Learn about the GST Composition Scheme, its rules, turnover limit (₹1.5 Cr/₹75 Lakh), tax rates, and eligibility. Simplify GST compliance for small businesses.

The GST Composition Scheme offers a simplified tax approach for small businesses like manufacturers, traders, and service providers with a turnover limit of ₹1.5 crore, or ₹75 lakh in special category states. This scheme provides lower tax rates ranging from 1% to 6%.

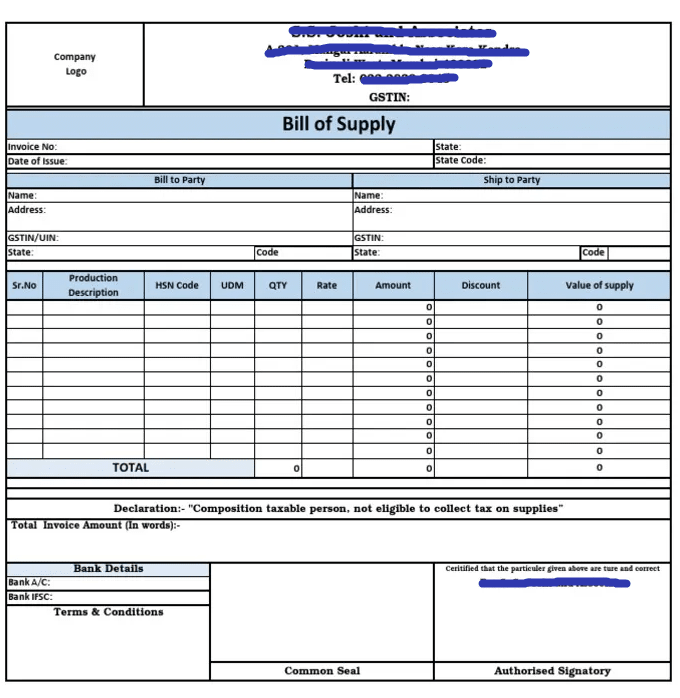

It is tailored for businesses operating solely within state boundaries, excluding those involved in interstate sales or dealing with non-taxable goods such as alcohol. Participants must issue a “Bill of Supply” instead of a standard tax invoice.

Adopting this scheme allows for significant cost reductions in compliance and accounting, streamlined tax procedures, and a focus on core operations without the complexities of regular GST compliance. It also supports easier cash flow management by disallowing Input Tax Credit (ITC).

In this blog, we will delve into the eligibility criteria, benefits, and compliance procedures of the GST Composition Scheme, offering a clear guide for small businesses to simplify their tax responsibilities.

Eligibility Criteria for the GST Composition Scheme

To qualify for this scheme, businesses must meet specific turnover criteria: Rs. 1.5 crore for most of the country and Rs. 75 lakhs for businesses in the North-Eastern states and Himachal Pradesh. The scheme is tailored for manufacturers, traders, and restaurants that aim to reduce the compliance load.

However, it is important to note that it excludes businesses engaged in interstate supplies, non-taxable goods like alcohol and tobacco, and those operating through e-commerce platforms.

Benefits of GST Composition Scheme

The GST Composition Scheme offers several advantages for small businesses, making tax compliance easier and more cost-effective. Here are the key benefits of opting for this scheme:

- Lower Tax Liability – Fixed tax rate (1%-6%) reduces overall tax burden.

- Simplified Compliance – Quarterly filings instead of monthly GST returns.

- Cost Reduction – Fewer compliance costs and lower accounting expenses.

- Focus on Business Growth – Less tax hassle allows more business focus.

- Easier Cash Flow Management – No ITC claim complexity, keeping cash flow steady.

- Ideal for Small-Scale Businesses – Suitable for traders, manufacturers, and restaurants operating within one state.

Tax Rates Under the GST Composition Scheme

The GST Composition Scheme offers significantly lower tax rates compared to the regular GST rates:

- Manufacturers and Traders: 1% of the turnover

- Restaurants: 5% of the turnover

- Service Providers: 6% of the turnover up to Rs. 50 lakh

How to Opt for the GST Composition Scheme?

GST Composition Scheme is applicable for registration at the time of GST registration as well as at the start of a new financial year. This option is available for new applicants at the time of provisional GST registration through Part B of FORM GST REG-01; while the registered taxpayers can fill in for this option through FORM GST CMP-02.

Regarding compliance, goods and service tax returns of CMP-08 for quarterly tax payment and GSTR-4 by the end of the subsequent FY April 30 are submitted.

GST Composition Scheme Registration Process

To opt for the GST Composition Scheme, businesses must follow a specific registration process:

- New Applicants – Select the GST Composition Scheme while registering via FORM GST REG-01.

- Existing GST Taxpayers – Submit FORM GST CMP-02 before the financial year begins.

- Quarterly Returns – File FORM CMP-08 by the 18th of the following month after each quarter.

- Annual Return – File FORM GSTR-4 before April 30th of the next financial year

Sector-Specific Applicability of Composition Scheme

It entails nil rated percentage for certain sections of sectors like small services, manufacturers, and restaurants etc. Every sector applies the different tax rates and qualifications meant to simplify the processes, minimise costs, and promote the companies with the turnover that does not exceed specified limits.

GST Composition for Service Providers

This Scheme is available for all small service providers whose annual turnover does not exceed ₹50 lakh which is charged at a flat GST rate of 6%. This is available for some service providers depending on the agreement with the carbon trust so as to ease tax issues hence minimising tax compliance. Still, the scheme has been designed in a way that those involved in providing inter-state services or e-Commerce sales are not allowed.

GST Composition for Manufacturers

Manufacturers can benefit from the current Composition Scheme that allows a tax rate of 1% of the turnover and easy tax remittance by companies that meet the eligibility criteria of the Scheme. Exempted products like alcohol are also not allowed in this scheme and the qualified manufacturers must be operating in only one state.

GST Composition for Restaurants and Hotels

Food businesses that do not sell alcohol can take advantage of the Composition Scheme and charge just 5% in taxes for a less complicated process. Hotels if qualified are required to be located within a single state and have turnover thresholds. Affordability is made possible through this option enables a reduction in compliance and maintenance of reasonable tax charges for the small establishments.

GST Composition for Jewellers, Contractors, and Others

- It applies certain restrictions to the jewellers and civil contractors where their conditions are different from the others. They have to carry out sales only within their own state, so that they fit the requirements of the scheme to confine operations to just one state. It is hoped that this restriction will help to reduce the tax complexity for smaller scale operations in these sectors.

- And for the persons having rental income from commercial complexes and buildings, civil contractors of intra-State Government contracts, etc.? They get eligible to receive simple tax rates under the scheme that tends to reduce their business complexities within the state boundaries.

Restrictions and Limitations

While the benefits are substantial, the scheme does come with its limitations:

- No Input Tax Credit: Businesses cannot claim input tax credit, which could be a potential disadvantage if they make a lot of taxable purchases.

- No Interstate Sales: The scheme restricts businesses from making interstate sales, limiting their market reach.

- Specific Exclusions: The scheme does not apply to certain business activities and transactions, which need careful consideration before opting in.

Process of Withdrawal and Transition from the GST Composition Scheme

Businesses may need to exit the scheme if they exceed the turnover limits or wish to take advantage of the regular GST system’s benefits like input tax credits. Exiting requires reverting to regular GST compliance, which involves detailed invoices and multiple monthly returns.

Documentation Required for GST Composition Scheme Registration

To register for the GST Composition Scheme, businesses must provide:

- Proof of Business Registration

- PAN Card

- Aadhaar Card

- Bank Account Details

- Proof of Business Address

GST Composition Scheme Bill Format

In the GST Composition Scheme, the seller has to issue a “Bill of Supply” instead of a tax invoice mentioning “Composition Taxable Person” to stick with the laid norms of the scheme. Find the attached partial gst composition format below,

GST Composition Scheme vs. Regular GST: Key Differences

However, the GST Composition Scheme is slightly easier in terms of tax compliance when compared to the Regular GST Scheme. Compared to the regular GST system where record keeping, multiple returns and an ability to claim Input Tax Credit (ITC) is mandatory, the Composition Scheme has lesser returns and no input tax credit to claim.

| Feature | GST Composition Scheme | Regular GST |

| Compliance | Quarterly CMP-08, simpler filing | Monthly returns, detailed record-keeping |

| Input Tax Credit (ITC) | Not available | Available |

| Tax Rates | 1%, 5%, or 6% | 5%, 12%, 18%, 28% |

| Who Can Opt? | Small businesses with turnover up to ₹1.5 crore | Businesses with any turnover |

| Interstate Sales | Not allowed | Allowed |

| Invoice Type | Bill of Supply | Tax Invoice |

Conclusion on GST Composition Scheme

In conclusion, the GST Composition Scheme significantly simplifies tax obligations for eligible small businesses, such as manufacturers, traders, and service providers, by offering reduced tax rates and streamlined compliance procedures. This scheme is ideal for businesses operating within state boundaries, as it excludes interstate sales and specific non-taxable goods. By opting for this scheme, businesses can issue a “Bill of Supply” instead of a standard tax invoice, focusing more on growth and less on tax complexities.

The scheme supports steady cash flow by eliminating the need for input tax credit claims, reducing administrative overhead, and allowing businesses to focus on operational expansion and competitiveness.

If you’re considering the GST Composition Scheme for your business, consulting with a tax professional can provide tailored advice and help streamline the GST registration and compliance processes. Reach to Vakilsearch experts today!

Frequently Asked Questions (FAQs) on GST Composition Scheme

The GST Composition Scheme is a simplified tax scheme for small businesses, allowing them to pay tax at a fixed rate on turnover instead of regular GST rates. It reduces compliance and filing requirements.

Businesses with an annual turnover of up to ₹1.5 crore (₹75 lakh for special category states) can opt for the Composition Scheme. Service providers can avail of it if their turnover is up to ₹50 lakh.

The Composition Scheme offers a lower tax rate and less compliance, but businesses cannot claim input tax credit (ITC) or charge GST on invoices. Regular GST requires full compliance, ITC benefits, and monthly/quarterly tax filings.

The turnover limit for GST Composition Scheme is ₹1.5 crore for manufacturers and traders and ₹50 lakh for service providers. For Northeastern and hilly states, the limit is ₹75 lakh.

Rule 4 of the GST Composition Scheme states that a taxable person opting for the scheme must file an intimation in Form GST CMP-02 before the beginning of the financial year and comply with all conditions.

The GST Composition Scheme Bill refers to the legal provisions under the Central Goods and Services Tax (CGST) Act, 2017, that govern the Composition Scheme. It allows small taxpayers to pay GST at a fixed rate with reduced compliance What is the GST Composition Scheme?

Who is Eligible for GST Composition Scheme?

What is the Difference Between Composition and Regular GST?

What is the Composition Limit for GST?

What is Rule 4 of Composition Scheme Under GST?

What is the GST Compostion Scheme Bill?