Understanding the GST ARN is crucial for businesses navigating the GST registration process. This guide explores what an ARN is, how it is generated, and its importance in tracking the status of GST applications. With a focus on simplifying the registration experience, we highlight the benefits of having an ARN, including ease of follow-up and enhanced compliance.

The GST ARN (Application Reference Number) is a unique number issued upon submitting a GST registration application in India. It helps businesses track the status of their application and ensures a smooth GST registration process. ARN is essential for monitoring compliance and adhering to GST regulations. This blog breaks down the essentials of GST ARN, including:

- How it is generated?

- Its purpose and significance

- The application process

- Steps to check arn status

Whether you’re launching a new business or managing an established enterprise, getting the GST ARN process ensures effortless compliance with GST norms.

ARN Full Form in GST

ARN full form in GST is Acknowledgement Reference Number. It is a unique 15-digit alphabetic number developed upon submission of your GST registration form. This reference number, therefore, points out the track status to which the applicant can identify the progress that has made the submission, the confirmation sent about the submission and updates over the processing status of such an application.

The significance is the provision of an apparently convenient and transparent mechanism that firms can easily access whether their GST is registered to ascertain whether their business compliance obligations have been met, according to tax requirements.

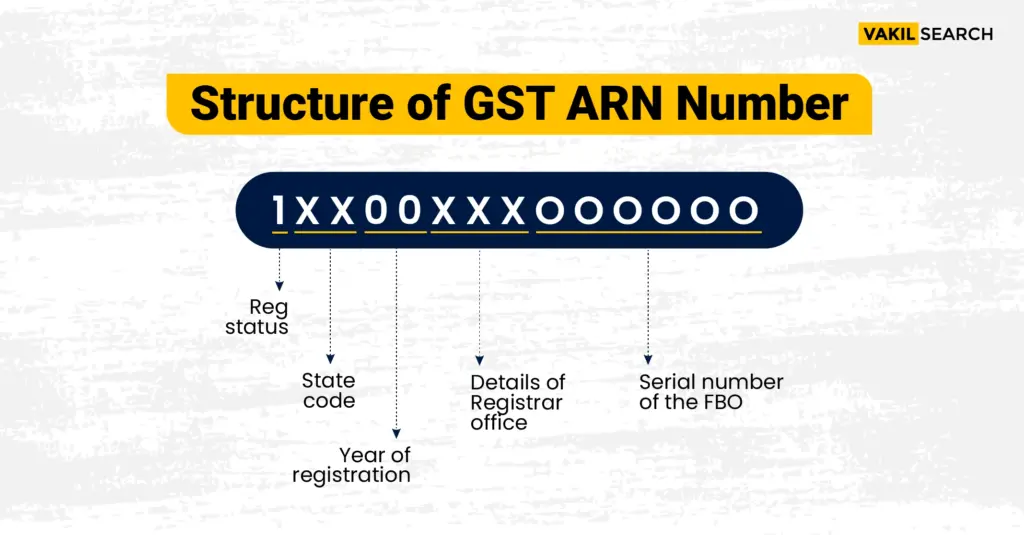

Structure of GST ARN Number

The GST ARN number is an alphanumeric, 15-digit number. Each digit carries a meaning, and the structure mostly comprises state codes, year, month, application serial number, and a check digit for validation.

- The first two digits are alphabetic and refer to state code

- This is followed by 4 digits, which refer to the month and year

- The rest of the 6 digits are automatically generated unique numerals given by the portal

- The last number in the ARN is a checksum digit.

For example, a sample GST ARN number would be like this: AA0703220001234. The format makes sure that each ARN is unique and traceable so that the applicants and the authorities can easily refer to the applications.

Why is GST ARN Important?

The GST ARN number will ensure transparency in the process of GST registration since applicants are able to track the status of the applications in real time. Moreover, it promotes efficiency with the timely processing, as administrative delays will be to a minimum. In respect of compliance maintenance, application through GST ARNs helps in preserving the proof of submission to trace the steps that the applicants require. They assist in communication between businesses and the GST department and make the process smooth and easy for both applicants and authorities.

What Are the Features and Benefits of GST ARN?

The GST ARN offers many features and benefits that help taxpayers through the GST registration and compliance process. This unique identifier, aside from helping in gst tracking applications efficiently, plays an important role in helping businesses manage taxes effectively. Here, we will discuss the major features and benefits of GST ARN number:

Key Features of GST ARN

There are several features in the GST ARN number, important for proper management of tax obligations.

- It is the unique identification for every application submitted for GST registration

- The GST registration status can be accessed in real time using the ARN

- The PAN of the business can be linked directly and thereby easily identified

- Through GST ARN, the central communication for registration-related updates is provided

- Separate ARNs can be facilitated for the multiple-branch business

- It ensures no duplicate registration under the same business entity

- It makes it easier to get through the numerous procedures followed for GST compliance.

Benefits of GST ARN for Businesses

GST ARN is a facility that offers more than just mere registration; it has facets regarding each dimension of business operations. This is one of the stronger advantages in that it helps businesses track the status of their GST application seamlessly, thus providing transparency and avoiding uncertainty within the registration process.

GST ARN also facilitates vendor verification, as business organisations can verify the status of the GST registration of their vendor to help in verifying claims for ITC and ensure that all is done in conformity. The use of ARN also assists businesses in demonstrating conformity with GST, which enhances business integrity and boosts client confidence and acceptance of the business.

Types of GST ARNs

The GST ARN number is an important identifier given to a business while signing up for the process, which doesn’t only enhance the convenience of the entire application but also helps in follow-up or tracking the progress of a GST registration. Familiarity with the type of ARN’s will be greatly beneficial to businesses in efficiently achieving compliance.

- Provisional ARN: This arises during the application process but indicates that the application will be taken into consideration as it’s under review yet not approved

- Last ARN: When the GST registration has been approved, and it starts to operate the business under GST

- Cancelled ARN: Issued for rejection or cancellation by the applicant who no longer requires GST registration

- Amended ARN: If changes have to be incorporated into the existing GST registration due to change in the details of the business or in their compliance requirement.

Several ARNs can also be produced by having multiple different states, where each state has its own version of GST, or by having several branches in multiple cities.

GST ARN for Different Business Structure

There are different types of GST ARN (Application Reference Number), each serving a unique purpose in the GST system in India. The ARN is a unique identifier provided to track the status of various GST-related applications. Here are the main 7 types:

- GST Registration ARN: This type of ARN is given once there is an application by a firm for GST registration. It gives the applicant an opportunity to track the progress of the registration process up to approval or rejection

- GST Refund ARN: Where a taxpayer submits for a refund of the GST (say, tax overpaid), then an ARN will be generated. This helps in tracking the refund status.

- GST Cancellation ARN: If a business wants to cancel its GST registration, then a cancellation ARN is generated. This ARN can be used to check the status of the cancellation application.

- GST Amendment ARN: In case a business wants to alter its GST registration details, an ARN is generated. This can go a long way in tracing the modification of the registration details such as change of address, business name, etc.

- GST Return Filing ARN: When the GST return is filed (for example, GSTR-1, GSTR-3B), an ARN is issued as evidence of return filing. This will show the status of submission of the return.

- GST LUT (Letter of Undertaking) ARN: A business house exporting commodities or service will pay IGST during import. However, if it does not pay the IGST due, an LUT needs to be filed by such a business. Upon filing the LUT, an ARN is issued for tracking the same

- GST Appeal ARN: If the taxpayer files an appeal against a GST assessment or order, then an ARN gets generated that follows the tracking of appeal status. Each ARN will help one track the status of the application realtime on the GST portal; therefore, the whole process is transparent and supports compliance.

How to Generate GST ARN?

ARN Number is generated automatically after submitting the application on the GST portal. This step-by-step guide takes you through the process, ensuring your application is filled out and tracked without problems until you receive your GST Identification Number, known as GSTIN.

Step 1: Submission of application for GST registration

Fill the online application form for GST Registration on the GST portal based on business information, type of registration, and other details relating to contact information.

Step 2: Submit Application

After completing this form, check every field and submit it along with all the required documents. Once you submit the application, there would be an automatic generation of the GST ARN that is a unique 15-digit number provided with a reference number in which your registration process would work.

Step 3: Receive ARN

Through Email and SMS, GST ARN Number received by you will be to the contact details filled on the application, whereby, you can confirm whether it has been submitted.

Step 4: Track status by GST portal

There is the facility to check how an application is moving from application making to the own GSTIN issue to see no step went missing and registration was going accordingly on the GST portal.

Required Documents for GST ARN Application

To generate a GST ARN Number, you’ll need the following documents:

- PAN (Permanent Account Number) of the business or individual applying

- Proof of Business: Business registration documents or ownership proof

- Bank Details: Bank account statements or cancelled cheque

- Identity and Address Proof: Aadhar, Voter ID, Passport, or other valid ID documents for the business owner(s) or partners.

Importance of Tracking ARN

This will ensure time-complaint registration, as the application date up to the issuing date of GSTIN could be traced with the ARN of GST. Monitoring status further can keep you posted regarding every step in your process of registration so that any query or error regarding such could be responded and rectified in time, so as not to delay GSTIN being issued.

Besides, the follow-up of the ARN provides assurance that your application is being processed, it becomes easier to transition smoothly towards compliance, and businesses can operate with confidence under the GST framework.

How to Check ARN Status?

Online verification of the GST ARN status is one of the easiest methods by which the status of GST registration application can be ascertained. With easy navigation on the GST portal, applicants can easily see where their application stands, a feature that is important to timely compliance.

Steps to Check GST ARN Status

Follow these steps to check your GST ARN status online:

- Step 1: Go to the official GST portal at gst.gov.in.

- Step 2: On the homepage, select Services > Registration > Track Application Status

- Step 3: In the ‘Track Application Status’ page, enter your 15-digit ARN in the designated field and complete the CAPTCHA verification

- Step 4: Click Search. The portal will display the current status of your GST application, such as ‘Pending,’ ‘Approved,’ or ‘Rejected,’ with further details based on the application’s progress.

- Step 5: Based on the displayed status, take appropriate action as needed to keep your application on track.

What Does Each GST Registration Status Mean?

Knowing the meaning of each GST registration status is essential for understanding the progress of your application:

- Pending for Processing: Your application is under review by GST authorities. No action is required, but you should check back periodically for updates.

- Approved: Your GST registration has been successfully approved, and your GSTIN (Goods and Services Tax Identification Number) is now active. This status enables you to begin GST-compliant operations.

- Rejected: If the status shows ‘Rejected,’ it means your application did not meet certain criteria or had issues during verification. You may need to reapply or address specific queries raised by the GST authorities.

- Provisional: Occasionally, an application may be provisionally accepted while pending further verification. This means you may use a provisional GSTIN, but final approval is still pending.

How to Download GST ARN Certificate?

Downloading the GST ARN certificate is a straightforward process that provides you with proof of your GST registration application. This certificate serves as a temporary acknowledgment until your final GST registration certificate is issued.

Steps to Download the GST ARN Certificate

- Step 1: Navigate to the official GST website at gst.gov.in.

- Step 2: If you have registered on the portal, log in using your credentials. If you are a new user, you may need to register first

- Step 3: Once logged in, access the Services tab on the homepage

- Step 4: Click on the Registration option, then choose Track Application Status

- Step 5: In the Track Application Status section, enter your 15-digit ARN in the designated field

- Step 6: Click Search. The portal will display your application status along with options to download the ARN certificate. Click the download link to save the certificate to your device

- Step 7: Ensure you save or print the ARN certificate for your records. This document is crucial for provisional registration.

Difference Between GST ARN Certificate and GST Registration Certificate

The two certificates, GST ARN certificate and GST registration certificate, are important papers. They serve different purposes as outlined below:

| GST ARN Certificate | GST Registration Certificate |

| This certificate is a temporary acknowledgment confirming the submission of your application for GST registration. | Issued after all GST registrations are approved, |

| Contains 15 digit ARN number for application tracking | this certificate includes a GSTIN, and business details, |

| It does not allow the collection of GST or claiming of ITC | It enables businesses to claim Input Tax Credit (ITC). This certificate is crucial for compliance under the GST regime. |

Validity and Verification of GST ARN Number

The verification and validation of your GST ARN are important for you to confirm that your GST registration application is active and recognised by the GST authorities. Checking the validity of an ARN number is a straightforward process for users and keeps them in compliance with GST regulations.

How to Validate GST ARN Number?

To ensure that your GST ARN is valid and active, follow these steps:

- Step 1: Go to the official GST website at gst.gov.in.

- Step 2: On the homepage, hover over the Services tab, then click on Registration and select Track Application Status.

- Step 3: Enter your 15-digit GST ARN in the provided field.

- Step 4: Enter the CAPTCHA code to verify that you are not a robot.

- Step 5: Click on Search to retrieve the ARN status.

- Step 6: The portal will display the current status of your ARN. If it is valid, it will show details regarding the application and its processing status.

What to Do if GST ARN is Invalid?

If you find that your GST ARN is invalid or has been rejected, take the following steps to address the issue:

- Check for Errors: Verify that you have entered the ARN correctly, as any typographical error can lead to an invalid status.

- Review Application Submission: Ensure that your application was submitted successfully. If there were any technical issues during submission, you may need to reapply.

- Contact GST Helpline: Reach out to the GST helpline or customer support for assistance. They can provide insights into why your ARN is invalid and guide you on the next steps.

- Reapply if Necessary: If your ARN was rejected due to incomplete or incorrect information, gather the necessary documents and information, and submit a fresh application for GST registration.

- Monitor the New Application: Once you reapply, keep track of the new ARN to ensure that it is processed successfully.

Handling GST ARN Notices

It may be a critical moment for the business to receive notices related to GST ARN, as most of the notices are indicative of the problem in the GST registration application, which requires immediate attention. Therefore, knowing how to handle such notices properly is important for maintaining compliance and ensuring smooth operations.

Reasons for ARN-Related Notices

GST ARN notices can arise from various issues, including:

- Incorrect Information: If the information provided in the GST registration application is inaccurate or inconsistent with the supporting documents, authorities may issue a notice to rectify the discrepancies.

- Missing Documents: Notices can also be issued if any required documents are not submitted or if the submitted documents do not meet the necessary criteria for verification.

- Non-Compliance with GST Regulations: Failure to comply with specific GST norms or guidelines can result in notices being sent to businesses, prompting them to take corrective actions.

- Application for Rejection: If the GST authorities deem an application ineligible for approval due to various reasons, they will send a notice indicating the rejection and the grounds for it.

How to Respond to ARN Notices?

When you receive a GST ARN notice, follow these steps to respond effectively:

- Read the Notice Carefully: Understand the specific issue highlighted in the notice, whether it’s related to incorrect information or missing documents.

- Gather Required Information: Collect all necessary documentation and evidence to address the concerns raised in the notice. This may include corrected information, additional documentation, or clarification on any discrepancies.

- Prepare a Response: Draft a clear and concise response to the notice, addressing each point raised by the GST authorities. Include the ARN number, your business details, and any supporting documents that validate your claims.

- Submit the Response: Respond to the notice through the GST portal or by the method specified in the notice. Ensure that you meet any deadlines for response submission to avoid further complications.

- Follow Up: After submitting your response, monitor the status of your ARN and any further communications from the GST authorities. You can track your ARN status online to confirm that your issues are being processed.

- Consult a GST Practitioner: If the notice is complex or you are unsure about how to respond, consider consulting with a GST practitioner or tax professional. They can provide expert guidance on resolving ARN-related issues and ensure compliance with GST regulations.

Key Considerations for Using GST ARN Efficiently

Efficient handling of your GST ARN (Acknowledgement Reference Number) is crucial for ensuring smooth compliance with GST regulations. By adopting best practices throughout the GST registration process, businesses can streamline their operations and minimise potential issues. Here are some key considerations for managing GST ARN effectively.

Choosing the Right Business Structure

Selecting the correct business structure is fundamental to the ARN processing and overall GST compliance. Different business entities—such as sole proprietorships, partnerships, LLPs, and limited companies—have unique registration requirements and implications for ARN handling. For instance:

- Sole Proprietorships may experience simpler processing due to a single owner’s details being directly tied to the ARN, facilitating quicker validations.

- Partnerships and LLPs require comprehensive documentation for all partners, which can complicate the ARN processing if any partner’s information is incorrect or incomplete.

- Limited Companies may have more stringent documentation and compliance checks, impacting the ARN processing timeline if the necessary papers are not correctly submitted.

Ensuring Compliance with GST Regulations

To avoid delays in ARN validation and final GST registration, businesses should follow these tips for compliance:

- Provide Accurate Information: Ensure that all details entered in the GST registration application are accurate and consistent with supporting documents. Double-check for typos, especially in critical information like PAN and business addresses.

- Submit Complete Documentation: Compile all required documents before submitting the application. This includes identity proofs, business registration certificates, bank details, and any additional documents requested based on your business structure.

- Track ARN Status Regularly: Use the GST portal to regularly monitor your ARN status. Early identification of issues allows for quicker resolutions and helps prevent prolonged delays.

- Respond Promptly to Notices: If you receive any ARN-related notices from GST authorities, respond promptly with the required information or documentation. Timely communication can prevent escalation and complications in your application process.

- Consult a Tax Professional: Engage with a GST practitioner or tax advisor to navigate the complexities of GST regulations. They can provide tailored advice on compliance and ensure that your application is submitted correctly.

Conclusion on ARN Number in GST

Understanding the GST ARN number is essential for businesses navigating the GST registration process. The ARN acts as a unique identifier, streamlining compliance and ensuring transparency in the registration journey. At Vakilsearch, we specialise in simplifying GST processes for businesses of all structures—whether you are a sole proprietorship, partnership, or limited company.

Our expert team provides customised support to ensure that your GST registration process is frictionless and smooth. Partner with Vakilsearch to tap into our expertise and vast experience in GST compliances to let you focus more on what matters most-growth. Let’s help unlock the full potential of your business with our comprehensive services.

FAQs on GST ARN

What is the GST ARN’s role in updating business information post-registration?

The GST ARN is crucial for businesses needing to update details, such as address changes, business structure modifications, or adding new branches. With the ARN, businesses can track and ensure their updates are processed promptly by GST authorities.

Can multiple ARNs be issued to a single business entity?

Yes, if a business operates in multiple states or has branches across different locations, separate ARNs can be generated for each, providing region-specific GST compliance and allowing easy status tracking.

How long does it typically take to receive an ARN after submitting a GST application?

Generally, the ARN is issued instantly upon successful submission of the GST application. However, certain factors like technical issues or document verification can sometimes delay ARN generation.

Is an ARN necessary for GST application cancellation?

Yes, the ARN is essential if a business decides to cancel its GST application. This number will be required to track the cancellation status and ensure the request is processed accurately by GST authorities.

Can I retrieve my ARN if I’ve lost it?

If the ARN is misplaced, it can typically be retrieved through the registered email or SMS, as these details are provided upon application submission. Alternatively, logging into the GST portal with application details can help recover it.

How does the GST ARN simplify compliance audits?

The ARN provides a record of registration submissions and updates, which assists in auditing and ensures all applications and changes made through the GST portal are documented for future reference.

What should I do if my ARN status doesn’t update for an extended period?

If an ARN status remains unchanged, contact the GST helpline for assistance. Delays could arise due to verification requirements or document issues, so ensure all submission details are accurate and complete.