TDS (Tax Deducted at Source) is not applicable on Sodexo meal cards. However, the amount loaded on the card might be considered your taxable income depending on your chosen tax regime.

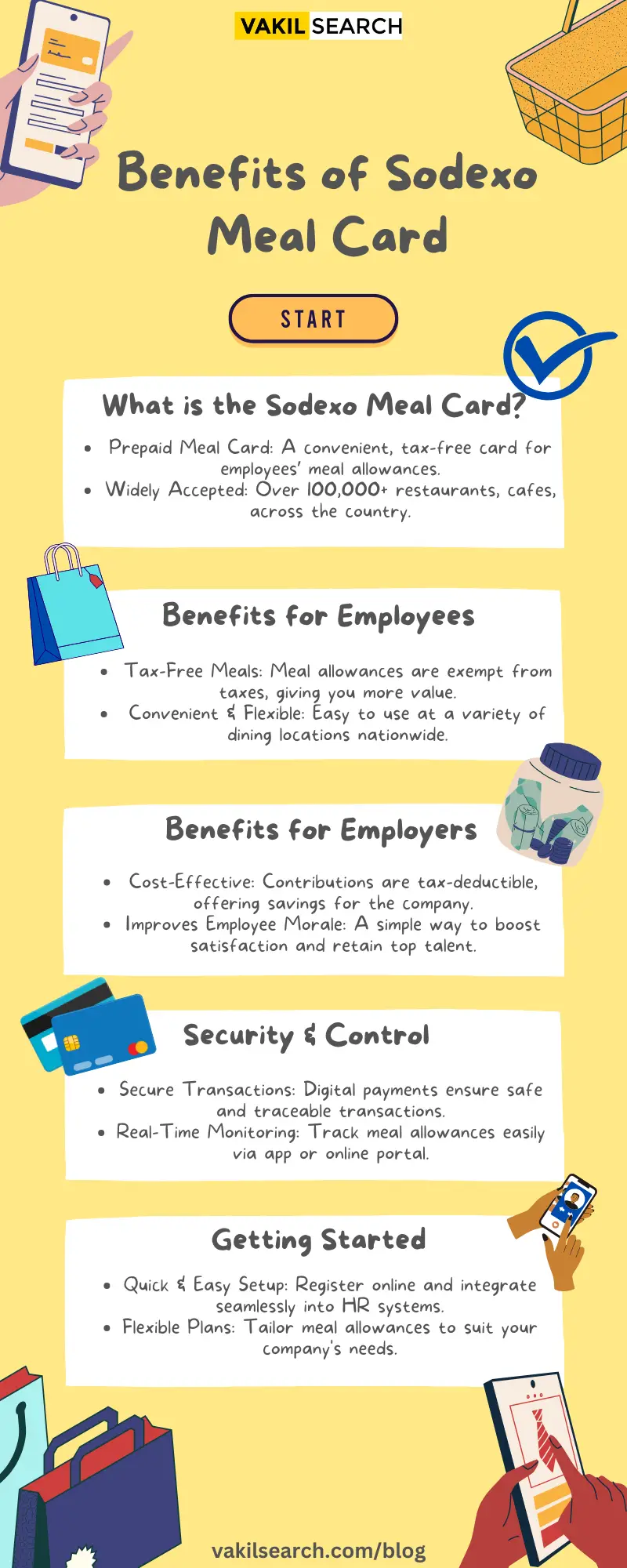

What is a Sodexo Meal Card?

A Sodexo meal card, also known as Pluxee Meal Benefit in India, is a prepaid card offered by Sodexo, a global food services and facilities management company. It functions as a type of employee benefit provided by companies to their employees to help them manage their food and beverage expenses.

Benefits of Sodexo Meal Card

Sodexo Meal Card Tax Benefits

The tax benefits of Sodexo meal cards, now branded as Pluxee Meal Benefit in India, depend heavily on the country and the specific program offered. Here’s a breakdown of the current situation:

India:

- In the old tax regime: Employees could claim exemption on meal vouchers up to ₹24,000 per year (limited to ₹2,000 per month). This significantly reduced their taxable income.

- In the new tax regime: As of the Finance Act 2023, perquisites and allowances like food coupons are no longer included in tax deductions. This means employees might not be able to claim tax benefits on Sodexo meal cards in the new tax regime. However, it’s recommended to consult a tax professional for exact clarification based on individual circumstances.

Other Countries:

- Tax regulations regarding meal cards vary considerably worldwide. In some countries like Singapore, tax exemptions might still apply. In others, the cards might just function as convenient payment methods without any specific tax benefits.

Discover how much you can save under the new tax regime with our new tax regime calculator. Try our income tax calculator now and stay ahead in 2024!

Sodexo Meal Card Tax Exemption

Sodexo meal card tax exemptions, with a focus on India:

India:

- New Tax Regime (Effective from FY 2023-24):

- No tax exemption available for Sodexo meal cards.

- Amount loaded on the card is considered taxable income.

- Old Tax Regime (Still Applicable for Those Opting for It):

- Exemption of up to Rs. 12,000 per year for food purchases using the card.

- Exemption does not apply to groceries or non-food items.

Understanding the Exemption Limit (Old Regime):

- The Rs. 12,000 exemption applies to the combined value of meal coupons or cards received from your employer in a financial year.

- If you receive other meal vouchers or benefits, their value is also included in the Rs. 12,000 limit.

While Sodexo meal card offer convenient ways for employees to manage food expenses, their tax benefits are no longer as straightforward in some regions, particularly India.

For Indian Employees:

- Remain informed about ongoing tax law changes.

- Claim exemption under the old regime only if applicable and within the prescribed limit.

- Explore alternative employee benefits that might offer tax advantages.

Globally:

- Recognize that tax rules regarding meal cards vary greatly by country.

- Seek local tax guidance or consult with Sodexo program administrators for accurate information.

Conclusion

The Sodexo meal card, also known as the Pluxee Meal Benefit in India, offers a convenient way for employees to manage their food expenses. While these cards have historically provided tax benefits, recent changes, particularly in India, have affected their tax-exempt status. Under the new tax regime effective from FY 2023-24, the amount loaded on these cards is considered taxable income, eliminating previous exemptions. Employees who opt for the old tax regime can still claim exemptions up to ₹12,000 per year for food purchases. It’s crucial for Indian employees to stay updated on tax law changes and consult tax professionals to understand their benefits and options. Globally, the tax rules for meal cards vary significantly, so employees should seek local tax guidance for accurate information. Despite the evolving tax implications, Sodexo meal cards remain a valuable employee benefit for managing meal expenses efficiently.

FAQs

Is Sodexo included in 80C?

No, Sodexo meal cards are not considered deductions under Section 80C of the Income Tax Act. 80C deductions include investments like provident funds, PPF, and life insurance premiums.

How much tax we can save on Sodexo?

The potential tax savings from Sodexo depends on your tax regime and how you spend the card. Old Tax Regime: You can claim exemption on up to Rs. 12,000 per year for food purchases using the card. This exemption does not apply to groceries or non-food items. New Tax Regime: No tax exemption is available on Sodexo cards. The amount loaded on the card is considered taxable income.

Is TDS applicable for Sodexo?

No, TDS is not deducted at source on Sodexo meal card payments. However, the amount loaded onto the card might be added to your taxable income depending on your tax regime.

Is Sodexo tax-free in the new tax regime?

No, Sodexo meal cards are not tax-free in the new tax regime. The amount loaded onto the card is considered taxable income.

Also Read: