Learn more on the Pravasi Pension Scheme, offering a tailored retirement plan. Know the eligibility criteria & embrace financial security while living abroad.

Pravasi Pension Scheme Overview

The Pravasi Pension Scheme, initiated by the government of Kerala in 2008 under the Pravasi Welfare Board, is a dedicated pension scheme designed for Non-Resident Keralites. This scheme acknowledges the contributions of Keralites working abroad and provides them with a financial safety net during their retirement. Governed by the Pravasi Welfare Board, the scheme aims to address the specific needs of Non-Resident Keralites by offering a structured pension plan. Through this initiative, the government of Kerala recognises and supports the welfare of its diaspora, ensuring financial security for those who have contributed to the state’s development while working overseas.

Highlights of Pravasi Pension Scheme

| Features | Details |

| Launched by | Pinarayi Vijayan, Chief Minister of Kerala |

| Introduced on | 21 April 2018 |

| Scheme under Act | Keralites’ Welfare Act, 2008 |

| Managed by | Kerala Pravasi Welfare Board |

| Funded by | Pravasi Kshemanidhi/ Pravasi Welfare Fund, Kerala |

| Entry Age | 19-60 years of age |

| Beneficiaries | Non-Resident Keralites (NRKs) and their families |

Monthly Contribution by Beneficiaries

- Eligible NRKs Working Abroad: Pay ₹350 per month for a period of 5 years

- Eligible NRKs Settled in Kerala: Pay monthly ₹200 for 5 years

- Eligible NRKs Settled Elsewhere in India: Pay monthly ₹200 for 5 years

Pension Benefits | - Monthly pension (Pravasi Kshemanidhi) of ₹2,000 from the age of 60 years onwards

- Additional pension benefits for more than 5 years of contributions

- Minimum Additional Pension: Minimum 3% of prescribed monthly pension of ₹2000

- Maximum Additional Pension: Up to twice of prescribed ₹2000

Features and Benefits of the Pravasi Pension Scheme

Eligible individuals must register with the Kerala Pravasi Welfare Board and make monthly contributions to access Pravasi Welfare Fund benefits.

- After reaching the age of 60, contributing members are entitled to receive the Pravasi Pension amount

- Contributors receive a minimum monthly Pravasi Pension of ₹2000 after retirement, contingent on continuous contributions to the Kerala Pravasi Welfare Fund until the age of 60

- Members contributing for more than 5 consecutive years receive an additional 3% of the minimum Pravasi Pension amount (₹2000) annually after completing 5 years

- The minimum monthly contribution is ₹300 for NRKs abroad and ₹100 for NRKs in India

- Non-payment of contributions for an entire year leads to the cancellation of membership

- The minimum contribution period is 5 years

- The Pravasi Pension Scheme is not available to Central and State Government employees

- The scheme is designed to provide a structured framework for financial security during the retirement years of eligible individuals.

Who All are Eligible for Pravasi Pension Scheme?

To qualify for the Pravasi pension, individuals must initially fall within the age range of 18 and 60 years. Eligibility extends to individuals falling into the following categories:

- Keralite working outside India, not residing in Kerala

- Keralite repatriating to Kerala permanently after at least two years of overseas work

- Non-resident Keralite working for a minimum of six months outside Kerala and in another Indian state

When submitting a Pravasi pension application, it is imperative to pay a registration fee of ₹200 for eligibility. The processing of the application is contingent on the payment of this registration fee.

Individuals aged between 55 and 60 are eligible to enrol in the Pravasi Pension scheme. However, a minimum contribution period of five years is mandatory before being eligible to receive pension benefits.

Documents Required to Apply for Pravasi Pension Scheme

- Identification Proof: Valid passport, birth certificate, AADHAR Card, and Voter ID Card

- Address Proof: Utility bills, passport, and AADHAR Card serve as proof of address

- Other Important Documents Required: Valid visa, passport, recent passport-sized photographs, and a digital copy of the non-resident Keralites signature are necessary.

Forms Used for Registration

- Form 1A: NRKs, Non-resident Keralites working overseas should complete this form

- Form 1B: Non-resident Keralites repatriated from overseas and settled in Kerala must fill out this form

- Form 2A: Non-resident Keralites settled in India but in a state other than Kerala should use this form.

Online Registration Process

The Kerala Pravasi Welfare Board offers a convenient online enrollment process for eligible non-resident Keralites interested in the Pravasi pension plan. Alternatively, individuals can opt for offline enrollment by submitting the necessary paperwork at a designated service centre in Kerala. The following steps guide you through the online registration process:

- Visit the official website of the Kerala Pravasi Welfare Board and locate the ‘Service’ tab

- Click on ‘Apply online,’ redirecting you to a new page for registration

- Select the appropriate category for new registration based on your situation. Opt for 1A if you are employed overseas, choose 1B if you have returned to India after at least two years abroad, and opt for 2A if you work outside Kerala but within India

- Follow the provided instructions to complete the online form, entering the required information

- Upload all necessary documents as digital copies as per the provided guidelines

- Once your application is complete, and you’ve uploaded the required documents, proceed to ‘submit’ to finalise your enrollment by paying the applicable fees.

This straightforward process ensures a seamless enrollment experience for those seeking to benefit from the Pravasi pension plan.

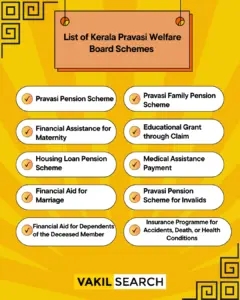

List of Kerala Pravasi Welfare Board Schemes

Pravasi Pension Scheme

- Monthly pension based on contributions.

- ₹2,000 basic pension after turning 60.

Pravasi Family Pension Scheme

- Entitlement for beneficiaries upon the member’s demise.

- Pension amount varies with member classification

Financial Assistance for Maternity

- Aid for eligible female members with two years of continuous dues payment.

Educational Grant through Claim

- Fund application after two years of contributions

- Supports children’s ITI/ITC degrees and professional post-graduate studies

Housing Loan Pension Scheme

- Loans for members with five years of consistent contributions.

- Used for home-related purposes.

Medical Assistance Payment

- Compensation of up to ₹50,000 for critical illnesses.

- Excludes benefits from other welfare programs.

Financial Aid for Marriage

- ₹10,000 incentive for child’s marriage for members contributing for three years.

Pravasi Pension Scheme for Invalids

- Irregular pension for members ceasing contributions after three years due to incapacity.

- Requires a valid incapacity condition and doctor’s certificate.

Financial Aid for Dependents of the Deceased Member

- Up to ₹50,000 for 1A category, and up to ₹30,000 for 1B category.

Insurance Programme for Accidents, Death, or Health Conditions

- Financial support for the family in case of accidental death or health-related complications

- Requires approval from a government agency and collaboration with centralised insurance firms.

Conclusion

The Kerala Pravasi Pension Scheme stands as a crucial initiative, offering financial security to non-resident Keralites during their post-retirement years. With a user-friendly enrollment process, individuals can access a monthly pension, ensuring a stable and dignified livelihood after the age of 60. The scheme not only emphasises economic support but also extends its benefits to various life events, such as maternity, education, housing, and medical emergencies, reflecting a comprehensive approach to the welfare of non-resident Keralites. For seamless legal assistance in navigating the enrollment process and understanding the nuances of the scheme, consider leveraging the expertise of Vakilsearch’s legal services, providing valuable support and guidance for a worry-free experience.

Frequenltly Asked Questions

What is the Kerala Pravasi Pension Scheme?

The Kerala Pravasi Pension Scheme is a program that provides a monthly pension to non-resident Keralites based on their contributions, with a basic pension of ₹2,000 starting at the age of 60.

How can I get a Kerala Pravasi pension?

To enroll for the Kerala Pravasi Pension, eligible individuals can apply online through the official Kerala Pravasi Welfare Board website or submit the required paperwork at a service center in Kerala

How can you file a claim under the Pravasi Pension Scheme after 60 years?

After reaching the age of 60, participants can file a claim for the Pravasi Pension Scheme by completing the necessary paperwork and submitting it along with required documents and enrollment fees through the online portal.

How can you check your Pravasi Welfare Fund status?

To check the status of your Pravasi Welfare Fund, visit the official website of the Kerala Pravasi Welfare Board. Look for the 'Service' tab and navigate to 'Check Status' or relevant options to inquire about your fund status.

What is the amount to be paid under the Pravasi Pension Scheme?

The amount paid under the Pravasi Pension Scheme varies based on individual contributions, with a basic pension of ₹2,000 per month granted once participants reach the age of 60.

How can I check my Pravasi pension status?

You can check your Pravasi pension application status online! Head to the Pravasi Kerala website and use your application or passport number to log in and see the update.

How do I get my Pravasi pension after 60 years?

If you're a Non-Resident Indian (NRI) who enrolled in the Pravasi pension scheme and have reached 60 years of age, you'll need to contact the Pravasi Kerala authorities. They'll guide you through the process of claiming your monthly pension.

What is the Pravasi pension scheme for NRIs?

The Pravasi pension scheme is a voluntary program in Kerala, India, specifically designed for NRIs. It allows them to contribute a fixed amount while working abroad and then receive a monthly pension after returning to India and reaching retirement age.

Can NRIs get a government pension in India?

In most cases, NRIs wouldn't be eligible for regular government pensions in India. However, schemes like the Pravasi pension offer NRIs a way to plan for their retirement in their home state.

Which is the best pension plan in India for NRIs?

The 'best' plan depends on your individual circumstances. The Pravasi pension scheme is a good option for those who plan to return to Kerala after retirement. NRIs can also consider private pension plans offered by Indian financial institutions that cater specifically to their needs.