Learn how to complete E-Way Bill registration with our step-by-step guide. Explore the E-Way Bill login process, Transporter ID, rules, and the latest updates.

E-Way Bill registration is a critical step for businesses and transporters involved in the movement of goods across India. It ensures compliance with the Goods and Services Tax (GST) regulations and facilitates the seamless transport of goods.

In this blog, we will delve deeper into how to register for an E-Way Bill efficiently. We’ll cover essential tips and guidelines to streamline the process, ensuring that businesses can focus more on their operations and less on compliance hurdles.

Time Limit for E-Way Bill Generation: Taxpayers can generate E-Way Bills only for documents dated within the last 180 days. Additionally, the validity of an E-Way Bill can now be extended for up to 360 days from the original generation date: Source Mandatory MFA/2FA for E-Way Bill and E-Invoice Generation: Multi-Factor Authentication (MFA) or Two-Factor Authentication (2FA) will be required on NIC portals for taxpayers with an Annual Aggregate Turnover (AATO) exceeding ₹20 Crores. This requirement will expand to all users in a phased manner starting from 1st April 2025.

Latest Updates on E-way Bills (As of 17th December 2024)

What is the E-Way Bill Login Portal?

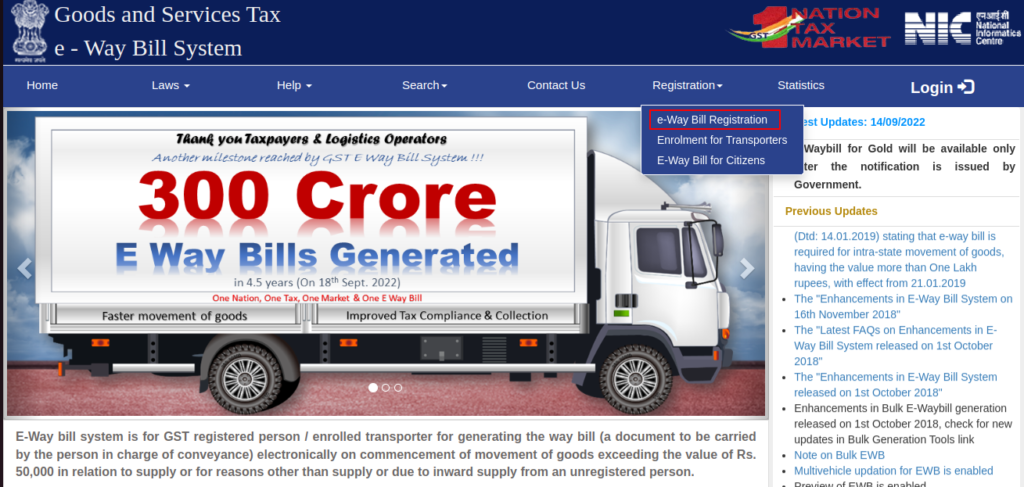

The E-Way Bill Portal (ewaybillgst.gov.in) is the official government website for generating, managing, and canceling E-Way Bills (EWBs). This centralized platform is used nationwide by taxpayers and transporters to ensure compliance with GST regulations.

Previously, the portal operated on ewaybill.nic.in. However, following directives from the GST Council, it was redirected to ewaybillgst.gov.in, which is now maintained by the National Informatics Centre (NIC).

How to Register for an E-Way Bill?

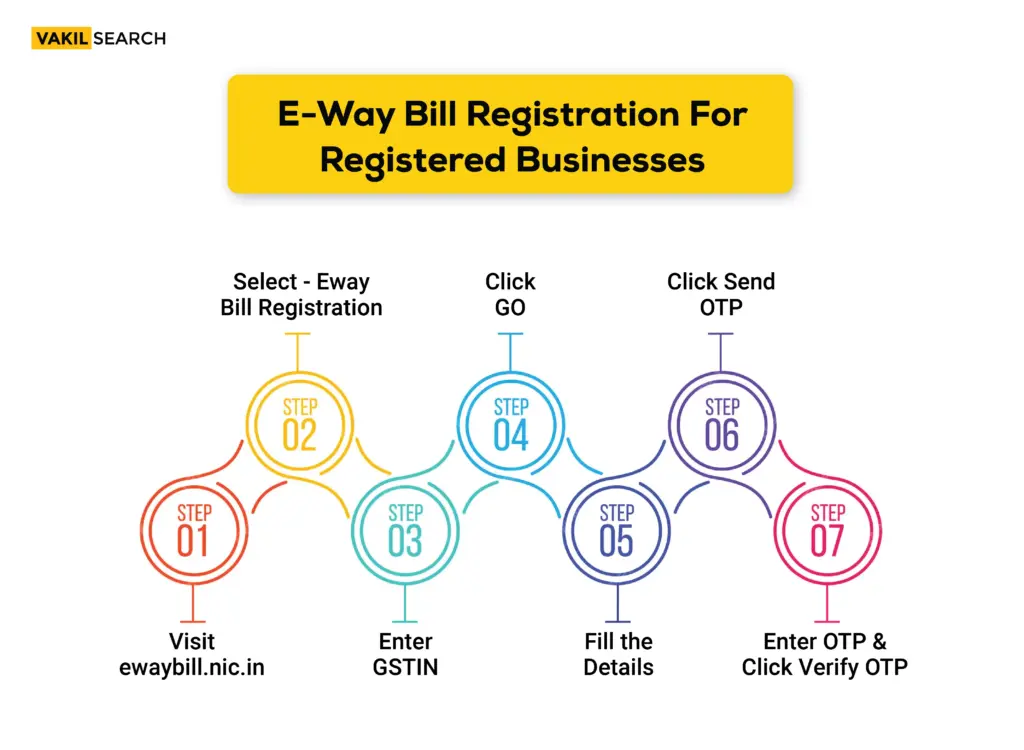

Generating an E-Way Bill online is a simple process through the E-Way Bill Portal. Follow these steps:

Step 1: Log in to the Portal

Visit the official E-Way Bill Portal → Log in using your GST credentials → Go to “Registration”→ Click on “e-Way Bill Registration”

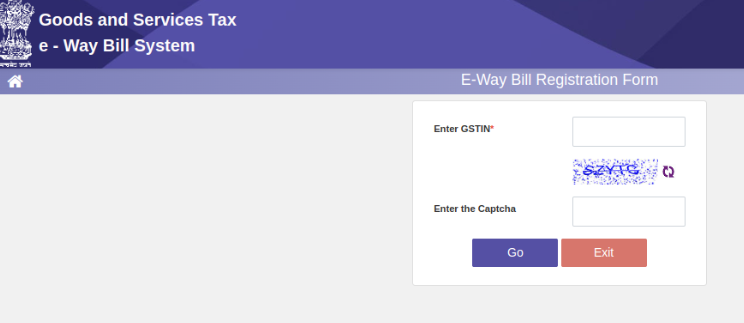

Step 2: Enter the GSTIN and the captcha code → Click on ‘Go’

Step 3: Verify GST Details and Authenticate with OTP

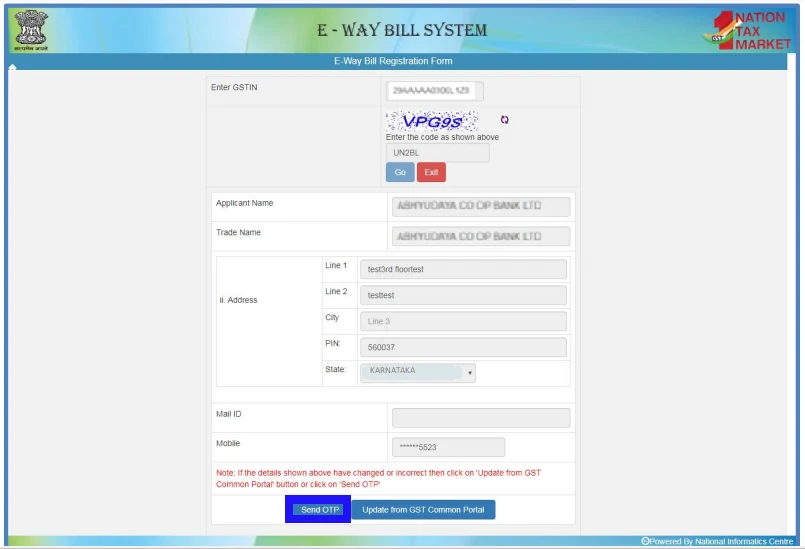

- Auto-Filled GST Details – Once you enter your GSTIN, the system will automatically fetch and display the registered details.

- Update if Necessary – If the displayed details are incorrect or outdated, click on ‘Update from GST Common Portal’ to retrieve the latest information.

- Send OTP for Verification – Click on the ‘Send OTP’ button to receive a One-Time Password (OTP) on your registered mobile number.

- Verify OTP – Enter the received OTP and click ‘Verify OTP’ to complete the authentication process.

Step 4: Create a New User ID and Password

- Enter User ID and Password – Choose a unique User ID and set a secure password as per the portal’s requirements.

- System Validation – The system will check the details entered and display an error message if any issue is found.

- Confirm and Create – Once all details are correctly filled in, your User ID and password will be successfully created.

Tips for Creating a Secure Password:

- Use a mix of uppercase & lowercase letters, numbers, and special characters.

- Avoid using personal information (e.g., name, birthdate).

- Ensure your password is at least 8-12 characters long for added security.

E-Way Bill Registration For Unregistered Businesses

Non-registered taxpayers who do not possess GSTIN can also register for an e-way bill on the portal by providing relevant business information. Following are how unregistered transporters can carry out e-way bill registration:

- Business Details Preparation: This step requires preparing required business data in order to continue with completion of the registration process.

- Go to E-Way Bill Portal: Open ewaybill.nic.in and hit the click on Enrolment for Transporters.

- Complete the Form: Fill in the enrollment form with the required business details including business name, location, and contact information.

- Fill Up Transporter ID: On successful submission of the form, the system will then provide a 15 digit identification number known as Transporter ID (TRANS ID) and also the user registration details thereby concluding the registration.

- Transporter ID Usage: Clients can be given out a 15 digit Transporter ID to enable them to append it to their e-way bill. This Transporter ID enables a transporter to log on into the e-way bill portal and enter vehicle numbers for a particular consignment in transit.

What is a Transporter ID?

A Transporter ID is a unique identification number assigned to transporters who are not registered under GST but are required to generate E-Way Bills for goods exceeding the prescribed value limit. Since unregistered transporters do not have a GSTIN, they must use their Transporter ID in place of GSTIN on every E-Way Bill.

To obtain a Transporter ID, an unregistered transporter must enroll on the E-Way Bill portal. Upon successful registration, the transporter receives a unique Transporter ID and a Username to operate on the portal. A detailed step-by-step enrollment process is available in our guide on Compliance with E-Way Bills by Transporters.

Handling Goods Received from an Unregistered Supplier

When a registered recipient receives goods from an unregistered supplier, the recipient must generate an E-Way Bill as if they were the supplier. This ensures compliance with GST regulations for the movement of goods.

Useful Resources for E-Way Bill

- FAQs on E-Way Bill – Read the official FAQs

- E-Way Bill User Manual – Download the official guide

Conclusion

In conclusion, registering for an E-Way Bill is an essential process for businesses and transporters involved in the movement of goods across state lines in India. The E-Way Bill Portal provides a centralized platform for users to generate, manage, and track E-Way Bills, ensuring compliance with GST regulations. The registration process involves logging in with a GSTIN, verifying business details, and completing authentication steps, which are crucial for maintaining the integrity and security of the transport documentation.

To efficiently manage and navigate the complexities of E-Way Bill registration, businesses must familiarize themselves with the portal’s functionalities and requirements. Staying informed about the latest guidelines and updates related to E-Way Bill operations can significantly ease the compliance burden and enhance operational efficiencies

FAQs on E-way Bill Registration

Who needs to register for an E-Way Bill?

Any business or individual involved in transporting goods under GST regulations must register if the consignment value exceeds ₹50,000. This includes registered businesses, unregistered transporters, and recipients receiving goods from unregistered suppliers.

How can a business register for an E-Way Bill?

Registration can be done through the E-Way Bill Portal by selecting ‘E-Way Bill Registration’ under the ‘Registration’ tab, entering the GSTIN, verifying details via OTP, and creating a User ID and Password.

When is E-Way Bill registration mandatory?

It is mandatory when transporting goods worth more than ₹50,000, for both interstate and intrastate movements as per state rules, when an unregistered transporter is involved, or when a registered recipient receives goods from an unregistered supplier.

Can an unregistered transporter get an E-Way Bill?

Yes, unregistered transporters can enroll on the E-Way Bill Portal and receive a Transporter ID, which must be used instead of a GSTIN when generating E-Way Bills.

Who is responsible for generating an E-Way Bill?

The responsibility lies with the supplier if registered; otherwise, the transporter must generate it. If goods are received from an unregistered supplier, the recipient must generate the E-Way Bill.

How can I check my E-Way Bill registration status?

Log in to the E-Way Bill Portal, navigate to ‘Search’ > ‘Taxpayer/Search by GSTIN,’ and enter the GSTIN to verify registration details.

Can an E-Way Bill be modified or canceled after generation?

An E-Way Bill cannot be modified once generated. However, it can be canceled within 24 hours if the goods are not transported or if incorrect details were entered, provided the transporter has not verified it.