This blog explores the essential aspects of Tax Deduction at Source (TDS) and its applicability to Limited Liability Partnerships (LLPs) in India. It deals with LLPs who are required to deduct TDS, the rates, threshold limits, compliance responsibilities, and the potential penalties for non-compliance. Understanding these TDS obligations is crucial for LLPs to ensure tax compliance and avoid legal consequences

In the world of business, various forms of organisations exist, each with its own set of rules and regulations. One such form is the Limited Liability Partnership (LLP), which combines the benefits of a partnership and a corporation. When it comes under Is LLP required to deduct TDS they have their own set of rules and responsibilities, including tax deduction at source (TDS).

A Limited Liability Partnership (LLP) is a legal entity established and incorporated according to the provisions of the Limited Liability Partnership Act of 2008. It operates as a distinct entity, separate from its partners.

In an LLP, the entity itself is responsible for its obligations up to the extent of its assets. However, the partners’ liability is restricted to the amount they have agreed to contribute to the LLP. This unique feature combines elements of both a corporate structure and a partnership firm.

Except in cases of fraudulent activities, individual partners do not bear personal liability. Additionally, partners are not held responsible or accountable for the misconduct or negligence of their fellow partners, as there is no shared liability within an LLP.

In this blog post, we will see the intricacies of whether LLP required to deduct TDS and explore the nuances of TDS in the context of LLPs.

Understanding TDS (Tax Deduction at Source)

What is TDS?

Tax Deduction at Source (TDS) is a mechanism introduced by the Indian Income Tax Act, 1961, to collect taxes at the source of income generation. It is a method through which the government ensures that taxes are collected in a timely manner and that taxpayers do not evade their tax obligations. TDS is applicable to various types of payments, including salary, interest, rent, and professional fees.

The Role of TDS

The primary role of TDS is to collect tax from individuals or entities who are making payments to others. When a payment is made, a certain percentage of the amount is deducted as tax and remitted to the government. The entity making the payment is responsible for deducting and depositing TDS.

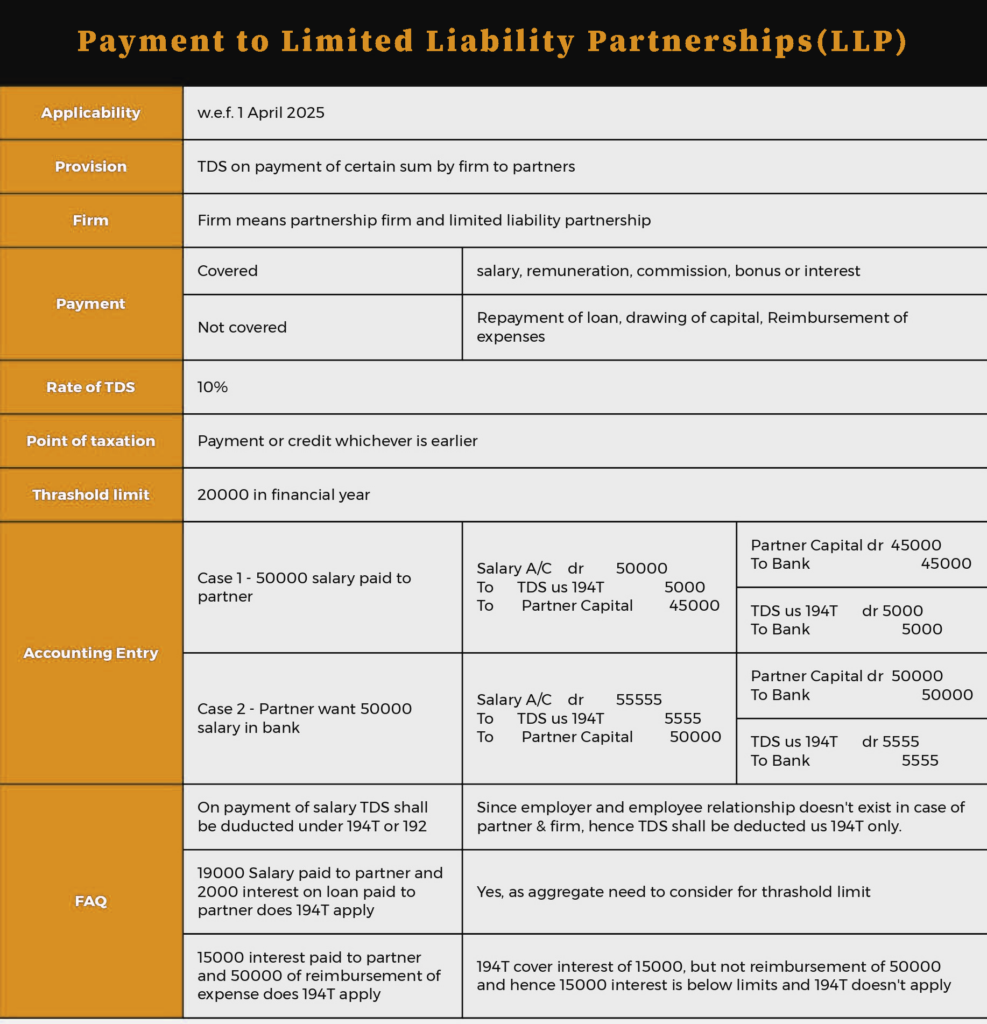

TDS Applicability to LLPs

-

Are LLPs Liable for TDS Deduction?

Every business, whether it’s a startup or company registration, will inevitably have expenses and payments to make, regardless of its size or scale. As a result, TDS regulations are relevant to businesses of all kinds and sizes. These regulations apply uniformly to individuals, partnerships, Limited Liability Partnerships (LLPs), and companies registered under the Companies Act of 2013. When a person makes payments for expenses, it represents income for the recipient. Consequently, the payer is obligated to withhold tax at the applicable rates when making payments. For smaller payments, TDS provisions are not triggered until they surpass a specified threshold limit. It’s essential to understand that TDS is only applicable to specific payments once they exceed the threshold limit. The most common types of expenses subject to TDS are outlined below.

-

Section 194J of the Income Tax Act

Section 194J of the Income Tax Act specifically deals with TDS on fees for professional or technical services. If an LLP makes payments for such services exceeding a specified limit, TDS becomes mandatory. However, there are certain thresholds and conditions mentioned in the section that need to be met for TDS to apply.

-

Section 194A for Interest Payments

When an LLP pays interest exceeding a particular limit, as defined under Section 194A of the Income Tax Act, it must deduct TDS. This is particularly relevant for LLPs engaged in financial activities or those that have borrowed funds.

-

Section 194I for Rent Payments

LLPs that lease or rent properties for their business activities must also be aware of Section 194I. If the rent paid exceeds a specified threshold, TDS is applicable.

TDS Deduction Rates for LLPs

TDS Rates for Different Payments

The rate at which TDS is deducted by an LLP varies based on the nature of the payment. Here are some common TDS rates for different types of payments:

- Professional Fees (Section 194J): The TDS rate for professional fees is typically 10%. However, this rate may vary, so it’s essential to check the latest provisions.

- Interest Payments (Section 194A): The TDS rate on interest payments varies depending on the payer’s relationship with the payee and the type of interest. It can range from 10% to 30%.

- Rent Payments (Section 194I): TDS on rent payments is typically deducted at a rate of 10%.

- Salary Payments: LLPs are not required to deduct TDS on salary payments as employees are responsible for their own income tax.

Threshold Limits

It’s important to note that TDS is not applicable to all payments. There are threshold limits specified for each type of payment under the relevant sections of the Income Tax Act. If the payment amount does not exceed these limits, TDS is not required.

Compliance and Responsibilities of LLP required to deduct TDS

When an LLP required to deduct TDS, it becomes imperative to fulfil certain compliance responsibilities:

- Obtaining a TAN: The LLP should obtain a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. This unique 10-digit alphanumeric number is necessary for TDS compliance.

- Deducting TDS: The LLP must deduct the applicable TDS at the time of making payments to the payee. This deduction should be made according to the prescribed rates and rules.

- Filing TDS Returns: LLP registration required to deduct TDS returns periodically, providing details of the TDS deducted and deposited. These returns are filed using Form 26Q for non-salary payments and Form 24Q for salary payments.

Issuing TDS Certificates: After deducting TDS, the LLP should issue TDS certificates to the payees. This certificate, known as Form 16A or Form 16B, serves as proof of TDS deduction.

Penalties for Non-Compliance

Failure to comply with TDS provisions can lead to severe consequences for an LLP:

- Interest and Penalties: LLPs may be liable to pay interest on delayed TDS deposits. Additionally, penalties may be imposed for non-deduction or short deduction of TDS.

- Disallowance of Expenses: Expenses for which TDS should have been deducted but wasn’t can be disallowed as deductions when calculating the LLP’s taxable income.

- Legal Action: Non-compliance with TDS provisions can result in legal action, including prosecution under the Income Tax Act.

Conclusion

In conclusion, whether an LLP required to deduct TDS depends on the nature of payments it makes and the provisions of the Income Tax Act. LLPs should carefully assess their payment obligations and ensure compliance with TDS regulations when applicable. Failure to do so can lead to financial penalties and legal consequences. Therefore, it is crucial for LLPs to stay informed about the latest TDS provisions and meet their tax obligations responsibly. Properly managing TDS not only helps in avoiding legal issues but also contributes to the smooth functioning and credibility of the LLP in the business world.