This blog post discusses the latest judgments on the cancellation of sale deeds in India. It explains that it is very difficult to cancel a registered sale deed, but that there are certain grounds on which a court may order its cancellation, such as fraud, coercion, or undue influence.

A sale deed is a legal document that transfers the ownership of a property from the seller to the buyer. It is a registered document, and once it is registered, it is difficult to cancel. However, there are certain circumstances in which a court may order the cancellation of a sale deed.

Here are some additional points to keep in mind regarding the cancellation of the sale deed:

- A sale deed can only be canceled by a court of law.

- The plaintiff in the suit for cancellation of a sale deed must have a valid ground for cancellation.

- The plaintiff must prove the ground for cancellation on a balance of probabilities.

- If the court orders the cancellation of a sale deed, the title to the property will revert to the seller.

Latest Amendments Under Registration Act

In 2023, the Andhra Pradesh Legislative Assembly introduced the Registration (Andhra Pradesh Amendment) Bill, 2023, which aimed to amend the Registration Act, 1908 by adding Section 77-A. This new section grants powers to the Registrar and the Inspector General of Registration to cancel registered documents under certain conditions. Cancellation may occur if:

- (A) The document is forged or pertains to a transaction prohibited by law.

- (B) The same property has already been conveyed through a previous registered document.

- (C) In specific cases such as:

- (i) Property owned by the State Government or local authorities

- (ii) Property owned by or given to religious institutions governed by the Tamil Nadu Hindu Religious and Charitable Endowments Act, 1959

- (iii) Property donated for Bhoodan Yagna and vested in the Tamil Nadu State Bhoodan Yagna Board

- (iv) Property belonging to Wakfs under the supervision of the Tamil Nadu Wakf Board.

This Bill received the President of India’s assent on 17 December 2023.

Similar amendments have been made by the Tamil Nadu Legislative Assembly through the Registration (Tamil Nadu Second Amendment) Act, 2021, which also grants the Registrar and the Inspector General of Registration powers to cancel documents under similar conditions, including when:

- (A) The document is forged or pertains to a prohibited transaction.

- (B) Specific cases where no sanction has been issued by the competent authority, including:

- (i) Property belonging to the State Government or local authorities.

- (ii) Property related to religious institutions governed by the Tamil Nadu Hindu Religious and Charitable Endowments Act, 1959.

- (iii) Property donated for Bhoodan Yagna and vested in the Tamil Nadu State Bhoodan Yagna Board.

- (iv) Property belonging to Wakfs under the Tamil Nadu Wakf Board’s supervision.

Latest Judgments on Cancellation of Sale Deed?

In the case of Areness Foundation vs. Government of NCT of Delhi (WPC 9123 of 2018), the Delhi High Court ruled that neither the registrar nor the Inspector General has the authority to annul or cancel a registered document, as their role ends once registration is complete. This decision aligns with the Supreme Court’s ruling in Satya Pal Anand vs. State of MP (2016), which confirmed that the 1908 Act does not provide explicit power to recall or cancel registrations once a document is registered.

Reasons of Cancellation a Sale Deed

- Section 31 of the Specific Relief Act, 1963: This section allows a party to seek the cancellation of a written contract, including a sale deed, if it is void or voidable

- Indian Contract Act, 1872: This act provides for the cancellation of contracts on grounds of misrepresentation, fraud, undue influence, or mistake

- Registration Act, 1908: Once a sale deed is registered, it can only be cancelled by executing a registered cancellation deed

- Civil Procedure Code (CPC), 1908: Parties can file a suit for the cancellation of a sale deed in a civil court, which will decide the matter based on evidence and legal principles.

Sale Deed Cancellation Under Specific Relief Act, 1963

Under the Specific Relief Act, 1963, a sale deed can be cancelled within three years of its execution based on the grounds specified in Sections 31 to 33.

Section 31 of the Specific Relief Act, 1963, states that any person against whom a written instrument is void or voidable, and who has a reasonable apprehension that such an instrument, if left unaddressed, may cause them serious injury, may sue to have it declared void or voidable. The court may, at its discretion, so adjudge it and order it to be delivered up and cancelled.

‘If the instrument has been registered under the Indian Registration Act, 1908 (16 of 1908), the court shall also send a copy of its decree to the officer in whose office the instrument has been so registered; and such officer shall note on the copy of the instrument contained in his books the fact of its cancellation,’ it states.

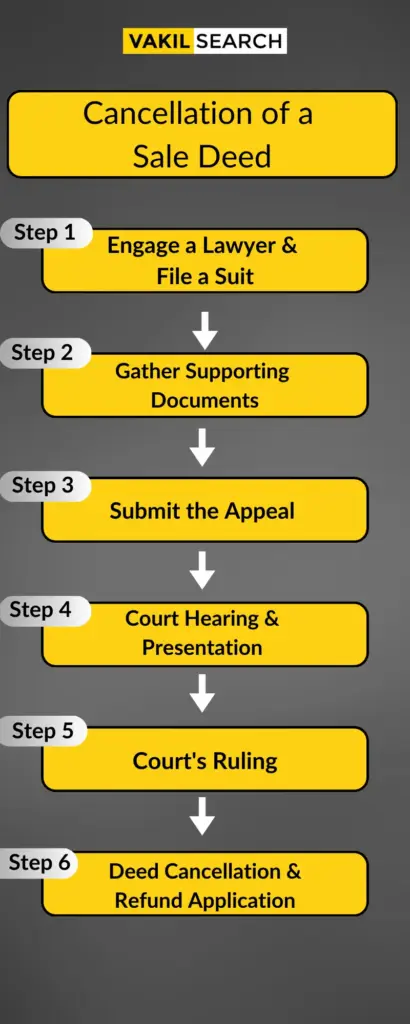

Process to Apply for Sale Deed Cancellation

The process to apply for the cancellation of a sale deed involves several key steps to ensure legal and proper handling. Below, is the detailed procedure for initiating and completing this process:

Step 1: Engage a Lawyer and File a Civil Suit

To initiate the cancellation of a sale deed, the affected party must file a civil suit in a district court. This requires hiring a lawyer to represent and guide them through the process.

Step 2: Gather and Prepare Supporting Documents

The lawyer will file the suit accompanied by all necessary supporting documents that substantiate the claim for cancellation.

Step 3: Submit the Appeal

Upon filing, if the court finds the appeal valid, it will accept it and issue notices to the other parties involved, requesting their responses.

Step 4: Court Hearing and Presentation

During the hearing, both the plaintiff and the respondent will present their arguments and provide evidence and witnesses. The burden of proof lies with the plaintiff to demonstrate the grounds for cancellation.

Step 5: Court’s Ruling

If the court rules in favor of the plaintiff, it will order the sale deed’s cancellation. A copy of the court’s order will be sent to the sub-registrar’s office to execute the cancellation. The court may also direct the responsible party to refund the plaintiff within a specified timeframe.

Step 6: Deed Cancellation and Refund Application

Following the court’s order, the sub-registrar will cancel the sale deed and issue a document confirming this. With this confirmation, you can apply for a refund of the stamp duty and registration fees previously paid.

Critical Components of a Sale Deed

- Date: The sale deed specifies the date the property is transferred, establishing the legal ownership timeline

- Names of Parties Involved: The names, addresses, and identification details (such as the father’s name) of the seller and buyer are clearly stated

- Property Details: The address of the sold property is provided, along with a description of its boundaries, area, common areas, constructed area, and number of floors

- Consideration Amount: This section records the total sale value or price agreed upon by the buyer. It may note if part of the payment is received upfront, with the balance to be paid in instalments

- Payment Terms: If the total amount has not been paid in advance, the deed specifies payment terms such as amount, due date, and interest payable on delays, legally safeguarding the seller

- Rights and Liabilities: The deed clarifies the rights being transferred and any ongoing liabilities the buyer accepts, including responsibilities like maintenance

- Stamp Duty: The required stamp duty is paid according to state law for legal registration of the document, which must be registered

- Signatures: Both the seller and buyer sign the deed in the presence of witnesses, and the registration is completed at the sub-registrar’s office.

Conclusion

The latest judgments on the cancellation of sale deeds have made it clear that it is very difficult to cancel a registered sale deed. However, there are certain grounds on which a court may order the cancellation of a sale deed, such as fraud, coercion, or undue influence. If you are considering filing a suit for cancellation of a sale deed, it is important to consult with a qualified lawyer to assess your chances of success.

LIBRA also offers a variety of other features that can be helpful for lawyers and law firms, such as:

- Legal Research: LIBRA provides access to a database of Indian case law and legislation.

- Document Management: LIBRA allows lawyers to store and manage documents electronically, and it provides a variety of features to help lawyers collaborate on documents with other lawyers and clients.

- Billing and Invoicing: LIBRA allows lawyers to track their time and expenses, and it provides a variety of features to help lawyers generate and send invoices to their clients.

Frequently asked Questions

What are the grounds for cancellation of the sale deed?

Grounds for cancellation of the sale deed typically include fraud, misrepresentation, coercion, undue influence, mistake, or lack of legal capacity. These grounds allow parties to seek judicial intervention to nullify the sale deed and restore the parties to their original positions before the transaction.

What is the Supreme Court judgement on registered sale deeds?

The Supreme Court has ruled that a registered sale deed enjoys a presumption of validity, but it can be challenged on grounds such as fraud, misrepresentation, or mistake. The court emphasises that while registration provides legal sanctity, it does not protect deeds tainted by illegality or fraud.

What is the limitation Act for cancellation of sale deeds?

According to the Limitation Act, 1963 the time limit for seeking cancellation of a sale deed is typically three years from the date the claimant becomes aware of the grounds for cancellation. Delay beyond this period may bar the claim unless exceptions such as fraud or mistake are proven.

How is court fee calculated in suit for cancellation of sale deed?

Court fees for a suit to cancel a sale deed are calculated based on the value of the property involved. Typically, fees range from a few hundred to thousands of rupees, depending on the property's market value. This fee structure ensures that the cost of legal action reflects the stakes involved in the cancellation process.

Can a third party file for cancellation of sale deed?

A third party does not have standing to directly file for the cancellation of a sale deed unless they can prove a legal interest or right affected by the transaction, such as inheritance rights or contractual obligations. Courts typically require direct involvement or harm to allow such actions.

What is the Supreme Court decision on cancellation of conditional gift deeds?

The Supreme Court has clarified that conditional gift deeds can be cancelled if conditions are not met or if the gift was made under undue influence, fraud, or coercion. The court emphasises fairness and intent behind conditional gifts, ensuring validity and justice in cancellation proceedings.

Can gift deeds be Cancelled by senior citizens?

Yes, senior citizens can seek cancellation of gift deeds if they can prove grounds such as fraud, coercion, or lack of mental capacity at the time of executing the deed. Courts may provide protections to seniors against exploitation, ensuring fair treatment and legal recourse.

Can gift deeds be challenged in court?

Gift deeds can be challenged in court on grounds including fraud, undue influence, or lack of legal capacity of the donor. Courts scrutinise such challenges to ensure the deed's validity and fairness, protecting the rights of all parties involved in the transaction.