Learn how GST applies to cryptocurrency in India. Understand tax rules for trading, mining, and using crypto under current GST laws and CBIC guidelines.

Cryptocurrencies have gained immense popularity in recent years due to their decentralized nature and the potential for huge returns on investment. However, the regulatory landscape surrounding cryptocurrencies is still evolving, and the applicability of GST on cryptocurrency is a topic of considerable interest. In this article, we will discuss the GST Applicability on Cryptocurrency in India.

GST Applicability on Cryptocurrency is a digital or virtual currency that uses cryptography for secure financial transactions. It is decentralized, meaning that it is not controlled by any government or financial institution. The earliest and best-known cryptocurrency, Bitcoin, was developed in 2009. Since then, a lot of other cryptocurrencies have been created.

In many countries, the taxation of cryptocurrency transactions is a complex and evolving area. The treatment of cryptocurrency for tax purposes can vary significantly depending on the jurisdiction. In some countries, cryptocurrency is treated as a capital asset, while in others it is treated as a currency.

One question that has arisen in many countries is whether the goods and services tax (GST) applies to cryptocurrency transactions. GST is a value-added tax that is levied on the supply of goods and services in many countries, including Australia, Canada, and India. In general, GST applies to the supply of goods and services in a country. A supply is considered to be made in a country if it is made within the country, or if it is imported into the country.

If GST applies to a supply, the supplier is required to charge GST and remit the GST to the government. The recipient of the supply is generally entitled to a credit for the GST paid on the supply, which can be offset against any GST that the recipient is required to pay on its own supplies. If you are someone struggling with the legal formalities involved in the GST registration process, our expert team of legal experts at Vakilsearch can be your best bet to make the process smoother for you.

In this blog, we will discuss whether GST applies to cryptocurrencies.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units. They are not issued by any central authority or government and are not backed by any physical asset or commodity. Bitcoin, Ethereum, and Litecoin are some popular examples of cryptocurrencies.

GST Applicability on Cryptocurrencies

In India, the GST applicability on cryptocurrency remains a contentious issue. The Central Board of Indirect Taxes and Customs (CBIC) has issued a clarification stating that cryptocurrencies are not considered as currency but as goods or services. Therefore, any transaction involving the exchange of cryptocurrencies for fiat currency or other goods and services will attract GST. For businesses engaging in cryptocurrency transactions, maintaining compliance with these regulations is crucial. This includes ensuring proper registration under GST, which is necessary for legally conducting transactions that involve cryptocurrencies as taxable goods or services. Proper registration enables businesses to manage GST obligations effectively, including the collection and remittance of the tax to the government.

Additionally, if a person mines or sells cryptocurrencies as part of a business or trade, they are required to register for GST and pay tax on the income earned. The tax rate will depend on the nature of the transaction and the classification of the cryptocurrency as goods or services.

What is a Cryptocurrency or Digital Asset Under the GST Act?

Neither cryptocurrencies nor digital assets are defined in the GST Act. However, according to the Finance Bill 2022, a “virtual digital asset,” or VDA, is any data, code, number, or token created using cryptographic methods that serves as a digital representation of value traded and can be applied to any financial transaction.

These resources can be electronically stored or transferred. Any other digital asset listed by the Central Government as well as a non-fungible token, or NFT, is also included in VDA. The GST treatment of cryptocurrency transactions depends on the specific facts and circumstances of each case. Here are some general principles that may apply:

- If a person buys cryptocurrency as an investment, the purchase of the cryptocurrency is generally not subject to GST. This is because the purchase of a capital asset, such as cryptocurrency, is not considered to be a supply for GST purposes.

- If a person sells cryptocurrency that they have held as an investment, the sale is generally not subject to GST. This is because the sale of a capital asset, such as cryptocurrency, is not considered to be a supply for GST purposes.

- If a person uses cryptocurrency to make a payment for goods or services, the transaction may be subject to GST. This is because the payment is considered to be made in exchange for a supply of goods or services.

Calculate GST interest effortlessly with our GST interest calculator online. Simplify your tax calculations.

GST Applicability on Cryptocurrency

With a few exceptions, GST applies to all supplies of goods and services. Since bitcoin is not actual money (like coins or paper money) and was not issued by a reputable financial institution, GST applies to it. 18% GST is applied to bitcoin trading.

For example, if a person pays for a cup of coffee with Bitcoin, the transaction would be subject to GST if the supplier of the coffee is registered for GST. The supplier would be required to charge GST on the supply of the coffee and remit the GST to the government. The recipient of the supply (the person who paid for the coffee) would be entitled to a credit for the GST paid on the supply, which could be offset against any GST that the recipient is required to pay on its supplies.

In some cases, cryptocurrency transactions may be treated as barter transactions for GST purposes. A barter transaction is a transaction in which goods or services are exchanged without the exchange of money. If a person exchanges GST Applicability on Cryptocurrency,

the transaction may be treated as a barter transaction for GST purposes. In this case, GST would apply to the value of the goods or services supplied, rather than to the cryptocurrency.

For example, if a person exchanges a painting for bitcoin, the transaction would be treated as a barter transaction for GST purposes. The supplier of the painting (the person who exchanged the painting for Bitcoin) would be required to charge GST on the value of the painting and remit the GST to the government.

The recipient of the supply (the person who received the painting in exchange for bitcoin) would be entitled to a credit for the GST paid on the supply, which could be offset against any GST that the recipient is required to pay on its supplies. There are some exceptions to the general.

After repeated frauds, the RBI prohibited banks and other financial institutions from facilitating cryptocurrency exchanges in April 2018. It should be noted, meanwhile, that there is no rule prohibiting Indians from buying or trading cryptocurrencies there. Nevertheless, the financial boycott of cryptocurrencies was restrained in 2020 by the Supreme Court of India.

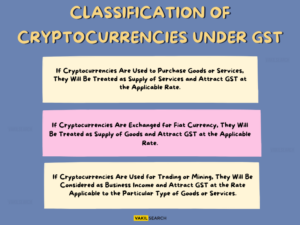

Classification of Cryptocurrencies under GST

The classification of GST Applicability on Cryptocurrency is not straightforward as they do not fit into any predefined category. However, based on the CBIC clarification, cryptocurrencies can be classified as follows:

- If GST Applicability on Cryptocurrency are used to purchase goods or services, they will be treated as a supply of services and attract GST at the applicable rate.

- If cryptocurrencies are exchanged for fiat currency, they will be treated as a supply of goods and attract GST at the applicable rate.

- If cryptocurrencies are used for trading or mining, they will be considered as business income and attract GST at the rate applicable to the particular type of goods or services.

How do Deal with Cryptocurrency?

There are several brokers available who are interested in trading bitcoins. Additionally, you can trade in partial bitcoins to buy or sell them. In India, the majority of trades give a base capital requirement between INR 100 and INR 500.

These trading platforms might charge for enabling these exchanges. Make sure your chosen trading platform is simple to use. Above all else, try to avoid sites without a KYC set-up as they could not be very secure.

Conclusion

GST Applicability on Cryptocurrency or other digital asset sellers are required to collect and remit GST from buyers.

Digital assets don’t have a specific HSN Code or GST Rate. As a result, the sale of cryptocurrency can be reported using HSN Code 960899 under the category “others” with an 18% tax rate. In addition, if the seller’s aggregate turnover reaches ₹ 40 lakhs during the financial year, they must register under the GST Act.

With decades of experience, Vakilsearch professionals can assist you in any scenario, whether it be a legal or financial one.