Check out this blog to learn how entries in accounting under GST are recorded and how to purchase entry with GST should be mentioned in the accounting journal. Also, learn the process of calculating net payable/receivable GST.

Goods and Services Tax (GST) is a value-added tax applied to goods and services. It replaces several indirect tax laws which were in force earlier. Implemented in July 2017, it still poses problems for the common person to understand or grasp fully. In the accounting journal, a purchase entry with GST involves recording the purchase of goods or services along with the associated Goods and Services Tax. This entry typically includes the purchase amount, the GST amount, and the total amount paid to the supplier. It reflects the financial transaction and ensures accurate recording of expenses and tax liabilities. In this article, we will discuss the details of purchase entry with GST. Also, helps you understand through examples how to Purchase Entries with GST in the accounting journal.

Understanding GST

GST, or Goods and Service Tax, is the tax imposed on the supply of goods and services. It is the best option to replace the multiple indirect taxes. GST was first introduced in France in 1954 as a tax regime. In India, it was introduced under the then Prime Minister Sir Atal Bihari Vajpayee. From then our tax system has seen a drastic improvement.

GST is administered in slabs by the government, with current rates set at 5%, 12%, 18%, and 28%. The Goods and Services Tax Council oversees GST, governed by the Goods and Services Tax Act of 2017. It applies to all goods and services except petroleum products and electricity, which are taxed by state governments. GST comprises two components: the State Goods and Services Tax (SGST) collected by state governments and the Central Goods and Services Tax (CGST) collected by the central government, both sharing an equal portion of the GST. For instance, if a product is charged 5% GST, both SGST (2.5%) and CGST (2.5%) will be levied equally. Also, there’s the Integrated Goods and Services Tax (IGST), applies to goods and services supplied across state borders.

GST Accounts

Under GST, the taxpayer needs to maintain the below-given accounts

-

CGST Account

CGST Account is divided into Output CGST and Input CGST.

-

SGST Account

SGST account is divided into Output SGST and Input SGST.

-

IGST Account

IGST account is divided into Output IGST and Input IGST.

-

e-Cash Ledger/ Electronic Money Ledger

The taxpayer maintains the book on the portal GST to pay GST

Records To Be Maintained Under Gst

- Production of goods

- Supply of goods and services (inward and outward)

- Inventory

- Payable output tax and tax already paid

Period for Retention of Accounting Entries Under GST

According to the GST Act, every taxpayer registered under it should maintain the books of accounts and records for a minimum of 72 months (6 years). The period is calculated from the last date of filing the Annual return for the relevant year. The last date to file an annual return is 31st December of the following year.

Accounting Inputs Under GST

GST in the Accounting Journal – To understand it better, let us take the example of a business transaction. GST in account too will be discussed in this context.

Example 1:

- Ms. Shubha purchased goods worth ₹1 lakh from the market locally

- She sold the goods for ₹3 lakh in the same region

- The consultation fee of ₹500 was paid by her through a bank account

- As Ms. Shubha was thinking about expanding her business, she bought furniture worth about ₹10,000

Taking CGST at 8% and SGST at 8% GST Accounting entries:

The accounting Journal entries with GST will be as follows:

|

Sl. No. |

Details | Debit (₹) |

Credit (₹) |

| 1 | Purchase A/c Dr | 1,00,000 | |

| CGST Input Dr | 8,000 | ||

| SGST Input Dr | 8,000 | ||

|

To Creditors A/c (Being Purchase Entry with GST) |

1,16,000 | ||

| 2 | Debtors A/c Dr | 3,48,000 | |

| To Sales A/c | 3,00,000 | ||

| To Output CGST A/c | 24,000 | ||

|

To Output SGST A/c (Being sales made to customers and entry with GST recorded) |

24,000 | ||

| 3 | Consultation fee A/c Dr | 500 | |

| CGST Input Dr | 40 | ||

| Input SGST Dr | 40 | ||

|

To Bank A/c (Being consultation done and charges paid through bank) |

580 | ||

| 4 | Furniture A/c Dr | 10,000 | |

| CGST Input A/c Dr | 800 | ||

| SGST Input A/c Dr | 800 | ||

|

To XYZ Furniture A/c (Being furniture purchased) |

11,600 |

By recording the GST Entry in Tally we get,

Total Input CGST = ₹8000 + ₹40 + ₹800 = ₹8,840

Total Input SGST = ₹8000 + ₹40 + ₹800 = ₹8,840

Total output CGST = ₹24,000

Total output SGST= ₹24,000

Therefore,

the NET CGST to be paid = ₹24,000 – ₹8,840 = ₹15,160

the NET SGST to be paid = ₹24,000 – ₹8,840 = ₹15,160

Impact of GST on Financial Statements

Let us now look at the impact of GST on the final statement and the profit and loss statement:

Profit and Loss Statement

| Details | Price (₹) | Details | Price (₹) |

| Raw Material | XXXX | Sales | XXXX |

| Purchases | XXXX | ||

| Depreciation | XXXX | ||

| Other Costs | XXXX |

You will notice there is a decrease in the cost of raw materials, purchases, and other related costs since the businessman can now avail of ITC on these expenses when filing the GST Return.

Balance Sheet

| Assets | Amount (₹) | Liabilities | Amount (₹) |

| Capital | XXXX | Fixed Assets | XXXX |

| Current Liabilities | XXXX | Current Assets | XXXX |

| Tax Payable | XXXX | Bill Receivable | XXXX |

| Bills Payable | XXXX | Credit Receivable | XXXX |

Under the accounting for GST journal entries, the cost of fixed assets will decrease as the businessman can avail of ITC (Input Tax Credit) on fixed assets.

Prerequisite for Keeping Records and Accounts Under GST Calculations

The Central Government has put in place draft rules for GST records and accounts. It contains an additional list pertaining to GST accounting online and maintenance of records. Under this, the books of accounts must be available at the storage facility while the goods are stored there. Details of shipment, delivery, receipts, and disposal of goods should also be available. The transporter of goods too should keep a record of the goods delivered or stored for delivery. Under the new GST rules, all records should be maintained at the places where the business transactions are done. If electronically maintained, the records should be ready to be displayed as and when required. If the taxpayer’s profits exceed the prescribed limit, he needs to get an audit done.

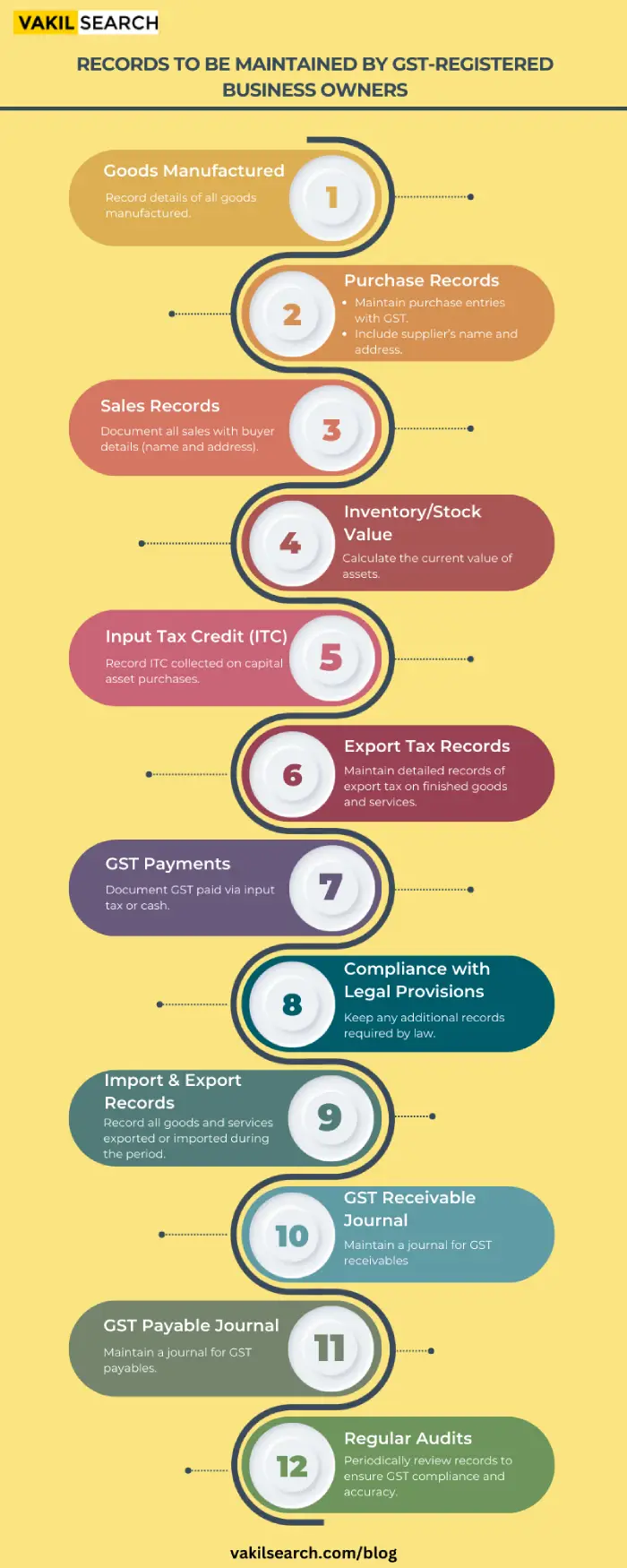

Records To be Maintained by Business Owners Registered Under GST

- Detail of all the goods manufactured by the taxpayer/ businessman

- The details of purchases made. The purchase entry with GST should be recorded. Purchase details, including the name and address of the supplier

- Details of all the sales made by the taxpayer. The record should also include the name and address of the buyer

- Inventory/stock value should be calculated accurately. It should be the current value of the asset in the list of the taxpayer

- Input tax credit under GST – the amount of income tax collected when purchasing capital assets

- the detailed record of the export tax on the sale of finished goods and services

- The GST paid input tax/ cash

- Any other record if instructed by the provisions of law

- Goods and services exported and imported during the relevant period

- GST receivable journal entry book must be maintained

- GST payable journal entry book must be maintained

Purchase Entry with GST

When you buy something for your business in a country with GST (Goods and Services Tax), you need to record the purchase with the tax included. Here’s a breakdown of how to make a purchase entry with GST:

Scenario: Imagine your company buys office supplies for $1,000, and the GST rate is 10% (so the tax amount is $100).

- Making the Entry: There are three main accounts involved:

- Office Supplies: This is the expense account where you record the cost of the supplies before GST. In this case, you would debit $1,000.

- GST Input Tax: This account tracks the GST you pay on your purchases. You would debit $100 for the GST on the office supplies.

- Accounts Payable or Cash: This account reflects how you’re paying for the purchase. If you’re buying on credit, you debit Accounts Payable for $1,100 (total cost including GST). If you’re paying cash, you debit Cash for $1,100.

- What it Means: This entry separates the cost of the supplies from the GST you paid. It shows the actual expense for your business, keeps track of the tax you can claim back (input tax credit), and reflects the total amount paid to the supplier.

By understanding how to record purchase entries with GST, you can maintain accurate financial records and ensure a smooth tax filing process.

Conclusion

We hope this article on GST in the Accounting Journal has helped acquire you your purchase entry with GST. It has been over five years since GST was implemented in India: https://services.gst.gov.in/services/searchtp, but the common person is still not well acquainted and perplexed with the new GST provisions. Through this article, we strive to remove the difficulties faced by taxpayers while dealing with GST issues. The books of accounts must be accurately maintained to avoid any consequences in the future. For more legal information, visit Vakilsearch.

FAQs

How to record purchases with GST in tally?

To record purchases with GST in Tally:

- Go to ‘Accounting Vouchers’ and select ‘F9: Purchase’

- Choose the supplier's account and enter the purchase details

- Input the items purchased with quantities and rates.

- Tally will calculate the total amount including GST based on the tax rates set up in the system.

How do I record a purchase in GST?

Firstly, know your purchase type: Local, interstate, or fixed asset. Then you gather details like Invoice number, date, amount, tax rate, and HSN/SAC (goods). Open the right voucher, that is check if purchase or expense, depending on the software. Enter supplier and purchase info. Then, choose tax ledgers - CGST, SGST, or IGST based on purchase type. Make sure everything looks right and save the entry.

What is the journal entry for purchases?

This shows the expense of the goods or services bought and boosts the purchase account along with the inventory of the purchased item. Credit the Party Account indicates the obligation from the purchase, recognizing that you owe money to the supplier.

How to do journal entry with GST?

A distinct account is needed for each category to distinguish between taxes paid on inputs and taxes received on outputs. This helps the business track Input GST and Output GST amounts separately, making it easier to calculate tax liabilities accurately.