Learn about GSTIN, its structure, format, and how to apply for it. Explore the importance of GST number for businesses, GSTIN verification, and compliance details.

Businesses exceeding ₹20 lakh (₹10 lakh for special states) in turnover must obtain a GSTIN. It simplifies tax filing, regulatory compliance, and legal recognition. GST verification can be done via the GST portal, ensuring credibility and legitimacy in business transactions.

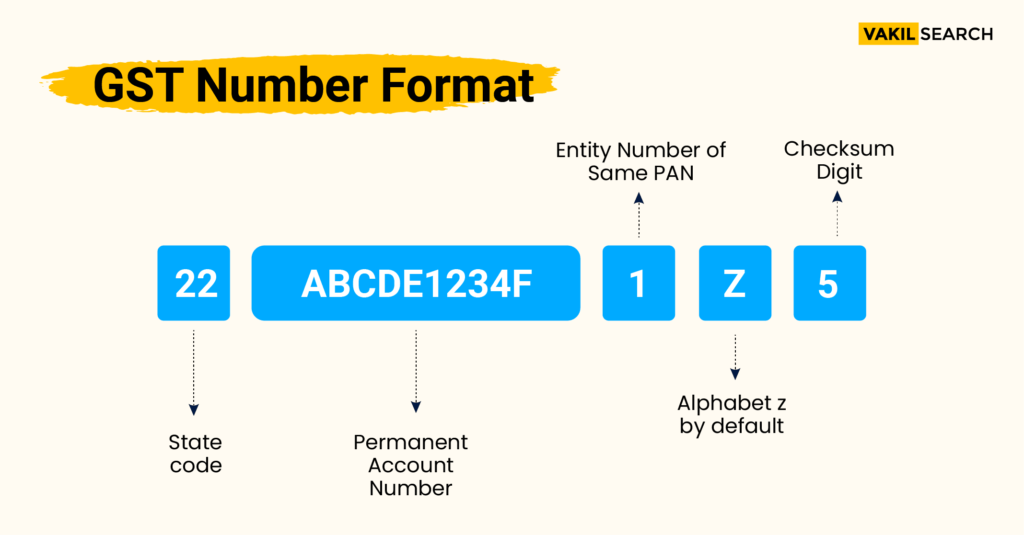

The GST number format includes two digits for the state code, ten digits for PAN, an entity code, a reserved character (‘Z’), and a checksum code. GSTIN helps businesses file GST returns, claim Input Tax Credit (ITC), and issue GST-compliant invoices while preventing tax fraud.

In this blog, we will explore the structure, importance, and application process of GSTIN. We will also discuss how businesses can verify and search GSTIN details to ensure smooth tax compliance.

What is GSTIN Number?

GSTIN (Goods and Services Tax Identification Number) is a 15-digit unique identifier assigned to businesses registered under the GST system in India. It is structured using the state code, PAN, entity code, and a checksum digit, ensuring accurate tax compliance and transparency.

GST Number Format

If you’re asking how many digits are in the GST number, the answer is 15. The 15-digit GST number structure is as follows:

First Two Digits: State Code

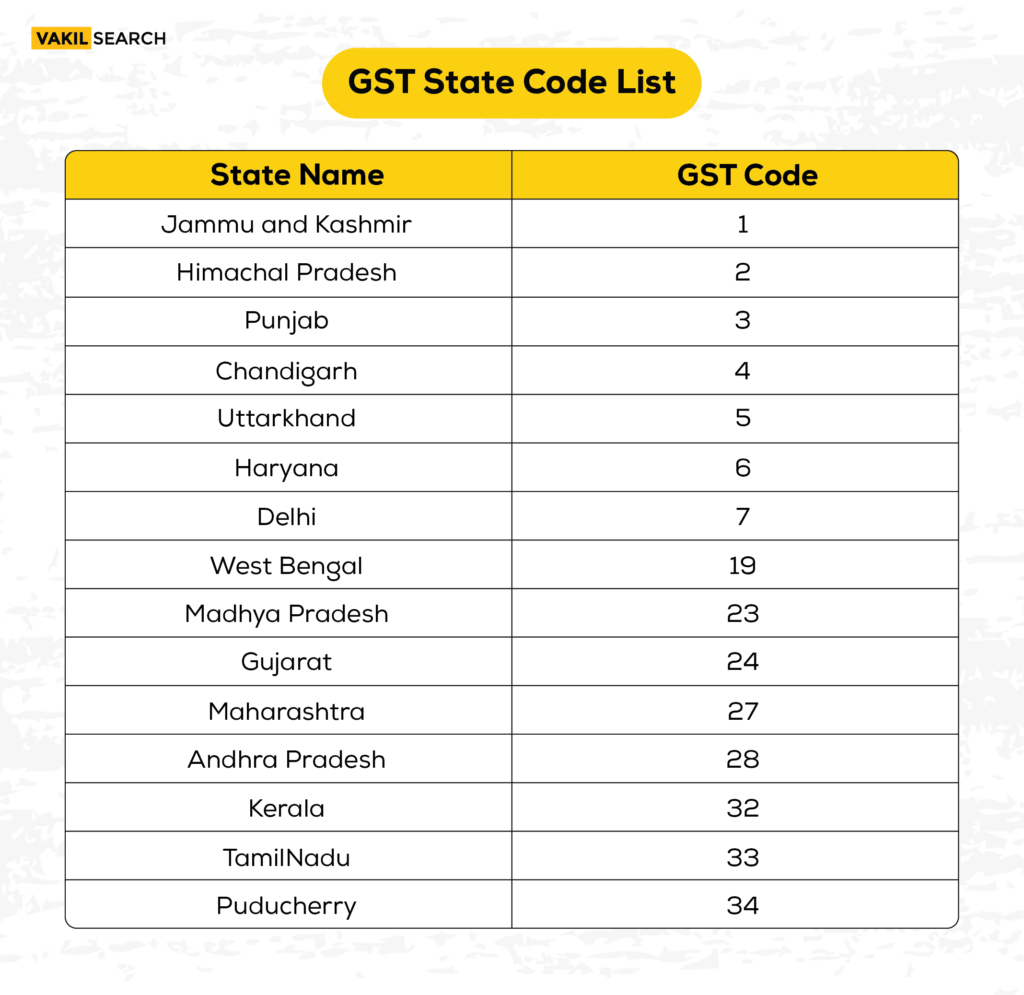

The first two digits represent the state code assigned as per the Indian Census 2011. Each state and union territory in India has a unique GST code.

For example:

- 27 – Maharashtra

- 22 – Chhattisgarh

- 07 – Delhi

- 29 – Karnataka

This code helps identify the state where the business is registered under GST. Here’s the comprehensive list of GST state codes for all states, Union Territories, and Central Jurisdiction:

Next Ten Digits: PAN of the Business

The next 10 digits represent the Permanent Account Number (PAN) of the business or entity. This ensures that the GST number is directly linked to the PAN, making each taxpayer unique.

Since PAN is unique to each taxpayer, it prevents duplication and ensures seamless tax compliance.

Thirteenth Digit: Entity Code

The 13th digit is alphanumeric (1-9 and A-Z) and indicates the number of registrations a legal entity has in a state under the same PAN.

- 1 – First registration in the state

- 2 – Second business under the same PAN in the same state

- A business can have up to 35 registrations in a state, each with a unique entity code.

Example: If a company has two business verticals in Maharashtra, its GST numbers would be:

- First GSTIN: 22ABCDE1234F1Z5

- Second GSTIN: 22ABCDE1234F2Z5

Fourteenth Digit: Reserved for Future Use

The 14th digit is always “Z”, which is a system-reserved character. It currently has no specific use but is kept for future updates in the GST system.

Fifteenth Digit: Checksum Code

The 15th digit is a checksum character used for error detection and validation.

- It is system-generated using an algorithm to ensure accuracy.

- It can be a number (0-9) or a letter (A-Z).

- This prevents fraudulent GST registrations and helps in verification.

Example of GST Number Breakdown

Let’s consider the GST number 22ABCDE1234F1Z5:

- 22 – Chhattisgarh (State Code as per the Indian Census)

- ABCDE1234F – PAN of the business (Permanent Account Number)

- 1 – First registration under this PAN in Chhattisgarh

- Z – Default character (Reserved by the system)

- 5 – Checksum digit for validation and error detection

This GST Number Breakdown helps simplify the GST system, ensures accuracy, and assists authorities in validating and managing GST-related activities effectively.

Why is a GST Number Required?

A GST Identification Number (GSTIN) is mandatory for businesses in India that meet the annual turnover threshold. It ensures compliance with tax laws, prevents penalties, and offers tax benefits.

1. Required for Filing GST Returns

- Businesses must file GST returnsto report their sales, purchases, and tax liabilities.

- Even if there are no transactions, registered businesses must still file GST returns to stay compliant.

2. Allows Input Tax Credit (ITC) Claims

- A GST number enables businesses to claim Input Tax Credit (ITC) on GST paid for purchases.

- ITC is available only if:

- The supplier uploads the invoice on the GST portal.

- Your GST number is mentioned on the invoice.

3. Prevents Legal Penalties

- Failing to register for GST when required leads to penalties:

-

- 10% of the tax due or ₹10,000, whichever is higher, for non-compliance.

- 100% penalty on collected GST if not remitted to the government.

A GST number helps businesses operate legally, reduce tax burdens, and maintain smooth financial operations.

Importance of GSTIN Number

A GST Identification Number (GSTIN) is essential for businesses operating under the Goods and Services Tax (GST) regime. It not only ensures tax compliance but also enhances credibility and facilitates smooth business operations. Here’s why having a GSTIN is important:

- Tax Compliance: Enables filing GST returns, tax payments, and claiming Input Tax Credit (ITC).

- Legitimacy: Establishes legal registration under GST.

- Transparency: Helps track tax liabilities and transactions.

- Ease of Operations: Mandatory for issuing GST-compliant invoices and conducting trade.

Who Requires a GST Number?

Any individual or business providing goods or services in India and exceeding the prescribed turnover threshold must obtain a GSTIN. The GST registration threshold limits are as follows:

- ₹20 lakh: For most states in India

- ₹10 lakh: For businesses operating in special category states such as Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim, Uttarakhand, and others.

How to Apply for a GST Number?

If you are a business owner, getting a GST registration number is essential to comply with tax regulations. A GST number allows you to collect and pay Goods and Services Tax (GST) legally. Here’s a step-by-step guide on how to apply for a GST number and get your business registered:

- Visit the GST Portal: Go to the official GST registration website (www.gst.gov.in) and click on the “Register Now” option.

- Fill in Basic Details: Provide details like your PAN card, business name, mobile number, and email address. You will receive an OTP for verification.

- Submit Business Information: Enter details such as business type, location, and bank account information.

- Upload Required Documents:

- PAN Card

- Aadhaar Card

- Business Registration Proof

- Bank Account Details

- Address Proof

- Receive Your GST Registration Number: After verification, you will receive your GST registration number (GSTIN) via email and SMS. You can then start collecting GST from customers and filing tax returns.

How to Check GST Number?

GST number verification can be done in the official GST site in the following way:

- Step 1: Open the GST Portal: Visit the official GST website.

- Step 2: Look out for the ‘Search Taxpayer’ Section: Find the search for taxpayers’ GST number option.

- Step 3: GSTIN & PAN to be Entered: Enter the GST number of the vendor or the business concerned which you intend to verify. Search can also be done using PAN or Business name.

- Step 4: Click on Search: When all the details have been filled in, press the trigger ‘Search’ to see the GST numberverification details.

- Step 5: Verify GST Status: The portal will provide information including but not limited to the business registered name and its GSTIN status whether active/cancelled and registration type.

Advantages: Verifying a GSTIN also helps in verifying the credentials of the vendor, avoiding fraud, and ensuring that the business in question is a tax compliant business.

What is the Cost of Obtaining GST number?

Registering for a Goods and Services Tax Identification Number (GSTIN) is completely free, with no government fees. You can apply for a GST number:

- Online – Through the official GST portal.

- Offline – At a GST Seva Kendra.

While the process is free, it can be time-consuming and complex due to documentation requirements. Vakilsearch offers affordable expert assistance, ensuring a smooth registration process and full compliance with GST laws.

Conclusion

GST number plays a crucial role in simplifying tax administration, ensuring seamless compliance, and facilitating transparent financial transactions. It enables businesses to avail input tax credits (ITC), issue GST-compliant invoices, and streamline return filings without unnecessary complications.

By verifying GSTIN details through the GST portal, businesses can prevent fraudulent transactions, authenticate vendors, and maintain regulatory credibility. This verification process enhances trust in business dealings and ensures that transactions align with government taxation policies. For businesses looking to expand operations, secure government contracts, or engage in inter-state trade, having a valid GST number is indispensable.

Professional guidance can simplify the registration and compliance process, allowing businesses to focus on growth and success. Registering for a GST number is mandatory for businesses exceeding the turnover threshold. Need expert assistance? Contact Vakilsearch GST experts today!

FAQs on GST Number

A GST number (GSTIN) consists of 15 alphanumeric characters: state code, business PAN, entity code, reserved character, and checksum code.

Visit the GST portal, click Search Taxpayer, and enter your PAN. The GST registration details will be displayed, including the state and registration status.

Any business with an annual turnover exceeding Rs 40 lakhs (Rs 20 lakhs for special states) must register for GST.

Yes, individuals can apply for a GST number using their PAN card. For assistance, you can contact Online Legal India for support.

Yes, visit the GST portal, click Search Taxpayer, and enter the PAN to view the GST registration details.

To verify a GST number, visit the official GST portal, click Search Taxpayer, enter the GST number, and click Search to verify the details.

The first 2 digits of GSTIN represent the state code, and the next 10 digits are the business's PAN number. What is the 15-digit GST number?

How do I get my GST number?

Who can apply for a GST number?

Can an individual obtain a GSTIN number?

Can we find the GST number by PAN number?

Can we verify a GST number?

How to get PAN number from GST number?