This blog highlights the differences between voluntary dissolution and mergers for Section 8 companies. It covers legal steps, financial impacts, and the effect on stakeholders. By learning these critical factors, organisations can make informed decisions aligned with their mission and goals.

Section 8 companies are established with a mission to create meaningful social impact, often operating in dynamic environments that require adaptability and resilience. However, challenges such as financial constraints, operational inefficiencies, or changing regulatory landscapes can lead organizations to reevaluate their future. In such situations, leaders often face two critical pathways: voluntary dissolution or merging with a like-minded organization.

Choosing between these options is not just a financial decision—it’s a strategic and ethical one. Both dissolution and merger come with unique considerations, from the impact on stakeholders and beneficiaries to the preservation of the organization’s mission and legacy. While voluntary dissolution ensures a clean closure with resources redirected responsibly, a merger offers the opportunity to continue the mission in collaboration with a partner, potentially creating greater impact.

This article explores the key factors to consider when deciding between voluntary dissolution and merger, guiding Section 8 companies toward the most suitable choice for their circumstances and goals. Whether it’s about maintaining financial sustainability or ensuring mission alignment, understanding these options can help leaders make informed, thoughtful decisions.

Understanding Voluntary Dissolution for Section 8 Companies

Voluntary dissolution refers to the formal process of winding up a Section 8 company when its members or directors decide to cease operations. This decision often arises due to financial challenges, shifting strategic priorities, or other organizational factors that make it impractical to continue.

The process involves compliance with legal requirements, asset liquidation, and obtaining approval from the National Company Law Tribunal (NCLT) in India. A thorough understanding of the reasons, legal procedures, and implications of voluntary dissolution can help organizations navigate this transition effectively.

Reasons for Opting for Voluntary Dissolution

Section 8 companies may choose voluntary dissolution for several reasons:

- Financial Constraints: Persistent financial struggles, insufficient funding, or an inability to meet liabilities often push organizations toward closure.

- Strategic Redirection: When the original mission becomes irrelevant or unattainable, dissolution may free resources for more impactful initiatives.

- Statutory Requirements: Regulatory non-compliance or failure to meet statutory obligations could necessitate winding up.

- Liabilities: Mounting debts and the inability to settle obligations can make voluntary dissolution the most responsible option.

- Non-Profit Closure: When an organization has fulfilled its objectives or lacks further purpose, dissolution ensures an orderly closure.

Legal Procedures for Voluntary Dissolution

The process of voluntarily dissolving a Section 8 company involves several legal steps to ensure compliance and transparency:

- Board Resolution: A formal resolution must be passed by the board of directors approving the dissolution.

- Regulatory Approvals: Necessary approvals must be obtained from the Registrar of Companies (RoC) and other regulatory bodies.

- Court Application: An application is filed with the NCLT to initiate the winding-up process.

- Asset Distribution: Assets must be liquidated or transferred to another organization with similar objectives, as per the rules governing Section 8 companies.

- Creditor Settlement: All liabilities and debts are settled before completing the dissolution process.

- NCLT Approval: Final approval from the NCLT is required to complete the dissolution and remove the company’s name from the register of companies.

Advantages and Disadvantages of Voluntary Dissolution

Advantages:

- Legal Compliance: Ensures the organization exits operations in a lawful and transparent manner.

- Cost Savings: Eliminates ongoing operational expenses in the absence of financial sustainability.

- Stakeholder Protection: Provides clarity to stakeholders by responsibly settling debts and redistributing assets.

- Strategic Closure: Allows directors to focus on other ventures or initiatives better aligned with their mission.

Disadvantages:

- Compliance Costs: The process involves significant legal and administrative expenses.

- Complexity: Navigating regulatory approvals, creditor settlements, and asset distribution can be time-consuming and complex.

- Impact on Stakeholders: Closure may negatively affect beneficiaries, employees, and other stakeholders who rely on the organization.

- Loss of Mission: Dissolution signifies the end of the organization’s mission, potentially leaving unaddressed gaps in social impact.

Voluntary dissolution is a critical decision for Section 8 companies, requiring careful consideration of its benefits and drawbacks. While it provides an orderly exit, organizations must weigh the implications on stakeholders, financial obligations, and legacy before proceeding.

Understanding Mergers for Section 8 Companies

Mergers provide Section 8 companies with an opportunity to consolidate resources, align missions, and create greater social impact. A merger involves two or more non-profit organizations coming together to operate jointly, pooling their resources, expertise, and operational strengths.

This strategic approach can address challenges such as limited funding, overlapping missions, and inefficiencies, while ensuring continuity in serving beneficiaries. Understanding the reasons, legal procedures, and implications of mergers is essential for Section 8 companies considering this option.

Reasons for Opting for a Merger

Mergers are often driven by the following strategic considerations:

- Strategic Alliances: Merging with another organization helps build stronger alliances that can amplify the impact of shared objectives.

- Resource Sharing: Combining resources such as infrastructure, funding, and expertise reduces redundancy and operational inefficiencies.

- Organizational Goals: Mergers allow organizations to achieve larger, more ambitious goals that may be difficult to pursue independently.

- Growth Potential: Joining forces with a complementary organization can expand geographic reach, beneficiary base, and funding opportunities.

- Funding Advantages: Funders and donors may prefer consolidated organizations that demonstrate efficiency and a unified approach to addressing social issues.

- Mission Alignment: When two organizations share similar missions, merging ensures a more cohesive approach to achieving their objectives.

Legal Procedures for Mergers

Mergers for Section 8 companies involve a well-defined legal process to ensure compliance and transparency:

- Board Resolution: Each organization must pass a board resolution approving the merger and outlining its objectives.

- Due Diligence: A thorough assessment of both organizations is conducted to evaluate financial health, liabilities, and operational compatibility.

- Merger Agreement: A formal agreement is drafted, specifying the terms of the merger, including roles, responsibilities, and asset distribution.

- Regulatory Steps: Approvals are sought from the Registrar of Companies (RoC) and other regulatory bodies, as required by the Companies Act.

- NCLT Approval: The National Company Law Tribunal (NCLT) must approve the merger to finalize the legal consolidation.

- Asset Transfer: The transfer or consolidation of assets and liabilities is executed in accordance with the merger agreement.

- Integration Plan: An integration strategy is developed to ensure a seamless transition in operations, management, and stakeholder engagement.

Advantages and Disadvantages of Mergers

Advantages:

- Synergy: Combines strengths and expertise, creating a more impactful and efficient organization.

- Resource Optimization: Eliminates redundancies and allows better utilization of shared resources.

- Mission Continuity: Ensures that the social mission is carried forward under a unified framework.

- Stronger Funding Appeal: Larger, more efficient organizations often attract more donor support and grant opportunities.

- Enhanced Reach: Expands the geographic and demographic impact of the merged entity.

Disadvantages:

- Integration Challenges: Merging operations, systems, and teams can be complex and time-consuming.

- Management Alignment: Differences in leadership styles or management philosophies may create conflicts.

- Mission Coherence: Diverging missions or objectives between merging entities may dilute the focus.

- Regulatory Complexities: Navigating legal procedures and compliance requirements can be resource-intensive.

- Loss of Identity: Smaller organizations may lose their individual identity and brand recognition post-merger.

Mergers provide Section 8 companies with a pathway to growth and sustainability while preserving their mission. However, they require careful planning, alignment of goals, and a robust integration strategy to ensure long-term success. Stakeholders must weigh the benefits and challenges of merging to determine if it is the right path forward.

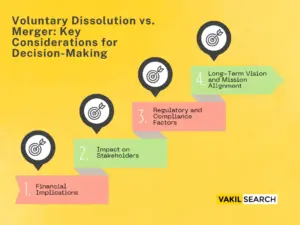

Voluntary Dissolution vs. Merger: Key Considerations for Decision-Making

Deciding between voluntary dissolution and a merger is a pivotal moment for any Section 8 company. The decision should be guided by a thorough evaluation of financial implications, stakeholder interests, regulatory compliance, and the organization’s long-term vision. Each option has unique advantages and challenges, and the choice ultimately depends on the organization’s goals and circumstances. Below are the key considerations to weigh when determining the best path forward.

Financial Implications

Financial health is a critical factor in deciding between dissolution and a merger.

- Voluntary Dissolution: Involves assessing the value of assets, liabilities, and debts to ensure all obligations are settled responsibly. Asset valuation and liquidation play a key role in meeting liabilities and redirecting remaining resources. Cost-benefit analysis is essential to determine if dissolution is the most economical option.

- Merger: Requires evaluating funding options, cost-sharing opportunities, and potential financial synergies. Financial forecasting is necessary to ensure the combined entity will remain stable and sustainable. Merging often provides access to shared resources and increased funding, making it an attractive alternative to dissolution.

Impact on Stakeholders

The decision must take into account the interests and expectations of all stakeholders.

- Voluntary Dissolution: Directly impacts beneficiaries, donors, volunteers, and partners. Transparent communication is vital to maintain trust and explain the reasons for closure. A clear plan for settling liabilities and redistributing assets demonstrates responsibility toward stakeholders.

- Merger: A merger can reassure stakeholders by ensuring mission continuity and expanding impact. Effective communication about the merger’s benefits, goals, and operational changes fosters stakeholder buy-in. However, misalignment or lack of clarity may lead to confusion or loss of trust.

Regulatory and Compliance Factors

Legal and regulatory obligations differ significantly between dissolution and merger.

- Voluntary Dissolution: Requires compliance with statutory regulations, including filing with the Registrar of Companies (RoC) and obtaining National Company Law Tribunal (NCLT) approval. Asset liquidation, liability settlements, and audits must be conducted according to legal requirements.

- Merger: Involves navigating regulatory approvals, filing merger agreements, and adhering to post-merger compliance standards. Due diligence is essential to ensure all liabilities and legal obligations are transferred seamlessly. Proper documentation and adherence to audit standards are critical for regulatory compliance.

Long-Term Vision and Mission Alignment

The choice should align with the organization’s long-term vision and mission.

- Voluntary Dissolution: Suitable for organizations that can no longer achieve their objectives or sustain operations. While it signifies the end of the entity, it allows for an orderly closure and the opportunity to redirect assets to similar causes, preserving the legacy.

- Merger: Enables the continuation and growth of the mission under a unified framework. Organizations with aligned goals can combine strengths to create a sustainable impact. However, it may require rebranding and adjustments to ensure coherence with the new entity’s mission and objectives.

Conclusion:

Deciding between voluntary dissolution and merger is a significant decision for any Section 8 company. It requires a comprehensive assessment of organizational health, financial sustainability, stakeholder interests, and alignment with long-term goals. While voluntary dissolution offers a structured exit when continuation is no longer feasible, mergers provide an opportunity to amplify impact by combining resources and expertise with a like-minded organization.

The right path depends on the unique circumstances of the company, including its financial position, mission alignment, and future prospects. By prioritizing responsible decision-making and transparency, Section 8 companies can ensure that their chosen course of action reflects their commitment to creating meaningful and sustainable change.

FAQs:

What is the process of voluntary dissolution for a Section 8 company?

Voluntary dissolution involves passing a board resolution, settling all liabilities, liquidating assets, and filing for approval with the National Company Law Tribunal (NCLT). The process also includes compliance with statutory requirements, such as submitting audited financial statements and notifying regulatory authorities.

How does a merger benefit a Section 8 company?

A merger can strengthen the organization by enabling resource sharing, strategic growth, and expanded reach. It ensures mission alignment and creates synergy by combining the strengths of two entities, which can lead to greater financial stability and a more significant social impact.

What are the primary costs involved in a voluntary dissolution for a non-profit?

The costs of voluntary dissolution typically include liquidation expenses, regulatory fees, compliance costs, legal consultation, and administrative expenses. These costs vary depending on the size of the organization and the complexity of its operations.

Can Section 8 companies merge with for-profit organizations?

Section 8 companies are generally restricted from merging with for-profit organizations due to legal and regulatory guidelines. Mergers are typically allowed only between non-profits or entities with aligned objectives, ensuring that the social mission remains intact.

How does a merger affect the existing commitments and liabilities of a Section 8 company?

In a merger, liabilities and obligations are typically transferred to the merged entity. This includes creditor rights, ongoing contracts, and other commitments. Proper due diligence and a clear merger agreement are essential to ensure a seamless transition.

What factors should be considered when deciding between dissolution and merger for a Section 8 company?

Key factors include financial health, stakeholder interests, mission continuity, regulatory compliance, and long-term organizational goals. A cost-benefit analysis and consultation with stakeholders are critical in making an informed decision.

Is there a tax impact when a Section 8 company undergoes dissolution or merger?

Section 8 companies generally enjoy tax exemptions, but the process of dissolution or merger can have tax implications, such as liabilities arising from asset transfers or liquidations. Ensuring compliance with tax regulations is crucial to avoid penalties or legal complications.