Co-operative credit societies in India are credit institutions owned by their members. This article focuses on everything you need to know about credit cooperative societies.

Cooperative credit society are credit institutions characterized by member ownership and control. Registered with the primary goal of fostering economic and societal progress, they emphasize providing accessible credit at fair interest rates.

What is the Purpose of a Credit Co-operative Society?

Upon successful registration, cooperative credit society offer various services for the welfare of their community members, such as: Deposit Procurement: Credit co-operative societies gather deposits exclusively from their members.

- Financial Assistance: Credit co-operative societies are designed to provide financial aid to their members.

- Elimination of Intermediaries: Credit co-operative societies often minimize additional expenses associated with intermediaries in trade and business.

- Low-Interest Loans: Members of cooperative credit society benefit from loans with favourable interest rates, covering various needs such as housing, personal assets, automobiles, etc.

- Protection of Rights: Credit co-operative societies are primarily responsible for safeguarding the rights of rural consumers and producers.

Eligibility Criteria for Forming a Credit Co-operative Society

The establishment of cooperative credit society in India, a strategic step towards financial empowerment, necessitates adherence to specific eligibility criteria, such as the following:

- Bank Certificate: Members are required to furnish a bank certificate validating the presence of a credit balance meeting the society’s requirements.

- Minimum Members: A minimum of fifty members is essential for establishing a credit cooperative society at the state level.

- Minimum Directors: A board of directors, comprising at least seven and not exceeding twenty-one members, is vital for fulfilling society’s requirements.

- Comprehensive Documentation: Detailed documentation outlining the Cooperative credit society role in social and economic development, including its name and registered office details, is mandatory.

- Capital Requirements: Members need to provide information on pre-registration compliance, encompassing initial capital, member count, and other pertinent data associated with the credit society.

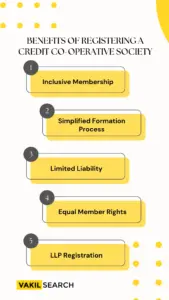

What are the Benefits of Registering a Credit Co-operative Society?

Cooperative credit society play a crucial role in fostering financial independence and addressing the economic well-being of less developed rural communities. The registration of these societies brings forth numerous advantages, emphasizing inclusivity and financial security.

Here are key points highlighting the benefits of registering a cooperative credit society:

-

Inclusive Membership:

Co-operative credit societies are open for anyone to join without any membership fees. There are no limitations based on gender, creed, race, caste, or religion. Individuals from diverse backgrounds are welcome to become members at any time.

-

Simplified Formation Process:

Establishing a Co-operative credit societies is a straightforward process. A group of ten or more adults can collaboratively form a society, and the registration process is uncomplicated. Notably, there are minimal legal requirements to fulfill, facilitating the ease of formation.

-

Limited Liability:

A notable benefit is the limited liability that comes with the formation of a cooperative credit society. Members’ liability is confined to the capital contributed to the society. This safeguards members from potential losses, ensuring that their personal assets and properties are not at risk in the event of societal losses.

-

Equal Member Rights:

Every member of the credit co-operative society enjoys equal rights at all times. Members actively participate in policy creation. This democratic management approach underscores the equal value and importance of all members.

-

LLP Registration:

Many cooperative credit society in India opt for Limited Liability Partnership (LLP) registration. LLP registration combines the benefits of a company and a collaboration, providing a streamlined business structure.

How to Register a Credit Co-operative Society: Necessary Documents

Credit Co-operative Society Registration Process with Required Documents:

Registering a Co-operative credit societies involves submitting specific documents and adhering to necessary procedures. Below are the essential details and documents required for credit co-operative society registration:

-

Model Bye-Laws:

Submit four copies of the model bye-laws that outline the rules and regulations governing the cooperative credit society.

-

Promoter Member Details:

Provide the names and a list of promoter members involved in the formation of thecooperative credit society.

-

Head Office Address:

Furnish details of the head office address where the credit co-operative society will be registered.

-

No Objection Certificate (NOC):

Include a No Objection Certificate obtained through an intensive inquiry letter, affirming compliance with necessary regulations.

-

Specific Plan Document:

Present a written document incorporating a specific plan format outlining how the Co-operative credit societies intends to contribute to the social and economic growth of its members and the community.

-

Bank Certificate:

Obtain a certificate from the bank confirming that the credit balance is in favor of the respective cooperative credit society.

-

Pre-Registration Meeting Details:

Include details and a copy of the judgment from the pre-registration meeting covering aspects such as funding, membership, operations, board structure, etc.

-

Proposed Society Name:

Provide the suggested name for the Co-operative credit societies as proposed by its members.

-

Additional Requirements:

- The cooperative credit society must have a minimum of 50 members in each state.

- The board of directors should consist of a minimum of 7 and a maximum of 21 members.

By fulfilling these requirements and submitting the specified documents, the Co-operative credit societies can proceed with the registration process. It is essential to ensure that all necessary details are accurately provided to facilitate smooth registration and compliance with legal regulations.

How Do You Categorise a Credit Co-operative Society?

Credit co-operative societies are categorized into three types based on their structure and functionality:

-

Primary Cooperative Credit Society Banks:

- This category of Co-operative credit societies comprises a community of borrowers and non-borrowers residing in a specific geographical area.

- There are no restrictions on residency, allowing individuals beyond the defined area to join.

- Members within this structure actively engage in each other’s business affairs, fostering a sense of mutual interest and support.

-

Central Credit Co-operative Society Banks:

- Central Co-operative credit societies banks are formed by individuals whose membership is limited to primary societies.

- Often referred to as a banking union, members have the opportunity to join almost every central co-operative bank.

-

State Cooperative Credit Society Banks:

- These societies are established to secure credit from affluent urban masses.

- Functioning as intermediaries between joint-stock banks and cooperative movements, they play a pivotal role in facilitating credit accessibility.

Understanding the three-tier structure, credit co-operative societies operate at different levels, catering to the financial needs of members within specific communities and facilitating cooperation and support among members.

How Can You Verify if a Co-operative Credit Society Is Registered?

Verifying the registration status of a Co-operative credit societies involves checking official records and documentation. Here are the steps to verify if a cooperative credit society is registered:

- Registrar of Co-operative Societies: Contact the Registrar of Co-operative Societies in the relevant state or region. Each state has its own office overseeing co-operative societies.

- Official Website: Visit the official website of the concerned Registrar of Co-operative Societies. Many authorities provide online portals for accessing information about registered societies.

- Search Functionality: Utilize the search functionality provided on the official website. It may allow you to search for co-operative credit societies based on their name, registration number, or other relevant details.

- Verification through Documents: Request verification through official documents. A registered co-operative credit society should have a registration certificate issued by the Registrar of Co-operative Societies.

- Visit the Registrar’s Office: If necessary, visit the Registrar’s office in person. Inquiries can be made at the office to confirm the registration status and gather additional information.

- Membership Information: Check membership details. A registered cooperative credit society should have a list of its members, and this information can be verified through official records.

- Consult Legal Professionals: Seek assistance from legal professionals or experts specializing in co-operative laws. They can guide you through the process and help verify the registration status.

It’s important to rely on official channels and documentation to ensure the accuracy of information.

Examples of Notable Co-operative Credit Societies in India

- Adarsh Credit Society

- Arogya Dhan Varsha Credit Society

- Arth Multi-state Credit Society

- Lokhit Bharti Credit Co-op. Society

- Navjivan Co-op Society

- Peers Co-operative Society

- Prithvi Credit Co-operative Society

- Sahara Credit Society

- Sanjivani Credit Society

Conclusion

In conclusion, while the registration process for co-operative credit societies in India is relatively swift, the compilation and management of necessary documents can be intricate. Seeking the assistance of legal experts is advisable to navigate through this process smoothly.

Connect with the professionals at Vakilsearch to facilitate the registration of your cooperative credit society with ease!

Frequently Asked Questions

How can one confirm if a cooperative credit society is enrolled or not?

To verify a cooperative credit society's enrollment status, individuals can contact the Registrar of Co-operative credit societies or check the official website for a list of registered societies. This ensures transparency and helps members make informed decisions about their financial affiliations.

How does the Co-operative Credit Society differ from other financial institutions?

Co-operative credit societies distinguish themselves by operating on a cooperative basis, where members are also owners. Unlike traditional financial institutions, they prioritise community welfare, offering democratic decision-making and shared benefits among members.

Are there specific criteria or qualifications that members must meet to participate in a Co-operative Credit Society, and how is membership determined?

Membership in a cooperative credit society typically requires individuals to meet certain criteria, such as residence or employment in the society's operational area. The specific qualifications vary, but a commitment to mutual cooperation and financial responsibility is fundamental.

How does the regulatory framework for Co-operative Credit Societies operate in India, and what authorities oversee their functioning?

Co-operative credit societies in India operate under the regulatory framework set by the Reserve Bank of India (RBI) and the National Bank for Agriculture and Rural Development (NABARD). These authorities oversee their functioning, ensuring compliance with established guidelines and regulations.

What types of financial services and products can members access through Co-operative Credit Societies, and how do they compare to traditional banking services?

Members of co-operative credit societies can access a range of financial services, including savings accounts, loans, and investment opportunities. While similar to traditional banking services, co-operative credit societies often prioritise personalised attention, community involvement, and competitive interest rates.

Are there any tax benefits or exemptions associated with being a member or investor in a Co-operative Credit Society in India?

Being a member or investor in a co-operative credit society in India may offer tax benefits or exemptions. Members should consult with financial advisors to understand the specific advantages associated with their participation and investment in these societies.

Can Co-operative Credit Societies provide loans or credit facilities to members, and what are the terms and conditions associated with such financial assistance?

Co-operative credit societies can indeed provide loans or credit facilities to their members. The terms and conditions are typically determined by the society's policies and the nature of the financial assistance needed. Members can benefit from more flexible terms and competitive interest rates.

Are there limitations on the geographical scope or area of operation for a Co-operative Credit Society, and how does this impact its services?

Co-operative credit societies may have limitations on their geographical scope, often operating within specific regions or communities. This localised focus allows them to better understand and serve the unique financial needs of their members within a defined area.

Can non-resident Indians (NRIs) or foreign entities become members of a Co-operative Credit Society in India, and what are the considerations for their participation?

Non-resident Indians (NRIs) and foreign entities may face restrictions in becoming members of co-operative credit societies in India. Regulations and considerations for their participation vary, and interested parties should consult with society authorities and regulatory bodies for specific guidelines.