If you want to start an eCommerce business, read this article to understand GST, TDS, and TCS under GST, as well as the registration process.

Overview

Section 2(44) of the CGST Act, 2017 defines e-commerce as the supply of goods or services via an electronic network. Under Section 2(45) of the CGST Act, 2017, an e-commerce operator (ECO) is a person who directly or indirectly owns or manages an electronic facility, platform, or GST for e-commerce.

E-commerce in India has been on an upward growth route. It is expected to reach US$99 billion by the year 2024 and become the second-largest e-commerce market after the US. Global players Facebook and Google have also made huge investments in the Indian e-commerce market. Additionally, the Central Board Of Excise & Customs (CBEC) has considered its high growth potential and tax complexity, hence, providing special provisions for e-commerce GST registration.

Latest updates on GST Registration

Here are a few GST registration updates to take note on:

The 52nd GST Council meeting, chaired by Union FM Nirmala Sitharaman, convened on October 7, 2023, at Sushma Swaraj Bhawan, New Delhi. The meeting aimed to address crucial issues within the GST framework.

In the preceding 51st GST Council meeting held on August 2, 2023, via video conferencing, significant discussions revolved around the implementation of a 28% GST levy on casinos, race courses, and online gaming. The decisions made during this meeting aimed to streamline taxation on various entertainment and gaming platforms.

The 50th GST Council meeting, conducted on July 11, 2023, took pivotal steps, including the decision to send intimations for excess Input Tax Credit (ITC) claims in GSTR-3B compared to GSTR-2B above a certain limit through DRC-01C to seek responses. Additionally, the meeting fixed the GST rate on online gaming at 28% on the full face value. The Council’s deliberations during this session impacted both compliance and tax rates in the digital gaming sector.

The GST landscape witnessed continuous updates, including the mandatory Two-factor Authentication for taxpayers with a turnover exceeding Rs. 100 Crore from July 15, 2023, impacting e-invoicing and e-way bill systems. Further instructions were issued on online scrutiny by the Central Board of Indirect Taxes and Customs (CBIC) for the financial year 2019-20 onwards, ensuring adherence to standardized procedures.

On May 16, 2023, the government portal went live with the GSTR-9 and GSTR-9C filing facility for the financial year 2022-23, providing a streamlined avenue for taxpayers to fulfil their filing obligations. Additionally, on May 11, 2023, the launch of the automated return scrutiny module aimed to enhance communication efficiency between GST officers and taxpayers, marking a significant step towards optimizing the scrutiny process.

On May 10, 2023, CBIC notified the initiation of the 6th phase of e-invoicing, requiring taxpayers with a turnover exceeding ₹5 Crore in any financial year from 2017-18 to issue e-invoices from August 1, 2023. This phase aimed to further integrate and digitize the invoicing process, aligning with the government’s ongoing efforts to enhance the GST ecosystem.

Goods and Services Tax (GST)

GST is an indirect destination-based tax applied on goods and services at the end place of consumption. Moreover, it is collected at every stage of sale or purchase. Hence we can say that it is a multistage, comprehensive, destination-based tax.

Except for exempted categories, irrespective of their turnover all e-commerce dealers/traders/aggregators selling goods/services online are required to register for GST under Section 24 (ix) and (x) of the Central Goods and Service Tax Act, 2017. They must collect and deposit a 1% tax (0.5 percent CGST + 0.5 percent SGST) on each transaction.

Eligibility Criteria

To understand the GST eligibility criteria, one needs to also understand TCS and TDS on GST along with Section 2(44) and Section 2(45) of the CGST Act, 2017, defining e-commerce businesses and e-commerce operators.

Tax Collected at Source (TCS)

An e-commerce operator (ECO) is responsible for collecting TCS. As per Section 52(1) of the CGST Act of 2017, every ECO shall collect tax at a maximum of 1% of the net value of taxable goods or services from the supplier making supplies through the operator’s online platform Additionally,

- If ECOs are operating through their own website and dealing in their own products, then they need to register GST for e-commerce under the category of the taxpayer (normal). For example, Oppo owns, operates, and manages its own website by itself. The company is selling its own products through its own website.

- Moreover, on the other hand, if an ECO gets supplies from suppliers to sell on their own online platforms, then they need to apply under the category of the tax collector (e-commerce). For example, Oppo sells products through Amazon, Flipkart, snap deal, etc.

Hence, there are two models for e-commerce GST

- Registration for ECO

- Registration for person supplying through ECO

Tax Deducted at Source (TDS) Under GST

TDS collection in GST is done by depositing with the government. Section 51 of the CGST Act, 2017, requires deducting TDS at a rate of 2% (1 % CGST+1% SGST) before making payments to suppliers. If the transaction value exceeds ₹ 2,50,000. Additionally, some of these categories are departments of the central government or state government, local authorities, governmental agencies, etc.

Who Will Collect TCS Under GST?

- Tax Collection at Source (TCS) under GST is primarily applicable to e-commerce operators.

- E-commerce operators act as intermediaries facilitating transactions between buyers and sellers.

- TCS is collected by the e-commerce operator at a specified rate on the consideration received by the seller from the sale of goods or services.

GST Registration Rules for Those Liable to TCS

- E-commerce operators liable to collect TCS must register under GST, irrespective of their turnover.

- The GST registration process involves providing necessary details about the business and its operators.

- Once registered, the e-commerce operator is obligated to collect TCS on eligible transactions and remit it to the government.

How to Calculate Net Value of Taxable Supplies

Section 52 (1) of the GST Act defines the net value of taxable supplies as the difference between the ‘total value of monthly taxable supplies [except services mentioned under Section 9(5)]’ through the ECO and the ‘total value of monthly taxable supplies returned to the suppliers.

GST Registration for People Supplying Online Information from Outside India

- Individuals or entities supplying online information and database access or retrieval (OIDAR) services from outside India to customers in India are liable to register under GST.

- OIDAR services include services like providing online content, website hosting, distance maintenance of programs, and more.

- Such service providers must register under GST, comply with the relevant tax regulations, and fulfill their tax obligations in India.

GST Registration Process for OIDAR Service Providers

- OIDAR service providers need to initiate the GST registration process by submitting the required details online.

- The registration form includes information about the service provider, their business operations, and any other particulars necessary for compliance.

- Once registered, OIDAR service providers must adhere to GST regulations, including invoicing, filing returns, and complying with tax rates applicable to their services. This ensures proper integration into the GST framework for cross-border digital services.

How to Register GST for E-Commerce?

The GST registration process is completed online. There is no need to submit any hard copies of printouts or proofs for enrollment. The steps for GST registration for an e-commerce seller are as follows:

Step 1

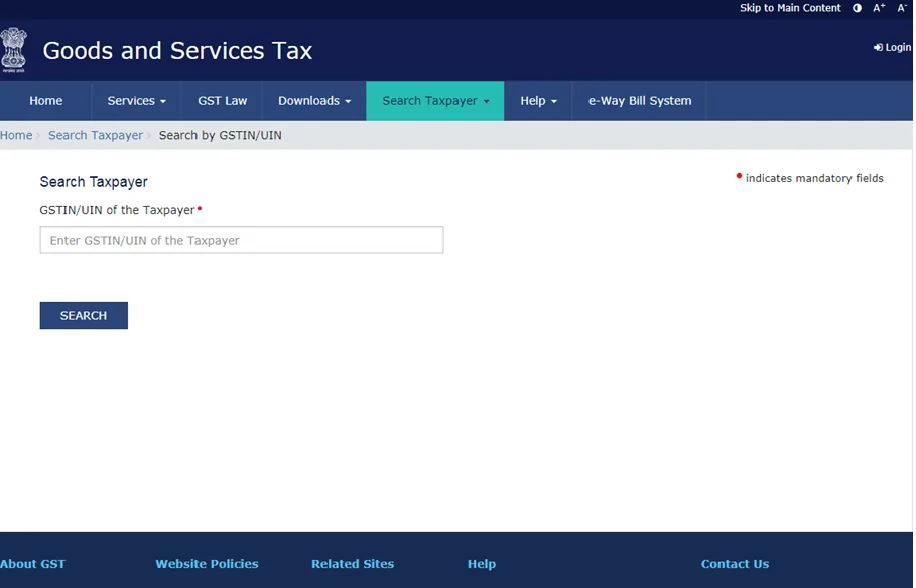

Go to GST registration official website available at – https://www.gst.gov.in

Step 2

Go to the ‘Services’ tab at the menu bar on the left side > Select Registration > New Registration.

Step 3

You are then redirected to the GST registration online form. Select your category, i.e., either as the taxpayer or the tax collector (e-commerce).

| Note: It is best to seek advice from a CA, CS, or GST practitioner before deciding on a category. You can seek advice from the Vakilsearch team, which is proficient in legal matters. |

Step 4

Permanent account number (PAN), Aadhar number, address proof, proof of business registration, bank account statements, legal name of the business, email address, and mobile number are all required to be uploaded to obtain GST registration.

Once the relevant documents have been uploaded, an Application Reference Number (ARN) will be sent via SMS and email to confirm the registration.

Registration Fee

In case you complete the GST Registration procedure online, no fee will be levied. You may however need to pay nominal fees for the professional services availed to obtain GST registration.

Conclusion

GST is required for all types of businesses, and the majority of business owners require assistance when applying for GST. You can contact Vakilsearch to resolve any issues you are having with applying for GST registration.

You can use our GST calculator to know how much GST you owe before you register.Frequently Asked Questions

Is GST registration mandatory for e-commerce?

Yes, GST registration is mandatory for e-commerce operators. They are required to collect and remit Tax Collection at Source (TCS) on transactions facilitated through their platforms.

How do I register my e-commerce business with GST?

To register an e-commerce business with GST, visit the GST portal, fill out the necessary details in the registration form, submit the required documents, and complete the verification process. Once approved, a GSTIN (Goods and Services Tax Identification Number) is issued.

Is GST registration mandatory for Amazon sellers?

Yes, GST registration is mandatory for Amazon sellers and other e-commerce operators. Sellers need to comply with GST regulations and collect TCS on transactions made through the platform.

What is the limit of GST registration for online business?

There is no turnover limit for GST registration in the case of e-commerce businesses. Registration is mandatory for all e-commerce operators, irrespective of their turnover.

Who pays GST in e-commerce?

In e-commerce transactions, both the buyer and the seller may have GST obligations. Sellers collect GST on the value of goods or services sold, and buyers pay GST on their purchases.

What is the GST turnover limit for e-commerce?

Unlike regular businesses, e-commerce operators are required to register for GST regardless of their turnover. There is no specific turnover limit for GST registration in the e-commerce sector.

What is the cost of GST registration for e-commerce?

The cost of GST registration for e-commerce businesses can vary. It is advisable to check the official GST portal or consult a tax professional for accurate information on registration fees.

Who is eligible for GST registration?

Any business or individual engaged in the supply of goods or services with a turnover exceeding the prescribed threshold limit is eligible for GST registration.

What is the tax on e-commerce?

E-commerce transactions are subject to GST. Sellers collect GST from buyers, and e-commerce operators collect TCS on behalf of the government.

Can I sell online without GST?

No, GST registration is mandatory for online sellers. Selling goods or services online without GST registration is not compliant with tax regulations.

Can I do business without GST registration?

Businesses with a turnover below the prescribed threshold may not be required to register for GST. However, certain businesses, including e-commerce operators, must register irrespective of turnover.

Is GST required for Shopify?

Yes, if your business on Shopify involves supplying goods or services and your turnover exceeds the prescribed limit, GST registration is mandatory. Compliance with GST regulations is essential for e-commerce businesses using platforms like Shopify.