Understanding GST: A regressive tax impacting income inequality. Benefits of Form GST PMT-06 and its payment methods explained concisely.

In 2019, the government of India rolled out a mandatory regulation for all GST holders exceeding a turnover of ₹ 500 crores to record all their invoices or rather generate their GST invoices through a common government portal to improve compliance and transparency. The idea is to not give the assessee the time to manipulate or distort the transactional statements of the entity in order to evade taxes. You have to record a sale as soon as it is made and an invoice has to be generated through the Invoice Registration Portal or the IRP. The threshold has been gradually brought down from ₹ 500 crore to ₹ 100 crore, then to ₹ 50 crore, then ₹ 20 crore, and finally now to ₹ 5 crore with an imminent announcement bringing the threshold further down to ₹ 1 crore in turnover.

The payment of GST has become relatively hassle-free and simple with the arrival of the GST challan system along with online transactions. Business owners find it very convenient to follow the new mechanism because they can transfer the requisite money by NEFT, RTGS, and Credit / Debit Cards among other methods.

To make a GST payment, the GST challan has to be first generated from the GST portal. Once this is done, the payment can be made by Internet banking, credit/debit card, NEFT, or cash payment at selected banks. In this article, we will go through the procedure for creating a GST challan and making the GST payment.

What is GST?

The Goods and Services Tax (GST) is a value-added tax (VAT) imposed on most goods and services for domestic consumption. Consumers bear the burden of paying GST, but businesses selling the goods and services remit it to the government.

Critics, however, raise concerns that the GST might disproportionately affect individuals in the lowest and middle-income brackets, making it a regressive tax. This could potentially worsen income inequality and contribute to social and economic disparities. To address these issues, some countries have introduced measures such as GST exemptions or reduced rates on essential goods and services like food and healthcare. Additionally, certain nations have implemented GST credits or rebates to help mitigate the impact of GST on lower-income households.

Benefits of Form GST PMT-06

The purpose and advantages of using the GST Payment Challan (Form GST PMT-06) are as follows:

- Instant Crediting: Any online payments made through Form GST PMT-06 will be promptly credited to the taxpayer’s electronic cash ledger on the same day.

- GST Practitioner Payments: GST practitioners can conveniently make payments on behalf of their clients using this challan.

- Single Challan Creation: The three-four copy challan is replaced with a single online challan, streamlining the payment process.

- Convenience and Transparency: Instant online payments eliminate the need to stand in queues, ensuring a higher level of transparency in the payment system.

- Unlimited Challans: Taxpayers can create multiple challans in a single day as there is no limit to the number of challans that can be generated.

Eligible Person to Generate Form GST PMT-06

On the common portal, individuals, including regular taxpayers, non-resident taxable persons (regardless of supplying OIDAR service), and casual taxable persons, can generate the challan in Form PMT-06. They are required to enter specific details about the amount to be deposited, covering tax, interest, penalty, fees, or any other amount according to Rule 87(2) of the CGST and SGST Rules, 2017.

Prescribed Time to Make the Payment

Once the challan is generated, the taxpayer must settle the pending payment within 15 days. Taxpayers under the QRMP scheme need to pay the due tax amount for each of the first two months. The payment for one month should be made by the 25th of the following month. For instance, the payment for April is due by the 25th of May.

Type of Payments Can Be Made Through the GST Challan

As mentioned earlier, the PMT-06 challan serves the purpose of making payments for tax, interest, late fees, and penalties under the GST law. It can be generated for the following types of payment:

- Internet banking via authorized banks

- Credit or debit card via authorized banks

- NEFT or RTGS from any bank

- Over-the-Counter (OTC) payment through authorized banks

Please note that over-the-counter payments are accepted only for deposits up to ₹ 10,000 per challan per tax period, using cash, cheque, or demand draft. In such cases, any commission payable will be borne by the person making the payment.

Additionally, for GST-unregistered individuals, any payment requires obtaining a temporary identification number generated through the GST portal.

Attributes of Form PMT-06

The form PMT-06 includes the following contents and format:

- CPIN (Common Portal Identification Number) – auto-generated.

- Challan expiry date.

- GSTIN (Goods and Services Tax Identification Number), legal name, email address, mobile number, and address – auto-populated.

- Deposit details in rupees, categorized under major heads like central tax, State tax, integrated tax, and cess. It is further classified under minor heads like tax, interest, penalty, fee, etc.

- Mode of payment, as discussed in the earlier section.

- Remitting bank details.

- Particulars of the depositor, including the CIN (Challan Identification Number) generated by the bank, for immediate payment or payment made later on.

Methods of Payment Through PMT 06

Methods of Payment for Taxpayers Other than the QRMP Scheme

For a regular taxpayer, it is essential to deposit tax in the electronic cash ledger to cover the net tax liability shown in the electronic liability ledger. Ideally, this tax should be paid without incurring any interest or late fee, and it should be done by the due date of filing GSTR-3B.

Methods of Payment for the Taxpayers Opting into the QRMP Scheme

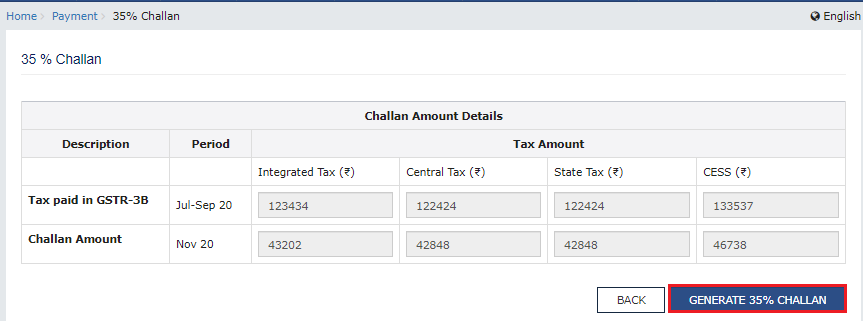

Taxpayers under the QRMP scheme are required to file GSTR-3B every quarter while making monthly tax payments. They have two options for computing the tax liability during the first two months of the quarter: the fixed sum method and the self-assessment method.

If the electronic cash ledger balance is insufficient to cover the tax liability or if there is no nil tax liability, taxpayers can utilize form PMT-06. The tax for the first two months of the quarter should be deposited using this form by the 25th of the following month.

Form PMT-06 Challan Generation

Before making the payment for the net tax liability, a registered person must generate a Form PMT-06 challan. Once the challan details are entered, a Challan Portal Identification Number (CPIN) is generated on the GST portal.

After completing the payment, the bank provides a Challan Identification Number (CIN) for any mode of payment, whether online or over the counter. The CIN should be referenced back in Form GST PMT-06 (challan). The registered person can submit the challan application on the GST portal within 24 hours of tax payment.

In case the concerned bank does not share the CIN, the GST portal will forward a complaint to the bank, and the registered person will be informed accordingly.

Procedure to Generate Challan in PMT-06 for GST Payment

The process for tax payment using Form GST PMT-06 is as follows:

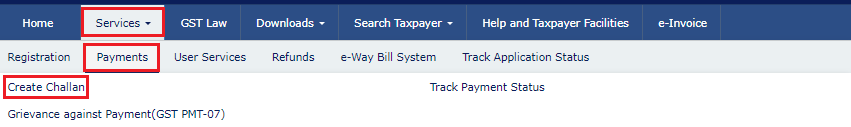

- Log in to the GST portal and go to ‘Services,’ then select ‘Payments’ and ‘Create Challan.’

- If you are in the QRMP scheme, choose ‘Monthly payment for quarterly returns’ as the reason for generating the challan. For non-QRMP scheme taxpayers, any other payment option can be selected to create the challan.

- Select the applicable year and tax period for the payment.

- Depending on the method (fixed sum or self-assessment), you will see either the previous period’s tax summary or the liability and ITC offset for the current period. Choose the relevant challan type and click ‘Proceed.’

- Complete the payment by clicking on the ‘Proceed‘ button.

- After entering the details in the challan, a Challan Portal Identification Number (CPIN) will be generated on the GST portal, which remains valid for 15 days. Make the payment before the CPIN expires.

- Once the payment is made, the bank will share the Challan Identification Number (CIN) as proof of successful payment. Enter the CIN in GST PMT 06.

- The amount paid will be credited to the Electronic Cash Ledger. For online payments made after 8 pm, the Electronic Cash Ledger will reflect the payment on the same day. You can submit the challan within 24 hours of payment.

How to Make a GST Payment?

GST payment can be done through the following methods:

- Internet Banking through authorized banks;

- A debit card or Credit card through authorized banks;

- The National Electronic Fund Transfer (NEFT) or Real Time Gross Settlement (RTGS) from any bank made online; or

- Over-the-counter payment through authorized banks for deposits up to Rs. 10,000 per GST challan per tax period, by cash, cheque or through a demand draft.

Generating a GST Challan

The process for generating your GST challan is as follows:

- Sign in to your GST account on the GST portal. Once you have landed on your dashboard you will see a button called ‘create challan’. Click on that button.

- It shows the Create Challan page. Enter your GSTIN or other ID in the GSTIN/Other Id field (User Id for unregistered applicants to make any payments). Enter the captcha text in the field labelled Type the characters as shown below. Select PROCEED from the menu.

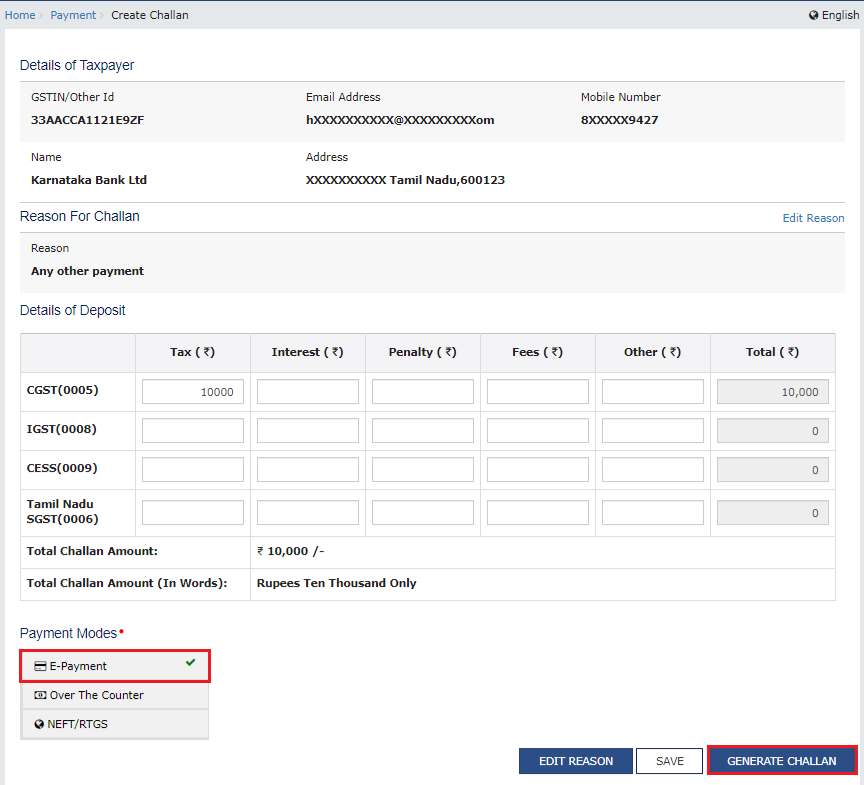

enter GSTIN - Enter details of the GST payment you would like to remit. Enter details of the GST payment that you would like to remit. The amount has to be provided under heads of the CGST, IGST, Cess and the SGST. Also, the breakup of the payment made towards tax, fee, interest, penalty and others has to be mentioned. Select the mode of payment from the payment modes option. Once all the necessary fields have been filled, click on Generate Challan.

- Verify GST payment details, You will now be redirected to the screen where you will need to verify the details entered so far and confirm that they are correct. Once done, click on the button that says ‘make payment’.

- In case it is a cash payment, a GST payment challan will be generated. The payment challan can be produced at an authorised bank that is mentioned above to make the payment over the counter.

DOWNLODED CHALLAN GST - If you choose to pay the goods and services tax online, then you must verify all essential details related to your payment. In case, there are some problems in calculation, then you may end up paying some extra money. Hence, you must take steps to avoid such a situation.

What Are the Consequences for Not Filing a GST Return?

- The dates for filing your GST returns are fixed. However, the government does give an extended window for late filings. But this comes with a penalty of ₹ 100 per day for GST and ₹ 200 per day of CGST or SGST, up to the limit of ₹ 5,000.

- If you have forgotten or missed the deadline for filing the returns in any particular month, you will not be able to file any other returns until that return is filed and the requisite fine or penalty is paid off.

FAQs

What is a GST Challan?

Any taxpayer engaged in the supply of goods or services must make GST payments if their output tax liability exceeds their input tax liability. Through the online GST portal, taxpayers can easily fulfil these obligations by generating GST challans and making payments through various online channels.

How long is a GST Challan valid?

Once generated, the challan in PMT-06 remains valid for a period of 15 days to complete any pending payment. A registered person has the option to submit the challan application on the GST portal within 24 hours of making the tax payment.

Is there any fee for generating a GST Challan?

No. To generate a challan for GST payment, simply visit www.gst.gov.in, then go to Services > Payments > Create Challan. Enter your valid GSTIN or Other Id (for unregistered applicants) to generate the challan

Can I make a GST payment without generating a Challan?

No, GST payments can be made through online or offline methods. Businesses need to evaluate the cash amount of tax to be paid after offsetting the input tax credit claimed. Subsequently, they should generate a GST challan either before or after logging into the GST portal, or during the process of filing the GST return.

Can GST Challan be cancelled?

Yes, you have the option to cancel an unpaid OTC Challan from the Challan History. To do so, go to Services > Payments > Challan History and proceed with the cancellation process.

Conclusion

The GST portal has certainly made a lot of things simple. But the framework still remains something of a technical chaos. If you have not been trained in the subject matter, you may not find it easy to fill out the form on your own. So it is always advisable to seek the guidance of a legal expert who has experience with these matters and guide you through the process so that your GST-related regulations are attended to without any hassle.