Retirement fund organisation If a person has a problem with their provident fund (PF) claim or any other service pertaining to their PF account, they can submit a complaint through the EPFO's online portal.

What is EPFiGMS?

An official channel for complaints or grievances regarding the EPF is the EPFiGMS. Through this portal, all registered EPF subscribers can submit their PF Withdrawal complaints, inquiries, and grievances online. It is a specially designed official Employees’ Provident Fund Organisation (EPFO) portal to address subscribers’ complaints.

Because they can file PF withdrawal complaint on this portal from anywhere, EPF subscribers can submit grievances with ease through EPFiGMS. The concerned office or department to whom the concerns relate will receive the filed grievances.

Following the grievance registration process, the system will automatically create a unique registration number and send out an email and SMS acknowledgement. EPF concerns can be easily registered and faster resolved with the help of this portal.

- On a special website, epfigms.gov.in, subscribers to the EPFO can register their complaints and monitor the progress of their complaints

- Your complaint will be resolved by EPFO within 15 days. Last year, EPFO reduced the time frame for settling numerous claims, including PF withdrawal, from 20 days to 10 days

- However, EPFO has issued a warning that complaints from users would only be taken into consideration if the member’s Universal Account Number (UAN) is provided.

Functions of EPFO Portal: EPFiGMS

To improve user efficiency, the grievance management system is updated over time to reflect current developments and eliminate process irregularities. Among the essential tasks carried out by the EPFiGMS are:

- The main purpose is to provide an integrated platform where EPF users may register and file complaints and get their issues resolved.

- When consumers file complaints through the portal, EPFiGMS compiles all of the complaints about various services that EPFO provides.

- Following collection, all grievances are thoroughly classified to streamline the process and pinpoint areas that are particularly prone to complaints.

- The relevant departments receive the complaints and process them further.

- It assesses and finds the effectiveness of the procedures and equipment used in the grievance redressal process.

- Enables subscribers to provide input on the management system and the redressal procedure to anticipate areas of unhappiness and determine whether the companies are upholding transparency for the benefit of the customers.

- By entering the relevant UAN and PF withdrawal complaint registration number, customers can use the ‘View Status’ area to verify the status of their redressal.

- To guarantee that a consumer-centric process is enabled, appropriate rules for the policies are drawn with consideration for all the services offered by EPFO.

Nature of PF Withdrawal Complaints Received on EPFO Portal

Numerous sources of PF Withdrawal complaints give rise to complaints. Nonetheless, records show that the majority of complaints are about:

- EPF, pension, and insurance claim settlements

- Switching PF accounts

- Employee enrolment failure or delay

- Issues with previous PF accounts

- Concerns pertaining to UAN

Who Can Register PF Withdrawal Complaints on EPFiGMS?

On the EPFiGMS, EPF subscribers can file PF withdrawal complaints. Among the EPF members are the following:

- PF participant.

- EPS retiree.

- Employer.

- Others but Only if a person lacks a UAN, PPO, or establishment number

Different Issues Relating to Grievance on the EPFO Portal

This grievance management system allows grievances about the following issues to be registered:

- Complete EPF Settlement or EPF Withdrawal

- PF Accumulation Transfer to a New EPF Account

- Issue of PF Slip/PF Balance Cheque Final Settlement of Pension Payment of Insurance Benefit Scheme Certificate Lost, Found, or Any Other Problem

How to File an Online Complaint Against Provident Fund?

PF withdrawal complaint can be given by following these steps:

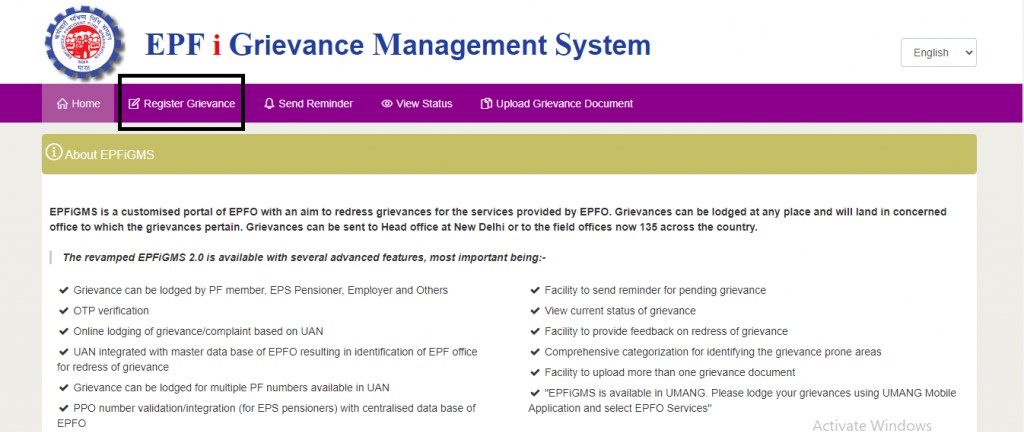

- Visit epfigms.gov.in, the website of EPFO

- On the top menu bar, select ‘Register Grievance.’

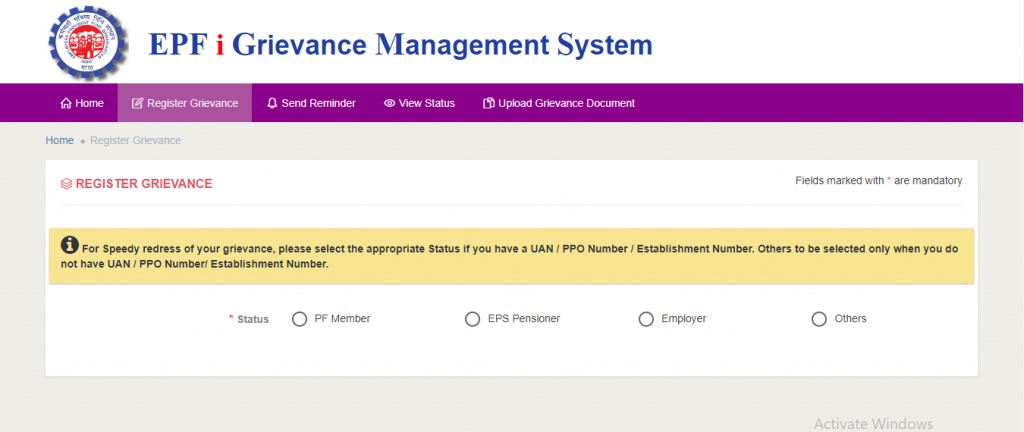

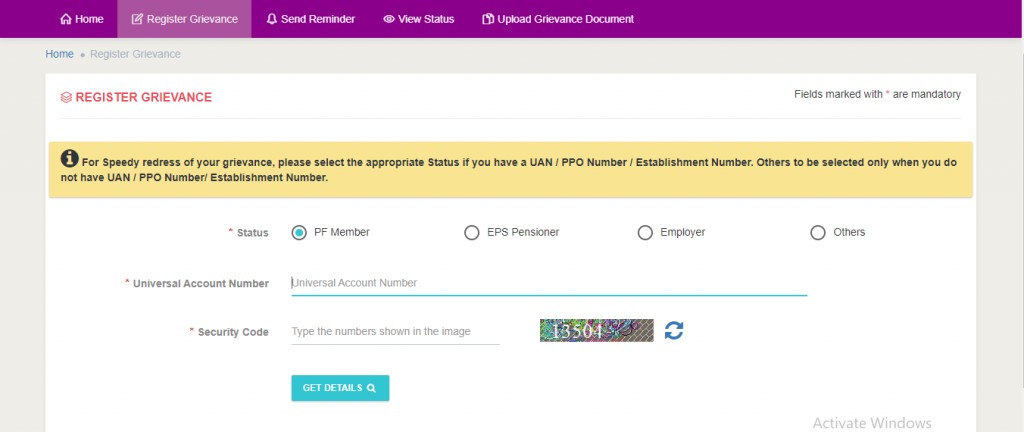

- There will be a new page. Choosing the suitable status from the drop-down option is important. Enter information such as your PF number, the office’s name to which the PF withdrawal complaint pertains, UAN, and security code.

- Include your name, phone number, and email address in the contact information field now

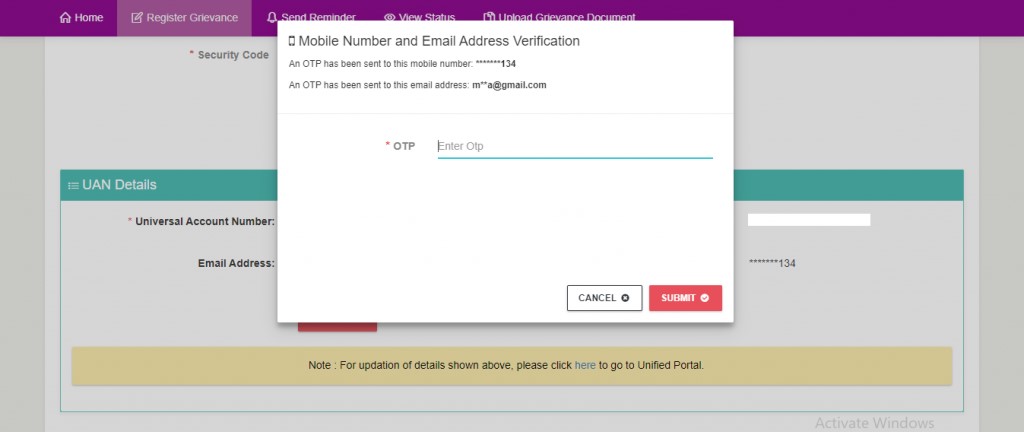

- Enter the received OTP now.

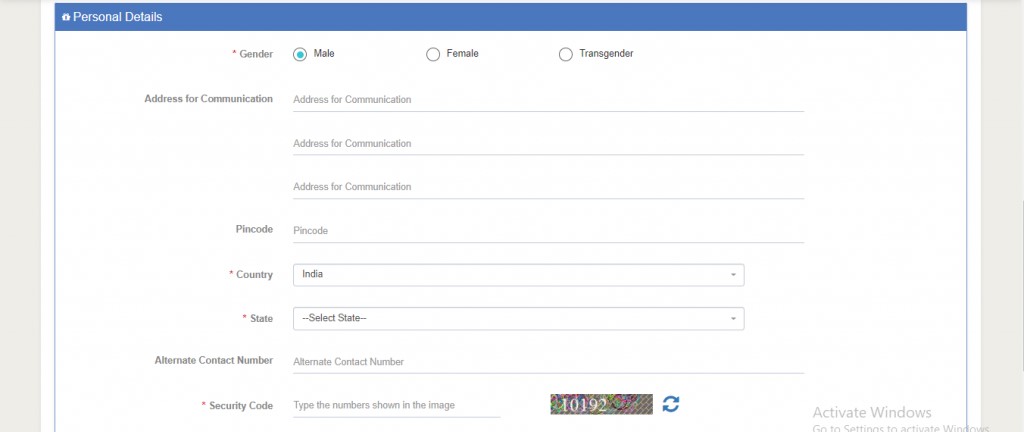

- Now enter the personal information, country, pin code, etc

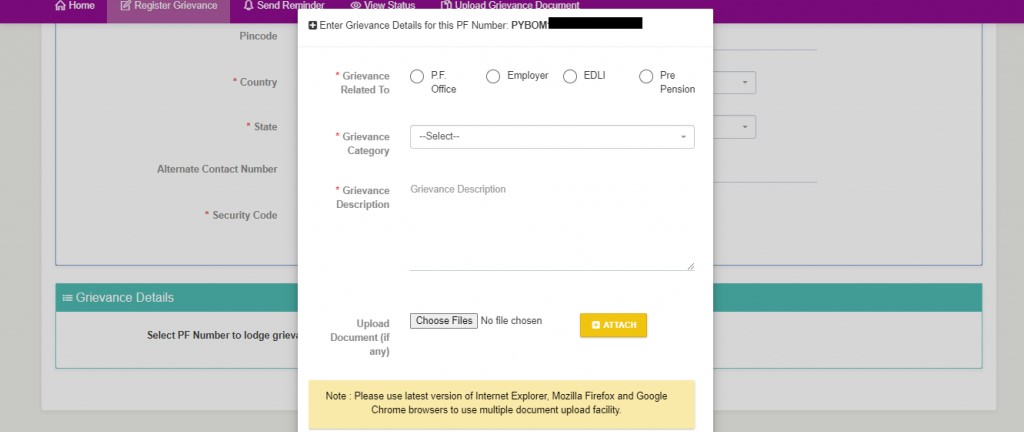

- Choose the category of PF withdrawal complaint from the drop-down option in the third column, and then, in no more than 5000 characters, outline your concern

- Additionally, you can include PDF files that are related to your PF withdrawal complaint. To submit your grievance, complete the captcha that appears on the screen

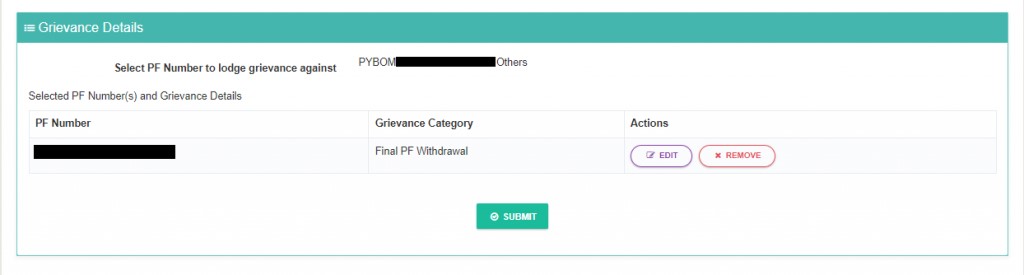

- Following the successful submission of your pf withdrawal complaint, a registration number will be generated. Keep the registration number on file for future use.

The government has made it possible for anyone to access a non-refundable advance from their employee provident fund in order to assist those who are struggling financially as a result of the ongoing COVID-19 pandemic in the nation (PF). The maximum amount that employees may remove from their PF accounts is 75% of the remaining balance, or three months’ worth of basic pay + dearness allowance, whichever is less.

More About EPFO

‘This advance has received a large number of applications.

The Employees’ Provident Fund Organisation(EPFO) has so far resolved 7.40 lakh Covid-19 claims, according to the most recent press release. The advance under such claims is available for application by employees online.

Working with only a third of its workforce, EPFO is currently attempting to resolve the claims in the order of priority. The claims submitted under COVID-19 are being resolved quickly—within three working days, according to an EPFO press release.

Many people, however, complained on social media platforms about the delays in obtaining the money or the denial of claims. ‘All claims submitted online go to the EPFO’s National Data Centre and are handled there.In the event of any discrepancies, the claims are referred to the regional offices for resolution’, according to an EPFO field staffer from the Gurugram office.

The officer stated that ‘the majority of the delays or denials are caused by faulty papers uploaded by the employees throughout the claim filing process.’

Reasons Why PF Claim is taking a long time Or Why PF Withdrawal is delayed

- Uncertain cheque book or passbook scan: An employee must upload a scanned copy of the chequebook, the cover page of the passbook, or the bank account statement when submitting a claim online. The applicant’s name, bank account number, and IFSC code must be included in these documents

- By doing this, it is ensured that all money transactions are accurate and that the bank account information uploaded as part of the KYC process or connected to an employee’s universal account number (UAN) is correct

- If the scan is unclear, it may be difficult to match the information with what is provided against the employee’s UAN

- As a result, EPFO may require you to upload the scanned copy once more, which could cause a delay. Therefore, upload a crisp scan of the document with the bank account information.

- Incorrect bank account information Sometimes information provided during a claim, such as the bank’s IFSC code or the account number, does not match what is seeded with the UAN. The reason could have been because the employer disseminated false information.

- It’s also possible that the bank account associated with the UAN has stopped being active. As a result, the user will need to change the bank information. Online updates to bank account information are possible.

- Sometimes an employee requests that the claim be sent to a bank account other than the one listed next to the UAN number. It needs to be changed as a result.

- Any modification to the KYC information, however, requires the employer’s approval. Employers can approve modifications online using their digital signatures, but occasionally they are unable to do so because of a continuing lockdown since their system may be at the office, which will cause a delay, according to the field officer.

Inadequate Balance

As the criteria is 75% of the provident fund balance or three months’ worth of basic plus dearness allowance, whichever is smaller, the employee must have contributed for at least three months in order to take the money.

Use Vakilsearch`s EPF calculator to decide out how an entire lot coins is probably amassed for your EPF account even as you retire.

The Bank’s Time Commitment

Within three days of receiving the claim, the EPFO processes it and sends the bank the check. The money is normally credited to the employee’s account one to three days later by the bank.

Therefore, it’s essential that your paperwork is in order and that your records match what is seeded with your UAN for a hassle-free withdrawal.

Steps to Register EPF Grievance Online

All PF members can follow these steps to register for EPF Grievance online:

- Step 1: Go to https://epfigms.gov.in/, the official EPFIGMS portal.

- Step 2: Select the “Register Grievance” menu item.

- Step 3: Choose one of the following options in opposition to the status:

Employer Others PF Member EPS Pensioner

- Step 4: Type the security code and your Universal Account Number (UAN).

- Step 5: At this point, select “Get Details.”

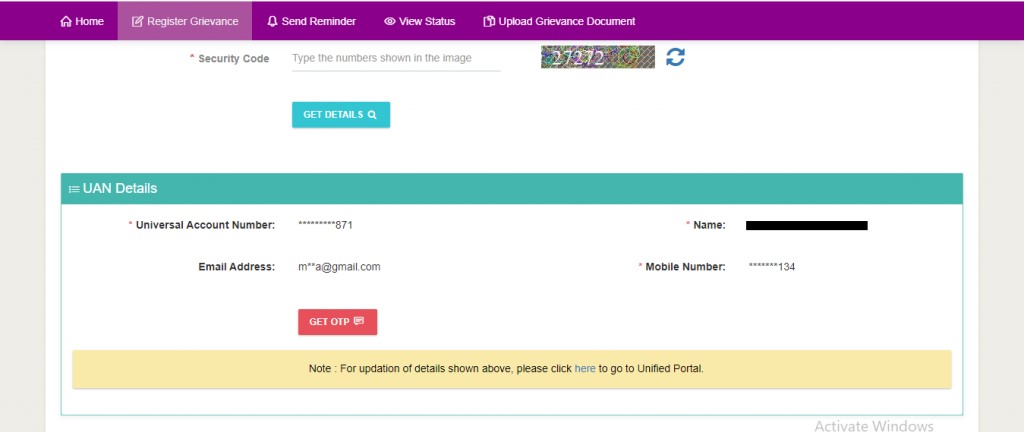

- Step 6: A screen will display your name, UAN, email address, and mobile number.

- Step 7: You must select the “Get OTP” option. Enter the OTP that was delivered to the mobile number you registered.

- Step 8: Select the PF Account Number from the list of personal information.

- Step 9: After that, choose the grievance, the grievance category, and the description.

- Step 10: The last step is to upload the necessary files. Selecting “Choose File and the Attach” is necessary.

Note: Your email address and mobile number will receive a registration number. Up to thirty days may pass before your PF withdrawal complaint is addressed.

Steps to Check your EPF Grievance Status

To find out the status of your EPF Grievance, take the following actions:

- Step 1: Go to https://epfigms.gov.in/, the official EPFIGMS portal.

- Step 2: Select the “View Status” from the menu.

- Step 3: Enter the registration number that was provided to you when you filed the PF withdrawal complaint.

- Step 4: If the PF withdrawal complaint was filed on an earlier version, you can enter the grievance password or your email address or mobile number.

- Step 5: After finishing, input the security code that appears on the screen.

- Step 6: Select “Submit” from the menu.

- Step 7: A screen will display your PF withdrawal complaint status.

Steps to Send Reminder of EPF Grievance

The procedures listed below can be used to remind someone about your PF withdrawal complaint:

- Step 1: Go to https://epfigms.gov.in/, the official EPFIGMS portal.

- Step 2: Select the “Send Reminder” option.

- Step 3: Enter the registration number that was provided to you when you filed the PF withdrawal complaint.

- Step 4: If the PF withdrawal complaint was filed on an earlier version, you can enter the grievance password or your email address or mobile number.

- Step 5: After that, input the security code and reminder description.

- Step 6: Select “Submit” from the menu. You will receive a reminder about your PF withdrawal complaint from the relevant department.

Delayed PF Withdrawal Claim

This is what the EPF asks of you: ‘Online claims submitted under COVID-19 are handled automatically and take 72 hours to complete’. However, claims that do not entirely comply with KYC must be processed manually, which takes time. We are also handling other claims, according to EPFO: https://www.epfindia.gov.in/site_en/index.php

EPFO Helpline Number

To raise a PF withdrawal complaint or get answers to questions, EPF subscribers can also get in touch with EPF customer service. The following email address is where they can direct any concerns or inquiries:

Employeefeedback@epfindia.gov is the address where staff members can direct PF withdrawal complaint and inquiries within

Employers can contact employerfeedback@epfindia.gov with complaints or inquiries. Even more, EPF customers can lodge grievances by calling 1800 118 005, which is a toll-free number.

They can file a PF withdrawal complaint on social media by visiting the official EPFO accounts on Twitter and Facebook. Nonetheless, before contacting the aforementioned email addresses or the EPFO toll-free line, it is advised that EPF members register their grievances and PF withdrawal complaint or submit their questions on the EPFiGMS.

Conclusion

Processing time for an EPF claim under COVID-19 A check is sent to your bank for crediting the amount after the EPFO processes the claim, and it takes another 1-3 days for the credit to appear in your account. And until the pandemic is over, the facility is accessible to all EPF subscribers.

Notably, users of the service may withdraw funds up to the lower of their basic wage or dearness allowance (DA) on a non-refundable basis. You only need to present the bank with a scanned image of your bank account to submit the claim.

For further information on programs such as provident fund, withdrawal, and others, please contact our Vakilsearch experts. We answer all of your PF withdrawal complaint-related questions.