Beginning 1 April 2021, taxpayers with a turnover of more than ₹50 crore must comply with the CBIC's GST e-invoicing plan. To understand more about what this means for your business, go to this article.

Electronic invoicing (GST e-Invoicing) has become a requirement for enterprises having an annual turnover of more than ₹50 crores beginning April 1, 2021.

The Honourable Finance Secretary recently announced this change. He stated that this measure would help to reduce GST avoidance and make business compliance easier.

The launch of the new e-invoicing system was scheduled initially for 1 April 2020. However, that move was postponed to 1 October, given the COVID-19 pandemic. On 1 October, the government rolled out the e-invoicing system for all businesses with an annual turnover of over ₹500 crores. By 1 January 2021, the system was applicable to taxpayers with an annual turnover of more than ₹100 crores vide notification No. 88/2020 dated 10th Nov 2020.

This system requires eligible companies to be linked to the GST number registration portal for an automated generation of Invoice Reference Number (IRN) for every B2B invoice. The invoices generated by the business will then be uploaded to the GSTIN registration portal: https://reg.gst.gov.in/registration/ within 24 hours. The new e-invoicing system will eventually replace physical invoicing – and the existing e-waybill system as well.

It will give real-time information on invoices to both the buyers and the sellers. The taxpayers will also not be required to generate separate e-waybills. What’s more is that with GST e-invoicing in place, banks will not be required to validate a whole lot of physical documents.

This move is not only expected to boost invoice lending for the MSMEs. But it is also expected that the payment cycle for the various Indian industries will improve as well. Thus, the new e-invoicing system will benefit both the tax administration and businesses, in some way or another.

The New System

This new system is expected to contribute immensely towards a more robust taxation regime and the ‘ease of doing business in India. The response from the users has been overwhelming as well. Further, On 1 October 2020, the very first day of this new system, over 8.4 lakhs of Invoice Reference Numbers (IRNs) were generated by almost 8500 users. Between the beginning and end of the first week of October 2020, the generation of IRNs increased by a whopping 163%. As of 7 October 2020, over 69.5 lakh IRNs had been generated by over 71000 users in the new system.

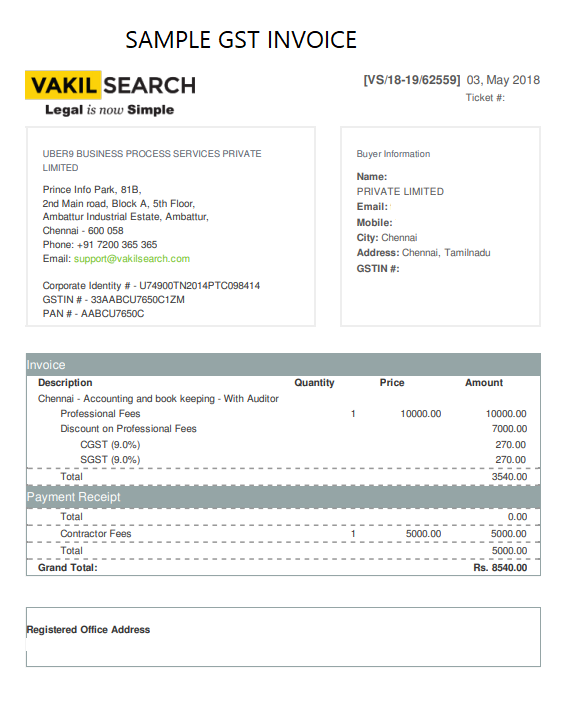

Sample for GST E-invoicing