Wondering about your GST application status? Learn how to check your GST ARN status and track approval, rejection, or pending updates easily.

Tracking the GST application status is crucial for businesses and individuals navigating the Goods and Services Tax (GST) registration process. Whether you’re a business owner or a professional, staying informed about the progress of your application ensures that you don’t miss important updates or face unnecessary delays.

The GST Application Reference Number (ARN) plays a key role in this process. It acts as a unique identifier, allowing you to track the status of your GST registration at any time. By using the ARN, you can easily monitor whether your application has been approved, rejected, or is still under review.

In this blog, we will dive deeper into how the GST ARN works, why it’s important, and how to effectively track the GST application status to ensure a smooth registration process.

What is GST ARN?

GST ARN stands for GST Application Reference Number. It is a unique identifier generated after submitting your GST registration application. Once you complete the application process, the GST portal provides this number to track the progress of your registration.

The GST ARN is crucial for checking the GST registration status. By using this number, you can easily monitor whether your application is under review, approved, or rejected. It helps ensure that the registration process stays on track and allows applicants to stay updated at all stages.

Why Track Your GST Application Status?

Tracking your GST application status is essential to avoid delays and ensure the accuracy of your registration. By regularly monitoring your GST status, you can stay informed about whether your application is approved, rejected, or still under review.

Timely updates through GST status tracking help you address any issues promptly, reducing the chances of complications. It also ensures that you can act quickly if additional documents or information are required, keeping the registration process smooth and on schedule.

Steps to Check Your GST ARN Status

Here’s how to check GST ARN status:

- Step 1: Go to the official GST portal

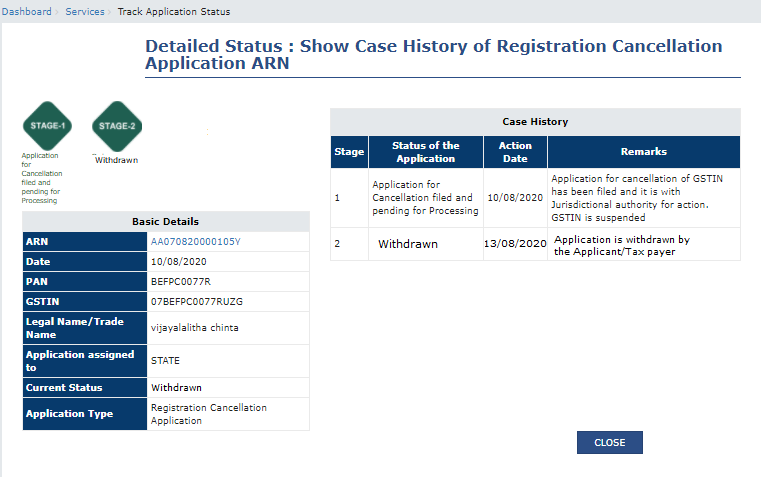

- Step 2: On the homepage, select Services > Registration > Track Application Status

- Step 3: In the ‘Track Application Status’ page, enter your 15-digit ARN number in the designated field and complete the CAPTCHA verification.

- Step 4: Click Search. The portal will display the current status of your GST application, such as ‘Pending,’ ‘Approved,’ or ‘Rejected,’ with further details based on the application’s progress.

- Step 5: Based on the displayed status, take appropriate action as needed to keep your application on track.

How to Track GST Application Status?

Certain taxpayers can track the status of their application such as new registration, core amendments, or cancellation by logging into the GST portal using the Application Reference Number (ARN) or the submission period.

However, this tracking feature is not available for first-time GST registration applicants. To track your GST application status, you can use the official GST portal’s tracking feature. Here’s how:

- Go to GST portal

- Navigate to Track Application Status

- Hover over the “Services” tab.

- Select “Registration”.

- Click on “Track Application Status”.

- Enter Your Details

- Choose “Registration” from the “Module” dropdown.

- Input your Application Reference Number (ARN) or Service Request Number (SRN).

Enter the Captcha Code as shown.

Step 4: Click on the “Download” hyperlink to obtain the acknowledgment receipt.

For a detailed guide, refer to the official GST tutorial: Track Application Status (Pre-Login). If you encounter issues or need further assistance, the GST Helpdesk is available at 1800-103-4786. Regularly monitoring your application status ensures timely updates and helps address any required actions promptly.

Common GST Application Status Updates

When tracking your GST application, you’ll come across various status updates. Understanding these statuses is crucial for knowing where your application stands and what action, if any, is required.

GST Application Approved

When your GST application is approved, you will receive your GSTIN number (Goods and Services Tax Identification Number). This confirms your successful GST registration and allows you to conduct business under the GST regime. You can now start issuing GST-compliant invoices, claim Input Tax Credit (ITC), and fulfill other GST-related obligations. The approval also signifies that your application has passed all necessary checks and is officially recognized by the tax authorities.

GST Application Pending

A “Pending” status means that your GST application is still under review. The authorities may need more time to process your details or additional documents might be required. During this time, ensure that you have provided all the necessary information accurately. If needed, you may be asked to submit more documents or clarify certain details. Stay updated by regularly checking your GST status and respond promptly to avoid delays in processing your application.

GST Application Rejected

If your GST application is marked as “rejected,” it means there was an issue with your submission. Common reasons for GST rejection include incorrect information, mismatched documents, or failure to meet certain eligibility criteria. To address this, carefully review the rejection notice to understand the specific reasons. Once you identify the issue, correct it and reapply for GST registration. Ensuring all details are accurate will increase your chances of approval during the next submission.

By keeping track of your GST application status, you can ensure timely responses and avoid delays in your business registration process.

Troubleshooting: What to Do if You Can’t Track Your GST Status?

If you’re unable to track your GST application status or the ARN is not showing up, there could be several reasons behind it. One common issue is entering the wrong ARN or missing login credentials. Ensure that the GST ARN you entered is accurate, and check if your login details are correct. If the issue persists, try clearing your browser cache or use a different browser. Sometimes, GST portal issues can occur due to maintenance or server downtime. If you still can’t track your status, contact GST portal support for further assistance.

Steps to Fix Tracking Issues

If you are facing difficulties tracking your GST application, follow these steps to resolve the problem:

- Double-check the ARN: Make sure you’re entering the correct ARN. Any small error in the number can cause the status not to show up.

- Verify Your Login Credentials: Ensure you are logging in with the correct credentials associated with your application.

- Clear Your Browser Cache: Sometimes, old data in the browser cache can cause tracking issues. Clearing it can resolve the problem.

- Try a Different Browser or Device: If the GST portal isn’t working on one browser, try accessing it through another browser or device.

- Contact GST Portal Help: If none of the above steps work, reach out to GST support or the GST helpdesk for assistance. You can inquire about any known issues and receive guidance on resolving your GST tracking problems.

Conclusion

In conclusion, tracking your GST application status is an essential step in ensuring a smooth and timely GST registration process. By using the GST ARN, you can easily monitor the progress of your application, whether it’s pending, approved, or rejected. Staying updated helps you take timely action and avoid any delays in your registration.

Remember, GST application tracking is a straightforward process that empowers you to stay on top of your registration journey. Regularly check your GST ARN status to ensure everything is on track and address any issues promptly. Keeping an eye on your GST application status ensures that your business remains compliant with the tax authorities.

Frequently Asked Questions (FAQs)

ARN is a unique number generated after the submission of your GST registration application. It is used to track the application status on the GST Portal.

Visit the GST Portal and enter your ARN or GSTIN to check the status of your GST registration application.

'Pending' indicates that your GST application is still under processing. You will need to wait for approval or further updates.

You will receive an approval notification and GSTIN after your application is successfully processed and accepted.

Common reasons for rejection include incorrect details, missing documents, or errors in the GST application. Check the rejection reason on the GST Portal.

No, you need your ARN or GSTIN to track the status of your GST application on the GST Portal.

Your ARN is generated automatically once you successfully submit your GST registration application through the GST Portal.

Check your ARN for accuracy. If issues persist, contact the GST Portal Helpdesk for assistance.

You can check the status of your GST filing by logging into the GST Portal and accessing your application’s progress.

The GST application status date reflects the most recent update on your application, whether pending, approved, or rejected. You can view it on the GST Portal. What is an ARN (Application Reference Number) in GST?

How can I track my GST application status?

What does it mean if my GST application is 'Pending'?

How do I know if my GST application is approved?

Why was my GST application rejected?

Can I check my GST application status without an ARN?

How do I get my GST ARN?

What should I do if the GST portal is not showing my ARN status?

How do I know the status of my GST filing?

What is the GST application status date?