Dearness Allowance is a significant part of the salary for Indian government employees; it is meant to offset the inflationary impact while holding on to buying power. It is periodically reviewed, reflecting changes in the cost of living to ensure economic changes do not affect their employee's economic stability. This blog outlines the significance of Dearness Allowance in safeguarding government employees’ purchasing power against inflation.

Overview of Dearness Allowance (DA)

Dearness Allowance is an index-linked cost of living adjustment. Both employees and pensioners are paid DA in India as compensation for inflation and the resultant fall in purchasing power.

What is DA In Salary?

DA is calculated as a percentage of Basic Salary or Pension and also over changes in the Consumer Price Index. Generally, DA is re-set twice in the course of a year, first in January and then in July. Although it is primarily applicable to government employees and staff of the public sectors, many private organizations now offer the same adjustments as well. DA has a pertinent role in maintaining the financial stability of employees in the midst of inflationary living costs.

Definition of Dearness Allowance

Dearness allowance, in other words, is a percentage compensation or variable salary component given to public sector employees and pensioners by the government in order to adjust wages with the movement in price levels.

DA works as a cost-of-living adjustment that helps employees or workers and pensioners to cope with price increase in goods and services.

This is the reason why it is of utmost importance to permit the government to guard its employee’s impact from the bad influence of inflation. Since the impact of inflation depends on the place of posting of the employee, the dearness allowance is calculated accordingly. Thus, the DA varies from employee to employee based on their posts in the urban, semi-urban, or rural sectors.

The system of Dearness Allowance for central government employees and pensioners has been recommended by the 7th Pay Commission, which has been implemented since January 2016. The periodic revision is listed below:

- This DA calculated based on AICPI all India Consumer Price Index for industrial workers and sometimes inflation rates that are adjusted periodically

- The DA has subsequently increased to 42% as of July 2023 with the latest data from CPI

- The DA is one of the central factors of the total salary structure as it affects the gross pay and pensions of the government employees

- Even the pensioners avail DA following the same norms while assuring equal protection against inflation.

History and Evolution of Dearness Allowance

Dearness Allowance was sanctioned soon after the Second World War and was then called as ‘Dear Food Allowance’. An ‘Old Textile Allowance’ was also sanctioned in 1947. However, it was altered and was reintroduced in the year 1953 as a ‘Revised Textile Allowance’.

DA initially was given in response to the demand of employees for wage revision. Later, it was linked up with the Consumer Price Index. In the past, various committees were constituted to discuss the payment of DA towards the Central Government employees.

The 3rd Central Pay Commission had also suggested recovery of DA whenever the CPI has gone up by 8 points above the index of 200. The percentage of neutralisation achieved from the effect of 1 January 1973 was between 100% to 35%.

The 4th Central Pay Commission recommended grant of DA on a ‘percentage system’ of the basic pay (1986). DA was to be paid twice a year; 1 January and 1 July. Each instalment of DA was to be calculated with reference to the percentage increase in the 12 monthly average of All India Consumer Price Index (base 1960). The extent of neutralisation now ranged from 100% to 65%.

This aspect of differential neutralisation was considered by the 5th Central Pay Commission, and they thought it to be gross injustice to senior officers. They recommended uniform neutralisation of 100% to employees at all levels. The Commission had suggested that every time the cost of living increased by 50% over the base level dearness allowance should be converted into dearness pay. It suggests that the base year of CPI be changed as early as possible. It even changes the base year for computing DA to 2001.

Importance of Dearness Allowance in India

Dearness Allowance (DA) is one of the most important compensation factors for employees and pensioners in India. It had long been regarded as a hedge against inflation, maintaining the effective purchasing power of individuals even after an increase in the cost of living.

Thus, DA corresponds to the change in the Consumer Price Index; therefore, it becomes an important form of monetary assistance for all the employees and pensioners. The importance of Dearness Allowance can be identified using the following factors:

- Maintains the worker’s standard of living: DA enables the worker to maintain his purchasing power and his ability to have the same goods and services.

- Increases the morale and motivation of the workers: An employee is likely motivated to hang in an organisation only if his monetary needs are being met.

- Retirement benefit: DA directly influences the pension amount of the pensioners into their post-retirement life.

- Consumer Price Index: The DA amount is chosen by considering the Consumer Price Index (CPI) or the Industrial Average. While CPI determines the rate of living cost change over time, the Industrial Average reports the average rate of inflation in industrial sectors. The DA an employee is entitled to will often vary with place because the cost of living changes from city, village, to semi-urban locality

Role of DA in Protecting Employees from Inflation

The Indian Government formed the pay commission to assess and revise pay in the public sector. Salary is that one, in various components thereof and dearness allowance, which forms part of an employee’s total salary and changes are brought about in it.

The pay commission considers every component that goes into calculating the salary of an employee. They even scrutinise the multiplication factor meant for DA calculation from time to time.

It has benefited more than 50 lakhs of central government employees and more than 60 lakhs pensioners. A DA hike considerably increases the monthly income of a government sector employee. Considering this fact, dearness allowance is granted to employees as a preventive measure against inflation because it is beyond the Government’s control to do anything with the varying elements that are making the commodity price increase.

How DA Affects the Cost of Living?

Dearness allowance is that cost of living adjustment that the Government pays to pensioners and public sector employees.

It is always calculated as a percentage of the basic salary to curb the effect of inflation. Under the Income Tax Act of 1961, it is necessary to claim the tax liability arising on DA at the time of filing an ITR. This component of salary is offered to employees both in India and Bangladesh.

Dearness Allowance payable by the Government of India to their employees and pensioners to neutralise the inflationary effect. As DA is on the cost of living, this pay element is not fixed. It changes for public sector employees as it depends upon the location. Therefore, DA allowance varies with the rural, urban, and semi-urban sector employees.

DA rates are pegged two times a year. Governments advance this allowance every six months. This change is usually applied starting January 1st of the year for the period January up to the month of June and July 1st of the year for the period from July up to the month of December.

How to Calculate Tax on Dearness Allowance?

The calculation starts with a base year, which is typically set by the government. For instance, the base year for the current calculation is often 2001 or another year specified by the relevant authorities.

- Consumer Price Index (CPI): The AICPI is a critical factor in determining DA. The CPI reflects the average change over time in the prices paid by consumers for goods and services, and it is published by the Ministry of Labour and Employment. The CPI figures are collected and released monthly.

- Current Index Calculation: To calculate the DA, the current AICPI value is compared to the AICPI value of the base year. The formula used is as follows:

- Determining DA Percentage: The resulting percentage indicates the increase in the cost of living. For example, if the current AICPI is 350 and the base year AICPI is 200, the DA would be calculated as follows:

- Application to Salary: Once the DA percentage is determined, it is applied to the basic salary of the employee. For example, if an employee’s basic salary is ₹50,000 and the DA percentage is 75%, the DA amount would be:

- Revisions: DA is revised biannually, usually in January and July, based on the latest CPI data. This ensures that the allowance reflects current economic conditions and inflation rates.

Formula for DA Calculation

This is how DA in salary is calculated for public sector employees and pensioners:

Central Government Employees

Public Sector Employees

Example

- Base Year AICPI: 200 (for the year 2001)

- Current AICPI: 350 (latest index value for the month of January 2024)

- Employee’s Basic Salary: ₹50,000

Steps for Calculation:

Determine the Increase in AICPI:

- Increase in AICPI=Current AICPI − Base Year AICPI

- Increase in AICPI = 350−200= 150

Calculate the DA Percentage:

- DA Percentage = (Increase in AICPI/Base Year AICPI)×100

- DA Percentage = (150/200)×100=75%

Calculate the DA Amount:

- DA Amount=(DA Percentage100×Basic Salary)

- DA Amount=(75/100×50,000)= ₹37,500

Total Salary with DA

To find the total salary including the DA:

- Total Salary=Basic Salary+DA Amount

- Total Salary=50,000+37,500=₹87,500

Components Involved in DA Calculation

The DA is arrived at with the All India Consumer Price Index, which is considered an important factor in calculating the price increases along with the base year that was chosen for comparison. Employees’ Basic Salary is also considered so as to calculate the DA payable to ensure that employees did not lose their purchasing power during inflation.

- Basic Salary: Basic ingredient for DA computation; This is that fixed part of any employee’s salary package

- Consumer Price Index (CPI): Measurable of Inflation It is the changes in cost of goods and services over some period of time

- Base Index: It is a reference point to compare the current CPI levels with the historical data

- DA Rate: Percentage decided by the government on the basis of CPI and base index

- DA Amount: Calculated amount of DA, that is the percentage of the basic salary

- DA Calculation: Basic Salary × DA Rate = DA

- DA Revision: DA rates are modified periodically in tandem with the changes of CPI

Differences in DA for Government and Private Sector Employees

The Dearness Allowance of central government employees is standardised and linked to the All India Consumer Price Index, and revised every six months. While in the private sector, there may also be an allowance provided similar in nature, but the computation, percentage, and frequency of revision can be quite different, depending entirely on the company’s policy.

| Government Sector | Private sector | |

| Calculation | DA is calculated as a percentage of the basic salary, determined by the government based on the Consumer Price Index (CPI). | DA is often included as a component of the salary package, and its calculation can vary widely among companies. Some may use a similar formula to the government sector, while others may have their own specific methods. |

| Revision | The government revises the DA rate periodically, typically every six months, to reflect changes in the CPI. | DA revisions in the private sector are less standardised and can occur at different intervals, depending on company policies and market conditions. |

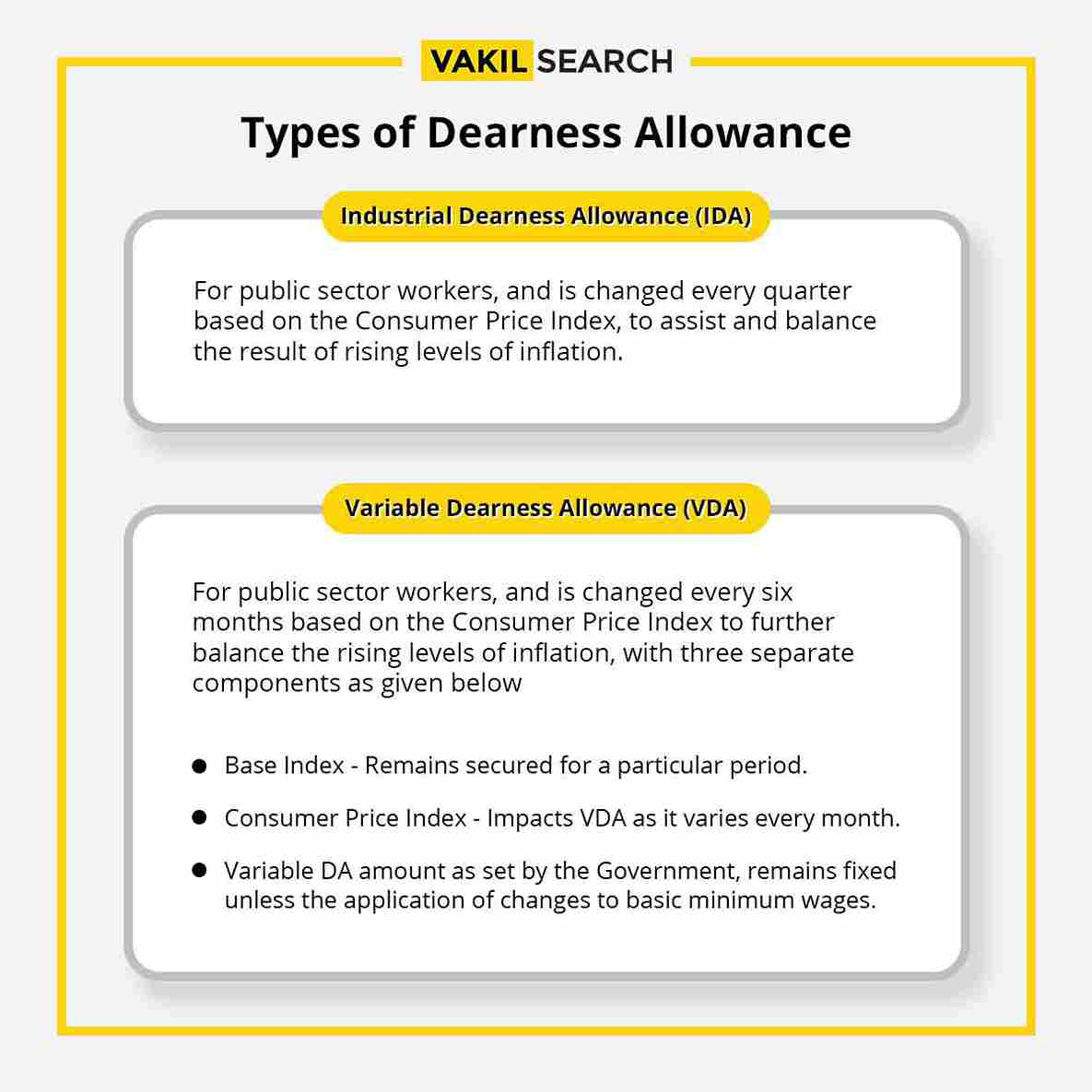

Types of Dearness Allowance

There are several types of DA. These are devised for different sectors so they must meet the needs of a specific sector.

Such as industrial DA, which is typically provided to the industrial workforce, Common DA that is provided to the government employees, and then the variable components of DA in the private sectors. They include:

Industrial Dearness Allowance (IDA)

It applies to the Central Government’s Public Sector Employees. The Industrial Dearness Allowance of the public sector employees is revised quarterly based upon changes in the Consumer Price Index to ease the inflationary impact of high levels of inflation.

Variable Dearness Allowance (VDA)

It applies to the employees of the Central Government. It is revised every six months according to the Consumer Price Index to help offset the impact of rising levels of inflation. VDA in itself is dependent on three different components as given below:

- Base Index- it only remains constant for a period of time

- Consumer Price Index will influence VDA as VDA varies every month

- The amount of DA, frozen by the Government will not change unless changes take place in the basic minimum wages declared by the Government.

Difference Between IDA and VDA

There are distinct differences between Industrial Dearness Allowance (IDA) and Variable Dearness Allowance (VDA) that cater to the needs of different employee categories.

| Feature | IDA (Industrial Dearness Allowance) | VDA (Variable Dearness Allowance) |

| Applicability | Applicable to employees of the public sector (PSUs) and some private sector companies. | Applicable mainly to employees under the Minimum Wage Act, particularly in the unorganised sector and government employees. |

| Basis of Calculation | Calculated based on the CPI (Consumer Price Index) specific to industrial workers. | Based on the rise in CPI (Consumer Price Index) for a specific category of workers. |

| Frequency of Revision | Revised quarterly (every three months) by PSUs or public sector enterprises. | Revised every six months by the Government of India. |

| Linked To | Linked to inflation rates and changes in the cost of living in industrial sectors. | Linked to inflation rates affecting workers under the Minimum Wages Act, based on different job categories. |

| Control/Regulation | Controlled and regulated by specific guidelines of PSUs or corporate sector agreements. | Controlled and regulated by the Ministry of Labour and Employment, Government of India. |

| Adjustment Mechanism | Increases/decreases are made based on inflation and price rise for industrial workers. | Adjusted based on CPI for different worker groups, impacting minimum wages in various sectors. |

| Purpose | Protects the income of industrial workers in PSUs from inflation. | Ensures minimum wage earners are compensated for inflation and rise in living costs. |

| Geographical Consideration | May vary based on the industrial region and PSU norms. | May vary based on geographic regions and categories of work under minimum wage laws. |

| Typical Recipients | Employees in government-owned companies, public sector units. | Unskilled, semi-skilled, and skilled workers in both public and private sectors under the Minimum Wage Act. |

Dearness Allowance Under the 7th Pay Commission

The implementation of the 7th Pay Commission brought significant changes to the structure and calculation of Dearness Allowance (DA) for central government employees.

Overview of the 7th Pay Commission

7th Pay Commission has obligated the DA for India’s central government employees, payable from 1 January 2024, which is 50% of basic pay. It helps to neutralise the effect of inflation in the economy so that his purchasing power remains uninfluenced. The government recently amended the method of calculating DA taking into account the changes arising from CPI itself due to inclusion of new items covering changing habits and expenses.

Changes to Dearness Allowance under the 7th Pay Commission

The Dearness Allowance, falling under the 7th Pay Commission, has been in and out of revision. The latest revision begins on 1st January, 2024, where the DA rate is hiked to 50% of the Basic Pay for Central Government employees. This would mean that Central Government employees would get an allowance of 50% of their Basic Pay. The rate of DA is, from time to time, revised on the basis of inflation in CPI. This way, DA retains its relevance and continues to serve the financial needs of government employees against the rise in inflation.

Impact of the 7th Pay Commission on Government Employees’ Salaries

The 7th Pay Commission indeed marked a major change in the salaries of the Central Government employees of India. The suggestions of the commission prompted a sharp increase in basic pay, allowances, and pensions. This was directly aimed at elevating the living standards of government employees while improving the attractiveness of government service. However, the 7th Pay Commission led to some concerns regarding the sustainability of fiscal policy too. The increased salary burden on the government has raised questions in terms of resource allocation and whether this would influence public services.

Dearness Allowance in the Public and Private Sector

Dearness Allowance (DA) is implemented aptly in the public and private sectors, reflecting varying policies and economic conditions. Here is a detailed outline for the same:

DA for Central Government Employees

Dearness Allowance, the DA for the Central government employees is at 47%. These rates have been effective from 1 July 2024. The DA is a kind of cost-of-living adjustment as the government compensates the employee for spending power loss due to inflation. With every hike in the cost of living, the DA is adjusted so that the employee can sustain his lifestyle. Till now, at 47% DA, the basic pay is complemented with 47% of the basic pay as dearness allowance that gets added to the gross salary. This revised DA will help the employees as it has provided compensation towards the current cost of living with a well-being attitude.

DA for State Government Employees

Dearness allowance paid to State Government employees is basically a compensation made by state governments to their employees as a cost of living allowance to compensate for the effects of inflation. It works out to some percentage of the basic salary of an employee and has variations based on the level of inflation and the policy decisions of respective state governments. DA rates are revised periodically, often twice a year, so that the purchasing power of the employee is not decreased with an increase in cost of living. State governments usually announce DA hikes after the central government has announced the hike in DA for central employees.

DA in the Private Sector

In the private sector, DA is less prevalent in practice compared with the public sector. In other private companies, payment for inflation comes in the form of salary increment, bonuses, or cost-of-living adjustments rather than DA. In manufacturing and other organisations where unionised labour prevails, DA could be paid to compensate for maintaining wages relative to inflation. Very flexible and widely different, depending on company policies, organisational health, and industry culture.

DA Rates and Periodic Revisions

The Dearness Allowance is an essential component in the compensation packages of government workers and retirees. The Dearness Allowance forces periodic review so that eligible beneficiaries can at least keep up with their purchasing power in an ever-changing economic landscape.

How Often is DA Revised?

The Dearness Allowance (DA) is revised biannually, with the Government of India implementing changes every six months. This mechanism was designed to mitigate the effects of inflation, which has been persistently rising. As a buffer against escalating prices, this allowance effectively enhances the take-home pay of government employees and pensioners. The Union Government reviews the DA every two years, specifically in January and July.

DA Hikes Based on Inflation and CPI Index

Between December 2023 and June 2024, the Consumer Price Index for Industrial Workers (CPI-IW) increased by 2.6 points, moving from 138.8 to 141.4. This rise will elevate the DA percentage hike from 50.28% to 53.36%, effective from July 2024. Notably, last year’s July 1 DA increase was announced on October 18, 2023, well ahead of the festive season.

The government adopted a new consumer price index with a base year of 2016 to calculate the DA starting from September 2020. The CPI-IW’s rise of 2.6 points from December 2023 to June 2024 directly influences the upcoming DA adjustments.

DA and Other Salary Components

Dearness Allowance (DA) is a crucial component of an employee’s salary, designed to counteract the effects of inflation on their purchasing power.

Impact of DA on Gross Salary

When the Dearness Allowance (DA) percentage reaches 50%, the allowance will increase to ₹24,000. This adjustment results in a salary increment of ₹1,920 (calculated as ₹24,000 minus ₹22,080). Furthermore, once the DA percentage exceeds 50%, all other allowances and salary components will also rise in accordance with the recommendations of the Seventh Pay Commission.

Tax Implications of Dearness Allowance

The treatment of Dearness Allowance (DA) has specific tax implications for employees and employers in India.

Is Dearness Allowance Taxable?

Yes, salaried employees are required to pay tax on DA (Dearness Allowance), as it is taxable for those receiving a regular salary. Additionally, it is mandatory to declare the tax liability on DA when filing income tax returns (ITR).

How to Calculate Tax on Dearness Allowance?

DA = ((Average of AICPI (Base Year – 2001=100) for the past 12 months -115.76)/115.76) *100.

Also Read: 8th Pay Commission Salary

Dearness Allowance in Pension

Dearness Allowance (DA) plays a vital role in the pensions of retired government employees and pensioners in India.

DA for Pensioners

The pension of retired public sector employees is revised in case of a new pay commission constituting a new compensation package. Likewise, DA gets revised too. In case the DA is upgraded by a certain percentage, the same happens in respect of the pension of the retired public sector employees. This not only pertains to the normal pension but also to the family pension.

DA Calculation for Pensioners

The formula for calculating the DA percentage is: DA% = [(Average CPI-IW for the past 12 months – Base CPI-IW) / Base CPI-IW] x 100 The base CPI-IW is the CPI-IW at the time the pension was granted. Multiply your basic pension by the DA percentage to determine the amount of DA you will receive. For example, if your basic pension is ₹10,000 and the DA percentage is 34%, your DA would be ₹3,400.

Recent Changes in DA for Pensioners

DA central govt employees increase by 4% The Dearness Allowance of central govt employees has increased by 4% with effect from 1 January 2024. The arrears would be paid from 1 January 2024.

The DA was increased from 46% to 50%. With the same percentage increase, it has been increased for central govt pensioners from 47% to 50%. This increase will effectively be from 1 January 2024. For instance, the central government employee, on a basic monthly salary of ₹48,000, was getting ₹22,080 as DA at 46%. At the new rate of 50%, DA will move to ₹24,000, which upon being added to ₹1,920 from his salary, adds to the total of ₹25,920.

Once DA reaches 50%, other allowances will also rise as are suggested by the 7th Pay Commission. Some of the allowances include HRA, daily allowance, Gratuity ceiling, hostel subsidy, children’s education allowance, special childcare allowance, transfer TA, and mileage allowance for personal transport.

These hikes, therefore, so devised by the central government, are expected to revive the flagging take-home salary for the employees by the central government where the living cost is also rising quite substantially.

FAQs on Dearness Allowance

What is the current DA rate in India?

Effective 1 January 2024, the Dearness Allowance (DA) for central government employees in India has been raised to 50% of their basic salary, a 4% increase from the previous 46% rate.

Can DA be Reduced?

The current Dearness Allowance (DA) rate for central government employees in India, as of 2024, is 45% of the basic salary, following recent hikes due to inflation. DA rates are revised twice a year, typically in January and July, based on the Consumer Price Index (CPI).

Can DA be Reduced?

Yes, DA can be reduced if the inflation rate falls significantly, as DA is linked to the cost of living index. However, reductions are rare, as governments typically aim to protect employees from fluctuating economic conditions and rising living costs.

Is DA the Same for All Government Employees?

No, DA is not uniform across all government employees. While central government employees receive a standardised DA, rates for state government employees may vary depending on individual state policies and financial conditions. Additionally, DA rates differ for urban and rural employees.

Is Dearness Allowance Different from a Cost of Living Adjustment (COLA)?

While both DA and Cost of Living Adjustments (COLA) aim to offset inflation, DA is specific to India and is a fixed percentage of the salary. COLA, common internationally, varies more widely and may include a range of living expenses, depending on location.

Why is DA Revised Periodically?

DA is revised periodically, typically twice a year, to ensure government employees’ salaries keep pace with inflation. It helps protect the purchasing power of employees by adjusting for the rise in the cost of essential goods and services, which are tracked through the Consumer Price Index (CPI).

How is DA Different for Employees in Rural and Urban Areas?

DA may vary between rural and urban employees due to the differing cost of living in these areas. Typically, urban employees face higher living costs, such as housing and transportation, leading to higher DA rates compared to their rural counterparts.

What Factors are Considered in Calculating DA Percentage?

DA is calculated primarily based on the Consumer Price Index (CPI), which tracks the price of a fixed basket of essential goods and services. Inflation rates, economic conditions, and government fiscal policies also play a role in determining DA percentage increases.

Does DA Affect Retirement Benefits?

Yes, DA impacts retirement benefits for government employees. Components such as pension and gratuity are often calculated based on basic salary plus DA. Hence, any increase in DA also results in higher retirement payouts for employees.

Is There a Cap on Maximum DA?

No, there is no fixed cap on the maximum DA that an employee can receive. DA is adjusted based on inflation trends, and it continues to rise in proportion to increases in the Consumer Price Index, ensuring compensation aligns with living costs.

How Does CPI Influence DA Changes?

The Consumer Price Index (CPI) is a key determinant of DA, as it measures the inflation rate. A rise in CPI signals increased costs for goods and services, prompting a corresponding rise in DA to ensure that employees’ wages maintain their purchasing power.

Do Private Sector Companies Offer DA?

Private sector companies in India generally do not offer DA as a formal component of salary. Instead, they may provide cost-of-living adjustments through annual salary increments, bonuses, or other allowances, although some industries with unionised workforces may offer DA.

Historical Significance of DA

DA originated during World War II when the British government introduced it to compensate employees for rising inflation. Over time, it became a permanent part of wage structures in India, evolving into a key salary component for government and some organised sector employees.

Are Contractual Employees Eligible for DA?

Contractual employees in government jobs are typically not eligible for DA unless explicitly mentioned in their contracts. Permanent employees receive DA as part of their salary structure, while contractual workers often rely on consolidated pay packages without DA benefits.

How Does DA Impact the Income Tax Slab?

DA is fully taxable under the Income Tax Act and contributes to the gross income of salaried employees. A higher DA can push employees into higher tax slabs, affecting their overall take-home pay after tax deductions are applied.

Does DA Contribute to Provident Fund?

Yes, DA contributes to the provident fund (PF) contributions of employees. Both the employee and employer's PF contributions are calculated as a percentage of the employee's basic salary plus DA, making it an essential component of retirement savings.

What are the key differences between DA and other salary allowances?

DA is specifically meant to compensate for inflation, while other allowances, such as House Rent Allowance (HRA) or Travel Allowance, cater to specific needs like housing and transportation. DA is revised periodically, whereas other allowances may remain fixed.

Can DA Be Frozen During an Economic Crisis?

Yes, DA can be frozen by the government during an economic crisis. For example, the Indian government temporarily froze DA hikes for central employees during the COVID-19 pandemic to manage fiscal stress and prioritise other essential expenditures.

How Does DA Vary Between States?

DA rates vary between different states in India based on each state’s economic conditions, cost of living, and fiscal policies. States often follow the central government’s lead in DA revisions, but the percentage increases and timelines may differ.

Is DA Applicable to Defense Sector Employees?

Yes, DA is applicable to defence sector employees, just like other central government employees. It is calculated in the same manner, based on inflation rates, and helps maintain the real value of their salaries amidst rising living costs.