsearch. We provide services that cover all the legitimate necessities of start-up businesses and established enterprises. Annual compliance, government registrations, and filings, incorporation, and accounting are a few of our major services.

FAQs

What is the list of documents required for GST registration?

The documents required include:

● PAN card of the applicant

● Aadhaar card of the applicant (for individuals)

● Passport size photographs of the applicant

● Proof of business address (e.g., electricity bill, rent agreement, etc.)

● Bank account statement or canceled cheque

● Authorization letter (if the application is filed by an authorized signatory)

● Business registration documents (Partnership Deed, Certificate of Incorporation, etc.)

When is GST registration required?

It is required under the following circumstances:

● When the annual turnover of a business exceeds the threshold limit prescribed by the GST authorities (currently Rs. 40 lakhs for most states; Rs. 10 lakhs for special category states).

● For businesses involved in the supply of goods or services in interstate transactions.

● If the business is registered under any previous indirect tax laws (VAT, Service Tax, etc.).

● For e-commerce operators or aggregators.

● Casual taxable persons and non-resident taxable persons also need to register for GST.

How to get a GST login ID and password?

To get login credentials, you need to register for GST on the official (gst.gov.in). During the registration process, you will receive a Temporary Reference Number (TRN) on your registered mobile number and email ID. Using this TRN, you can complete the registration process and create your ID and password.

How to get login details?

The details can be obtained by successfully registering for GST on gst.gov.in. Once your application is processed and approved by the authorities, you will receive your User ID and password, which will grant you access to the wesite's various features and services.

How to create GST User ID and password?

To create your User ID and password, follow these steps:

● Visit the official site (gst.gov.in).

● Click on the 'Services' tab and select 'Registration' from the drop-down menu.

● Choose the 'New Registration' option and provide the required details to generate a Temporary Reference Number (TRN).

● Use the TRN to log in again, and you will be prompted to create your user ID and password during the registration process.

How to user to the gst.gov.in with ARN?

After successful GST registration, you will receive an Application Reference Number (ARN) on your registered email and mobile number. You can use this ARN to log in to the gst.gov.in. However, please note that the ARN is primarily used for tracking the status of your application and is not the same as your regular user ID and password.

How to login to the gst.gov.in with TRN number?

The TRN (Temporary Reference Number) is generated during the initial stages of GST registration. It allows you to continue the registration process and create your credentials. However, once you have completed the registration and received your ID and password, you should use those credentials to log in to the gst.gov.in.

What to do if the login is locked?

If your login is locked, you can follow these steps to unlock it:

● Visit the gst.gov.in and click on the 'Login' button.

● Click on the 'Forgot Password' link on the login page.

● Enter your User ID and the provided captcha code, and click on 'Generate OTP.'

● You will receive an OTP (One-Time Password) on your registered mobile number and email.

● Enter the OTP and click on 'Verify.'

● After successful verification, you can reset your password and unlock your login.