In this article, we will take a look at documents required for pan card used in partnership firm and what firms can do to apply for one. Read more!

Benefits of Having a PAN Card for Partnership Firms

Partnership firms are formed by two or more parties who agree to share the responsibilities and profits or losses incurred by a business. They agree to do so over an oral or written agreement called a partnership deed. Since a verbal agreement has no validity for tax purposes, most partnership firms have a written, legally valid partnership deed in place before starting the business. The registration, working and regulation of Partnership firms fall under the purview of the Indian Partnership Act, 1932. However, to file taxes, the partnership firm must register with the IT Department and possess a valid PAN card. In this article, we will take a look at the Documents Required for PAN Card and how the PAN card is useful for a partnership firm, and what firms can do to apply for one.

PAN Card Requirements for Partnership Firm

To be eligible to file Income Tax returns, partnership firms need to submit their partnership deed and PAN card to the IT department. Firms can apply for a PAN Card through application form 49A. However, before filing a PAN card application, a firm must complete certain formalities. Here’s a look at what a partnership firm registration needs to do before filing for a PAN card.

- Prepare and duly notarize the partnership deed through a public notary

- Define and authorise one partner to act as the manager and sign on behalf of the partnership firm

- Mention the date of formation and place of business of the partnership firm in the deed

- Ensure that every page of the deed is signed by all the partners and two additional witnesses

- Stamp and authorise the deed using a rubber stamp that bears the name of the Partnership firm along with the word-partner.

Documents Required for PAN Card Used in Partnership Firm

- Partnership Deed

- Digital signature certificate

- Proof of Residence of the office

- Rental agreement

- Sale Deed

- NOC from the owner

- Utility bills that are not older than three months

- Proof of Residence of the office

- Proof of identity of partners

- Address proof of all partners

- An attested affidavit stating that all the facts provided are accurate and true

- Certificate of Registration

PAN Card Online Application Process

Here’s how you apply for a PAN Card online through the Income Tax Department’s website by providing Documents Required for PAN Card through online:

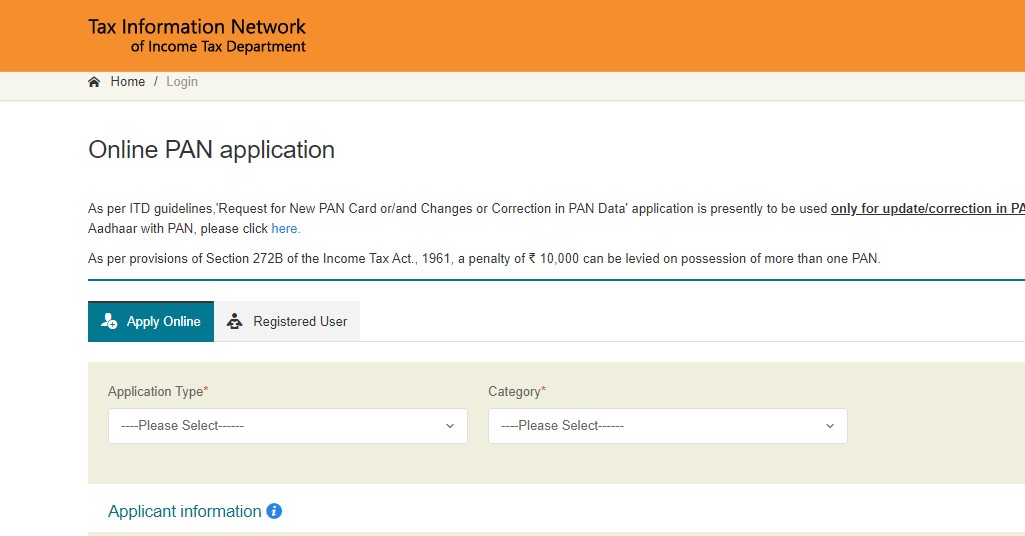

Step 1: Visit the official website of the NSDL via https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

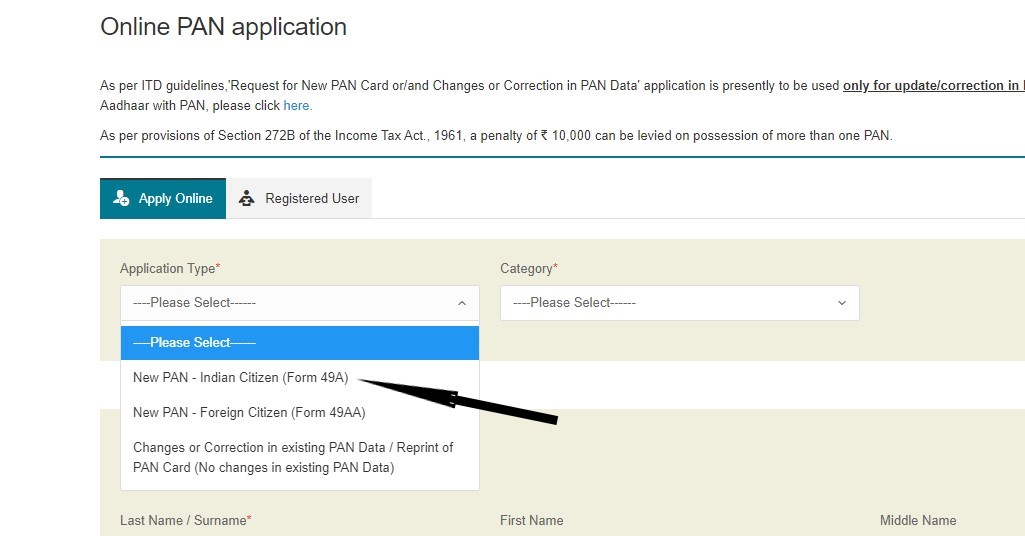

Step 2: From the home page, Select the application type from dropdown menu as New PAN for Indian Citizen )Form 49A) option.

Make sure you go through the instructions carefully before starting to fill the form.

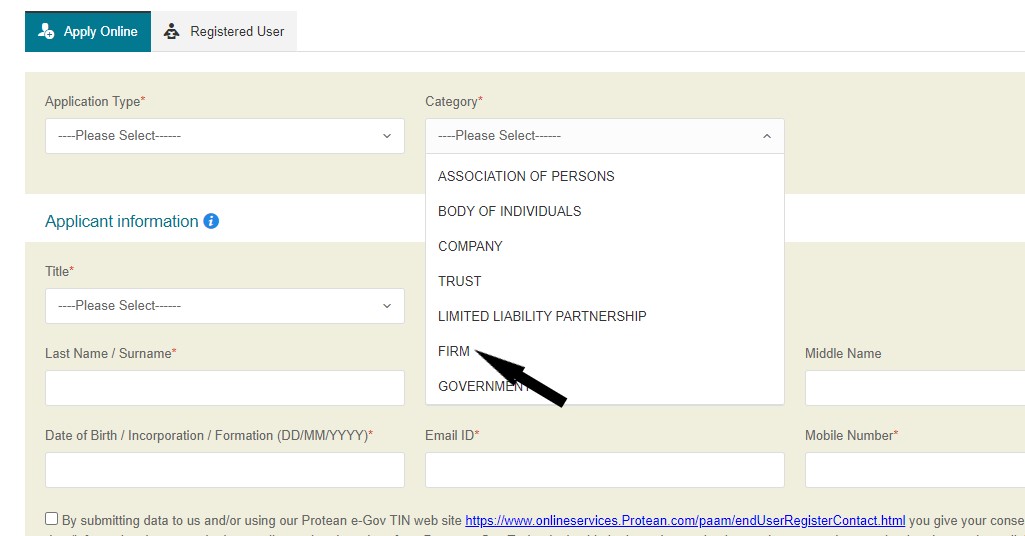

Step 3: Select Firm as your category and provide the other details requested

In case there is an error in the format, a response will be generated indicating the errors

Step 4: The applicant must then make the required changes and re-submit the form.

Step 5: Next, choose a mode of payment from DD, credit or debit card, net banking and cheque and complete the payment of INR 105

Step 6: Once the process is complete, take a print-out of the acknowledgement slip

Step 7: Fix a recent passport size photograph on the slip and attest it with a black pen

Step 8: Next, send this acknowledgement receipt to the Income Tax Department along with the other supporting Documents Required for PAN Card within fifteen days.

PAN Card Offline Application Process

- If you do not have access to the internet, you can apply for a PAN Card by visiting the nearest TIN office

- Request for an application form

- Fill the form using a black ball-point pen and make sure you go through all the details provided carefully to avoid any mismatch or error

- Have the managing partner sign or use the rubber stamp to authorise the application

- Submit the application along with the Documents Required for PAN Card and pay the appropriate registration fees (typically INR 105).

After verification of the Documents Required for PAN Card, the PAN card will reach the address provided in around fifteen days. To track your PAN Card online, you may use the acknowledgement number you receive after completing the registration.

PAN Card Application Details for Partnership Firm

Here’s a look at the details you need to fill on an application form for obtaining a PAN card as a partnership firm by submitting documents required for PAN card :

✅ Firm’s name as per the Certificate of Registration with an M/S tag

✅ Date of incorporation as per the partnership deed

✅ Office address as per the partnership deed

✅ Select Partnership Firm in your status of applicant form

✅ Choose income from the business as your source of income on the form

✅ Choose an appropriate business code, as mentioned below

✅ Mention all the supporting Documents Required for PAN Card as you will be submitting as proof

✅ In the Declaration, mention the name of the authorised partner

✅ Also, mention the place and date at the end.

PAN Card Application Business Codes

| Business Code | Types of Businesses |

| 01 | Medical Profession and Business |

| 02 | Engineering Business |

| 03 | Architecture |

| 04 | Chartered Accountancy |

| 05 | Interior Decoration |

| 06 | Technical Consultancy |

| 07 | Company Secretary |

| 08 | Legal Practitioner and Solicitors |

| 09 | Government Contractor |

| 10 | Insurance Agency |

| 11 | Films, TV and Entertainment |

| 12 | Information Technology |

| 13 | Builders and Developers |

| 14 | Brokers and members of the Stock Exchange |

| 15 | Performing Arts and Yatra |

| 16 | Ship, Aircraft, Hovercraft, and Helicopter Operators |

| 17 | Taxi, Lorry, Bus or Commercial Vehicle plying |

| 18 | Horse ownership or jockeying |

| 19 | Cinema Halls and Theatres |

| 20 | Others |

Also Read: