Complete 2025 guide to GST registration documents for all business types in India. Includes document checklists, application steps, error prevention tips, benefits, and updated FAQs for GST compliance

GST registration documents are mandatory for businesses seeking legal operation and tax compliance under India’s Goods and Services Tax (GST) framework. The required paperwork varies by business structure and serves to verify identity, establish legal legitimacy, and facilitate seamless tax compliance.

For sole proprietorships, core documents include a PAN card, Aadhaar card, proof of business address (such as a rent agreement or electricity bill), and bank verification details (like a cancelled cheque or recent statement). Partnership firms are required to submit the partnership deed, the firm’s PAN card, and residential address proof for all partners. Limited Liability Partnerships (LLPs) and companies must provide a Certificate of Incorporation, Memorandum and Articles of Association (MOA & AOA), a board resolution, and a Digital Signature Certificate (DSC) for their authorized signatories. Some business categories require additional documentation based on their operational nature.

E-commerce businesses must submit marketplace platform agreements, whereas non-resident taxable persons are required to provide valid foreign entity registration documents. Submitting accurate documents expedites the GST registration process, minimizes delays, and enables businesses to claim input tax credits while maintaining legal compliance.

This guide details the essential GST registration documents for various business types and presents a clear, step-by-step breakdown of the application process.

Required GST Documents by Business Structure

The documents required for GST registration vary depending on your business structure. Below is a breakdown of mandatory documents for each type of entity to ensure a compliant and error-free application.

Sole Proprietorships

Sole proprietorships must submit key documents such as the PAN card, Aadhaar card, and proof of business address, typically a rent agreement or utility bill. Bank account verification, through a cancelled cheque or statement, is also mandatory.

Partnership Firms

Partnership firms need to submit their registered partnership deed, the firm’s PAN card, and residential address proof for each partner. A bank account proof, such as a recent bank statement or cancelled cheque, is also necessary.

Limited Liability Partnerships (LLPs):

LLPs must submit a Certificate of Incorporation, LLP Agreement, PAN card, and address proof of designated partners. A board resolution and a valid Digital Signature Certificate (DSC) are required for authorized signatories.

Private and Public Limited Companies

Private and public limited companies must provide a Certificate of Incorporation, Memorandum of Association (MOA), Articles of Association (AOA), and a resolution passed by the board of directors. Additionally, PAN details and address proof of authorized directors along with their DSCs are required.

E-Commerce Businesses

E-commerce platforms must upload agreements with marketplaces like Amazon, Flipkart, or Shopify. These documents validate operational scope and help associate GST returns with platform transactions.

Non-Resident Taxable Persons

Non-resident taxable persons must provide foreign business registration documents, passport copy, and proof of Indian authorized signatory (such as PAN or Aadhaar).

Sample Document References

Below are visual references of commonly required documents like PAN, Aadhaar, and bank proof to help ensure your uploads match GST portal expectations.

PAN Card – Mandatory for all applicants

Aadhaar Card – Identity proof for proprietors and partners

Business Address Proof – Rent agreement, electricity bill, or property tax receipt

Bank Account Proof – Bank statement or cancelled cheque for financial verification

Digital Signature Certificate (DSC) – Required for companies and LLPs for authentication

Submitting clear, valid documents significantly reduces the risk of application rejection and ensures faster GST registration with full compliance under 2025 tax guidelines.

Step-by-Step GST Registration Process (2025)

Once your documents are ready, the next step is completing the GST registration process online. Here’s a step-by-step guide to help you register smoothly through the official GST portal in 2025.

-

Step 1 – Visit the GST Portal

Begin by visiting the official GST portal at https://www.gst.gov.in, the central platform for GST registration, returns filing, and tax services.

-

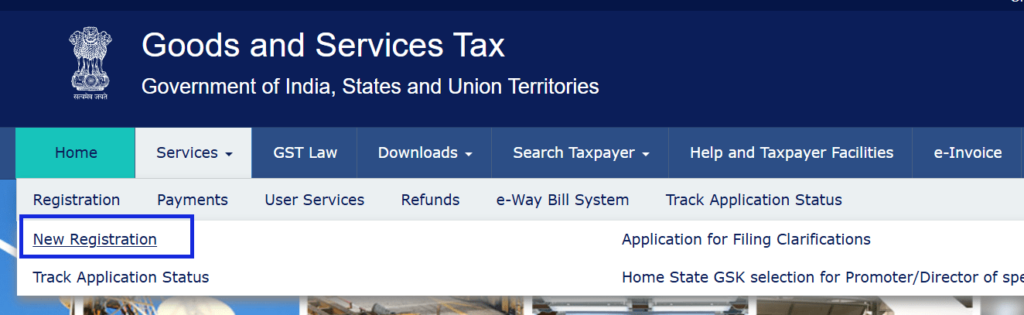

Step 2 – Navigate to the Registration Section

Click on ‘Services’ > ‘Registration’ > ‘New Registration’ on the portal homepage. Choose your type of taxpayer and enter your PAN, email, and mobile number to generate an OTP.

-

Step 3 – Fill the Part A of GST REG-01

In Part A, input the business’s legal name, PAN, email, and contact details. Validate your contact via OTP and receive a Temporary Reference Number (TRN).

-

Step 4 – Complete Part B of the Application

Log in with your TRN and upload the required documents based on your business type. These include identity proofs, address proofs, and business registration papers.

-

Step 5 – Verify and Submit with DSC or e-Sign

Choose a mode of authentication: Digital Signature Certificate (DSC) for companies and LLPs, or Aadhaar-based e-Sign for proprietors. Submit the application upon successful validation.

-

Step 6 – ARN Generation and Application Tracking

After submission, an Application Reference Number (ARN) is generated. You can track the application status on the GST portal using this ARN.

Common Mistakes That Delay GST Registration

Even with the right documents, small errors can lead to delays or rejection of your GST application. Understanding these common mistakes can help you avoid setbacks and get registered faster.

-

Incomplete or Incorrect Document Submission

Uploading blurred or invalid documents, such as expired Aadhaar cards or mismatched PAN entries, often results in application rejection or delay.

-

Mismatch Between PAN and Business Name

The legal name in your PAN must exactly match the name submitted during registration. Even minor discrepancies can lead to verification failure.

-

Incorrect Address Proof or Utility Bill

Address documents must match the declared place of business. Submitting outdated utility bills, unregistered rent agreements, or unrelated residential documents is a frequent error.

-

Digital Signature Issues (DSC Not Working)

A common issue among companies and LLPs is using an invalid or expired DSC. The system may fail to recognize the certificate, halting the application at the submission stage.

-

Failure to Validate OTP or TRN Timely

OTPs and TRNs are time-sensitive. Delays in verifying these steps can lead to session expiry, forcing applicants to restart the process.

How to Avoid GST Registration Delays

Fortunately, most GST application delays are preventable. By following these practical tips, you can reduce processing time and ensure a hassle-free registration experience.

-

Double-Check Document Validity and Clarity

Ensure documents are legible, current, and match the details provided in your registration form.

-

Use Matching Credentials Across All Fields

The PAN name, business name, and address should be identical across all uploads and form fields.

-

Keep DSC Updated and Properly Installed

Companies and LLPs should verify that the DSC is active, correctly mapped, and compatible with the GST portal.

-

Complete OTP and TRN Validation Promptly

Enter OTPs and activate TRNs within the given timeframe to prevent session expiration or system reset.

Benefits of GST Registration for Businesses

Beyond compliance, GST registration offers several advantages that can strengthen your business’s credibility, financial efficiency, and long-term growth potential.

Why GST Registration Matters for Your Business?

-

Enables Legal Operation Across India

A valid GSTIN allows businesses to legally operate across state lines, issue tax invoices, and meet statutory tax obligations under the GST regime.

-

Access to Input Tax Credit (ITC)

Registered businesses can claim ITC on purchases, reducing their overall tax liability. This helps improve working capital and cost-efficiency.

-

Increased Credibility and Compliance Score

A GSTIN enhances a business’s trust factor with customers, vendors, and financial institutions. It also contributes to better compliance scoring in B2B evaluations.

-

Eligibility for Government Tenders and Schemes

Many government tenders and MSME schemes require GST registration as a mandatory criterion, especially for subsidies and contract bids.

-

Simplified Compliance Through Centralization

With a single GSTIN, businesses no longer need to manage multiple indirect taxes like VAT, service tax, or CST — GST centralizes and simplifies the filing process.

FAQs About GST Registration (2025)

Still have questions? Below are answers to the most common queries businesses have about GST registration, helping you clear doubts and move forward with confidence.

No. GST registration is mandatory only if a business exceeds the threshold turnover limit — ₹40 lakhs for goods and ₹20 lakhs for services in most states. However, voluntary registration is allowed for smaller businesses.

There is no government fee for GST registration in India. However, businesses may incur professional service charges if using third-party consultants.

It typically takes 2–6 working days to receive a GSTIN after successful document submission and verification.

Operating without a GSTIN when required is illegal and can attract penalties, including fines and tax evasion notices.

Incorrect details may lead to application rejection or post-approval complications. You can file for amendment using GST REG-14 after registration. Is GST registration mandatory for all businesses in India?

What is the cost of registering for GST in 2025?

How long does it take to complete GST registration?

Can a business operate without GST registration?

What happens if I enter incorrect details in my GST application?

Conclusion

GST registration is more than a compliance formality — it’s a gateway to legal recognition, input tax credit eligibility, and long-term business growth. Whether you’re a sole proprietor, an e-commerce seller, or a registered company, providing accurate and complete documents ensures a smoother application and faster GSTIN allotment.

Understanding document requirements by business type, avoiding common mistakes, and following a step-by-step registration process can help you stay compliant and competitive in 2025. With the right preparation, your business can unlock the full benefits of India’s unified tax system and build trust with customers, partners, and regulatory bodies.

If you’re ready to get started, ensure your documents are in order — and move forward confidently with your GST registration.