Getting a mutual fund license in India can be a very effective way to break into the finance industry and start offering investment products to clients. Know more about the Cost of Mutual Fund License

Overview: Cost of Mutual Fund License:

- Getting a mutual fund license in India can be a very effective way to break into the finance industry and start offering investment products to clients. When considering this career path, people often ask, “What is the Cost of Mutual Fund License?”

- The cost of obtaining a mutual fund license in India can vary widely depending on several factors, including the type of license you need and the amount of training and education required. Here are some of the key costs to keep in mind:

SEBI Registration Fee:

To be able to sell mutual funds in India, you need to be registered with the Securities and Exchange Board of India (SEBI). The fee for this registration is Rs. 25,000.

Cost of Mutual Fund License – Training and Education:

Many mutual fund companies require their sales agents to complete a certain amount of training and education before they can start selling their products. The Cost of Mutual Fund License, this training can vary widely depending on the provider but typically ranges from a few thousand to several lakhs of rupees.

Compliance and Administrative Costs:

- Once you are registered with SEBI and have completed the necessary training, you will need to comply with various regulations and administrative requirements. This can include costs for maintaining records, filing reports, and meeting continuing education requirements. It can cost several lakhs of rupees per year to cover these expenses.

- Obtaining a mutual fund license in India requires compliance with the regulatory framework set by the Securities and Exchange Board of India (SEBI).

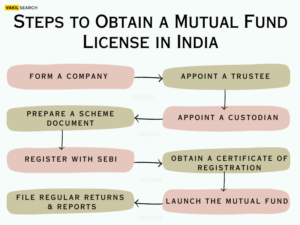

Here are the steps to obtain a mutual fund license in India:

- Form a Company: The first step is to form a company in India. It is advisable to Register a Company under the Companies Act, 2013 as a public limited company.

- Appoint a Trustee: In India, mutual funds must have a trustee who protects the unit holders’ interests. The trustee can be a company or an individual and should be appointed within six months of the formation of the company.

- Appoint a Custodian: A custodian is responsible for safeguarding the securities of the mutual fund. As soon as the trustee is appointed, the custodian should be appointed.

- Prepare a Scheme Document: The scheme document is a comprehensive document that outlines the objectives, features, and working of the mutual fund. The scheme document must be approved by the board of directors of the mutual fund before it is submitted to SEBI.

- Register with SEBI: The next step is to register with SEBI. To comply with this regulation, you will need to submit the scheme document, the articles of association and memorandum of association of the company, as well as the trust deed to SEBI. The SEBI will review the documents and may ask for additional information or clarification.

- Obtain a Certificate of Registration: SEBI will grant the mutual fund a certificate of registration once satisfied with the information submitted. Registration certificates are valid for three years and may be renewed every three years.

- Launch the Mutual Fund: After obtaining the certificate of registration, the mutual fund can be launched. The mutual fund must comply with the guidelines set by SEBI, including the investment guidelines, disclosure norms, and other operational requirements.

- File Regular Returns and Reports: The mutual fund must file regular returns and reports with SEBI. This includes half-yearly and annual reports, as well as NAV (Net Asset Value) reports. The mutual fund must also comply with the disclosure norms set by SEBI.

In addition to these steps, the mutual fund must comply with the provisions of the SEBI (Mutual Funds) Regulations, 1996, and other relevant regulations. The mutual fund must also appoint a registrar and transfer agent, and ensure that its operations are in compliance with the provisions of the Indian Trusts Act, of 1882 and the Indian Contract Act, of 1872.

Conclusion:-

In summary, the cost of a mutual fund license in India can range from a few thousand to several lakh rupees. You will need different types of licenses and training and education depending on your profession. It’s imperative to carefully consider these costs before pursuing a career in the mutual fund industry. To learn more about getting a mutual fund license, please contact our legal experts at Vakilsearch. Ensure that you have the support and resources you need to succeed.