After taxpayers have filed their Income Tax Returns, the subsequent step is to verify the ITR-V Acknowledgment form provided by the Income Tax Department. Safeguarded by an ITR password, this document ensures access is restricted to authorized users.

Every individual must give due attention to their respective income tax notices. However, the notice under Section 143 (1) of the Income Tax Act, 1961 is Password to open ITR protected for privacy and security reasons. The Income Tax (IT) department gives individuals the ITR password for income tax intimation once their Income Tax Returns (ITR) are processed. This is done to let them know if they have to pay any additional amount to settle their taxes or if they are due for a refund. Yet, the notice thus sent is not very plainspoken and is quite complicated. Regardless, the taxpayer has the utmost necessity to assimilate the content of the notice, word by word. The notice carries vital information as to whether the ITR submitted by the taxpayer aligns with the record held by the IT department. In this blog, you will learn how to open your ITR V form with ease.

What is ITR-V?

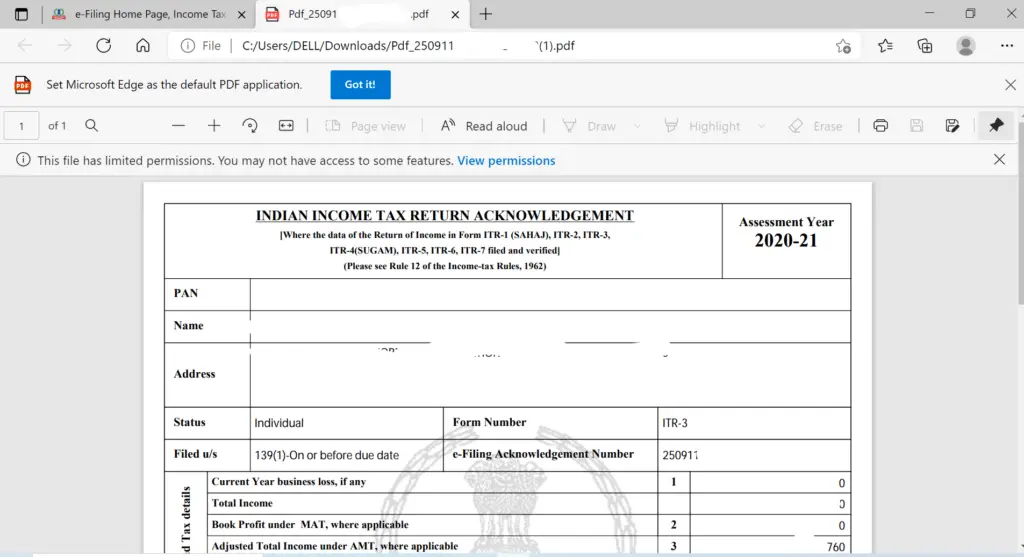

ITR-V or Income Tax Return Verification is provided by the Income Tax Department to the taxpayers. As the name suggests, the IT department verifies the authenticity of the proofs submitted by the taxpayers online, and a single-page acknowledgment is sent to them through e-mail. The ITR-V can also be downloaded from the e-filing website. It has to be noted that ITR-V applies to those who file the return without a digital signature. E-filing has made it possible to obtain the ITR-V form from the comfort of one’s home or office without much hassles.

Steps to Obtain ITR-V Acknowledgment Form

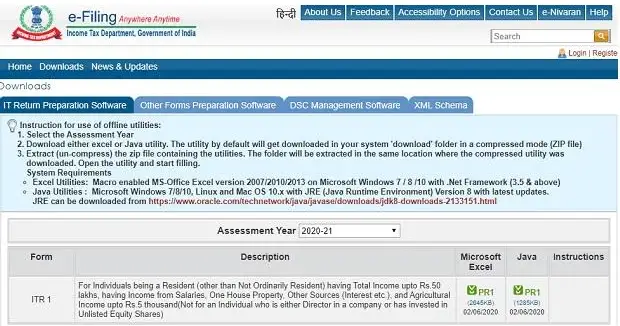

Once ITR is filed by a taxpayer, the ball is set rolling. The next course of action would be for the IT department to prepare the ITR-V acknowledgment and send it to the taxpayer’s registered email address. The same is also downloadable from the official website of the IT department. The following steps have to be practiced to download the form:

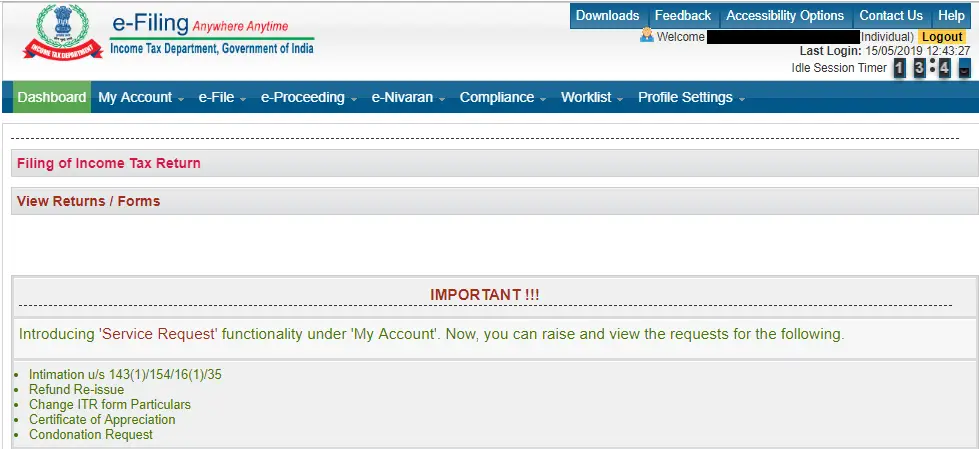

- Step 1: Log in to the official website of the Income Tax Department and select the “View Returns/ Forms” link

- Step 2: Choose the option “Income Tax Return”, or “Assessment Year” and click “Submit”

- Step 3: Click on the ‘Acknowledgement Number’ to download the ITR-V form. The taxpayers can also choose to e-verify their Income Tax Returns. For e-verification, select ‘Click here’ on the respective page

- Step 4: Click on ‘ITR-V/Acknowledgement’ to download the form

- Step 5: The IT Processing Centre (IPC) sends the password-protected ITR-V file to the taxpayer. It has to be kept in mind that the document thus sent is confidential in nature.

How to Get the ITR Acknowledgement Number?

To get the ITR Acknowledgement Number, you can follow these steps:

- Check Registered Email: After filing your ITR, you will receive the ITR-V on your registered email, which contains the ITR acknowledgment number.

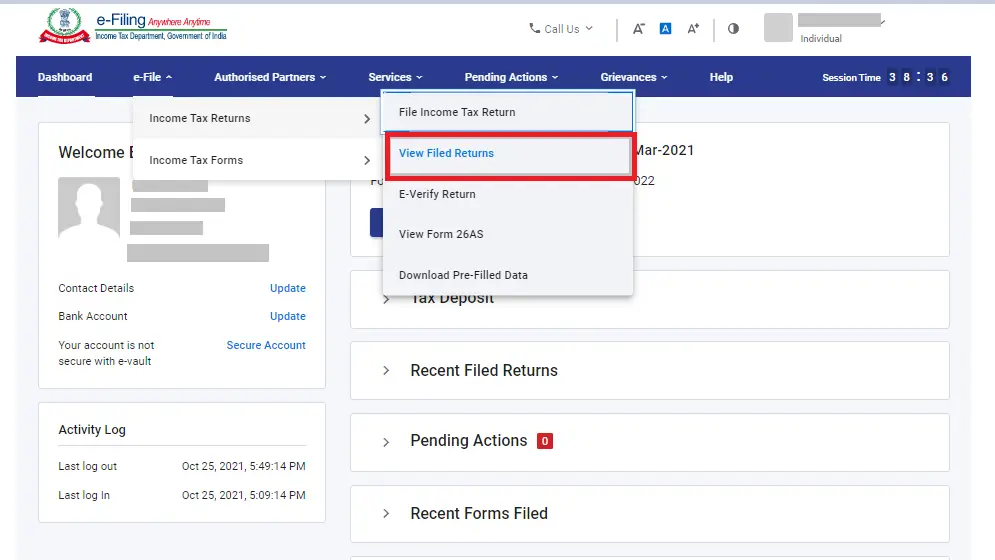

- Login to e-Filing Portal: You can also log in to the e-Filing portal and find the acknowledgment number under the “View Filed Returns” option.

- Download ITR-V: You can download the ITR-V from the e-filing portal, and the acknowledgment number will be mentioned on the form.

It’s important to check your ITR status periodically to ensure it has been accepted and processed by the Income Tax Department

How to Verify ITR Using Acknowledgement Number?

- Step 1: Navigate to the homepage of the e-filing portal.

- Step 2: Select “Income Tax Return (ITR) Status.

- Step 3: On the ITR Status page, input your acknowledgment number and a valid mobile number, then click “Continue.”

- Step 4: Enter the 6-digit OTP received on your mobile (from Step 3) and click “Submit.”

Note:

- The OTP remains valid for 15 minutes.

- You have three attempts to enter the correct OTP.

- The on-screen OTP expiry countdown timer indicates the remaining time.

- Resending OTP generates a new one.

Upon successful validation, you can view your ITR status.

Note:

- If your PAN is inoperative, a pop-up message will state that a refund cannot be issued. You can link your PAN by clicking “Link Now” or proceed with “Continue.”

- Use “Filter” to view filed returns based on different criteria (AY or Filing Type).

- Click “Export to Excel” to export your returns data to an Excel format.

- Click “View Details” to review the life cycle of the return and action items (e.g., returns pending for e-Verification).

Verify Return Using EVC (Electronic Verification Code)

There are four methods to generate an Electronic Verification Code (EVC) for e-verifying income tax returns, outlined as follows:

Net Banking: E-Verify Using EVC Generated Through Net Banking

- Log in to your Net Banking Account

- Visit the e-filing portal.

- Click on the E-Verify link associated with the uploaded return.

- Successfully verify the e-return.

Bank ATMs: E-Verify Using EVC Generated Through Bank ATMs

- Swipe your ATM Card in a Bank ATM.

- Choose the option for e-filing PIN.

- Receive the EVC on your Registered Mobile Number.

- Log in to the e-Filing Portal and select the option to E-Verify Return using Bank ATM.

- Enter the received EVC on the portal.

- Successfully verify the e-return.

Bank Account Number: E-Verify using EVC generated through Bank Account Number.

- Go to the e-filing Portal.

- Pre-validate your Bank Account Number if not validated.

- After successful validation, click the e-verify link, select the option to E-Verify using Bank Account Details, and Generate OTP.

- Receive the EVC on your Registered Mobile Number.

- Enter the EVC on the e-filing Portal.

- Successfully verify the e-return.

Demat Account Number: E-Verify using EVC generated through Demat Account Number.

- Go to the e-filing Portal.

- Pre-validate your Demat Account Number if not validated.

- After successful validation, click the e-verify link, select the option to E-Verify using Demat Account Details, and Generate OTP.

- Receive the EVC on your Registered Mobile Number.

- Enter the EVC on the e-filing Portal.

- Successfully verify the e-return.

Why is E- E-Verification of ITR Important?

E-Verification of Income Tax Return (ITR) is crucial for several reasons, contributing to the efficiency, accuracy, and security of the income tax filing process. Here are some key reasons why E-Verification of ITR is important:

1. Confirmation of Filing

E-verification serves as a confirmation that the taxpayer has indeed filed their income tax return. It ensures that the filing process is complete.

2. Timely Processing

E-Verification expedites the processing of the tax return by confirming its authenticity promptly. This helps in the timely assessment and processing of any refunds, if applicable.

3. Avoidance of Manual Submission

Prior to the introduction of e-verification methods, taxpayers had to manually submit a signed copy of ITR-V to the Centralized Processing Centre (CPC). E-verification eliminates the need for such manual submissions.

4. Enhanced Security

E-verification methods, such as OTP (One-Time Password) verification, add an extra layer of security to the process. This helps in preventing unauthorized access and misuse of personal information.

5. Faster Refund Processing

Timely verification accelerates the processing of refunds, if applicable, leading to a faster disbursement of refunds to eligible taxpayers.

6. Reduction of Paperwork

E-verification eliminates the need for physical documents to be sent to the tax department. This not only reduces paperwork but also contributes to environmental sustainability.

7. Compliance with Regulations

E-Verification ensures that taxpayers comply with the regulations set by the Income Tax Department, promoting a more streamlined and accountable tax filing process.

In essence, E-Verification of ITR is essential for ensuring the completeness, accuracy, and security of the income tax filing process, benefiting both taxpayers and tax authorities. It streamlines the process, reduces the chances of errors or rejection, and promotes a more efficient and secure digital tax ecosystem.

ITR Password Format for Opening ITR Acknowledgment Form

The ITR-V can be accessed by the taxpayer only with an authenticated Password to open the ITR. The ITR password is unique for every taxpayer. The Password to open ITR combines the taxpayer’s PAN number and Date of Birth (DoB). It is obtained by entering the lowercase PAN number and birth date in the ‘DDMMYYYY’ format without any space between the two. Further, the form can be opened only in Acrobat Reader versions 8.0 or above. Suppose the user still has issues accessing the record. In that case, the E-filing Income Tax Administrator can be contacted through e-mail at ask@incometaxindia.gov.in, and the taxpayer has to mention the details about the PAN number and the DoB. The generation of a Password to open ITR to access the ITR-V acknowledgment form can be better understood through the following illustration:

Consider the taxpayer’s PAN to be BCDEF2485T and their DOB is May 12, 1990. The Password to open the ITR of the form would be Bcdef2485t12051990.

Once the ITR-V acknowledgment form is obtained by the taxpayer by duly entering the ITR password, the same should be furnished to the Central Processing Centre (CPC) of the IT department through post in the following address:

Generation of Electronic Verification Code (EVC):

An alternative to the submission of the ITR-V to the IT department is the Electronic Verification Code, wherein taxpayers can check their returns online. Electronic Verification Code (EVC) is a 10-digit alphanumeric code, required to E-verify the tax return that was submitted. The code is generated online through the official website of the IT department. It is necessary to verify the return within 120 days. Failing to do so would render the ITR submission invalid by Income tax Assessment.

Steps to Generate EVC:

- Step 1: The taxpayers are required to ITR Login to their Net Banking Account

- Step 2: The user has to navigate to the tab relating to Income Tax Filing on the Home page

- Step 3: On selecting the “E-Verify” option, the user is navigated to the official website of the Income Tax department

- Step 4: The ‘My Account’ tab is clicked to generate the EVC and the same is sent to the registered e-mail ID and mobile number after the generation

- Step 5: Using the EVC thus generated, the ITR can be verified.

The ITR can also be verified through the Aadhar card through the following steps, provided the PAN card and the Aadhar card are linked.

- Step 1: The taxpayer should link the PAN card and the Aadhar card

- Step 2: The user has to go to the official website of the IT department and select e-Verify using Aadhaar OTP

- Step 3: An OTP will be generated and will be sent to the mobile number that is registered with the Aadhar card

- Step 4: On receiving the OTP and entering the same in the website the ITR can be verified. The OTP thus generated is valid only for 10 mins

- Step 5: Once the e-verification is accomplished, the attachment is downloaded. The attachment is for reference purposes only, and no further steps are required after this.

An alternate method to check the ITR is through the Debit card. This can be done as shown below.

- Step 1: The taxpayer is required to swipe the debit card at a bank ATM

- Step 2: Select the option of “Generate PIN for e-Filing”

- Step 3: The EVC or the PIN is received in the registered mobile number

- Step 4: The user then has to visit the Income Tax Department e-filing website and select the option “e-verify” using Bank ATM

- Step 5: The EVC is now entered to gain access to the ITR.

For detailed steps on each method, reach out to the experts at Vakilsearch.

FAQs on ITR-V Password

Is the Password to Open ITR document the same every year?

The ITR password for opening the ITR document is unique for every taxpayer and is generated based on the combination of the taxpayer's PAN number and date of birth.

Can I set my own ITR password for my file, or is it assigned by default?

The Password to Open ITR file is assigned by default and is generated based on the combination of the taxpayer's PAN number and date of birth.

What should I do if I forget the ITR password to open my ITR document?

If you forget the password to open your ITR document, you can contact the Income Tax Department or the e-filing Income Tax Administrator through email and provide your PAN number and date of birth to obtain the ITR password.

Are there specific password requirements, such as length or special characters, for ITR files?

The Password to Open ITR file is a combination of the taxpayer's PAN number and date of birth in the DDMMYYYY format, without any spaces or special characters. It is recommended to use Adobe Reader version 8.0 or above to open the ITR password-protected PDF document.

Can I change the Password to Open ITR document after it has been generated?

No, you cannot change the Password to Open ITR document as it is generated by the Income Tax department for your benefit.

Is the Password to Open ITR different for various ITR forms (ITR-1, ITR-2, etc.)?

The ITR Password to Open ITR document is the same for all ITR forms and is generated based on the combination of the taxpayer's PAN number and date of birth.

Are there any security measures or best practices I should follow regarding the password for my ITR document?

It is recommended to keep the Password to Open ITR document confidential and not share it with anyone. It is also recommended that you use a strong ITR password for the email account used for e-filing.