If you are looking forward to selling your property, it is essential to download form 16 for TDS. Read below to know the process you need to follow.

Form 16 is a TDS certificate that contains details about the tax deducted from employees’ salaries. It helps taxpayers understand tax deductions made on their payments. Forms 16A and 16 B fall under this certificate. It can be confusing to understand the difference between these. Form 16A is issued by the employer and details out the various deductions made on other income sources other than the main income of the employee. Form 16B is needed for the sale of the property. The buyer of the property issues this certificate to the deductee, i.e the seller. The form details the tax deducted at source on purchasing a property. Learn how to download Form 16 for TDS.

What is Form 16B?

A deductor’s TDS certificate, Form 16B, is governed by the income tax returns online of 1961. Form 16B is one of the certificates for source-based tax deductions. In this document, the amount that is subtracted as a source-based tax deduction from the sale of a property is attested. The buyer fully pays this amount to the income tax division. The payer is responsible for withholding taxes and paying them to the government. After the deduction, one can file a tax return; the total tax due is then reduced before the remaining balance is paid.

You can deduct this amount from the cost of purchasing a new property. When selling the property, the buyer must deduct the TDS payment from the sale price. This money must be deposited with the Income tax department. Buyers are allowed to deduct 1% of the TDS online rate in accordance with Section 194 of the ITA. Buyers must deliver Form 16B Income tax to sellers after buyers have remitted this tax amount to the IT department. In contrast, TDS is not imposed when an agricultural or mobile property is sold for less than ₹50 lakhs.

Essentials to Know Before Issuing Form 16B

The usual requirements for Form 16B are:

- A buyer is required to take a resident seller into account

- Buyers must make a 1% TDS deduction during the crediting of the payment

- A vendor who does not have a PAN is liable for 20% TDS, according to Section 206AA

- Any building or piece of land is considered immovable property

- For properties costing more than ₹50 lakhs, a sale consideration is necessary

- Agricultural land does not require a TDS.

Find out how to calculate TDS on salary with our user-friendly online TDS interest calculator for precise results.

Steps to Download Form 16B

Follow these steps to download Form 16B:

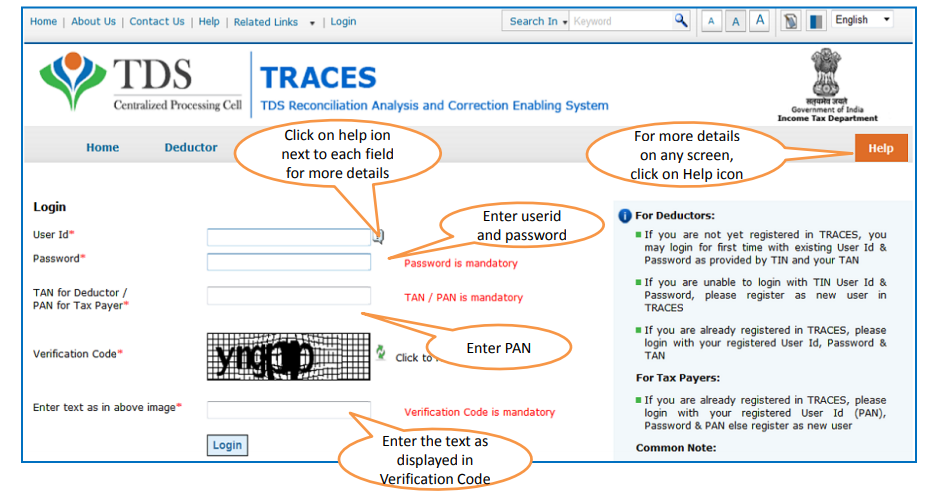

- Visit the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website and enter your taxpayer login details

- If you are a new user and want to make an account, you must first register as a taxpayer there

- The details you will require to register are PAN, Date of Birth and your name. These are needed to verify the details of tax deducted or paid by you

- You will have your account ready once your information is verified. Your PAN will be your User ID

- After entering the PAN number as the username, you are given the option to choose a password

- Once the information is entered, you will receive an activation link to your email address. You’ll also get a code sent to the registered mobile number. Please click the activation link and enter the activation code that was delivered to your mobile in order to activate your account

- After creating an account, log in and select ‘Form 16B’ from the list of downloads if you are the buyer

- Include the seller’s PAN number, the Form 26QB acknowledgement number, the assessment year, and any pertinent data

- As soon as you’ve submitted the data, you’ll have the option to download Form 16B. You can print, save, and download the form

- Using Form 26AS, the buyer can obtain more information regarding the TDS that was withdrawn. Similar to Form 26AS, which shows all TDS deducted under the chosen PAN number, a consolidated statement would show all TDS deducted under that PAN number. As a result, it will include the information reflected on Forms 16, 16A, and 16B.

Relation Between Form 16B and Form 26QB

A challan or return under section 26QB will be given to the individual who pays the government with a tax deduction at the source. It is an electronic document that falls under Section 194-IA.

Since there is no chance for adjustments after the form has been entirely filled out, Form 26QB should be filled out precisely. After it has been filed, this form cannot be changed without first getting in touch with the income tax division.

There are only a few rules that must be followed when applying for this form; it is necessary and must be submitted in order to acquire Form 16B. Those are:

- Form 26QB should be mandatorily submitted no later than 30 days after the deduction-making month. A different Form 26QB should be facilitated for each instalment paid if the tax deduction at source is given in instalments

- A different Form 26QB is necessary for every buyer-seller combination. In case of a single buyer and three sellers, each will have a distinct Form 26QB, such as seller 1, seller 2, and seller 3. The same logic holds true if there are more buyers.

Conclusion

Taxes should be notably paid to the government by anyone who makes money that is taxable. In addition, the assessee is required to file an income tax return. The statute governing income taxes stipulates the deduction of tax at source in order to streamline taxation and combat tax evasion at several points. The total amount of tax due can be reduced by the tax withheld at the source, leaving the taxpayer to pay the balance.

When paying tax deduction at source for the sale of the property to the government in accordance with such taxation policy, a TDS certificate is given by the deductor for the deductee indicated as Form 16B. After deducting it from the total, the buyer makes this payment and pays it to the seller. A 1% source tax deduction will be applied to the entire selling consideration sum. For more information regarding this, or if you need any help, get in touch with the legal experts of Vakilsearch.

Also, Read: