This article will help you understand the GST form ITC-01 and its details. Read the details below to know more.

For all taxpayers involved with the claimed input tax credit, the ITC 01 is a crucial filing document. There are numerous qualities and rational aspects that should be noted. The taxpayer must submit the ITC 01 form with each new GST registration to be eligible for the input tax credit.

In this article, we’ve broken out and chronologically divided some of the most recent and essential concerns to be aware of when filing the GST ITC 01 into separate parts. The acknowledgement and the actions to be taken while filling out the Form will be covered in the points. Examine all situations following the procedures required by the government to file the Form and any applicable conditions:

Situations in Which a GST ITC-01 Form Must Be Filed

Before a form is duly filled in, one needs to understand the context of making an official application. Before we delve into the further intricacies, the readers are requested to note the following points

In the following circumstances, the declaration form in ITC-01 is anticipated to be provided:

- When the GST enrollment application is submitted within 30 days of the GST becoming due. Article 18(1)(a)

- When the person chooses voluntary registration. Article 18(1)(b)

- If the person follows the composition policy while continuing to enrol as a regular assessee. Article 18(1)(c)

- When a tax is applied on the supply of exempt goods and services. Article 18(1)(d)

Types of Input Tax Credits & Their Acknowledgement

- Input tax credit for the input used to make the stock as of the halt date.

- Input tax credit for inputs used in semi-finished items as of the deadline.

- State-issued input tax credit for input that was present in final goods as of the cutoff date

- Input tax credit about capital items as of the deadline.

Most readers are requested to make a step-by-step approach to meet the objective. However, in case you need help understanding the intricacies, you can choose to pay to get professional assistance. Timely action to apply for GST number can prevent future compliance issues.

The Procedure to Follow When Filing ITC-01

The procedural norms are understood to be intricate, and readers are requested to go through every detail of the process.

- Keep in mind that Input tax credit under GST needs to be claimed. For instance, the ITC cannot be claimed on Form ITC 01 in the context of services. If the composition dealer selects the composition policy, ITC about capital items may be claimed, and privileged supplies are subject to taxation.

- As of the cutoff date, invoice-level information for ITC on the purchase must be provided.

- Form ITC 01 must be submitted within 30 days of enrollment or migration to the standard policy.

- Invoices for inputs may be reclaimed for up to a year and for capital items for five years.

- The Chartered Accountant certificate must be uploaded.

How do you declare and submit an ITC claim before registering, withdrawing from the composition scheme, or when an exempt supply of goods or services becomes taxable on the GST Portal?

The steps for claiming an ITC before registering, withdrawing from the composition scheme, or when an exempt supply of goods or services becomes taxable on the GST Portal are outlined below.

ITC-01 Filing Procedure on the GST Portal

Below is explained the step-by-step approach to the ITC 01 filing procedure. However, readers are requested to follow the step-by-step approach, in order to achieve measurable objectives while carefully filling up the application format

Navigate to the ITC-01 page after logging in.

- Launch your browser and navigate to www.gst.gov.in. The homepage or front page will show up.

- Log in to the GST portal using the login information.

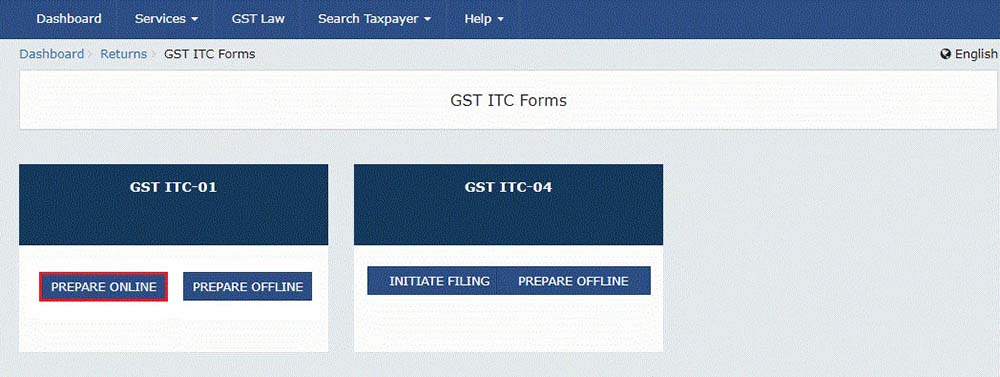

- Select Services, then select Return>ITC Forms from the menu.

- GST ITC Forms will be available online. To prepare the return by entering data on the portal, click the “Prepare Online” button under the GST ITC-01 tile.

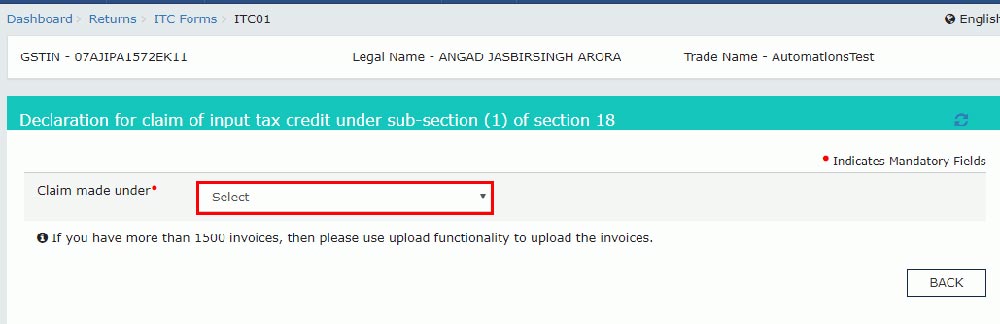

- Next, select the relevant part from the drop-down list under “Claim made.”

- Claim submitted under Section 18(1)(a): It applies to taxpayers who submitted a registration application within 30 days of becoming liable and may only be submitted once.

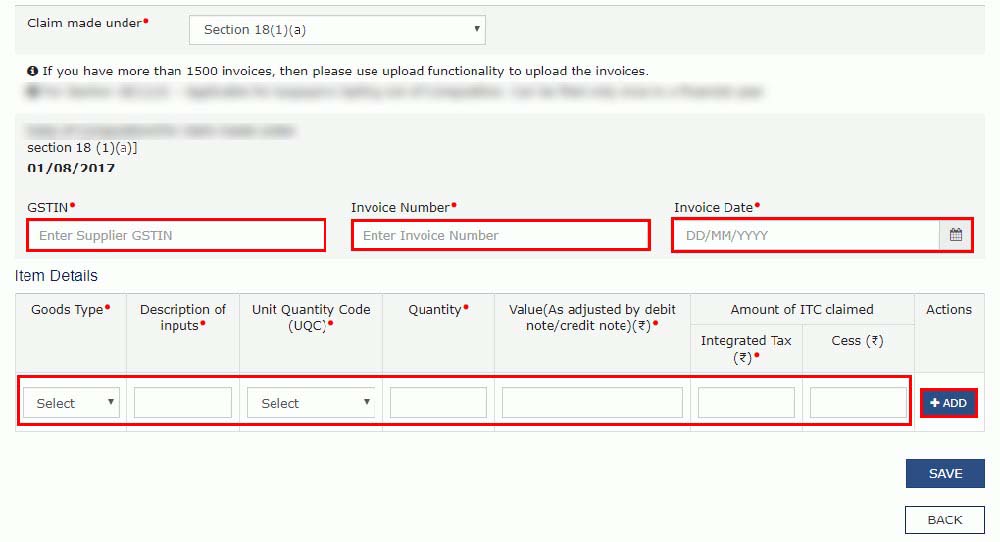

o Press the “Add Details” button

o Select a suitable type from the drop-down menu

o Enter the GSTIN of the supplier of the goods or services in the GSTIN box

o Fill in the Invoice Number field with the invoice number

o In the invoice date field, choose the appropriate invoice creation date from the calendar

Note: The invoice date must occur before the approval is granted.

o Fill out the Description of Inputs area with information about the currently-in-stock inputs, including those in semi-furnished or finished items.

o From the drop-down list, select the appropriate Unit Quantity Code (UQC).

o Enter the number of entries in the Quantity field now.

o Fill out the Invoice Value column with the proper value.

o As necessary, fill in the importance of the ITCs claimed for Central Tax, Integrated Tax, SGST/UTGST Tax, and Cess.

Note: CGST and SGST amounts must be equal, and each portion cannot exceed the invoice value. The payment of IGST shall not be greater than the invoice value in the case of an interstate purchase.

o Now, select “Add to Table” from the menu.

o Information has been updated. Press the Save button.

o Up to 20 invoices can be uploaded at once using the same process; be sure to click on save before adding the next invoice.

Using DSC/EVC, Submit GST ITC-01: What Do You Need to Know?

To make a flawless application submission, please follow the given steps. However, one requires stringent detailing to go through the process.

- Check the box next to the declaration.

- Select the authorised signatory from the drop-down menu for Authorised Signatory. There are two buttons available.

1) Submit ITC to DSC

2) Submit ITC to EVC. To finish the GST ITC-01 filing, click on each one individually.

- Submit to DSC:

o A warning will appear on the screen; press the continue button.

o Next, pick out the certificate and then press the sign button.

- Submit to EVC:

o OTP will be sent to the registered email and mobile number for the authorised signatory on the GST portal. Could you put it in the relevant field?

o Press the verify button now.

o A success notification will appear on the screen, an ARN will be produced, and the taxpayer will receive an SMS and email.

o Reload the page, and the GST ITC-01’s status will now read “Filed.”

Conclusion

Filling in the GST – 01 ITC format is complex. Electronically processed application forms are to be filled in duly while furnishing valid data at the end of the day. Most legal experts declare the process requires diligence, better comprehension and clerical accuracy in processing details. Keeping an eye on detailed information is needed, and you can also take professional help from Vakilsearch. We hope this article adds to your knowledge regarding the GST form. For further information, contact our legal experts today.