Learn how to cancel GST registration online. Check eligibility, process, documents & penalties. Avoid compliance issues with this complete guide.

Cancellation of GST registration means that the taxpayer will no longer be a registered person under GST and will not have to pay/collect any GST, claim an input tax credit or file returns. GST registration cancellation is a crucial process for businesses that no longer require registration under the Goods and Services Tax (GST) system. Businesses may need to cancel their GST registration for several reasons, including discontinuation of operations, a drop in turnover below the threshold limit, a change in business structure, or the taxpayer no longer being liable to pay GST. Proper cancellation ensures that the taxpayer obligations are fulfilled, avoiding unnecessary compliance burdens and penalties.

A person registered under GST must apply for cancellation through the GST portal if they no longer wish to remain registered. The process involves filing an application, clearing pending returns, and settling any outstanding input tax credit liabilities. Additionally, GST officers can initiate cancellation if a taxpayer fails to comply with GST regulations, such as not filing returns for a consecutive period.

Knowing how to cancel GST registration is essential for smooth business transitions. The process involves submitting the cancellation application online, followed by verification and approval by GST authorities. Once approved, the taxpayer is relieved from filing future GST returns. However, post-cancellation, businesses must comply with specific rules, such as filing a final return to declare any tax liabilities on closing stock.

Understanding GST compliance during the cancellation process ensures businesses avoid penalties and complete the transition without complications. Whether voluntarily opting for cancellation or facing cancellation due to non-compliance, taxpayers must follow the correct procedures to settle their tax liabilities effectively.

Reasons for Cancelling GST Registration

GST registration can be cancelled voluntarily by a business or by the tax authorities in cases of GST non-compliance. The reasons for cancellation fall into two main categories: voluntary cancellation and suo moto cancellation by the GST authorities.

-

Voluntary Cancellation of GST Registration

Businesses may choose to cancel their GST registration in the following scenarios:

- Discontinuation of Business – If a taxpayer shuts down operations, they can apply for GST cancellation to avoid unnecessary compliance requirements.

- Turnover Threshold Falling Below the Limit – If the business’s annual turnover drops below the GST exemption limit (₹40 lakh for goods and ₹20 lakh for services in most states), they can opt to deregister.

- Change in Business Constitution – If a business undergoes structural changes, such as converting from a sole proprietorship to a private limited company, a new GST registration is required, leading to cancellation of the old one.

- Merger or Transfer of Business – When a business merges with another entity or is sold, the existing GST registration is cancelled, and the new entity applies for fresh registration.

- Death of Taxpayer – In case of the proprietor’s death, the legal heirs must cancel the GST registration.

- Composition Scheme Opt-Out – If a taxpayer under the composition scheme decides to switch to the regular GST scheme, they must cancel their existing GST registration and reapply under the new scheme.

Read more in detail: Voluntary Registration under GST

-

Suo Moto Cancellation by GST Authorities

The GST department can cancel registration due to GST non-compliance, such as:

- Failure to File Returns – If a taxpayer does not file GST returns for a continuous period (six months for regular taxpayers, three tax periods for composition dealers), authorities issue a REG-17 notice and may cancel registration.

- Fraudulent Registration – If a taxpayer is found to have obtained GST registration using fake documents, authorities can initiate cancellation.

- Non-Operational Business – If the GST department finds that a registered entity is non-existent or not conducting business from the declared place of business, it may cancel registration.

Understanding these reasons ensures businesses maintain compliance and cancel their GST registration when necessary to avoid penalties.

Eligibility for GST Registration Cancellation

GST registration cancellation is available to certain eligible taxpayers under specific circumstances, while some entities are ineligible for cancellation. Businesses must assess their eligibility before applying for deregistration to ensure compliance with GST laws.

-

Eligible Taxpayers for GST Cancellation

A registered taxpayer may apply for GST cancellation under the following conditions:

- Business Closure – If a business permanently shuts down its operations, the taxpayer can request cancellation of GST registration.

- Falling Below the Turnover Threshold – Businesses whose annual turnover drops below the prescribed GST threshold (₹40 lakh for goods and ₹20 lakh for services in most states) can opt for deregistration.

- Change in Business Constitution – If a sole proprietorship converts into a partnership, LLP, or private limited company, the existing GST registration must be cancelled, and a new registration obtained.

- Merger, Sale, or Transfer of Business – If a business merges with another entity, is sold, or transferred to a new owner, the GST registration of the old entity must be cancelled.

- Death of the Proprietor – In case of the proprietor’s death, legal heirs can apply for GST cancellation.

- Opting Out of the Composition Scheme – If a composition dealer chooses to switch to the regular GST scheme, the existing GST registration under the composition scheme must be cancelled.

-

Ineligible Entities for GST Cancellation

Certain entities cannot cancel their GST registration, even if they wish to, due to their tax obligations. These include:

- Tax Deductors (TDS) and Tax Collectors (TCS) – Entities required to deduct or collect tax at source under GST laws must maintain their GST registration.

- UIN (Unique Identification Number) Holders – Foreign diplomatic missions, embassies, and other UN bodies with a UIN cannot cancel their registration.

- Businesses with Outstanding Liabilities – Taxpayers with pending GST returns, unpaid dues, or unresolved disputes must settle their tax obligations before applying for cancellation.

Special Cases

In cases of fraud or non-compliance, GST authorities may suo moto cancel a taxpayer’s registration, making them ineligible to apply voluntarily. Businesses should ensure they meet the eligibility criteria before proceeding with GST cancellation.

Step-by-Step Process to Cancel GST Registration

Filing for Cancellation Through the GST Portal

To cancel GST registration, businesses must apply through the GST portal by filing Form REG-16. Follow these steps:

- Log in to the GST Portal – Visit www.gst.gov.in and use your credentials to log in.

- Navigate to Cancellation Option – Go to ‘Services’ > ‘Registration’ > ‘Application for Cancellation of Registration’.

- Fill REG-16 Form – Enter details such as:

- Reason for Cancellation (e.g., business closure, falling below the GST threshold).

- Date of Discontinuation of business.

- Tax Liability and Input Tax Credit (ITC) Details.

- Upload Supporting Documents – Attach required documents such as business closure proof, sale agreement (if applicable), or any legal documents.

- Submit the Application – After completing all fields, submit the form and receive an Application Reference Number (ARN) for tracking.

Verification and Approval Process

Once REG-16 is submitted, the GST officer reviews the application:

- Application Verification – The GST officer checks the submitted details and supporting documents for accuracy.

- Request for Additional Information (if needed) – If required, the officer may seek clarifications before approval.

- Approval and Issuance of REG-19 Order – If satisfied, the GST officer issues a REG-19 order within 30 days, officially canceling the GST registration.

- Status Update – The business receives a confirmation of cancellation on the GST portal.

Filing the Final Return (GSTR-10)

After cancellation, the business must file GSTR-10 within three months to finalize tax dues:

- Log in to the GST Portal and go to ‘Returns’ > ‘Final Return (GSTR-10)’.

- Report Pending Liabilities – Declare any pending tax liabilities, stock held, and ITC reversal.

- Pay Dues (if applicable) – Clear outstanding dues before submission.

- Submit the Final Return – Ensure accurate details and file within 90 days to avoid penalties.

Non-compliance Penalties: A late fee of ₹200 per day (₹100 CGST + ₹100 SGST) applies for delayed GSTR-10 filing, with a maximum penalty of ₹10,000.

By following these steps, businesses can successfully cancel their GST registration while ensuring compliance with tax regulations.

Consequences of Cancelling GST Registration

Cancelling GST registration has several implications for businesses, impacting tax obligations, input tax credit (ITC) claims, and legal compliance requirements. Below are the key consequences:

-

Cessation of Taxable Supplies

Once a business’s GST registration is canceled, it is no longer authorized to collect GST on supplies. Any taxable supply made post-cancellation becomes non-compliant, potentially leading to penalties. Businesses must ensure they stop issuing GST invoices and charging GST from customers after cancellation.

-

ITC Ineligibility

After GST cancellation, businesses lose the ability to claim Input Tax Credit (ITC) on purchases. Any unused ITC becomes irrecoverable, leading to increased operational costs. If the business holds stock on which ITC was previously claimed, it may be required to reverse ITC and pay tax on closing stock at the time of cancellation.

-

Tax Payment Obligations

Before cancellation is finalized, businesses must clear any pending tax liabilities. If the final return (GSTR-10) is not filed, penalties apply. Additionally, businesses may need to pay tax on capital goods and stock-in-hand, as per GST rules.

-

Legal Compliance Post-Cancellation

Even after cancellation, businesses must maintain records for up to six years from the date of cancellation for audit or investigation purposes. This includes invoices, tax payment records, and ITC claims. The GST authorities can audit canceled taxpayers if discrepancies arise.

-

Restricted Business Operations

Without GST registration, businesses face limitations such as:

- Ineligibility for inter-state trade (which requires GST registration).

- Exclusion from B2B transactions, as many registered buyers prefer GST-compliant vendors.

- Restrictions on e-commerce selling, as platforms like Amazon and Flipkart require GST registration for sellers.

To avoid disruptions, businesses should carefully evaluate the consequences before applying for GST cancellation.

Revocation of GST Registration Cancellation

Revocation of GST registration cancellation is the process of reinstating a previously canceled GST registration. Businesses whose GST registration was canceled by the authorities due to non-compliance can apply for revocation if they rectify the compliance issues. Below are the key details regarding revocation:

Time Limit for Revocation of GST Registration

Businesses must apply for revocation within 30 days from the date of the cancellation order issued by the GST authorities. This applies only to suo moto cancellations, meaning cases where the GST officer canceled the registration due to non-compliance, such as failure to file GST returns.

To be eligible for revocation, the taxpayer must:

- Clear all pending tax liabilities and late fees.

- File any outstanding GST returns.

- Ensure full compliance with GST regulations before applying.

If the taxpayer fails to apply for revocation within the 30-day revocation timeline, they must apply for a new GST registration, as revocation will no longer be possible.

Steps to Revoke GST Registration Cancellation

To revoke a canceled GST registration, follow these steps:

- Log in to the GST Portal – Visit the official GST portal and navigate to the “Services” tab.

- Fill Out the REG-21 Form – Select “Revocation of Cancellation” and fill in GST REG-21 form with reasons for revocation.

- Attach Supporting Documents – Upload necessary documents, such as proof of pending return filing and tax payment receipts.

- Submit the Application – Verify details and submit the application online.

- Await GST Officer’s Decision – The GST officer will review the application and may issue a notice for further clarification.

- Approval or Rejection – If satisfied, the officer will approve revocation; otherwise, the request may be rejected.

Once revocation is approved, the GST registration becomes active again, allowing the taxpayer to resume business operations with GST compliance.

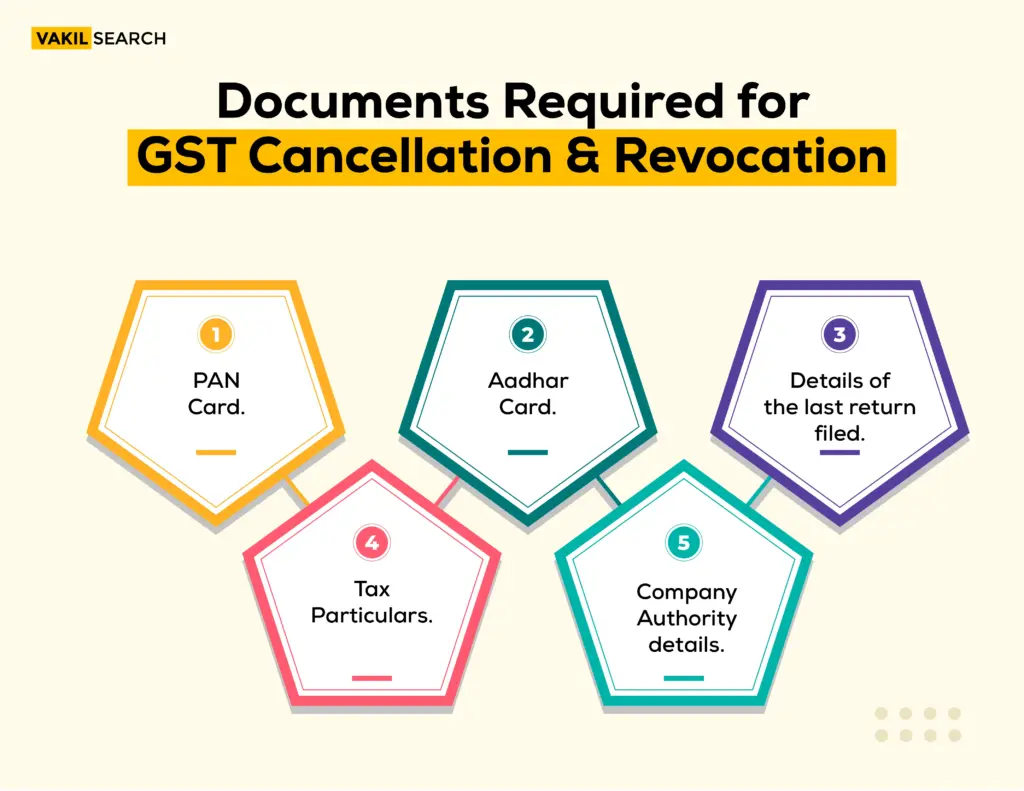

Documents Required for GST Cancellation and Revocation

Proper documentation is essential for both GST cancellation and revocation to ensure a smooth process. Below are the required documents for each process:

Documents Required for GST Cancellation

When applying for GST cancellation, businesses must provide the following:

- GSTIN – The GST Identification Number of the taxpayer.

- Supporting Documents – Proof of business closure, such as a dissolution certificate for companies or business closure affidavit for sole proprietors.

- Reason for Cancellation – A written explanation of why the GST registration is being canceled, such as falling below the GST turnover threshold or discontinuing operations.

- PAN and Aadhaar Card – Identity verification of the business owner or authorized signatory.

- Last Filed GST Returns – Copies of recent GSTR-1, GSTR-3B, or GSTR-9 returns to confirm no pending tax liabilities.

- Final Tax Payment Proof – If applicable, proof of payment of outstanding taxes or reversal of input tax credit (ITC).

Documents Required for GST Revocation

If a taxpayer wishes to revoke a suo moto cancellation by GST authorities, they must submit:

- GSTIN – The canceled GST registration number.

- Cancellation Order Copy – A copy of the REG-19 order issued by the GST officer.

- Supporting Documents – Proof that compliance issues have been resolved, such as pending GST return filings or late tax payment receipts.

- REG-21 Form – The formal application for revocation of cancellation.

- Clarification Response (if required) – If the GST officer requests additional details, a written response with relevant supporting documents is needed.

Having accurate supporting documents ensures faster approval of cancellation or revocation requests and helps businesses avoid delays or rejection.

Common Mistakes to Avoid While Cancelling GST Registration

Cancelling a GST registration requires careful attention to ensure compliance and avoid unnecessary penalties. Many taxpayers make common mistakes that lead to delays, rejections, or legal complications. Below are some key mistakes to avoid and tips to ensure a smooth GST cancellation process.

-

Submitting Incomplete Applications

One of the most common errors is submitting an incomplete REG-16 form without providing all required details and supporting documents. Missing information, such as an incorrect reason for cancellation or lack of business closure proof, can lead to rejection.

Tip: Double-check that all sections of REG-16 are properly filled out and attach the necessary documents, including GSTIN, PAN, and Aadhaar.

-

Delays in Filing GSTR-10 (Final Return)

Taxpayers often miss the deadline for filing GSTR-10, which must be submitted within three months of cancellation approval. Missed deadlines result in late fees and penalties.

Tip: File GSTR-10 promptly to clear any pending tax liabilities and input tax credit (ITC) reversals.

-

Incorrect Filings and Pending Liabilities

Filing incorrect GST returns before cancellation, such as errors in ITC claims, tax payments, or turnover figures, can lead to compliance issues.

Tip: Ensure all outstanding GST returns (e.g., GSTR-1, GSTR-3B) are filed correctly before submitting the cancellation request.

-

Ignoring Post-Cancellation Compliance

After cancellation, taxpayers are still required to maintain records for up to 72 months and may be subject to audits.

Tip: Keep proper records of past tax returns, invoices, and compliance documents even after cancellation.

By avoiding these common mistakes, businesses can ensure a hassle-free GST cancellation process without unnecessary complications.

Conclusion

Cancelling GST registration is a crucial step for businesses that no longer require active registration due to business closure, falling below the turnover threshold, or other valid reasons. Following the proper cancellation process ensures compliance with GST laws and prevents unnecessary legal and financial complications.

The process begins by filing an application through the GST portal using Form REG-16, where businesses must specify the reason for cancellation and submit supporting documents. After submission, the GST officer verifies the application, and upon approval, issues a REG-19 order within 30 days. Once the cancellation is approved, businesses must file GSTR-10 (Final Return) to settle any pending tax liabilities. Failing to do so can lead to penalties and compliance risks.

It is essential to ensure GST compliance throughout the cancellation process. Errors such as incomplete applications, missed deadlines, or incorrect filings can delay approval and create legal complications. Moreover, after cancellation, businesses must retain records for the required period to comply with any future audits or assessments by tax authorities.

For businesses facing complex situations—such as tax liabilities, pending refunds, or compliance issues—seeking guidance from a tax professional is highly recommended. A professional can help navigate the legal requirements, minimize compliance risks, and ensure a smooth cancellation process.

By carefully following the correct procedures and meeting all legal obligations, businesses can successfully cancel their GST registration while avoiding future tax complications.

FAQs on Cancelling GST Registration

Any registered taxpayer can apply for GST registration cancellation if they no longer meet GST requirements. Voluntary cancellation applies to businesses that cease operations, fall below the turnover threshold, or change business structure. Involuntary cancellation occurs due to non-compliance, failure to file returns, or regulatory violations, initiated by GST authorities via suo moto cancellation.

The time limit for filing GSTR-10, the final return after GST registration cancellation, is within three months from the date of cancellation or the date of the cancellation order, whichever is later. Failure to file GSTR-10 within the deadline may result in penalties, late fees, and legal consequences.

If GST registration is not cancelled properly, the taxpayer remains liable for filing returns, paying taxes, and complying with GST regulations. Failure to comply may result in penalties, interest on unpaid taxes, and legal action. Additionally, non-filing of GSTR-10 can attract fines and restrictions on future registrations.

Yes, GST registration can be cancelled if a business is dormant or non-operational. The taxpayer must file Form REG-16 on the GST portal, stating the reason as discontinuation of business. After verification, the GST officer issues a REG-19 cancellation order. Filing GSTR-10 is mandatory to complete the process.

Yes, a business can re-register for GST after voluntary cancellation by applying for a new GST registration on the GST portal using Form REG-01. The applicant must provide business details, PAN, Aadhaar, and supporting documents. Upon approval, a new GSTIN is issued, allowing the business to resume taxable operations.

Failing to file GSTR-10 attracts a late fee of ₹200 per day (₹100 each for CGST and SGST), up to a maximum of ₹10,000. Additionally, interest at 18% per annum may apply on pending tax liabilities. Non-compliance can also lead to legal consequences and difficulties in future GST registration.

The GST cancellation approval process typically takes 30 days from the submission of Form REG-16 on the GST portal. The GST officer reviews the application, verifies documents, and issues the REG-19 order upon approval. Delays may occur due to incomplete documentation or pending tax liabilities.

After cancelling GST registration, businesses must file GSTR-10 (final return) within three months to settle pending liabilities. They should maintain records for six years for compliance purposes. If needed, they can apply for re-registration. Non-compliance may lead to penalties or legal action from GST authorities.

No, GST registration cannot be cancelled without filing all pending returns. Businesses must clear outstanding GSTR-1, GSTR-3B, and GSTR-10 before applying for cancellation. Failure to do so may lead to penalties, interest, and rejection of the cancellation request by GST authorities. Compliance is mandatory before cancellation approval. Who can apply for GST registration cancellation?

What is the time limit for filing GSTR-10 after cancellation?

What happens if GST registration is not cancelled properly?

Can GST registration be cancelled if the business is dormant?

Is it possible to re-register after cancelling GST registration?

What is the penalty for not filing GSTR-10?

How long does the approval process for GST cancellation take?

What to do after cancelling gst registration?

Can I cancel gst registration without filing returns?