A bank reconciliation statement is a document that compares the bank statement with the company's financial records and identifies any discrepancies between the two. It ensures that all transactions have been properly recorded and accounted for. Read this blog to learn more about the Bank Reconciliation Statement.

Companies keep a cash book to register both their cash and bank dealings. The cash book has an entry for the cash on hand and the total at the bank. The bank records every customer’s account and keeps track of deposits and withdrawals. These are noted on the customer’s account as credits and debits. The bank regularly sends out statements to the customers summarizing their account activity. The purpose of a bank reconciliation statement is to compare the bank transactions listed in the books of accounts with the bank statement.

What Is a Bank Reconciliation Statement?

A Bank Reconciliation Statement (BRS) is drawn up to bring together the differences between the Cash Book and the passbook. In other words, a BRS is a report created to determine the discrepancies between the bank balance in the cash book and the passbook on a particular date.

The discrepancy between the bank balance according to the cash book and bank statement should be investigated if the amount listed in the passbook does not correspond to the bank column of the cash book. It is essential to identify the cause of any difference. It is essential to settle any discrepancies.

The statement can help uncover discrepancies such as unrecorded deposits, fees, or payments or identify payments that the bank has not cleared.

Why Prepare a Bank Reconciliation Statement?

BRS are made periodically to ensure that all bank transactions are accurately recorded in the cash book’s bank column and by the bank in their records.

It helps to identify any errors when recording transactions and to determine an exact bank balance as of a given date. By regularly reviewing the bank reconciliation statement, the company can identify any issues that need to be addressed, such as discrepancies in the amount of money in the bank or other potential issues with the accuracy of the records. This helps to ensure that all transactions are accurately recorded and that the bank balance is correct.

How to Prepare a Bank Reconciliation Statement?

A bank reconciliation statement is a document that reconciles the balance in an entity’s checking account with the corresponding amount on its books. This statement aims to ensure that the cash balance in the entity’s books is accurate and up-to-date.

- The initial move is to contrast the opening balances of the bank column in the cash book and the bank statement; they may not be alike due to checks that had not been credited or presented in a prior period.

- Cross-refer the credit side of the bank statement with that of the debit side of the bank column of the cash book and the debit side of the bank statement with the credit side of the bank column of the cash book. Check for any items that appear in both records and mark them with a tick.

- Go through the bank column of the cash book and compare it to the passbook. Identify any entries that haven’t been entered into the bank column of the cash book, create a list of those, and make the necessary corrections in the cash book. Verify if any inaccuracies appear in the cash ledger.

- Begin the bank reconciliation process by determining the adjusted and revised balance in the bank column of the cash book. Include the unpresented cheques issued by the business and subtract any Uncredited Cheques that have been paid in but not yet collected.

- Correct the discrepancies in the bank account. If the bank column of the cash book shows a debit balance, add in all the money the bank incorrectly credited and take away any amounts they incorrectly debited. If the balance is a credit, do the reverse. The outcome must match the amount stated on the bank statement.

In case of any help related to this, you can always consider the legal experts of Vakilsearch.

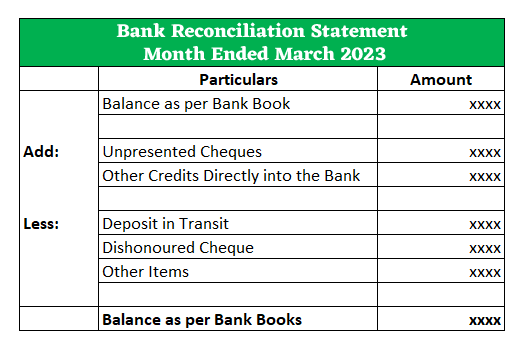

BRS Format

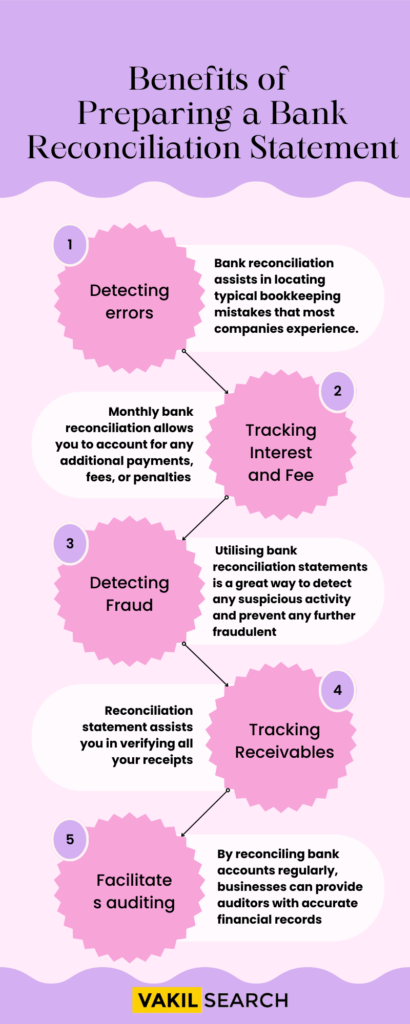

Benefits of Preparing a Bank Reconciliation Statement

Accounting mistakes could result in more than just awkward situations, such as returned checks or calls from creditors and vendors asking for money that has already been paid out.

Bank reconciliations help to identify fraudulent activity, minimise the risk of incurring financial penalties and late fees, and ultimately protect the integrity of a company’s financial records. This offers:

Detecting Errors

Bank reconciliation assists in locating typical bookkeeping mistakes that most companies experience. These mistakes can include miscalculations, missed payments, and duplicate payments.

Tracking Interest and Fee

Monthly bank reconciliation allows you to account for any additional payments, fees, or penalties that have been added to your account and subtract any amounts that need to be taken away.

Detecting Fraud

Though it may not be possible to prevent an employee from taking your money in the past, you can take steps to ensure it does not occur again. Utilising bank reconciliation statements is a great way to detect any suspicious activity and prevent any further fraudulent activity from occurring. It is advisable to have an external person perform reconciliations to keep the accounting employee from manipulating the books or the reconciliations.

Tracking Receivables

Reconciliation statement assists you in verifying all your receipts so you can avoid any embarrassing moments and spot unreported transactions.

Tips to Ensure Efficient Bank Reconciliation Statement

First, it’s important to have all the required paperwork and data ready. Having all the necessary evidence and details in one place provides a clearer perspective.

Avoiding common errors, such as:

An Error Relating to Duplication of Entries

A mistake resulting in duplicate entries, not recognising a transaction that would create a discrepancy of the same size and mistakes with commas and periods that could lead to significant errors in the figures. For instance, Transposition errors can occur when entering figures into the books, such as mistakenly entering ₹240.13 instead of ₹2,401.30 or ₹2.1 lakhs instead of ₹2.2 lakhs.

Banks Can Make Mistakes Too

Your bank might have made an error. This could mean that incorrect amounts have been removed from your account or sums have been added to your balance that is not yours. If you come across any discrepancies that you are unsure of, it’s best to contact your bank for clarification.

Reconciling items

Reconciling differences between your cash book and bank statement is essential to keep your bank reconciliation meaningful.

To do this, it is important to constantly identify differences between the two take action to solve them, and then put them out of your mind. If this isn’t done, then the discrepancies will continue to accumulate and your reconciliation won’t be accurate.

This process requires that the reconciled transactions are checked regularly to make sure they are reflected correctly in both the bank column of the cash book and the bank statement.

Conclusion

The Bank Reconciliation Statement is a valuable tool for managing finances and keeping track of bank accounts. It is an essential tool for businesses to ensure accuracy in their accounting records, as it allows them to reconcile the balance in their books with the balance recorded by their bank.

Vakilsearch also provides knowledge regarding the usage of Bank reconciliation statements. Get in touch with us to learn more about how we can help.