In this article we will understand the provisions and the requirements for a company to avail the newly launched Fast Track Exit (FTE) scheme.

Introduction

It is already taxing and tedious to register a company in terms of regulatory requirements and formalities. But did you know that shutting down a company is way more difficult? At least it used to. For a business to wind down, the company first had to get their financials thoroughly audited, print newspaper announcements to call forth anyone who might have any objection to the closure, get valuation done of all assets and liabilities and settle all dues before the name is finally struck off. Incorporating a company may take ten to fifteen days. Shutting down a company can take months.

In order to redress this issue the Ministry of Corporate Affairs of India introduced the Fast Track Exit Mode or the FTE mode on 3rd July 2011, to help non-functioning companies to remove their company names from the register of companies. Any business owner running a non-profitable business, owning a defunct business, or planning to start a new company can use the FTE Mode to get their company’s name struck off from the register, according to Section 560 of the Companies Act, 2013.

What Is the Fast Track Exit Scheme?

Before the introduction of the FTE scheme, many companies would just suspend their business operations once the business was defunct and let the company lie dormant by filing nil returns every year given that it was less costly and time consuming than actually shutting down a company. And while the existence of a non-operational entity may not have any significant impact on the owners of the entity, its existence requires the government authorities to process their annual returns. This extra workload can affect the efficiency of the officers responsible.

The FTE scheme was launched to speed up the process of the disposal and removal of the companies from the registered list. Companies can voluntarily submit an application to remove their names from the register without court intervention. It also empowers the Registrar of Companies to strike off the names suo moto, or of his own accord, under certain circumstances. This way, the FTE provides a platform for companies that are no longer functional to be struck off from the register.

Eligibility Criteria

However, not all companies are eligible to avail the benefits of FTE. The companies must fulfill certain eligibility criteria to qualify for strike-off under the FTE scheme. To apply for the Fast Track Exit scheme:

- The company must neither have any assets nor any liability.

- The company shouldn’t have initiated any business activities since its incorporation or

- The company shouldn’t have been involved in any sort of business activity in the past year.

Companies to Which Fast Track Exit Doesn’t Apply

The FTE scheme does not apply to a certain class of companies even if they seem to satisfy the eligibility criteria mentioned above. Those companies are listed below:

- The companies that had been listed.

- Those falling under Section 25 of Companies Act.

- The companies that are vanishing.

- The ones which were subjected to investigation or inspection in the past.

- The companies having pending prosecutions against them in the court.

- The ones that have a secured loan.

- The companies that had accepted public deposits that are either outstanding or default in repayment of the same.

- The ones that are under immense debt or the ones facing management issues.

- The companies for which the filing of important documents have been put to stay by the court or other higher authorities.

- The companies that have dues of taxes, loans to banks, or other financial institutions.

Documents Required

If a company wants to get its name struck off from the registered list through the FTE scheme, the applicant needs to fill in the application form online with the registrar, and pay INR 5000 as an application fee.

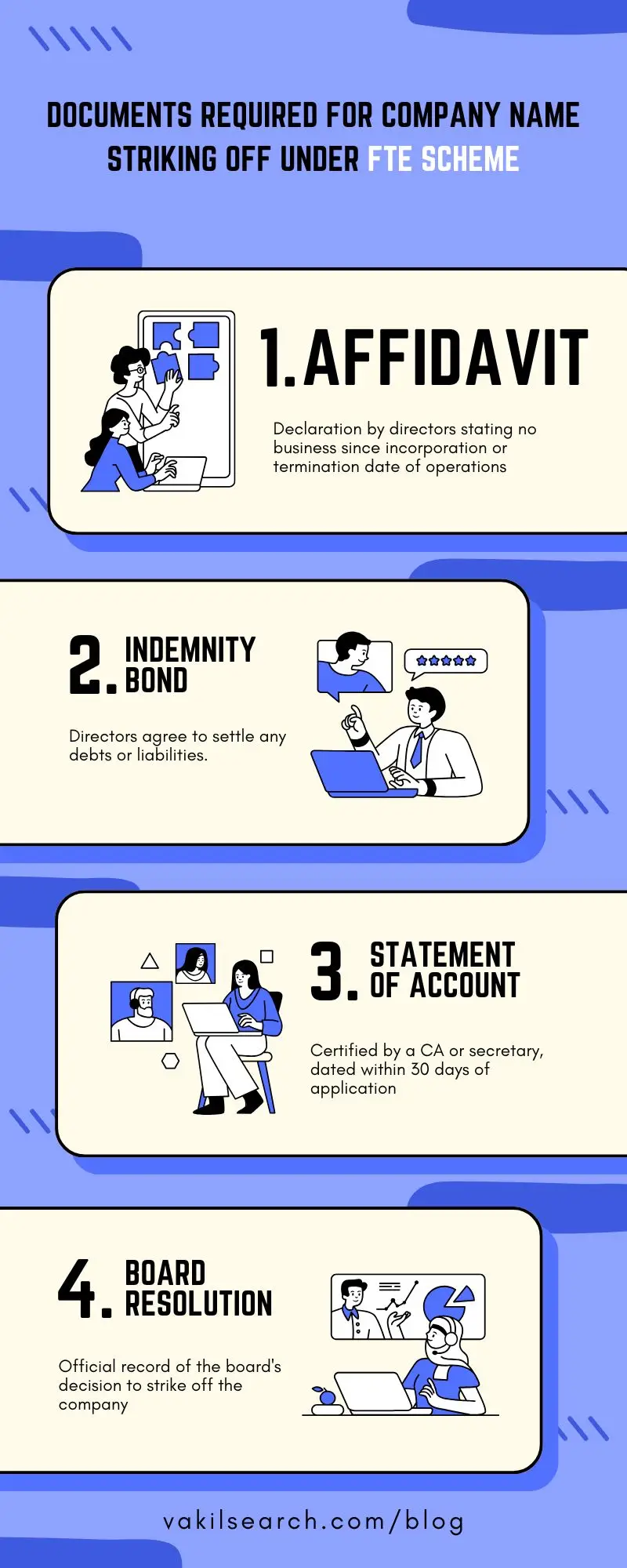

Once the application is submitted successfully, the applicant is required to submit certain documents which include:

An Affidavit

It is a proclamation made by all the directors of the company stating either that the company hasn’t undertaken any business since its commencement or that the business was terminated on a particular date (which needs to be specified on the documents).

Indemnity Bond

The indemnity bond has to be signed and produced by every director of the company either individually or collectively in the name of the company. The indemnity bond usually states that if any losses, debts, assets, or liabilities incur even after removing the name of the company, they will be paid by the directors individually or collectively in the name of their company.

Statement of Account

It has to be prepared by a professional Chartered Accountant or by the secretary of the company and has to be attached to the FTE application form. The account statement so prepared must not be older than 30 days, preceding the date of application.

Copy of Board Resolution

The board resolution containing a written statement on the decision of the board members needs to be submitted along with the application form. It also serves as a legal document or record.

Things to Keep In Mind

-

Litigation

A company that has pending litigations can apply under the FTE scheme, provided it specifies the details in the e-form. Details regarding the litigations must also be mentioned in the affidavit.

-

NOC

All the directors of the company concerned must confirm no dues are pending against the company. The MCA must also receive a confirmation letter that the Income Tax department has no objection to striking off the name of the company.

-

Objections

The ROC allocates time for the companies to submit a response to the objections raised by the RBI, Income Tax department, etc. If the concerned department is satisfied with the company’s response, then the ROC will proceed with the deregistration process.

-

Application Procedure

The procedure to apply for Fast Track Exit and fill in the application form for the same is given below:

-

- 1st step: If the company fulfils the eligibility criteria, it can download and obtain an FTE form the MCA portal.

- 2nd step: After the form has been filled, the company has to pay INR 5000 as the registration fee.

- 3rd step: The ROC then examines the company, and checks whether it satisfies the criteria. Then within 30 days of application, the company is dissolved. Then, the name of the company is also struck off from the list.

- 4th step: After the application is filled, the stakeholders are given a tenure of 30 days to raise any objections.

- 5th step: After all the objection and intimation process is completed, the Registrar of Companies finally approves and strikes off the name of the company and a notice is sent regarding the same to the official gazette under section 560(5) of the Companies Act, 1956.

-

Stamp Duty

The final step involves paying off the stamp duty on the Affidavit and Indemnity Bond. The applicant must This is done with respect to the State Stamp Act.

As per the Delhi Stamp Act, there has to be a non-judicial stamp paper of INR 10 on the affidavit. Also a stamp paper of INR 200 on the Indemnity bond.

-

Post-strike-off Liabilities

After the removal of the company’s name, all the directors must pay and settle all the claims against the company. They must also pay and settle all the liabilities in the name of the directors or the company.

Conclusion

While the process of winding up a company have been more or less simplified in terms of cost and time, the procedure itself requires the trained hand of a legal professional with prior experience in these matters. Even the slightest error in the processing of the form can delay the closure process indefinitely. If you have any queries with regards to closure of a company, FTE scheme or any other queries, feel free to contact us and our team of legal experts will get in touch with you to understand your requirements and provide you the assistance you need.

FAQs

What is FTE in MCA India?

The Ministry has released guidelines for the 'Fast Track Exit (FTE) Mode,' providing defunct companies the chance to have their names removed from the register under Section 560 of the Companies Act, 1956, within a specified timeframe.

What is the fee for filing FTE forms in India?

The fee for filing the Fast Track Exit (FTE) form in India varies and depends on the authorized capital of the company. Different fee slabs exist based on the capital, starting from INR 5,000.

What is the procedure for fast track exit under Companies Act 2013?

The procedure for fast track exit under the Companies Act, 2013 involves filing the necessary form (FTE) with the Registrar of Companies (RoC). The company must meet the eligibility criteria and settle outstanding statutory dues before initiating the process.

What is the fast track dissolution of the company?

Fast track dissolution of a company refers to the expedited process of closing down a defunct company, allowing it to exit the corporate register quickly. It is a mechanism to streamline the closure of companies with minimal complexities.

What is a fast track exit for a startup?

Fast track exit for startups is a simplified and accelerated process for closing down defunct startups. It involves filing the necessary form with the Registrar of Companies, and startups meeting the specified criteria can use this fast-track option for a quicker exit.

What is Section 47 of the company Act?

Section 47 of the Companies Act pertains to the voting rights of shareholders. It outlines the rules regarding the voting rights attached to shares held by companies in their own name.

What is Section 77 of the Companies Act?

Section 77 of the Companies Act deals with the duty of a company to maintain a register of its members, indicating details such as names, addresses, and the number of shares held by each member. This register is a crucial aspect of corporate record-keeping.