Discover the advantages and disadvantages of GST in India. Learn about GST benefits, tax simplification, ITC, compliance challenges & its economic impact.

GST has streamlined India’s tax system, replacing multiple indirect taxes like VAT, excise duty, and service tax. The four-tier tax structure (5%, 12%, 18%, and 28%) provides clarity, while input tax credit (ITC) eliminates the cascading tax effect, reducing business costs and ensuring uniform tax compliance.

Despite its benefits, GST imposes a higher compliance burden, especially on small businesses and MSMEs, requiring frequent return filings (GSTR-1, GSTR-3B, etc.). Technical challenges, ITC mismatches, and tax slab complexities add to operational hurdles, affecting businesses’ cash flow and administrative efficiency.

The introduction of e-invoicing, e-way bills, and digital tax filing has increased transparency, reduced tax evasion, and promoted economic growth. However, delayed refunds, higher tax rates on luxury goods, and dual tax administration (CGST & SGST) create confusion, requiring further simplification in GST policies

In this blog, we will explore the key advantages and disadvantages of GST, its impact on businesses, and how taxpayers can navigate compliance challenges effectively. We will also discuss possible reforms to improve the GST framework.

Comparative Analysis: GST Benefits and Disadvantages

Below is a comparison of the advantages and disadvantages of GST, highlighting its impact on businesses and the economy with practical examples,

| Advantages of GST | Disadvantages of GST |

GST replaced multiple indirect taxes (VAT, excise, service tax) with a single tax system, making compliance easier. Example: A manufacturer now files a single GST return instead of multiple state and central tax filings. |

GST requires monthly and annual return filings (GSTR-1, GSTR-3B), increasing compliance costs for businesses. Example: SMEs must hire accountants or use GST software to manage frequent tax filings. |

GST allows input tax credit (ITC), reducing double taxation and lowering costs. Example: A retailer can now claim ITC on GST paid on raw materials, reducing the final tax burden. |

ITC mismatches, sector-specific tax rates, and digital filing requirements make GST compliance difficult for small traders. Example: A small trader dealing with multiple tax slabs struggles with cash flow issues due to delayed ITC refunds. |

GST provides relief to small businesses by setting a higher registration limit (₹40 lakh for goods, ₹20 lakh for services). Example: A small shop earning ₹15 lakh annually is not required to register for GST. |

Some items are now taxed at higher GST slabs (e.g., luxury items, tobacco, aerated drinks). Example: A luxury car that had a lower tax burden before now falls under the 28% tax slab with additional cess. |

GST removed state entry taxes, reducing delays in interstate trade and logistics costs. Example: A transport company now avoids multiple state tolls and benefits from faster deliveries. |

Businesses face GSTN portal issues, invoice mismatches, and server downtimes, leading to filing difficulties. Example: A company unable to file GSTR-3B due to technical glitches faces late fees and penalties. |

GST provides clarity and structure for e-commerce taxation through TCS (Tax Collected at Source). Example: An online seller now follows a uniform tax system instead of dealing with multiple state VAT regulations. |

Many non-GST compliant businesses struggle with digital invoicing and tax formalization. Example: Small retailers in rural areas find it difficult to transition from cash-based transactions to GST invoicing. |

GST promotes digital tax filing and monitoring, reducing fraud and boosting tax compliance. Example: Businesses must now generate e-invoices, ensuring proper tax reporting and reducing tax evasion. |

Delayed GST refunds on ITC create liquidity problems, especially for exporters. Example: An exporter must wait for refunds on input tax, affecting cash flow and operations. |

GST improves India’s ease of doing business, attracting foreign direct investment (FDI) and economic growth. Example: Companies benefit from ‘Make in India’ policies as tax compliance becomes simpler. |

GST follows a dual tax system (CGST & SGST), sometimes leading to disputes and confusion in tax jurisdiction. Example: A business dealing in multiple states faces ambiguity in tax filing under different state laws. |

What Are the Advantages of GST?

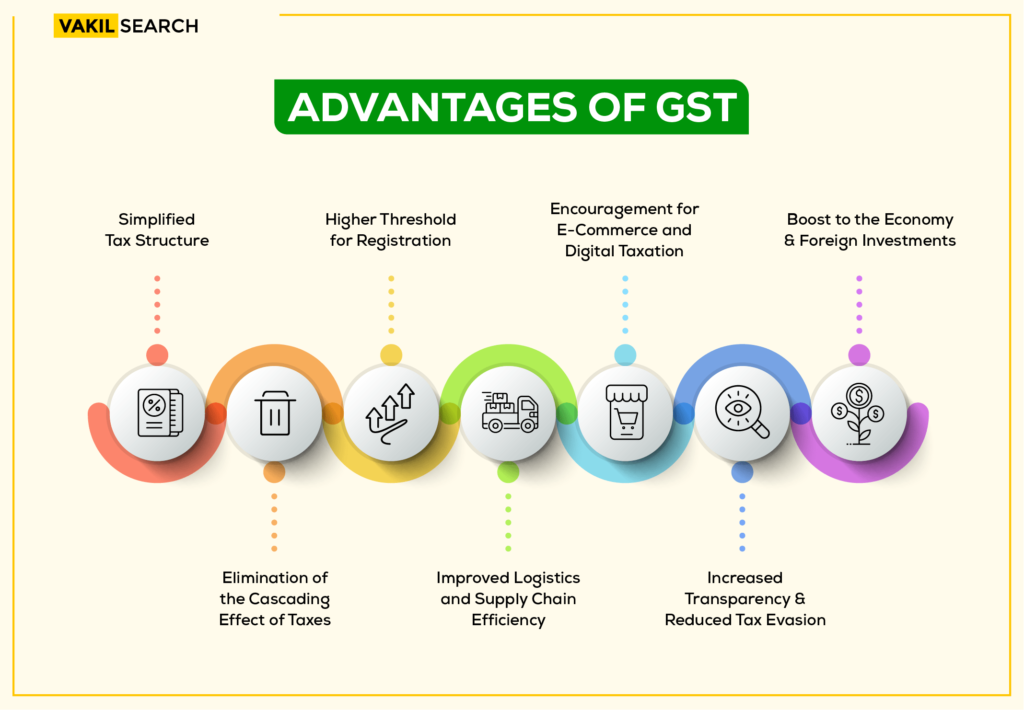

Understand the advantages of GST at a glance with the help of this image:

-

Simplified Tax Structure

The Goods and Services Tax (GST) has replaced multiple indirect taxes such as VAT, excise duty, and service tax, creating a single tax system that simplifies compliance for businesses. Previously, businesses had to adhere to different tax structures in each state, increasing complexity and costs. With GST, the indirect tax replacement ensures uniformity across the country, reducing administrative burdens. The ease of compliance allows businesses to focus more on growth rather than tax-related complexities.

And while the rates of taxes are uniform, different goods carry different rates of tax burdens. The GST tax structure is a four tier tax structure with four slab rates for different types of goods. They are as follows:

- 5% GST – Essential goods and services such as packaged food, transport services, and medicines.

- 12% GST – Processed food, mobile phones, and restaurant services.

- 18% GST – Standard goods like electronics, cosmetics, and ACs.

- 28% GST – Luxury goods such as automobiles, tobacco, and premium services.

Additionally, some items are taxed at 0% (exempted), while sin goods attract a cess.

To learn more about how GST applies to different categories of goods and services, visit our detailed guide on GST slab rates and tax structures. Alternatively, you can refer to official GST resources for the latest updates on tax classifications and exemptions.

-

Elimination of the Cascading Effect of Taxes

Before GST, businesses suffered from the cascading tax effect, where taxes were applied on top of already-taxed goods or services, increasing the overall tax burden. GST eliminates this issue through the Input Tax Credit (ITC) mechanism, allowing businesses to claim credit for taxes paid on purchases and offset them against output tax liability. For example, if a manufacturer pays GST on raw materials, they can deduct this tax when calculating GST on final products, ensuring a seamless credit flow and reducing costs.

-

Higher Threshold for Registration

GST has introduced a higher registration threshold, providing compliance relief for MSMEs (Micro, Small, and Medium Enterprises). Businesses with an annual turnover below ₹40 lakh for goods and ₹20 lakh for services (₹10 lakh in special category states) are exempt from GST registration. This helps small businesses save on compliance costs and focus on expansion without immediate tax liabilities.

-

Improved Logistics and Supply Chain Efficiency

GST has reduced the transportation time and logistic costs which led to increased operational efficiency and faster deliveries in the industry.Under the pre-GST system, businesses faced interstate trade barriers due to entry taxes and check-post delays, increasing transportation costs. However, with the introduction of e-way bills through the GSTN operational efficiencies have further streamlined, allowing goods to move faster across state borders, benefiting industries reliant on quick deliveries.

-

Encouragement for E-Commerce and Digital Taxation

GST has brought structured digital taxation for e-commerce operators, making compliance uniform across states. Businesses selling through online platforms must comply with TCS (Tax Collected at Source) provisions, ensuring proper tax collection on digital transactions. This move strengthens the digital economy and prevents tax evasion in the e-commerce sector.

-

Increased Transparency and Reduced Tax Evasion

GST operates through the GST Network (GSTN), a digital filing system that records transactions electronically. This creates an audit trail, making it harder for businesses to evade taxes. With automated return filings, strict invoice matching, and compliance tracking, GST has significantly reduced tax fraud and increased government revenue.

E-invoicing under GST enhances transparency by enabling real-time invoice reporting to the GSTN, preventing fake invoices and tax evasion. It ensures automatic reconciliation with GSTR-1 and E-Way Bills, reducing mismatches and fraudulent ITC claims. This digital system strengthens compliance, minimizes tax leakage, and promotes a more accountable tax structure.

-

Boost to the Economy and Foreign Investments

GST has contributed to India’s GDP growth by formalizing the economy and reducing the unorganized sector. With a unified tax system, foreign investors find it easier to do business in India, boosting Foreign Direct Investment (FDI). Additionally, initiatives like Make in India benefit from GST’s streamlined taxation, promoting domestic manufacturing and export competitiveness.

Overall, GST has brought numerous benefits by simplifying taxation, reducing costs, and enhancing transparency, making it a game-changer for India’s economy.

What Are the Disadvantages of GST?

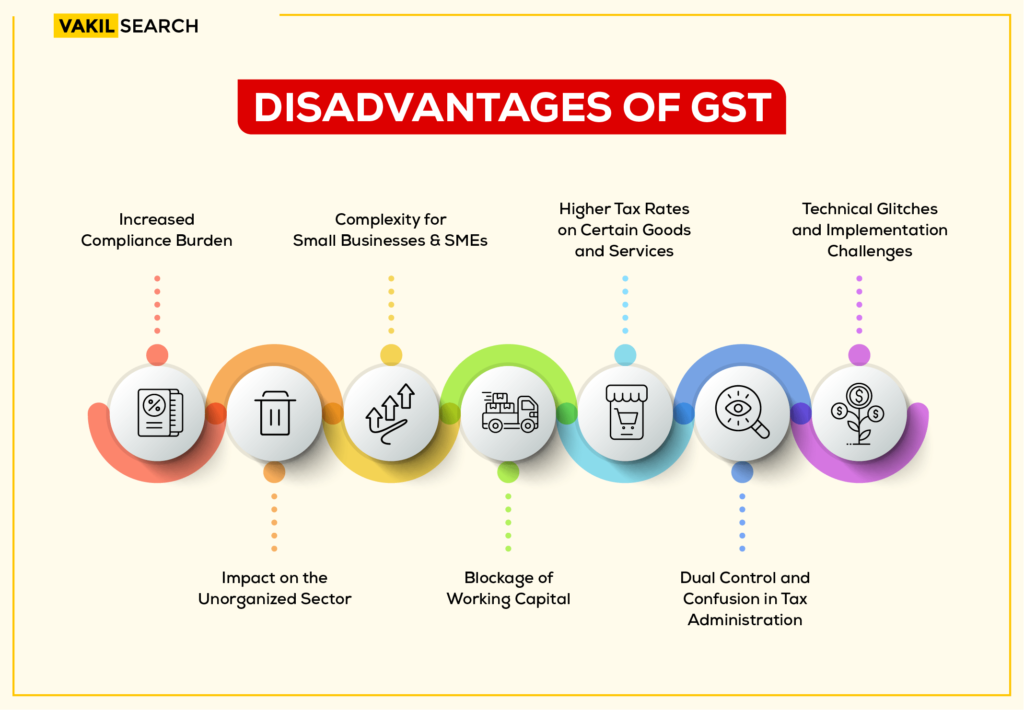

Understand the disadvantages of GST at a glance with the help of this image:

-

Increased Compliance Burden

GST has significantly increased the compliance burden for businesses, requiring them to file multiple returns every month. Businesses must submit GSTR-1 (outward supplies), GSTR-3B (summary return), and other forms within strict filing deadlines. The frequency of filings and reconciliation of invoices increase administrative workload, particularly for small businesses. Additionally, businesses must invest in GST-compliant software to ensure proper record-keeping and timely submissions, adding to operational costs.

-

Complexity for Small Businesses and SMEs

For small businesses and SMEs, adapting to GST has been challenging due to input tax credit (ITC) mismatches, sector-specific compliance issues, and increased financial strain. SMEs often struggle with cash flow issues as they must pay GST upfront on sales while awaiting refunds for ITC. Moreover, businesses dealing with multiple tax rates and complex filing requirements find compliance cumbersome, leading to additional reliance on tax professionals.

-

Higher Tax Rates on Certain Goods and Services

While GST has streamlined taxation, some goods and services are taxed at higher GST slabs, making them more expensive. For example, luxury goods such as high-end cars and branded items fall under the 28% tax slab, while sin goods like tobacco and aerated beverages attract even higher cess. This has impacted affordability and demand for such products, affecting industries dependent on them.

-

Technical Glitches and Implementation Challenges

The introduction of GST faced several transitional challenges, with businesses struggling to adapt to new tax laws. The GSTN portal issues such as server downtimes and errors in invoice reconciliation made it difficult for taxpayers to file returns on time. Many businesses faced technical difficulties in generating e-way bills and matching ITC claims, leading to delays and penalties.

-

Impact on the Unorganized Sector

GST has accelerated the formalization of the economy, forcing businesses in the unorganized sector to comply with tax regulations. Many non-GST compliant businesses struggled to transition due to a lack of awareness and digital literacy. Small traders and informal businesses that previously operated without structured invoicing now face increased documentation requirements, making it harder for them to compete with larger enterprises.

-

Blockage of Working Capital

A major drawback of GST is the blockage of working capital due to refund delays on ITC claims. Businesses must wait for GST refunds after exports or purchases, affecting their liquidity. Many SMEs struggle with cash flow management as they are required to pay GST on sales before receiving payments from customers, creating a financial strain, especially for small traders and exporters.

-

Dual Control and Confusion in Tax Administration

GST operates under a dual tax administration system, where both Central GST (CGST) and State GST (SGST) apply to transactions. This often leads to confusion among taxpayers regarding compliance procedures. The allocation of tax collection responsibilities between the central and state governments sometimes results in disputes and delays, making tax administration more complex than initially anticipated.

While GST has introduced significant benefits, businesses—especially SMEs—face several challenges in compliance, working capital management, and tax administration. Addressing these issues will be crucial for the long-term success of GST in India.

Need expert help? Get professional assistance with Vakilsearch!

Conclusion on GST Merits and Demerits

GST has simplified India’s tax system, reducing compliance complexities and eliminating the cascading tax effect through input tax credit (ITC). It has also boosted economic transparency, improved logistics efficiency, and encouraged digital taxation, making it easier for businesses to operate.

However, small businesses and MSMEs face higher compliance burdens, frequent return filings, and ITC mismatches, leading to cash flow issues. Additionally, technical glitches, dual tax administration (CGST & SGST), and higher tax rates on luxury goods create challenges in tax management.

For GST to be more effective, streamlining tax slabs, improving ITC processing, and enhancing the GSTN portal are necessary. Addressing compliance burdens and refund delays will help businesses maximize the benefits of GST while ensuring smoother tax administration and economic growth.

Future Scope and Recommendations

To maximize the GST impact and address existing challenges, further simplifications are necessary. The government can consider reducing the number of tax slabs, enhancing the GSTN portal for smoother compliance, and providing faster ITC refunds to improve business liquidity. More training and support programs for small businesses can help them adapt to GST regulations. By continuously refining its structure, GST can become even more effective, ensuring economic growth while reducing compliance burdens for businesses.

FAQs on Advantages and Disadvantages of GST

What are the advantages and disadvantages of GST?

GST simplifies taxation by creating a unified market, reducing tax evasion, and eliminating cascading taxes, leading to better transparency and economic growth. However, it also has drawbacks, including implementation challenges, higher compliance costs, potential inflation in some sectors, and increased tax filing burdens for small businesses.

How does GST impact exports?

GST positively impacts exports through the zero-rated supply mechanism, ensuring no tax burden on exported goods and services. Exporters can claim refunds on input tax credit (ITC), reducing costs. This enhances global competitiveness, simplifies compliance, and promotes Make in India, boosting international trade and foreign exchange earnings.

Is GST beneficial for consumers?

Yes, GST benefits consumers by ensuring price stability, reducing the cascading effect of taxes, and increasing transparency in pricing. With a unified tax system, hidden taxes are eliminated, making goods and services more affordable. Additionally, input tax credit (ITC) helps businesses lower costs, leading to potential consumer savings.

How does GST affect state revenue?

GST affects state revenue through a dual tax structure, where CGST goes to the central government and SGST to the respective state for intrastate transactions. For interstate sales, IGST is collected and later distributed. The GST compensation cess ensures states recover revenue shortfalls for a limited period.

Can GST rates be simplified further?

Yes, GST rates can be simplified by reducing the number of tax slabs and moving toward a single or dual-rate structure. This would ease compliance, reduce classification disputes, and improve transparency. A unified GST slab could enhance efficiency and economic growth, benefiting businesses and consumers while maintaining revenue neutrality.