The Goods and Services Tax Identification Number (GST number) is a 15-digit number assigned to each taxpayer under the GST system (GSTIN). Apply for GST in India with the help of experts at Vakilsearch.

GSTIN Meaning

GSTN means Goods and Services Tax Identification Number. It is a unique 15-digit code assigned to every taxpayer registered under India’s GST system. It serves as a key identifier for businesses, ensuring compliance and facilitating tax operations.

How Many Digits Are There in GST Number?

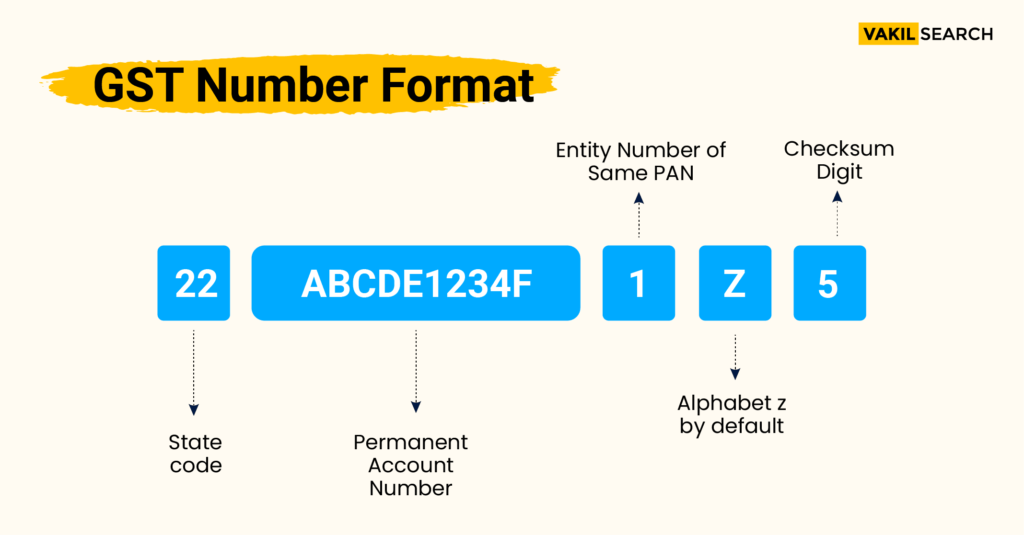

Structure of GSTIN consists of 15 digits. These digits have a specific structure:

- First 2 Digits: Represent the state code as per the Indian Census.

- Next 10 Digits: Are the PAN (Permanent Account Number) of the business or entity.

- 13th Digit: Indicates the number of registrations within a state for the same PAN.

- 14th Digit: Is by default “Z” for future use.

- 15th Digit: Is a checksum character used for verification.

GST Number Format

Importance of GSTIN

- Tax Compliance: Enables filing GST returns, tax payments, and claiming Input Tax Credit (ITC).

- Legitimacy: Establishes legal registration under GST.

- Transparency: Helps track tax liabilities and transactions.

- Ease of Operations: Mandatory for issuing GST-compliant invoices and conducting trade.

Why is GSTIN Essential?

GSTIN is mandatory for businesses exceeding the GST turnover threshold. It streamlines taxation, ensures accountability, and offers benefits like ITC and enhanced credibility.

Who Requires a GSTIN?

Any individual or business providing goods or services in India and exceeding the prescribed turnover threshold must obtain a GSTIN. The threshold limits are as follows:

- ₹20 lakh: For most states in India

- ₹10 lakh: For businesses operating in special category states such as Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim, Uttarakhand, and others.

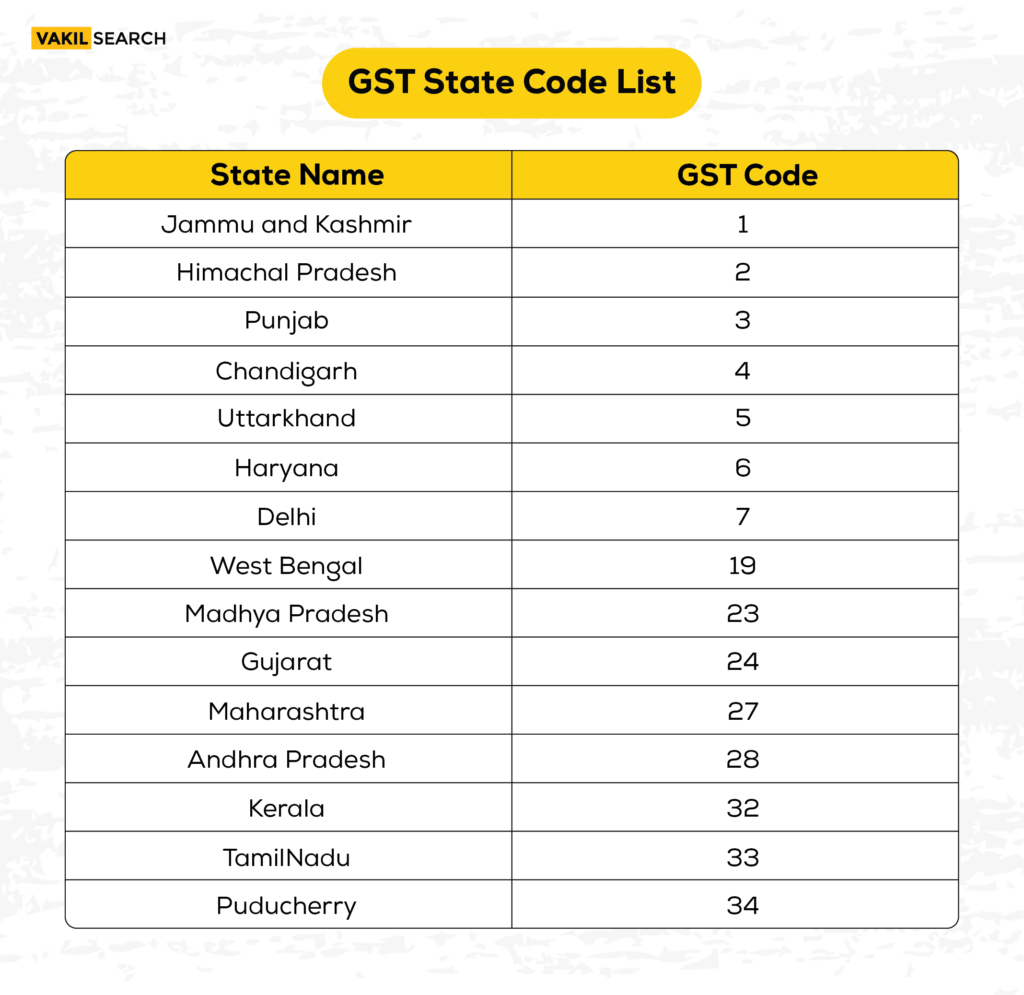

GST State Code List

Here’s the comprehensive list of GST state codes for all states, Union Territories, and Central Jurisdiction:

Significance of State Code in the GST Number

The state code in the GST Number plays an essential role in identifying the geographical location of the business. The first two digits of each GSTIN indicate the state or union territory in which the business is registered. This code serves a critical function for the GST system as it describes the scope of the economic activity of the business along with the tax rate applicable.

Cost of Obtaining GSTIN

- Registering for the GST through the Government GST portal is completely free.

- Nonetheless, organisations may opt for help from GST Suvidha Providers (GSPs) or other service providers, as this can be charged.

- Utilising such services can help organisations in dealing with complicated registration processes however they are not a requirement to complete the process.

Types of Business Entities Eligible for GSTIN

- Any business structure can apply for GST registration whether it is a sole proprietorship or a partnership or an LLP or private limited company or a corporation.

- Every entity type that is registered under the GST has to adhere to the GST provisions relevant to its activity and turnover range.

How to Apply for a GST Number?

Any business structure can apply for GST registration whether it is a sole proprietorship or a partnership or an LLP or private limited company or a corporation. Every entity type that is registered under the GST has to adhere to the GST provisions relevant to its activity and turnover range. This registration allows the entities to raise the tax invoices legally, collect the GST, and claim the input tax credit.

Applying for a GST number involves a systematic process through the official GST Portal, where businesses need to fill out Form GST REG-01. This step ensures your business is registered under the Goods and Services Tax system.

- To apply for GST registration, visit the official GST portal and complete Form GST REG-01.

- Provide necessary business details, including turnover, business type, and address.

- Submit all required documents and verify the information before submitting the application.

- Ensure accuracy to avoid delays or rejections due to discrepancies in the application.

- After submission, a GST application reference number (ARN) will be generated, and the GSTIN will be assigned upon successful verification.

By following these steps carefully, you can complete your GST registration successfully and avoid common application errors, ensuring compliance with GST regulations.

How to Search for a GST Number?

Whether one is a business or an individual, searching for a GST number becomes a very vital step in ensuring that the registered entity is not a fake one as it contains a unique number associated with it. It is possible to come across several search methods to obtain the necessary GSTIN details through the various tools available in the GST Portal. This aids in ascertaining whether any business is genuine, and therefore ensures that tax laws are observed.

GST Number Search by Name, PAN, or Firm Name

The official GST Portal provides an option to look up a GSTIN through a business name, PAN, or firm name. This is an easy search process that helps users find registration details of any entity which is registered under GST. To perform the search:

- Step 1: Visit the GST Portal

- Step 2: Go to the Search Taxpayer section

- Step 3: Enter the business name, PAN, or firm name in the respective field

- Step 4: Click Search to view the GSTIN information of the entity

This ensures that any person or business transacting with another business can confirm if the latter is correctly registered for GST purposes.

Other Methods of Searching for GST Number

Aside from the options of searching by name or PAN, GSTINs can be located by other means. These come in handy in particular situations such as when looking for a fresh company or when different parameters are being searched within:

- By Phone Number or Contact Number: Some businesses may have their GSTIN linked to their phone number. You can use this information to search for the GST number on the portal.

- By ARN (Application Reference Number): The ARN is provided when a business applies for GST registration. It can be used to track or verify the GSTIN of newly registered businesses.

- Using Third-Party Apps: There are several third-party applications available that can help you search for GSTINs. However, it is essential to be cautious when using these apps, ensuring that your data remains secure and that the apps are reliable and accurate.

Every one of these techniques provides additional options for users who wish to check whether a taxpayer is registered for GST. However, such services should be available in a controlled wearable manner with respect to such portals like the GST Portal only for healthy data security and integrity.

GST Number Search and PDF Download Options

The GST Portal has included the option of downloading GSTIN details in a PDF format which can be quite useful for businesses that need to keep records or carry out audits. This feature is likely to apply to tax consultants, audit firms, and any business that has to verify several entities within its operations for compliance.

Here’s how you can download the GSTIN information in PDF format:

- Step 1: Visit the GST Portal and go to the Search Taxpayer section.

- Step 2: Perform the search using the business name, PAN, or other search criteria.

- Step 3: Once you have the results, click on the option to Download PDF.

- Step 4: The downloaded file will contain all the details about the GSTIN, including the entity’s status, legal name, and registration date.

In this way, companies keep track of verified GSTINs for all transactions and audits in compliance with tax regulations with the help of this feature in the process of cleansing transactions.

How to Check GST Number?

GST Number verification through an online platform is an important step for both enterprises and individuals in checking the genuineness of the registered entities. The GST Portal provides simple and convenient verification tools which help prevent malpractices and ensure adherence to tax laws. Proper verification minimises risks to your business and ensures that all transactions that are subject to GST are valid.

Steps for GSTIN Verification on the GST Portal

GSTIN verification can be done in the official GST site in the following way:

- Step 1: Open the GST Portal: Visit the official GST website.

- Step 2: Look out for the ‘Search Taxpayer’ Section: Find the search for taxpayers’ GSTIN option.

- Step 3: GSTIN & PAN to be Entered: Enter the GSTIN of the vendor or the business concerned which you intend to verify. Search can also be done using PAN or Business name.

- Step 4: Click on Search: When all the details have been filled in, press the trigger ‘Search’ to see the GSTIN verification details.

- Step 5: Verify GST Status: The portal will provide information including but not limited to the business registered name and its GSTIN status whether active/cancelled and registration type.

Advantages: Verifying a GSTIN also helps in verifying the credentials of the vendor, avoiding fraud, and ensuring that the business in question is a tax compliant business.

Importance of GST Number Verification for Businesses

For companies operating in the tax brackets, it is essential to check GST numbers to remain compliant, and protect the business from tax fraud. This is how checking GST numbers regularly helps mitigate risk;

- Ensuring Tax Compliance: Verifying GSTIN ensures that you are dealing with registered businesses that are complying with GST regulations. It helps avoid dealing with unregistered vendors who might create tax issues.

- Protecting Input Tax Credit (ITC): To claim input tax credit, it is essential to ensure that your suppliers are registered under GST. Verifying their GSTIN ensures that their details are accurate, making it possible for your business to legally claim credits and reduce the tax burden.

- Preventing Fraud: Verifying a GSTIN helps avoid fraud and prevents businesses from engaging with fraudulent suppliers or customers who may issue false invoices.

- Maintaining Financial Transparency: Verification of GST numbers helps maintain proper financial records and audits, making it easier for businesses to follow due diligence practices.

By regularly verifying GST numbers, businesses can mitigate risk, ensure smooth tax processes, and comply with government regulations.

Modifying, Updating, or Cancelling a GST Number

A GSTIN may require revision or annulment on the occasions where there are alterations in the business particulars, the operational state, or due to legal reasons. The procedures involved in the alterations, modifications and/or cancellations of the GST registrations are not complicated but rather precise. It is worth understanding the right process since it is the easiest way to avoid any complications with the Goods and Services Tax bodies.

Modifying GST Number Details

If you’re changing your GST number information due to the altering of any business information such as the name, address or any other significant detail, do the following:

- Log into the GST Portal: Visit the official GST Portal and log in using your credentials.

- Go to the ’Modification’ Section: On Services Tab, search for ‘Registration’ and click on ‘Amendment of Registration’ after that.

- Complete the Amendment Form (GST REG-14): Provide the necessary information for new business address, legal name change or change of the authorised signatory.

- Attach Additional Documents: Based on the nature of the alteration, it may be necessary to provide certain documents such as proof of address, business registration certificate, PAN card etc.

- Approval and Acknowledgement: Subsequent to Submission the changes shall be verified by the relevant authorities. In case of Approval, the detailed changes will be reflected in the GSTIN certificate sent to you.

Documentation Requirements:

- Evidence of business registration or address

- PAN for business owner or authorised signatory

- Other documents justifying the amendment (if any)

Approval Timeline: Modifications take between 15-30 days to be approved but could take less or more time depending on how complex the changes are.

Cancelling a GST Number

A GST number can be cancelled for various reasons including stopping the operations of the business, dropping below the threshold of turnover, and in cases of restructuring. This is the procedure for requesting for GST cancellation:

Eligibility for Cancellation: Cancellation can occur if the business is discontinued, the turnover falls below the GST registration threshold, or the business relocates outside India.

Steps for Cancellation:

- Step 1: Login to the GST Portal: Access your GST Portal account.

- Step 2: Initiate Cancellation: Under the ‘Services’ tab, select ‘Cancellation of Registration’ and click on ‘Apply for Cancellation’.

- Step 3: Fill out the Cancellation Form (GST REG-16): Provide the reason for cancellation and fill out the required details.

Tax Filing Before Cancellation: Before the cancellation is approved, businesses must file final GST returns, clearing any pending tax dues.

Submit Documents: You may need to submit documents such as proof of business closure, property closure, or turnover declaration.

Acknowledgment and Cancellation Approval: Once the application is processed, you will receive an acknowledgment. The GST department will verify the details and cancel the GST registration if everything is in order.

Key Factors To Consider:

- GST cancellation does not mean that you have no tax obligations. Make sure that all returns and dues are settled prior to cancellation.

- A GSTIN which has been cancelled can no longer be used to carry out business transactions.

Benefits of Having a GST Number

A Goods and Services Tax Identification Number (GSTIN) offers many benefits to businesses so they can operate within the tax laws and increase their efficiency. There are tax benefits, as well as other benefits, such as improved market reputation, that make GST registration an unfriendly business activity because it has positive effects on the growth and sustainability of the business.

-

Legal and Compliance Benefits

A GSTIN makes it easier for businesses to address the Goods and Services Tax in India, all in an effort to ensure that they are in conformity with the law and all its provisions. Here are some main compliance advantages:

-

- Compliance with Taxation Policies: A GSTIN helps its holder in maintaining the required level of compliance with the prescriptions of the GST law, thus assisting in avoiding non-compliance penalties. Companies without a proper GSTIN may be fined, barred from enjoying some privileges, or arrested.

- Enhanced Financial Record Keeping: A GSTIN aids in careful record keeping for tax purposes, promoting accountability in financial management, and easing audits. It helps in timely submission of GST returns and proper adherence to business invoicing and payment procedures.

- Easy Taxation: By bearing a GSTIN, a business will find it easy to declare the sales made, purchases made as well as taxes payable, which incentively makes the tax returns filing organised. This eliminates the chances of tax avoidance and ensures that all documents required in the tax assessment are available.

Utilising a GST number in the course of your business comes with undeniably clear advantages from a legal standpoint as it prevents businesses from incurring any legal consequences in the process of carrying out its operations.

-

Access to Input Tax Credit (ITC)

Businesses that have registered under the GST are allowed to seek Input Tax Credit (ITC) for the tax incurred on goods or services acquired for business purposes which reduces their tax burden. This is beneficial since operational costs are reduced because the input tax paid on materials or services is able to offset the tax on sales thus improving cash flow.

-

Enhanced Business Credibility and Access to Wider Markets

Having a GSTIN makes a business look more respectable, enhances its suppliers and even consumer’s confidence in the business with regards to meeting their tax obligations. This also means that businesses can do business across states and participate in e-commerce which increases the market size for them and allows them to carry out business transactions across states without any hindrance or additional taxation.

-

Invoicing and Billing Requirements

- Inclusion of GSTIN in the invoices: All the business invoices must include GSTIN so that the transaction can be tax compliant and healthy.

- Obligation by Law: If GSTIN is not mentioned in the invoices, penal measures and other complications will arise during an audit.

- Proper Invoicing to Facilitate Effective Filing of GST Returns: Properly issued invoices provide the basis for the proper filing of GST returns (GSTR-1, GSTR-3B).

- Audit Benefits: Proper invoicing provides clear records for tax authorities during audit processes mitigating challenges in tax compliance.

- GST Compliance and Transparency: Appropriate documentation is a sign of transparency in the business, and helps build confidence with the concerned parties.

-

Filing GST Returns

- Submitting GST Refunds: GST rates needs to be determined for the refund applicant applying for various GST returns like GSTR-1 (sales) as well as GSTR-3B (summary of tax liabilities).

- Tax Monitoring: Through the GSTIN, one can keep records of sales, purchases, tax remittances as well as input tax credits to help in filing their returns correctly.

- Refund claims processing: A GST competence number is important in giving out refunds so that a situation that emanates from business entities wanting to claim their input tax credits and other cashback does not arise.

- Enforcement of Tax Laws by the Tax Bodies: Submitting returns under a given GSTIN prevents any irregularities in returning tax within the set time in the correct amount which may cause fines.

- Expediting GST Filing: GSTIN enables the business to carry out proper storage and filing of tax records thereby easing the process of taxes filing.

-

E-Invoicing

In the case of e-invoicing, which is when an invoice is generated electronically and shared between a supplier and buyer, businesses whose turnover exceeds a certain limit are required to apply for GSTIN. The system allows a business to create, validate and transmit an invoice through electronic modes. E-invoicing aids in improving efficiency by shortening the workflow, minimising manual errors that cost revenues, increasing tax revenue and ensuring better compliance.

Penalties and Consequences of Not Having a GST Number

- Penalties for Non Compliance: Qualifying businesses who do not register for GST will incur penalties such as fines and interests for unpaid taxes which will be imposed under the provisions of Section 122 of the GST Act.

- Legal Risks: Conducting business in an entity without obtaining a GST Number when it is required can result in being sued and possibly being prevented from running the business or being required to fight over tax payments owed.

- Financial Consequences: Businesses risk availing themselves of input tax credit (ITC) without a probable pregnancy tax identification number (GSTIN) which increases expenses. In addition, it will strain the financial contingency by way of compliance audits and imposition of penalties.

- Credibility Loss: A business for which GST registration has been made compulsory and which has not registered may lose its reputational equity with its suppliers, customers, tax authorities, and this will compromise the principal business relationships in the future.

- Risk of Seizure of Goods: Any business registered with GST and not complying with registration and sale operational requirements may risk the tax authorities confiscating their goods and properties during routine inspections.

Conclusion on GST Number (GSTIN)

In conclusion, obtaining a GST number is crucial for businesses operating under India’s Goods and Services Tax system. It ensures compliance with legal requirements, simplifies tax reporting, and enables businesses to claim input tax credits, improving their financial efficiency. Understanding the GSTIN structure and application process is essential for smooth operations in the modern tax landscape. For businesses with these complexities, expert support can make the process seamless and efficient. For assistance with GST registration and compliance, reach out to professional services today.

It is essential for businesses to stay compliant with tax regulations and streamline their operations. The process involves several key steps, and understanding them is vital for ensuring smooth business continuity. Professional guidance can simplify the registration and compliance process, allowing businesses to focus on growth and success.

FAQs on GST Number (GSTIN)

Can I Search for a GST Number Using Only a Contact Number?

Unfortunately, it is not possible to search for a GST Number solely using a contact number. The GSTIN can be searched using the business's name, legal entity, or PAN number through official platforms.

Is There Any Validity Period for a GST Number?

A GST Number does not have an expiry date and remains valid indefinitely. However, businesses must ensure compliance by filing returns regularly, or they may face penalties or cancellation of the GST registration.

What Happens if I Do Not Use My GST Number Actively?

If a business does not engage in any transactions, it is required to file NIL returns. Failing to do so may result in penalties or the cancellation of the GST registration.

How Do I Know if a Business is Registered with GST?

You can verify a business's GST registration using the GSTIN verification tool available on the official GST portal. This will confirm the legitimacy of the GST registration and ensure compliance with tax regulations.