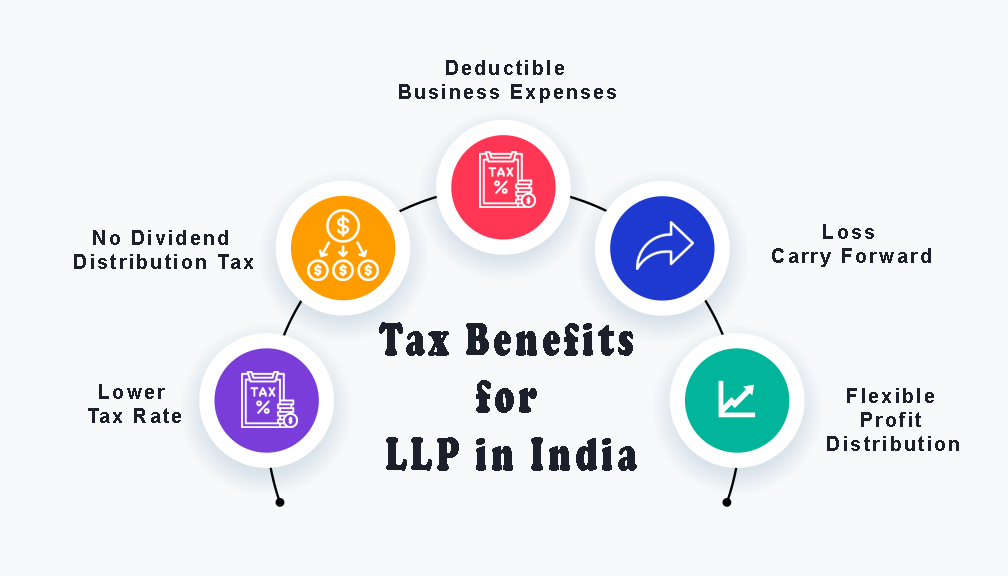

Limited Liability Partnerships (LLPs) are a popular business structure in India due to their flexible and tax-efficient nature. They offer several tax benefits to partners, including lower tax rates, tax deductions, and exemptions. Vakilsearch assists you in exploring the various tax benefits and other information available here.

Limited Liability Partnerships (LLPs) are a hybrid business structure that offers the tax benefits of a LLP and a limited liability company (LLC). LLPs have become a popular business structure in India due to their flexibility and tax efficiency. LLPs are subject to lower tax rates compared to companies, making them an attractive option for small and medium-sized businesses.

Tax Rates for LLPs in India

One of the significant tax benefits of LLPs is their lower tax rates compared to companies. LLPs are taxed at a flat rate of 30% on their profits, while companies are subject to a higher tax rate of 25% to 30%. Additionally, LLPs are not subject to the surcharge and cess that companies have to pay.

However, LLPs must pay a minimum alternate tax (MAT) of 18.5% on their book profits. The MAT is designed to ensure that companies and LLPs that claim excessive deductions and exemptions pay a minimum amount of tax. The MAT credit can be carried forward and set off against future tax liabilities.

Tax Deductions for LLPs

- LLP registration are eligible for several tax deductions, which can help reduce their taxable income and lower their tax liability. Some of the common tax deductions for LLPs include:

- Business Expenses: LLPs can claim deductions for expenses incurred in running their business, such as rent, salaries, utilities, and other operating expenses.

- Depreciation: LLPs can claim depreciation on their fixed assets, such as buildings, machinery, and equipment. Depreciation is a non-cash expense that reduces the taxable income of the LLP.

- Research and Development: LLPs engaged in research and development activities can claim a deduction of up to 150% of their R&D expenses.

- Charitable Donations: LLPs can claim a deduction for donations made to recognised charities under section 80G of the Income Tax Act.

- Startup Deductions: LLPs that are startups can claim a deduction of up to 100% of their profits for the first three years of operation

Tax Exemptions to Limited Liability Partnerships (LLPs) in India

- Export Income: LLPs that earn income from exports are eligible for an exemption under section 10AA of the Income Tax Act. The exemption is available for a period of five years, starting from the year in which the export income is first earned. The exemption applies to the profits derived from the export of goods or services and is calculated based on the proportion of export turnover to total turnover.

- Capital Gains: LLPs are eligible for an exemption on long-term capital gains if they invest the proceeds in certain specified assets such as residential property, bonds, or shares. The exemption is available under section 54EC of the Income Tax Act and applies to gains arising from the sale of a capital asset held for more than three years. The LLP must invest the proceeds within six months from the date of sale to claim the exemption.

- Dividend Income: LLPs, once successfully completed through the company registration process, are exempt from paying tax on dividend income received from Indian companies. This exemption, outlined under section 10(34) of the Income Tax Act, applies to all dividend income received by the LLP.

- Angel Tax: LLPs that receive investments from angel investors are exempt from the “angel tax” under section 56(2)(viib) of the Income Tax Act. The exemption applies to investments made by resident angel investors and is subject to certain conditions such as the total income of the LLP not exceeding Rs. 25 crores and the investments being made at fair market value.

- Start-Up Tax Benefits: LLPs that are classified as start-ups can avail themselves of several tax benefits such as exemption from tax on their profits for the first three years of operation under section 80-IAC of the Income Tax Act. Additionally, start-ups can avail of various other benefits such as tax exemption on investments made by eligible investors, exemption from long-term capital gains tax on the sale of residential property, and exemption from taxation on shares issued to eligible investors.

- Deduction for Scientific Research: LLPs that are engaged in scientific research and development activities can claim a deduction of up to 150% of their expenses under section 35(2AB) of the Income Tax Act. The deduction is available for expenses incurred on scientific research and development activities carried out in India and is subject to certain conditions such as the registration of the scientific research and development facility with the Department of Scientific and Industrial Research.

- Deduction for Donations: LLPs that make donations to recognised charitable organisations are eligible for a deduction under section 80G of the Income Tax Act. The deduction is available for donations made to specified charitable organisations such as the Prime Minister’s National Relief Fund, the National Defence Fund, and the National Foundation for Communal Harmony.

Conclusion

Limited Liability Partnerships (LLPs) offer several tax benefits to partners, including lower tax rates, tax deductions, and exemptions. LLPs are taxed at a flat rate of 30% on their profits, while companies are subject to a higher tax rate of 25% to 30%. Additionally, LLPs are eligible for several tax deductions and exemptions, which can help reduce their tax liability.

LLPs engaged in scientific research and development activities can claim a deduction of up to 150% of their expenses, while LLPs that make donations to recognised charitable organisations are eligible for a deduction under section 80G of the Income Tax Act.

By understanding the various tax benefits available to LLPs, partners can maximise their tax savings and optimise their LLP’s tax structure. Additionally, proper tax planning and compliance can help LLPs avoid penalties and other legal consequences, ensuring long-term success and sustainability. For understanding better, you can always contact our Legal experts.