Explore CA charges, pricing models, and tips for ITR filing. Make informed choices with insights and guidance in this article.

Filing an Income Tax Return (ITR) is a crucial financial obligation for every taxpayer. While you have the option to file it yourself, seeking assistance from a Chartered Accountant (CA) can simplify the process and ensure accuracy. However, understanding the charges that CAs levy for ITR filing and the factors influencing these charges is essential. In this article, we’ll delve into the various aspects that influence ITR filing fees by CA, explore different pricing models, and provide tips for negotiating or selecting the right CA based on your budget and requirements.

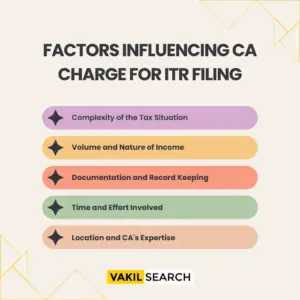

Factors Influencing CA Charge for ITR Filing

-

Complexity of the Tax Situation

The complexity of your tax situation is a significant factor that influences the ITR filing fees by CA. If your financial situation is uncomplicated, with only a few sources of income and straightforward deductions, the charges will likely be lower. However, if you have multiple income streams, investments, or international transactions, the complexity increases, and so does the cost of preparing and filing your tax return.

-

Volume and Nature of Income

The volume and nature of your income play a crucial role in determining the ITR filing fees by CA. Different types of income, such as salary, business income, capital gains, or rental income, require varied levels of analysis and documentation. CAs often charge based on the types and number of income sources they need to consider while preparing your tax return.

-

Documentation and Record Keeping

The quality and completeness of your documentation and record-keeping can affect the charges levied by a CA. If your financial records are well-organised, accessible, and accurate, it reduces the time and effort required by the CA to compile and analyse your financial data, resulting in lower charges.

-

Time and Effort Involved

The time and effort a CA needs to invest in understanding your financial situation, preparing your ITR, and ensuring compliance with tax laws greatly influence the charges. More complicated cases or those requiring in-depth analysis will naturally incur higher charges due to the increased time and effort required.

-

Location and CA’s Expertise

The geographical location and expertise of the Chartered Accountant also impact the ITR filing fees by CA. Chartered Accountants in metropolitan areas or with specialised knowledge in complex tax matters may charge higher fees due to the higher cost of living and demand for their expertise.

Different Pricing Models for CA Services

1. Fixed Fee Model

In this model, CAs charge a predetermined fixed fee for specific services related to ITR filing. The fee is based on the complexity of the tax situation, volume of income, and the nature of services required. This model provides clarity to clients regarding the costs involved.

Simplify your taxes – Explore our tool to easily calculate income tax online.

2. Hourly Billing

Under this model, CAs charge an hourly rate for the time spent on your tax preparation and filing. The total charge depends on the complexity of your tax situation and the number of hours required to complete the task.

3. Value-Based Pricing

In this model, the ITR filing fees by CA are determined based on the perceived value of the services provided by the CA. The complexity of the tax situation, the expertise required, and the benefits the client gains from the services all contribute to the pricing.

Tips for Negotiating or Selecting the Right CA

-

Understand Your Needs

Before approaching a CA, clearly understand your tax situation and what services you require. This will help you negotiate effectively and select a CA whose expertise aligns with your needs.

-

Compare Multiple CAs

Obtain quotes from several CAs and compare their charges and services. Consider their experience, qualifications, and reputation to make an informed decision.

-

Discuss Pricing Upfront

During your initial consultation, discuss the pricing structure and ensure there are no hidden charges. Clarify the scope of services covered by the quoted fee.

-

Inquire About Discounts

Some CAs offer discounts for certain types of clients, such as students or senior citizens. Inquire about any available discounts to optimise your expenses.

-

Assess Experience and Expertise

Choose a CA with a good track record and expertise in handling tax situations similar to yours. Their experience can contribute to accurate filings and potentially reduce your tax liability.

Conclusion

Selecting the right CA for your ITR filing is a critical decision that can impact your financial well-being. Understanding the factors influencing ITR filing fees by CA, different pricing models, and following negotiation tips will help you make an informed choice based on your budget and specific requirements. Additionally, Vakilsearch facilitates legal and financial services, and can aid in connecting you with competent CAs. Remember, investing in a competent CA, potentially facilitated by platforms like Vakilsearch, can lead to accurate filings and potential tax savings in the long run.