Learn about GST on gold in India in 2025, including tax on gold ornaments, making charges, and digital gold. Get a detailed breakdown of GST calculations.

Under the current GST regime in India, all gold transactions—whether for jewellery, bullion, or digital formats—are taxed under a standardized structure designed to simplify compliance and enhance transparency. A 3% GST is uniformly levied on the value of 18K, 22K, and 24K gold, divided equally between Central GST (CGST) and State GST (SGST). Additionally, a 5% GST is applied specifically on making charges, which cover the labour and craftsmanship costs involved in designing gold jewellery.

This system replaces the previously fragmented model of VAT, service tax, and excise duty, offering a single-point tax structure. Whether you’re buying a 22K bridal necklace, 18K contemporary jewellery, 24K investment-grade coins, or even digital gold, GST is calculated separately for the metal value and the making charges, providing full cost breakdown and billing transparency.

Quick Reference: GST Rates on Gold Components (2025)

| Gold Type / Component | GST Rate | Tax Basis |

| 18K, 22K, 24K Gold (Metal) | 3% | On intrinsic gold value |

| Making Charges (Labour) | 5% | On fabrication/service component |

| Digital Gold | 3% | On purchase value |

HSN Code Reference (for Businesses)

- HSN Code 7113 – Gold jewellery and articles thereof

- HSN Code 9988 – Job work and making charges in jewellery services

Why Understanding GST on Gold Matters in 2025

Gold in India is more than just a luxury—it’s a financial asset, cultural staple, and investment tool. Knowing how GST is applied helps buyers plan purchases, compare rates more accurately, and avoid overpaying due to hidden or miscalculated taxes. For jewellers and bullion traders, this knowledge ensures legal compliance and customer trust, especially in high-ticket segments like 22K traditional jewellery or 24K bullion.

Moreover, for digital-savvy investors buying digital gold online, GST is still applicable at 3%, which is important when comparing investment options. Being informed about tax slabs, component-wise application, and updated rules not only empowers consumers but also supports India’s larger goal of formalizing the gold economy and reducing cash-based, informal gold transactions.

What is the GST on Gold?

The GST on gold in India is 3%, including physical, digital gold, and jewelry. This is split into 1.5% CGST and 1.5% SGST. For example, a ₹1,00,000 gold purchase attracts ₹3,000 GST, applicable to gold, coins, and bars.

What Are the GST Rates on Gold?

Taxes on gold in India vary based on transaction type. Here’s how it works:

- GST on gold value: GST is applied to all gold purchases, regardless of purity (22-carat, 24-carat, or 18-carat).

- GST on Making Charges: 5% GST is added to gold jewellery making charges.

- GST on imported gold: Gold imported into India attracts 12.5% customs duty and 3% IGST on assessable value (gold price + customs duty).

As an example,

- Gold Value: ₹50,000

- Making Charges: ₹5,000

- GST on Gold (3%): ₹50,000 x 3% = ₹1,500

- GST on Making Charges (5%): ₹5,000 x 5% = ₹250

Total GST Payable: ₹1,500 (on gold) + ₹250 (on making charges) = ₹1,750. Tax planning for gold purchases and investments is simplified by this rate structure.

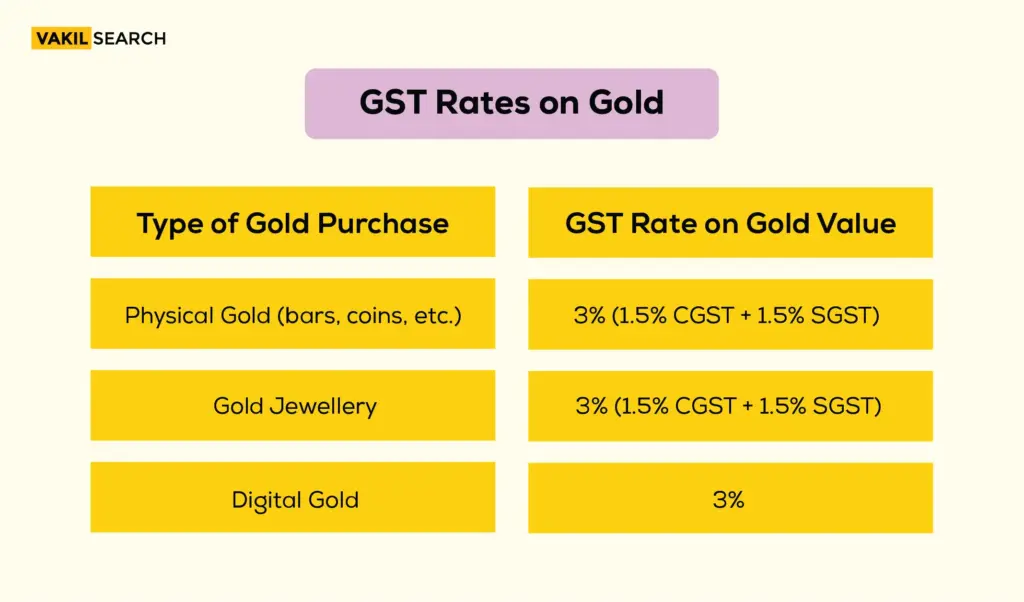

GST Rates on Gold

What is the GST on Purchases of Physical Gold?

Regardless of its form (bars, coins, or jewellery), GST on gold purchases in India are subject to 3% (1.5% CGST + 1.5% SGST). An additional 5% GST is imposed on the making charges for gold jewellery. These taxes have replaced earlier levies such as VAT and service tax, resulting in a uniform taxation system.

For example, if you buy gold worth ₹1,00,000 with ₹10,000 in making charges, you’ll pay ₹3,000 (3%) as GST on gold value and ₹500 (5%) as GST on making charges, bringing the total to ₹1,13,500. Both buyers and businesses must understand these rates, as they directly impact the final price of physical gold.

What is the GST on Gold Jewellery Making Charges?

In the case of gold jewellery, the making charges are subject to a 5% GST under the GST framework. These making charges are used to cover the cost of the craftsmanship and labor involved in creating the jewelry.

For instance, if the making charges for your jewellery amount to ₹5,000, the GST on making charges would be ₹5,000 x 5% = ₹250. This amount is added to the total cost of the jewellery, along with the 3% GST on the value of gold.

It is important for buyers to be aware of these additional charges when planning gold jewellery purchases. The government streamlined taxation by introducing GST on making charges, ensuring consistency throughout India. To ensure transparency, always inquire with your jeweller if making charges are itemized separately.

What is the GST on Digital Gold?

Digital gold, another popular investment option, is also subject to 3% GST, just like physical gold. GST is applied to the transaction value at the time of purchase for digital gold. Unlike physical gold, digital gold does not involve making charges, so there is no additional GST imposed.

For example, if you purchase digital gold worth ₹50,000, the GST will be ₹50,000 x 3% = ₹1,500, bringing the total cost to ₹51,500. Investors should also be aware that when selling digital gold, any capital gains are subject to income tax as per applicable rates, adding an additional layer of compliance.

What is the 24 Carat Gold GST Rate in India?

The GST rate for 24-carat gold in India is 3%. This rate applies to both gold jewelry and gold coins, and is consistent across various forms of 24-carat gold.

For example, if you purchase a 24-carat gold coin weighing 10 grams for ₹50,000 with a 5% making charge (₹2,500), the total value becomes ₹52,500. The GST applied will be ₹1,575 (3% of ₹52,500), making the final cost ₹54,075.

What is the 22 Carat Gold GST Rate in India?

In India, the GST rate for 22-carat gold is 3%. This rate applies to gold jewelry and ornaments made of 22-carat gold, including gold coins and other items.

For instance, if you buy a 22-carat gold necklace weighing 50 grams for ₹1,50,000 with a 5% making charge (₹7,500), the total value becomes ₹1,57,500. The GST charged will be ₹4,725 (3% of ₹1,57,500), bringing the final price to ₹1,62,225.

What is the 18 Carat Gold GST Rate in India?

The GST rate for 18-carat gold in India is also 3%. This rate applies to gold items made from 18-carat gold, including jewelry, coins, and other forms of 18-carat gold.

For example, if you purchase an 18-carat gold bracelet weighing 20 grams for ₹40,000 with a 5% making charge (₹2,000), the total value becomes ₹42,000. The GST applicable will be ₹1,260 (3% of ₹42,000), making the final cost ₹43,260.

How to Calculate GST for Gold?

To calculate the total cost of gold, including GST, follow these steps:

-

Step 1: Determine the Gold Value

Start with the market price of gold for the weight and purity you want to purchase. For example, 10 grams of 22-carat gold = ₹50,000.

-

Step 2: Add Making Charges

The cost of crafting jewellery is charged by jewelers.

Let’s assume making charges = ₹5,000.

-

Step 3: Calculate GST on Gold Value (3%)

GST on the gold value is 3% of ₹50,000: ₹50,000 x 3% = ₹1,500

-

Step 4: Calculate GST for Making Charges (5%)

GST on making charges is 5% of ₹5,000: ₹5,000 x 5% = ₹250

-

Step 5: Add Everything

Add the gold value, making charges, and their respective GST amounts:

Total Price = ₹50,000 (Gold) + ₹5,000 (Making Charges) + ₹1,500 (GST on Gold) + ₹250 (GST on Making Charges) Final Cost = ₹56,750. You can calculate your total gold jewellery purchase cost, including GST, by following this simple steps mentioned above. Calculation:

In 2017, the GST replaced earlier taxes such as VAT, excise duty, and service tax with a unified 3% GST on gold value and 5% GST on making charges. In the upcoming Union Budget 2025, the jewellery industry is requesting that GST rates be revised and gold monetisation measures be enhanced. To encourage compliance and make gold more affordable, stakeholders, including Malabar Gold & Diamonds and GJC, are advocating a 1% GST on gold. Demands: Industry leaders highlight that reducing taxation would boost consumer demand, drive formalisation, and help the sector grow from $80 billion (FY24) to $145 billion by FY28. When gold is used for further production, resale, or business purposes, businesses registered under GST can claim input tax credit. Gold purchases made for personal use are not eligible for ITC. Buyers must have valid tax invoices and comply with GST regulations in order to claim ITCs. Consider these points when investing in gold to minimize unnecessary costs. GST on gold affects everyone—whether you’re buying jewellery, investing in digital gold, or running a gold business. A 3% GST is charged on gold value, and 5% GST on making charges for jewellery, which adds to the total cost. Knowing these GST rates and how GST is calculated helps you plan your purchases better. For businesses, staying compliant with GST rules and using benefits like input tax credit can save money. As gold remains a popular investment in India, understanding GST is important for making smart and cost-effective decisions. Stay informed, calculate carefully, and make the most of your gold investments! To compute GST on gold jewellery, you need the advice of experts such as Vakilsearch Indeed. Get Your GST Registration Done Easily with Vakilsearch Experts!! Still have questions? Below are answers to the most common queries people have about GST on gold, helping you understand the rates, making charges, and purchase guidelines with clarity.

The GST rate on gold in India is 3%, consisting of 1.5% CGST and 1.5% SGST. It applies to all forms of gold, including jewellery, coins, and bars. For a ₹1,00,000 purchase, GST is ₹3,000.

The GST on 22k gold is 3% of the gold's value. Additionally, a 5% GST is applied on making charges for gold jewellery. These rates apply uniformly across India, ensuring transparency in pricing.

Post-GST, you pay a 3% GST on the gold value, 5% on making charges, and 12.5% import duty on 1 gram of gold. Previously, there was 1% sales tax, with no tax on gold making charges or GST on the gold value.

The 3% GST on gold replaces the earlier 1% VAT and 1% service tax, introduced to discourage gold imports into the country. The higher charges are aimed at reducing gold import dependency.

In India, purchasing gold without paying GST is illegal, as GST is mandatory on all gold purchases. Exceptions include gold bought through specific government schemes or sovereign gold bonds, which may be GST-exempt.

As of April 10, 2025, the gold prices in Chennai are ₹8,560 for 22K gold, ₹9,338 for 24K gold, and ₹7,090 for 18K gold, with price increases of ₹270, ₹294, and ₹255 respectively.

Post-GST, the tax on 1 gram of gold includes a 3% GST on the gold value, 5% GST on making charges, and 12.5% import duty. Previously, there was 1% sales tax and no GST on the gold value.

Making charges on gold range from 3% to 25%, depending on the value of the gold. Wastage charges typically range from 5% to 7%. These charges are negotiable, and simple designs tend to have lower making charges.

To calculate gold making charges, determine the current market price of gold, the weight of the jewelry, and the making charge (either a fixed amount per gram or a percentage of the gold's value). Add the making charges to the gold’s value and GST to get the final price.

No, gold does not have 12% GST. The GST rate on gold is 3%, and 5% applies only to the making charges for jewellery.

No, gold is not GST-exempt. A 3% GST is applied to gold purchases, and an additional 5% GST is charged on jewellery making charges.

Step

Particulars

Calculation

Amount (₹)

1

Gold Price (10 grams, 22-carat)

Given

₹50,000

2

Making Charges (10% of gold price)

₹50,000 x 10%

₹5,000

3

GST on Gold Value (3%)

₹50,000 x 3%

₹1,500

4

GST on Making Charges (5%)

₹5,000 x 5%

₹250

5

Total Cost

Gold + Making Charges + GST

₹56,750

Impact of GST on Gold Prices

Jewellery Sector Seeks Tax Relief in Budget 2025

Input Tax Credit for Gold Purchases

Consideration Before Investing in Gold

Check Purity and Certification: Opt for BIS hallmarked gold to ensure authenticity and resale value.Conclusion on GST Gold Rate

FAQs About GST on Gold

What are the GST rates on gold?

What is the GST on 22k gold?

How much tax do you pay on 1 gram of gold?

Why is there a 3 percent GST on gold?

How to buy gold without GST?

What is the price of 1gram gold today?

How much tax do you pay on 1 gram of gold?

What are making charges on gold?

How do you calculate gold making charges?

Does gold have 12% GST?

Is gold GST exempt?