The growth of e-commerce in India has made it compulsory for users to know the basics of Net Banking and how to use it. Read on to know how you can register on HDFC Online banking portal and use it in your day-to-day life.

HDFC Online banking has been growing rapidly in India in recent years. The number of online transactions has increased tremendously from the year of 2018 to 2020. This has been possible because of the increased awareness about HDFC Online banking and online procedures among users. The government has been promoting digital transactions and online banking to take India forward in the direction of a cashless economy.

Did you know?

HDFC Bank is the largest private sector bank in India based on its assets.

If you have an account in HDFC bank and you want to start with net banking this article will be of great use to you. We have mentioned different types of net banking services provided by HDFC and how you can register on the HDFC Online banking portal and start using it.

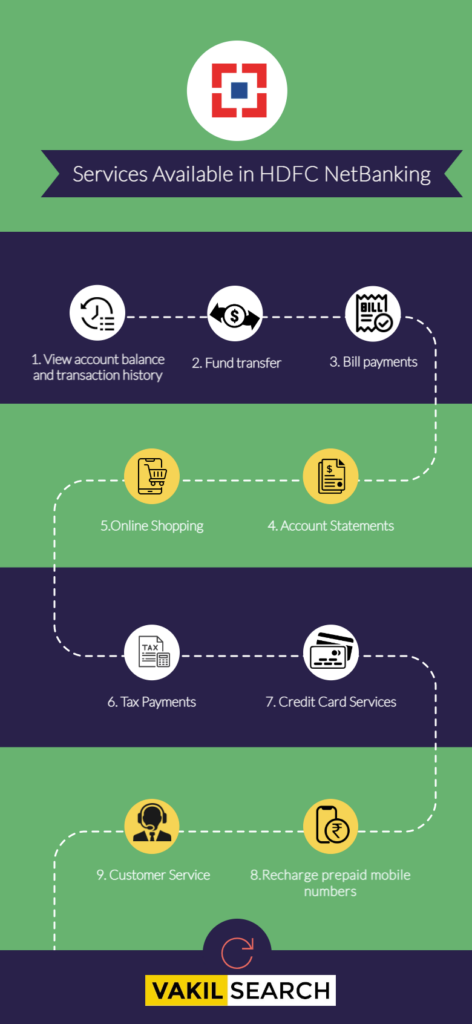

Services Provided by HDFC Online Banking

HDFC Internet Banking is an online banking service offered by HDFC Bank. It allows customers to access their accounts and perform banking transactions from anywhere in the world. With HDFC Online Banking customers can transfer funds, view account statements, pay bills, set up standing instructions, apply for loans and credit cards, and much more. Customers can also access banking services through the HDFC mobile banking app.

Services Available in HDFC Online Banking:

- View Account Balance and Transaction History: HDFC NetBanking users can quickly view their account balance and check the last 5 transactions made through their account.

- Fund Transfer: HDFC net banking users can transfer funds to other banks in real-time. This includes both interbank and intrabank transfers.

- Bill Payments: HDFC NetBanking users can make payments towards electricity, telephone, mobile bills, and more.

- Online Shopping: Shop online with the convenience of net banking and get great discounts.

- Account Statements: View your account statements for up to the last 24 months.

- Tax Payments: Pay your taxes directly from your HDFC Bank account.

- Credit Card Services: View your credit card statement, make payments, and set up auto-payments, all from the convenience of your net banking account.

- Customer Service: Get in touch with HDFC Bank’s customer service team to get your queries and complaints addressed.

- Recharge Prepaid Mobile Numbers: HDFC Internet banking users can recharge their prepaid mobile numbers using the net banking service.

- Open Fixed Deposits: HDFC NetBanking users can open fixed deposits and manage their existing fixed deposits from the comfort of their homes.

- Make Investments: HDFC Online banking users can make investments in mutual funds and IPOs using their net banking facility.

- Apply for Loans: HDFC Online Banking users can apply for various loan types like home loans, car loans, and personal loans through their net banking facility.

- Request for Chequebooks: HDFC netbanking users can request chequebooks and manage their existing chequebooks through their net banking facility.

HDFC Online Banking Registration Process

HDFC Online Banking registration can be done in multiple ways. We’ve mentioned the steps for different registration methods below.

-

Online

-

- Go to the HDFC Bank website and click on the ‘Net Banking’ option.

-

- Enter your Customer ID and mobile number.

-

- On the next page, enter the OTP (One Time Password) sent to your registered mobile number.

- Enter the details of the HDFC debit card.

- Set the IPIN for HDFC Online Banking purposes. Now you can log in to your HDFC NetBanking using this IPIN.

-

Using Welcome Kit

- Go to the bank branch and get the net banking registration or download it online.

- Fill in the details in the form and submit it to the HDFC Bank branch.

- The bank will send you and Ipin via courier. Now visit the HDFC net banking portal and enter the customer ID you have been provided by the bank and click on login.

- You need to enter the Ipin provided and also form a new password and confirm it.

- Now you can log in to HDFC net banking using your customer ID and the new password set by you.

-

Using ATM

-

- Visit an ATM and insert the debit card into the machine.

- Enter the ATM pin and select ‘other option’. Select the net banking registration option and click on confirm.

- The bank will send you the net banking IPIN by courier.

- After that, you can follow the steps mentioned previously to register to HDFC NetBanking portal.

-

Phone Banking

- Call the HDFC phone banking number and provide your customer ID.

- You also have to provide a telephone identification number or debit card and the pin for verification purposes.

- The phone banking agent will start the net banking registration request and you will receive the IPIN via courier in 5 days.

Transfer of Funds Using HDFC Online Banking

Once you register into the HDFC internet banking portal and you know how to log in to your account you can easily transfer funds using HDFC Online banking services. We have mentioned below the step-by-step process of how to do it.

- Login to your HDFC NetBanking account and click on the tab name ‘fund transfer’. The next page will appear before you.

- Here select the type of transaction you want to do and click on the go button. There are different types of transactions with transfer limits. For example, transfers within the bank can be done up to ₹25 lakhs per day, whereas International transfer is limited to 5000 USD per day. In case you want to transfer money to an eCMS account the limit is ₹10 lakh per day.

- Once you select the type of transfer you will be required to select the amount you want to transfer along with the description of the transfer. You also need to select the drawee account and this account must meet the criteria of the transfer type.

- A page with terms and conditions will appear, go through it and click on continue.

- On the next page all the details about the fund transfer will be provided, check them and click on confirm option.

- Now you can get the reference number and the acknowledgment of the fund transfer.

- Using these you can track the transfer of funds in the later stage.

HDFC Online Banking Transaction Limits and Charges Applicable

Conclusion

Net banking has emerged as one of the most convenient ways for fund transfer, payment of bills, etc. The banking operations can be done with just a few clicks and it also provides a completely secure way of funding transactions. These are some of the main reasons that have led to the popularity of net banking.

If you have a bank account in HDFC bank and you want to start Intenet banking it is important to know the proper steps and different methods you can use to create an HDFC net banking account and start using it. In the article, we mentioned everything that you need to know to get started with online banking with HDFC.