The Employees' State Insurance Corporation (ESIC) is a social security scheme in India that provides medical and other benefits to employees and their families. Every employee who earns less than INR 21,000 per month and works in an establishment with 10 or more employees is covered under ESIC.

Introduction

The Employees’ State Insurance Corporation (ESIC) is a social security scheme in India that provides medical and other benefits to employees and their families. Every employee who earns less than INR 21,000 per month and works in an establishment with ten or more employees is covered under ESIC.

The ESIC Act defines ‘wages’ as any remuneration paid or payable to an employee in cash or kind or partly in cash or partly in kind. It includes any dearness allowance but does not include any sum paid to the person employed to defray special expenses entailed on him by the nature of his employment or any gratuity payable on discharge.

The ESIC Act also exempts certain allowances from the definition of ‘wages’. This means that these allowances are not included in the calculation of the employee’s ESIC contribution.

What is ESIC?

The Employees’ State Insurance Corporation (ESIC) is a social security scheme in India that provides medical and other benefits to employees and their families. Every employee who earns less than INR 21,000 per month and works in an establishment with ten or more employees is covered under ESIC.

What Are Allowances?

Allowances are payments made to employees in addition to their basic salary. Allowances are typically paid to cover specific expenses, such as travel expenses, house rent allowance, and meal allowance.

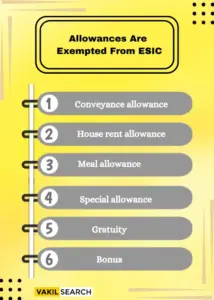

Which Allowances Are Exempted From ESIC?

The following allowances are exempted from ESIC:

- Conveyance allowance: This is an allowance paid to employees to cover their travel expenses from home to work and vice versa.

- House rent allowance: This is an allowance paid to employees to cover their house rent expenses.

- Meal allowance: This is an allowance paid to employees to cover their meal expenses.

- Special allowance: This is an allowance paid to employees to cover specific expenses, such as medical expenses, educational expenses, and childcare expenses.

- Gratuity: This is a lump sum payment made to employees on their retirement or termination of employment.

- Bonus: This is a performance-linked payment made to employees.

Examples of Exempted Allowances

- Travelling allowance (TA): This is an allowance paid to employees to cover their travel expenses while on official duty.

- Daily allowance (DA): This is an allowance paid to employees to cover their living expenses while on official duty.

- Hotel allowance: This is an allowance paid to employees to cover their hotel expenses while on official duty.

- Uniform allowance: This is an allowance paid to employees to purchase and maintain their uniforms.

- Medical allowance: This is an allowance paid to employees to cover their medical expenses.

- Educational allowance: This is an allowance paid to employees to cover the educational expenses of their children.

- Childcare allowance: This is an allowance paid to employees to cover the childcare expenses of their children.

- Performance bonus: This is a bonus paid to employees based on their performance.

- Profit-sharing bonus: This is a bonus paid to employees based on the profits of the company.

Benefits of Exempting Allowances From ESIC

There are a number of benefits to exempting allowances from ESIC. These benefits include:

- Reduced employer contribution: Employers are required to contribute to ESIC based on the total wages of their employees. By exempting allowances from ESIC, employers can reduce their ESIC contribution.

- Increased employee take-home salary: By exempting allowances from ESIC, employees can take home more salary.

- Improved employee morale: Exempting allowances from ESIC can help to improve employee morale, as employees will feel that they are being compensated fairly.

Conclusion

A number of allowances are exempted from ESIC. These allowances include conveyance allowance, house rent allowance, meal allowance, special allowance, gratuity, and bonus. Exempting allowances from ESIC can benefit both employers and employees. Employers can reduce their ESIC contribution, while employees can take home more salary and enjoy improved morale.

It is important to note that the exemptions mentioned above are general in nature. There may be specific cases where an allowance may not be exempted from ESIC. It is always advisable to consult with an ESIC expert to confirm whether a particular allowance is exempted from ESIC.

It is also important to note that the ESIC Act is subject to change from time to time. It is always advisable to stay updated on the latest changes to the ESIC Act to ensure that you are in compliance.

Frequently Asked Questions:

Both the employer and the employee are responsible for paying ESIC contributions. The employer's contribution is 4.75% of the employee's wages, while the employee's contribution is 1.75% of their wages.

ESIC contributions are calculated on the basis of the employee's wages. The employee's wages include all remuneration paid to the employee in cash or kind in respect of his employment, except for the allowances that are exempted from ESIC.

ESIC contributions are payable on a monthly basis. The employer is responsible for deducting the employee's contribution from their salary and depositing it with the ESIC along with their own contribution.

ESIC provides a number of benefits to employees and their families, including: Medical care: ESIC provides medical care to employees and their families through a network of ESIC hospitals and dispensaries. Maternity benefits: ESIC provides maternity benefits to female employees for a period of 26 weeks. Sickness benefits: ESIC provides sickness benefits to employees who are unable to work due to illness or injury. Disablement benefits: ESIC provides disablement benefits to employees who become permanently disabled. Dependents' benefits: ESIC provides dependents' benefits to the dependents of deceased employees. Who is responsible for paying ESIC contributions?

How are ESIC contributions calculated?

When are ESIC contributions payable?

What are the benefits of ESIC?