Have a bank account in Canara Bank? Want to leverage the benefits of net banking? In this article, we will explain how to register for and log in to the Canara Bank net banking portal.

Canara Bank, established in 1906, is a prominent name in the Indian banking sector. In recent times, the bank has embraced technological advancements to enhance the efficiency, speed, and security of its services. The introduction of Canara internet banking has provide a comprehensive range of services through a user-friendly online platform, simplifying banking transactions for its customers.

Canara Internet banking – canara portal enables registered users to perform a variety of activities. From online fund transfers and service requests to opening new term deposit accounts and accessing account statements, customers can conveniently manage their banking affairs through the online interface.

Key Features and Services of Canara Internet Banking Portal

- Online Fund Transfers: The portal facilitates hassle-free online fund transfers between Canara Bank accounts and to other banks.

- Service Requests: It allows users to submit service requests online for various banking needs.

- Account Management: Users can manage their accounts, including checking balances, viewing transaction history, and downloading account statements.

- Term Deposit: The canara portal also enables the opening of new term deposit accounts through the net banking portal.

Steps: Canara Bank Internet Banking Registration on Portal?

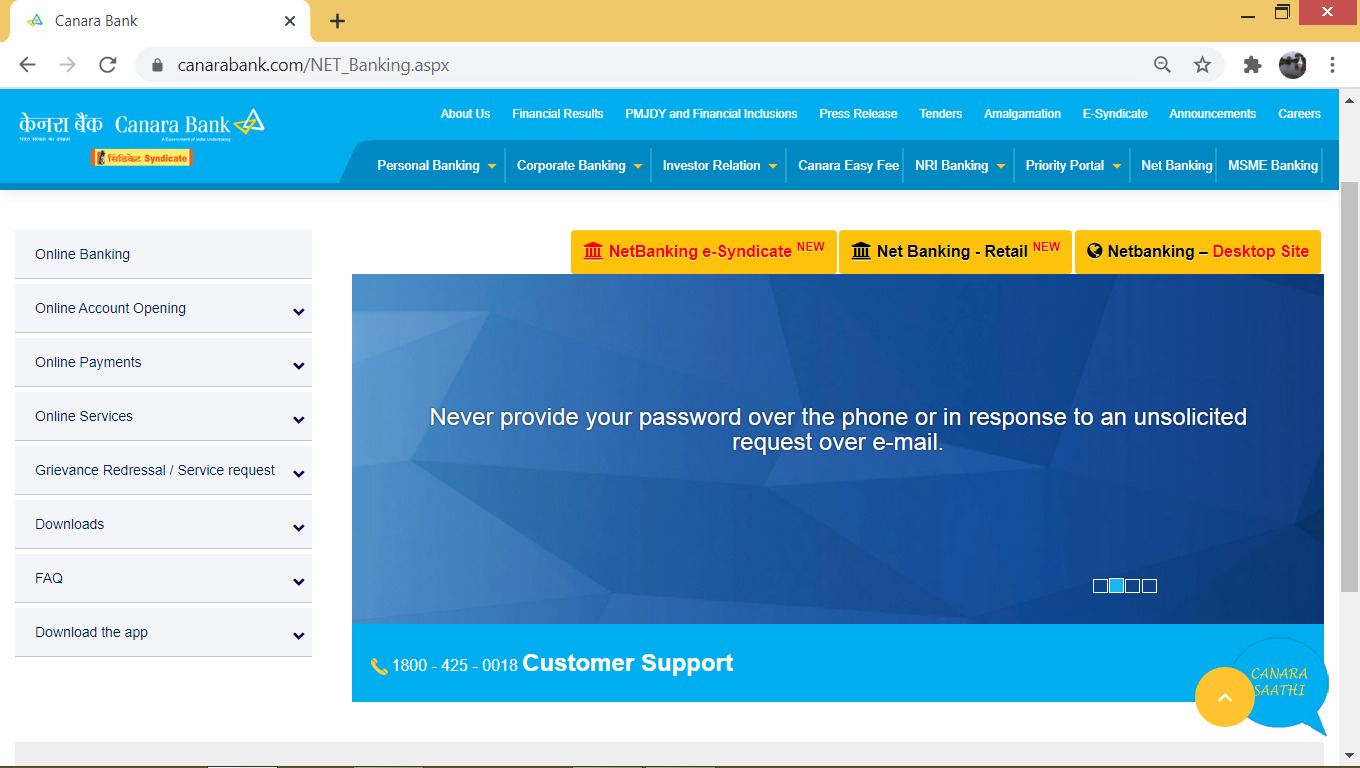

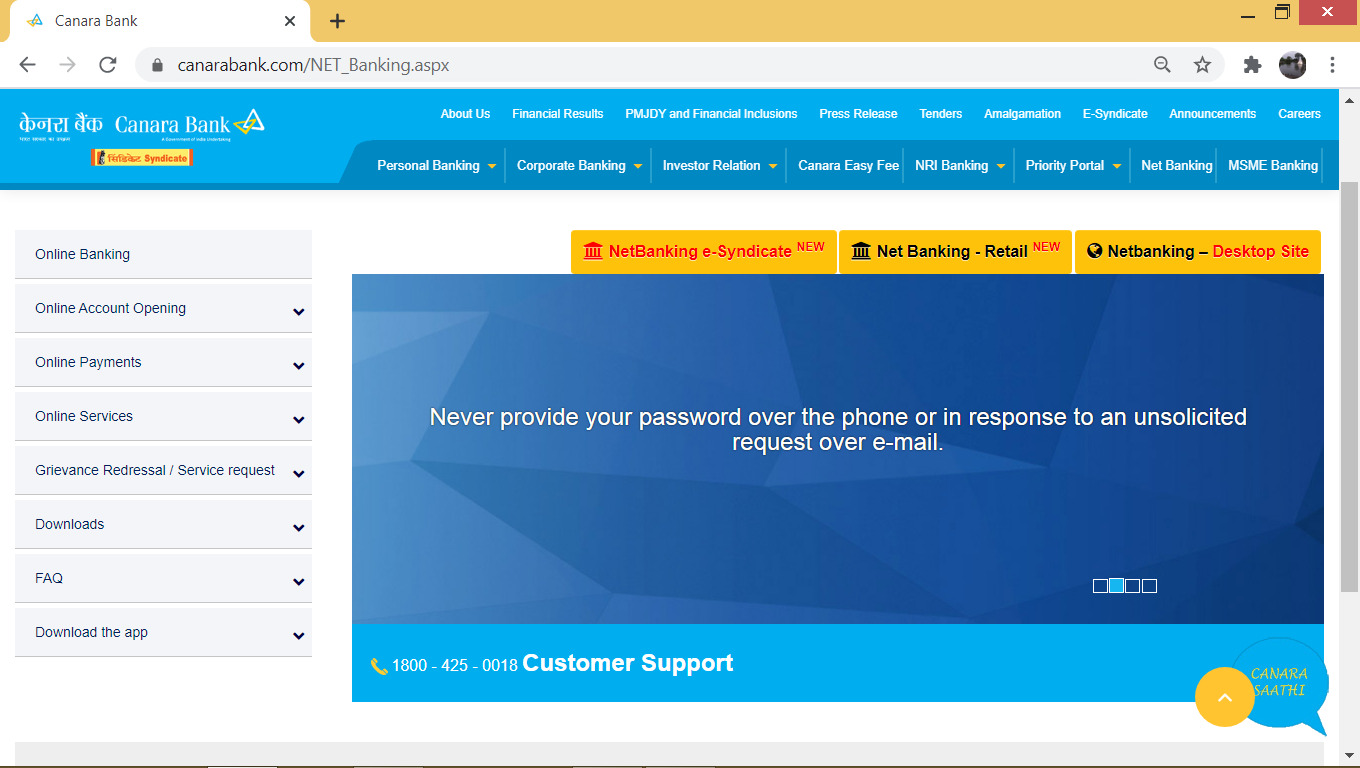

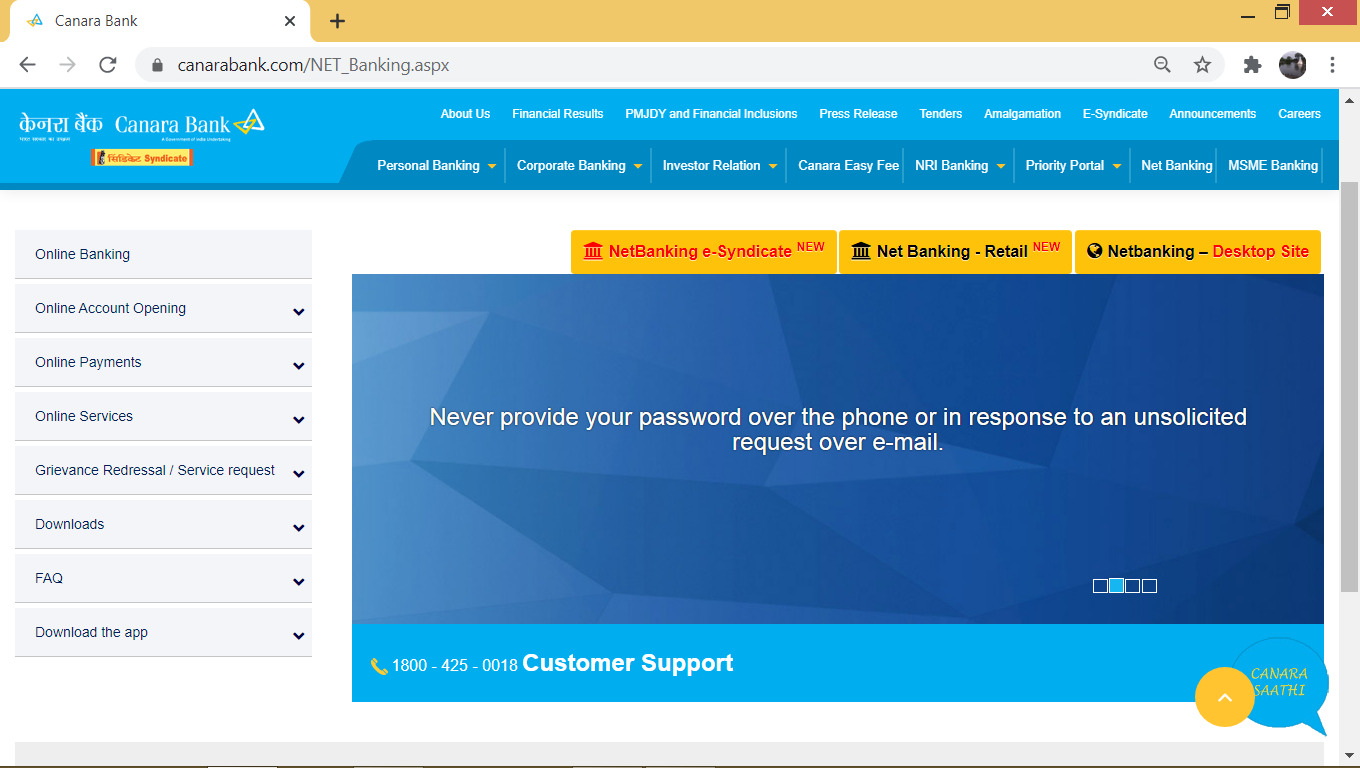

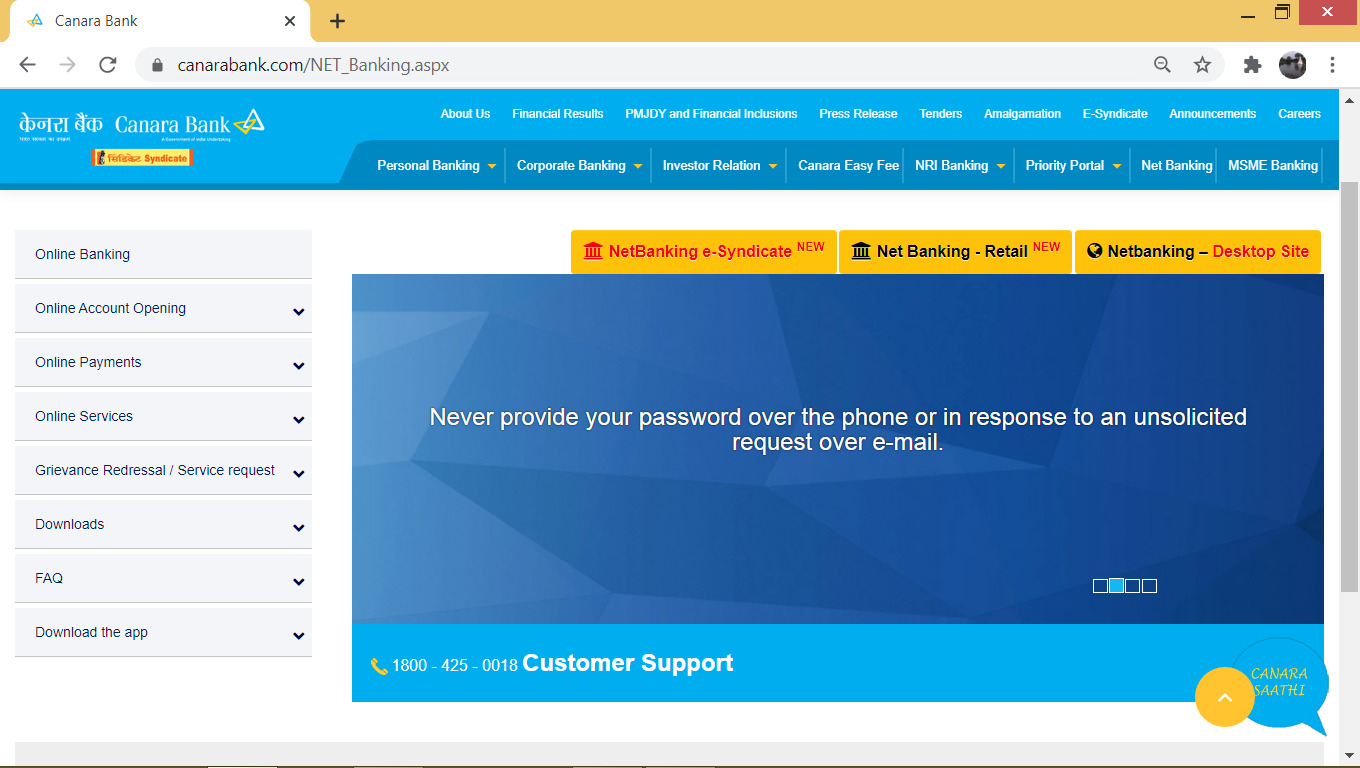

- Step 1: Visit the Canara Internet banking site. Next, click on the ‘Net Banking – Retail’ option on the screen.

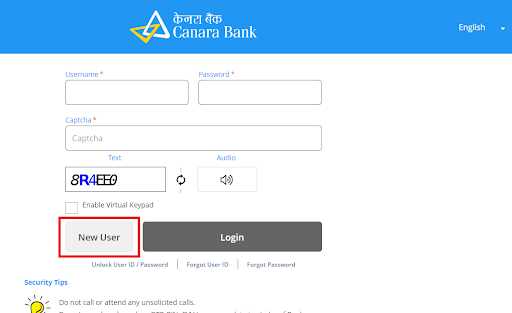

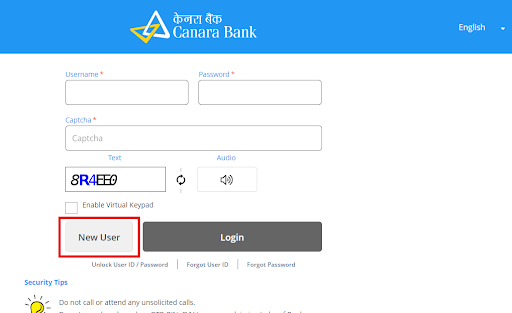

- Step 2: On the next screen, click the ‘New User’ button.

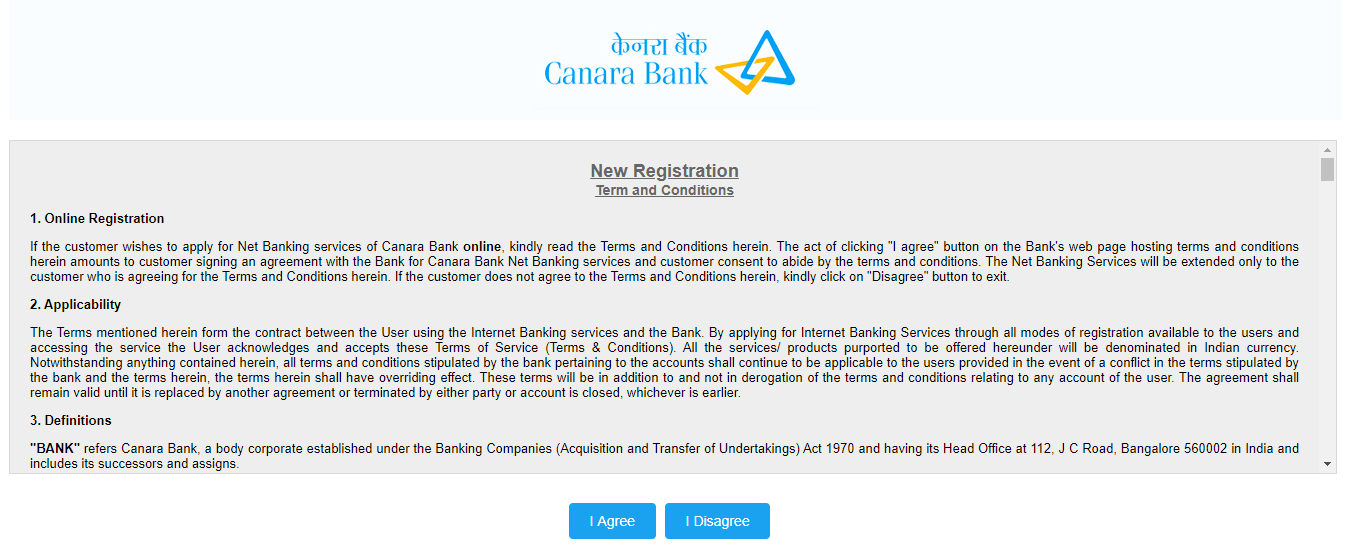

- Step 3: Read and agree to the ‘Terms & Conditions’ before proceeding.

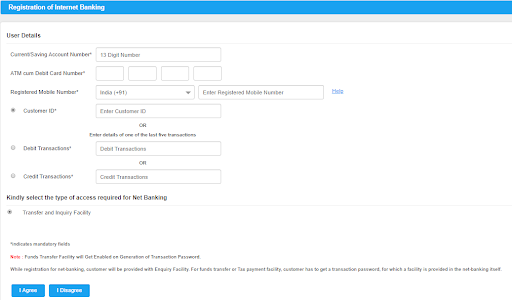

- Step 4: Enter account number, customer ID, registered mobile number, and debit card number. Click ‘I Agree’ to submit the information.

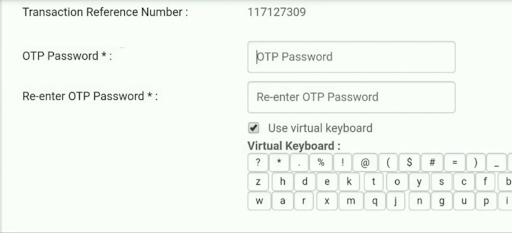

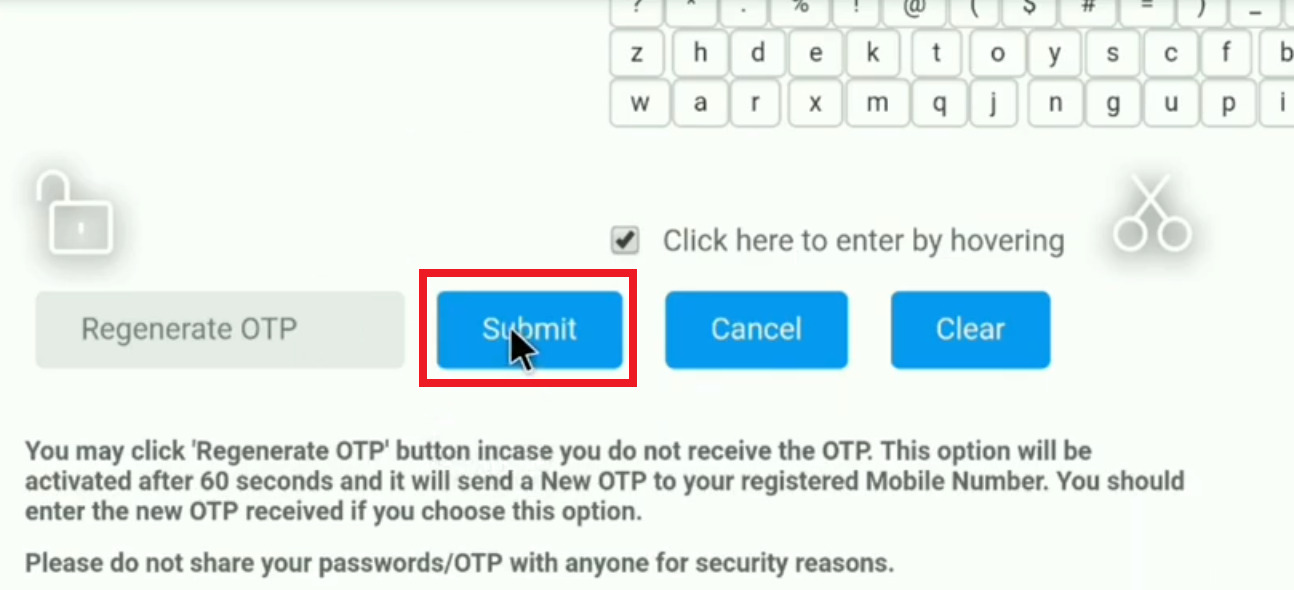

- Step 5: A transaction reference number will be displayed, and an OTP will be sent to your registered mobile number. Enter the OTP and click ‘Submit.’

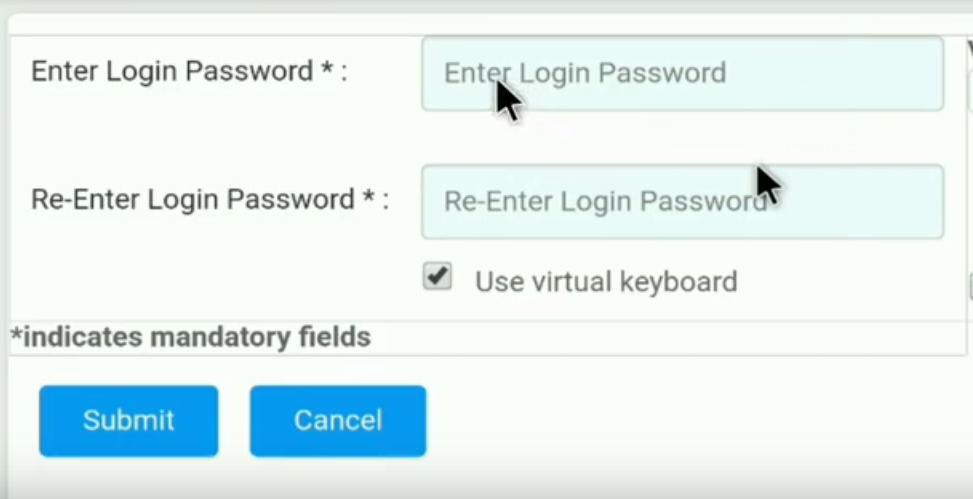

- Step 6: Create a login password as per the Bank’s parameters. Click ‘Submit’ after entering the password.

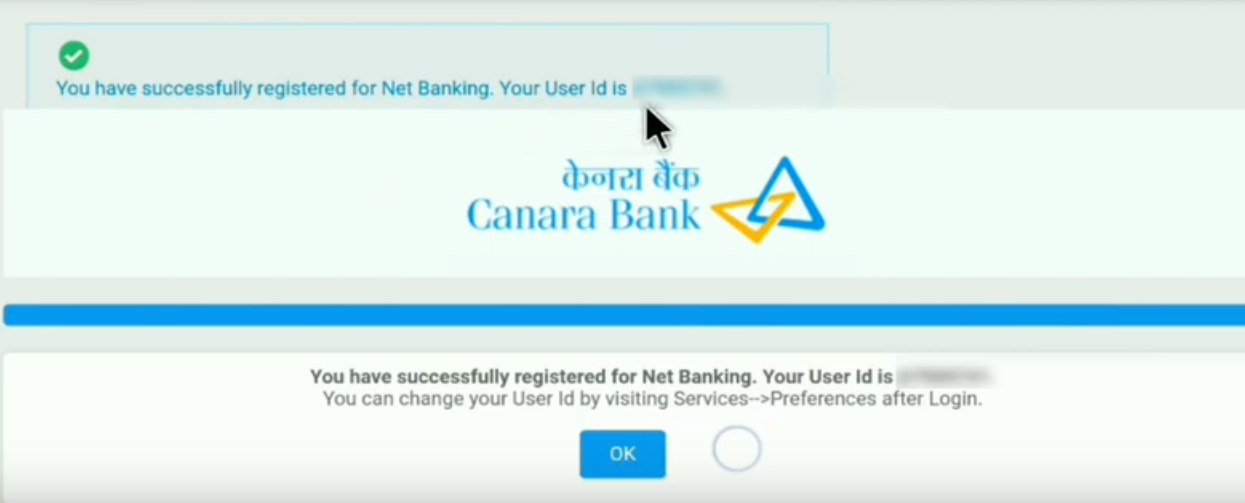

- Step 7: On successful submission, the registration process is completed, and a message with your user ID will be displayed.

Canara Bank Net Banking Login?

- Step 1: Visit the Canara Internet banking site and click on the ‘Net Banking – Retail’ button.

- Step 2: Enter your Username and Password on the login page. Enter the captcha and click ‘Login.’

- Step 3: Upon activation, you will be directed to your account’s dashboard to select and avail the desired services.

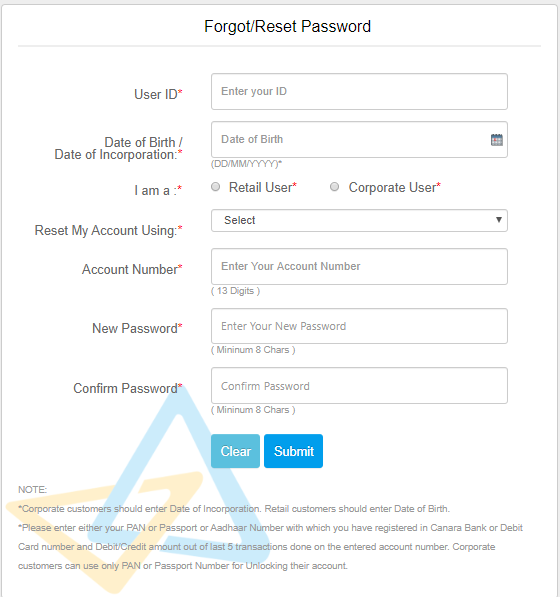

How to Reset Your Password on the Canara Internet banking-Canara Portal ?

- Step 1: Visit the Canara Internet banking site and click ‘Net Banking – Retail.’

- Step 2: Click ‘Forgot password’ and enter details like user ID, date of birth, and account number.

- Step 3: You will now be redirected to the ‘forgot/reset password page.

- Step 4: Here, you need to enter details such as your user ID, date of birth and account number.

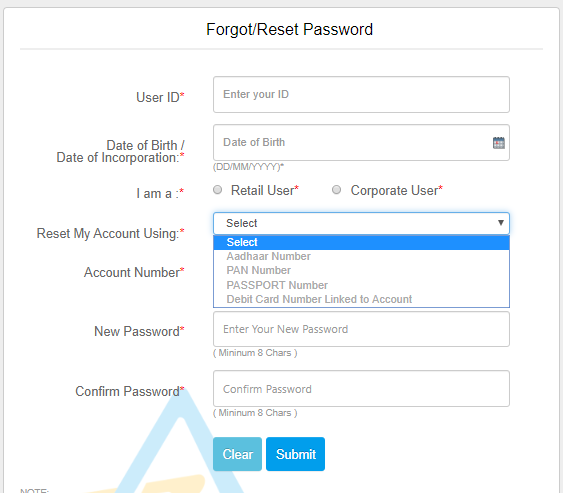

From the drop-down menu, choose your preferred option to reset the password (such as your Aadhaar number, passport number, PAN or the debit card number linked to the account). Enter the new password twice in the spaces provided, to confirm the same.

- Step 5: Next, click on‘ Submit’. Your password will now be reset.

How to Transfer Funds on the Canara Bank Netbanking Portal?

- Step 1: Visit the Canara Internet Banking site. On the homepage, click on the ‘Net Banking – Retail’ button.

- Step 2: On the resultant screen, enter your username and password. Next, enter the captcha before clicking on the ‘Login’ button.

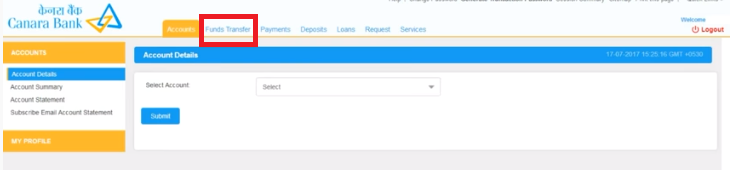

- Step 3: Click ‘Funds Transfer’ on the dashboard.

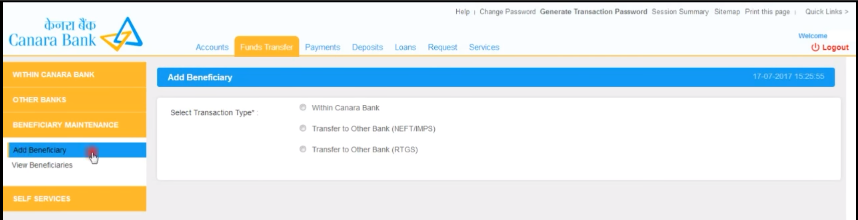

- Step 4: Under ‘Beneficiary Maintenance,’ click ‘Add Beneficiary’ for a new account.

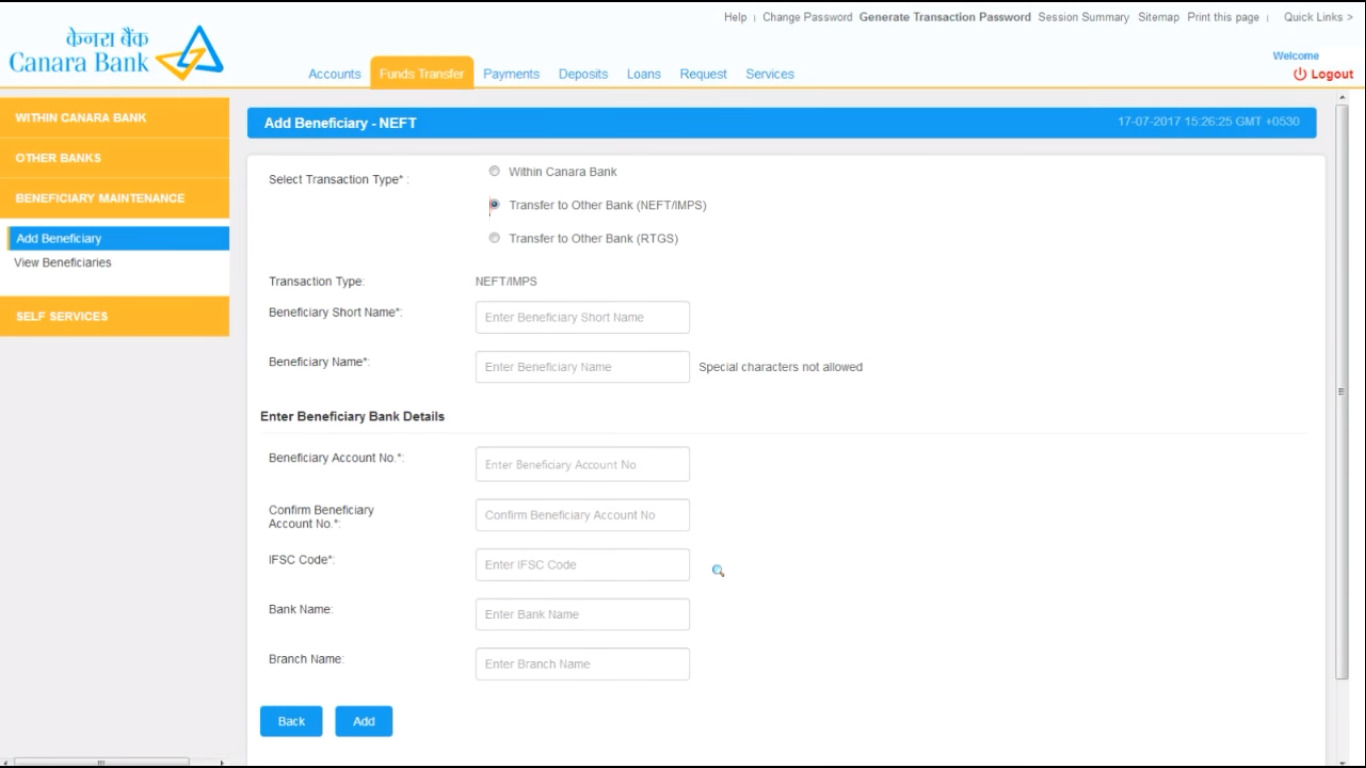

- Step 5: Choose the transaction type and fill in the beneficiary details.

- Step 6: Depending upon the transaction type you choose, a form will be displayed on your screen. For instance, if you choose the second option, the following form will be displayed:

- Step 7: Enter the required details such as the beneficiary name, account number, IFSC code, bank name and branch name and click on the ‘Add’ button.

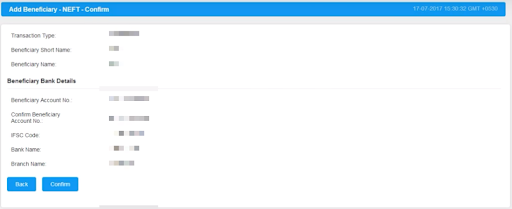

- Step 8: You will then be asked to review the details entered.

If everything seems to be in order click the ‘Confirm’ button.

If you find any of the details entered to be incorrect, click ‘Back’ to go to the previous screen and re-enter the correct details.

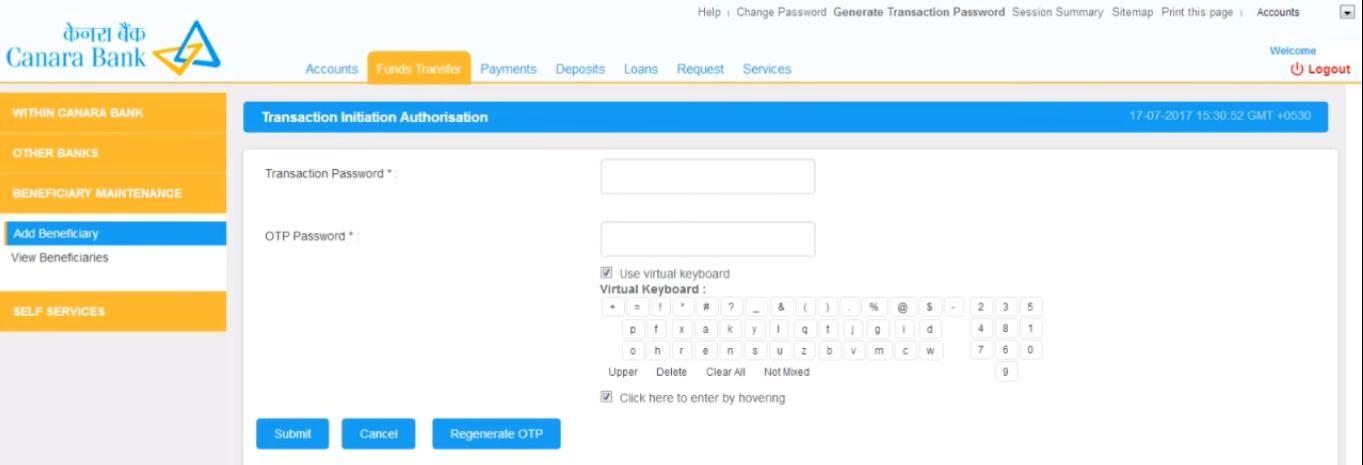

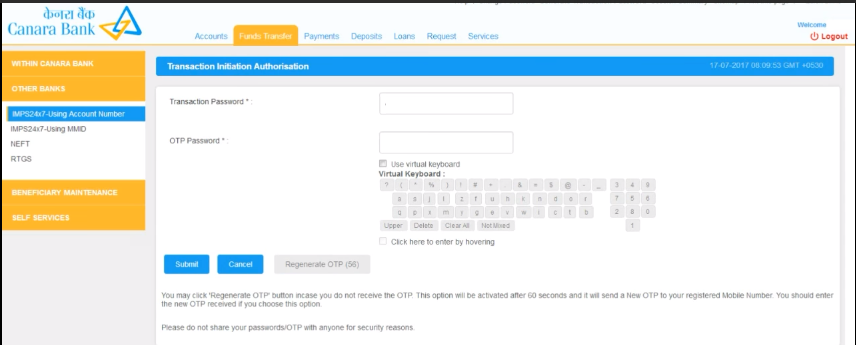

- Step 9: On the following page, a transaction password and the OTP sent to your mobile. Enter the same in the space provided and click ‘submit’

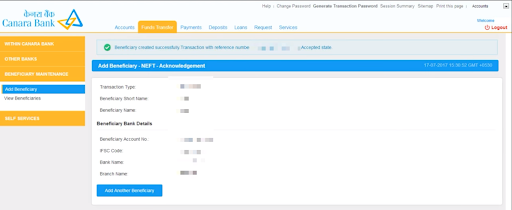

- Step 10: The following screen will appear upon the successful addition of the beneficiary.

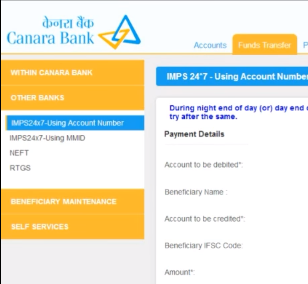

- Step 11: Now choose the ‘Other Banks’ option for this beneficiary and select the appropriate transfer option

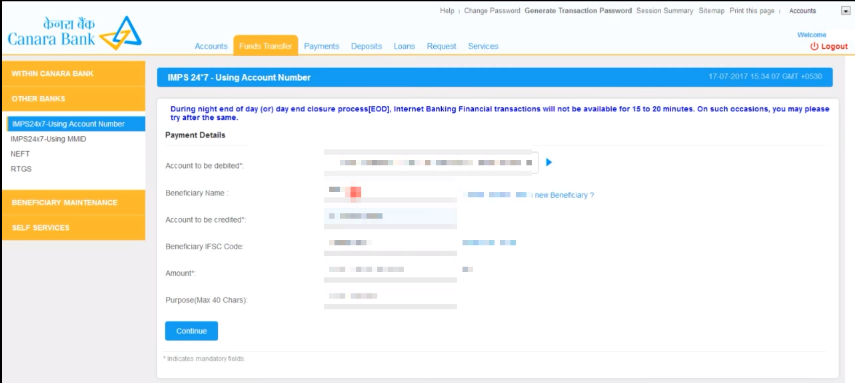

- Step 12: Then, enter relevant details as shown below and click ‘continue’

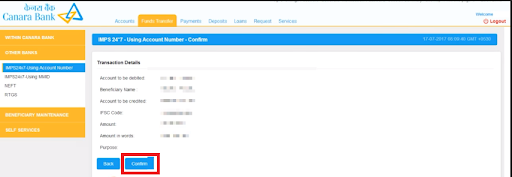

- Step 13: Ensure that you check if the details are correct and click the ‘confirm’ button on being satisfied that everything is in order.

- Step 14: Enter your transaction password and the OTP received. Then, click ‘ submit’ and the fund transfer process.

FAQs

What is Canara Bank?

Canara Bank is a major public sector bank in India, providing a wide range of banking services, including personal banking, savings accounts, fixed deposits, and debit cards.

What is the SWIFT code for Canara Bank?

The SWIFT/BIC code for Canara Bank is CNRBINBBXXX.

How can I open an NRO/NRE account with Canara Bank?

To open an NRO/NRE account, you need to provide the necessary details such as the SWIFT code, your account number, and the bank's branch name.

What are the different types of deposit accounts offered by Canara Bank?

Canara Bank offers various deposit accounts, including fixed deposits, recurring deposits, and time deposits, with different interest rates and tenures.

What is the minimum tenor for Canara Bank's deposit accounts?

The minimum tenor for Canara Bank's deposit accounts is 7 days.

What is the interest rate for Canara Bank's deposit accounts?

The interest rates for Canara Bank's deposit accounts vary depending on the account type, tenure, and the amount deposited. The bank offers different interest rates for general public, senior citizens, and other categories.

What is the maximum deposit acceptable for Canara Bank's tax-saving deposit scheme?

The maximum deposit acceptable for Canara Bank's tax-saving deposit scheme, known as the Kamadhenu Deposit Plan, is ₹1.50 lakh.

What is the process for reclaiming unclaimed deposits with Canara Bank?

Canara Bank has an unclaimed deposit initiative that allows customers to reclaim forgotten funds and ensure their financial assets are secure.

What is the process for accessing Canara Bank's download center?

To access Canara Bank's download center, you need to visit their website and navigate to the download center page.

For interest rates on single domestic bulk term deposits of ₹10 Crore and above, how can I get the rates?

For interest rates on single domestic bulk term deposits of ₹10 Crore and above, you need to contact the bank directly or visit the net banking portal.