Employees’ eligibility for gratuity depends on the last drawn basic salary & many other factors. Read here to know more about gratuity & its eligibility.

If you’ve worked 5 or more continuous years for the same organization, you’re entitled to a gratuity—a lump‑sum farewell benefit. The statutory formula is

For firms outside the Gratuity Act, replace “15” with “½‑month salary” and divide by 30. The amount is tax‑free up to ₹20 lakh.

Employee benefits—non‑cash rewards that sit on top of salary—matter. Surveys show half of Indian workers would switch jobs for better perks, and happier staff drive higher productivity and lower attrition. Among the most valued perks is gratuity, a legal retirement benefit available once specific service milestones are met.

What is Gratuity?

Under the Payment of Gratuity Act 1972, gratuity is the employer’s “thank you” for long, loyal service. It becomes payable when an employee:

-

completes 5 year’s continuous service;

-

retires, resigns, is laid‑off, suffers disability, or dies.

Employers can self‑fund the payout or buy a group gratuity policy from an insurer.

Eligibility Checklist

| Event | Eligible? | Note |

|---|---|---|

| ≥ 5 yrs continuous service & resignation/retirement | ✔︎ | Standard trigger |

| Superannuation pension | ✔︎ | Even < 5 yrs if policy allows |

| Disablement from accident/illness | ✔︎ | 5‑year rule waived |

| Death | ✔︎ | Paid to nominee/heirs |

Statutory Formulae

-

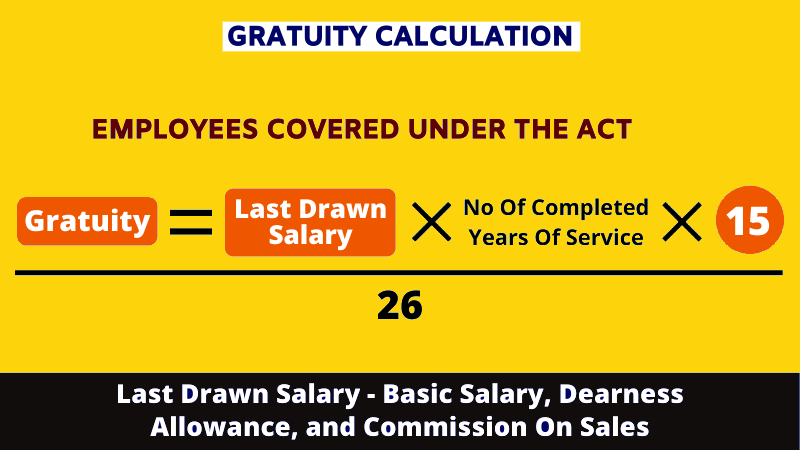

Covered employers

Gratuity = (Basic + DA) × 15 × Completed years ÷ 26 -

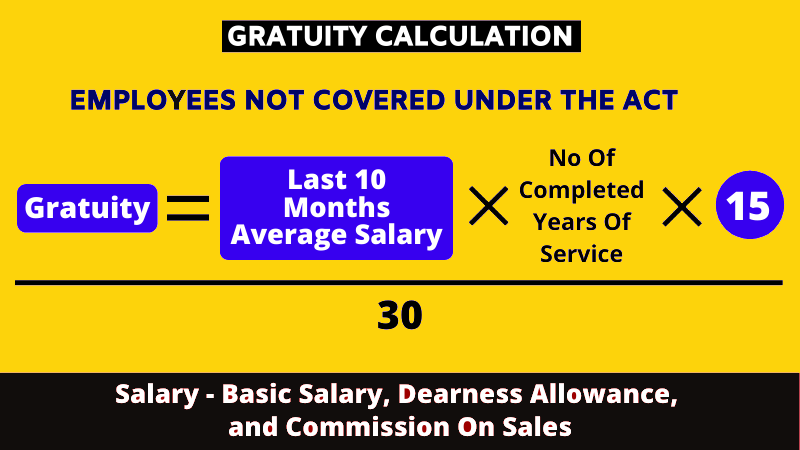

Not covered employers

Gratuity = (Basic + DA) × ½ × Completed years(30‑day month assumption) -

Death benefit slabs

-

< 1 yr – 2× basic salary

-

1–<5 yrs – 6×

-

5–<11 yrs – 12×

-

11–<20 yrs – 20×

-

≥ 20 yrs – ½ month basic per 6‑month block (max 33×)

-

Ceiling: ₹20 lakh (tax‑free). Amounts above remain taxable.

Tax Treatment

| Recipient | Exemption |

|---|---|

| Central/State/Local‑govt staff | 100 % |

| Gratuity‑Act employees | Least of (i) ₹20 lakh, (ii) actual received, (iii) 15/26 × salary × years |

| Non‑Act employees | Least of (i) ₹20 lakh, (ii) actual received, (iii) ½‑month average salary × years |

Salary = Basic + DA (+ commission if % of sales).

Why Use a Gratuity Calculator?

-

Instant, error‑free estimates from home.

-

Uses correct statutory constants (15 days/26 or ½‑month/30).

-

Helps financial planning and tax forecasting.

Compliance Snapshot for Employers

-

Register the establishment under the Act.

-

Display abstract of rules at the workplace.

-

File opening/change/closure notices.

-

Obtain employee nominations and file with authority.

-

Report accidents/fatalities annually.

Practical Tips for Employees

-

File your nomination as soon as you join.

-

Keep records of basic + DA and service years.

-

Use the ₹20 lakh exemption strategically in retirement planning.

-

Collect gratuity even if the firm is in losses or insolvency—the benefit has priority in liquidation.

Gratuity Calculation

-

Employees Covered Under the Act

-

Employees Not Covered Under the Act

Conclusion

The Payment of Gratuity Act, 1972 provides immense benefits for employees. An employee may, by the statute, designate a family member for gratuity and other benefits when they join your organisation. This will make it possible for the family member to receive the money even after the employee has passed away. Even though the business is losing money, the corporation is still required by the statute to pay the employee’s due gratuity. The highest gratuity paid by the employer is ₹10 lakhs. This enables many employees to get high tip payments. The corporation may contribute more than ₹10 lakhs, but it won’t be taken into account for tax exemption purposes anymore. Even if the employer files for bankruptcy, every employee is entitled to a gratuity. If the employee is eligible for Gratuity benefits, no court may withhold the gratuity due to them.

All employees should endeavor to accept their gratuities from the companies they have devoted their time and effort to build a reasonable corpus for their future. For your business to attract and retain top talent, it’s critical to offer the correct incentives and bonuses to employees Also ally; it contributes to a diverse workplace. Understanding your employees’ needs and interests is another strategy.

FAQs on Gratuity Eligibility

Is 4 years 7 months eligible for gratuity?

In the Salem textile case (2011), the Madras High Court ruled that an employee is entitled to a gratuity even if he has worked for four years and 240 days. To understand whether or not the same rule applies in your jurisdiction, get in touch with our experts right away.

Who is eligible for gratuity salary?

Employees covered under The Payment of Gratuity Act, 1972 are eligible for gratuity salary provided they fulfil the minimum conditions prescribed under the Act.

Is 4 years 8 months eligible for gratuity?

The Madras High Court has ruled that an employee is entitled to a gratuity even if he has worked for four years and 240 days. To understand whether or not the same rule applies in your jurisdiction, get in touch with our experts right away.

What is gratuity new rules 2023?

According to Gratuity new rules 2023 - Employers must ensure that base pay accounts for 50% of an employee's CTC (cost to the company) and that the remaining 50% is made up of overtime, housing costs, and employee allowances under the new gratuity policy for 2023. Furthermore, any additional allowances or exemptions paid by the employer that exceed 50% of the CTC will be considered payment.