Apply for Atal Pension Yojana 2024 and know about benefits and scheme.

Account Holders in NPS, and APY will able to Contribute through UPI

The account holders in NPS APY will be able to contribute through UPI, which is a unique payment identifier. This will enable them to receive pension payments directly into their bank account without any hassles. The UPI facility will also help in easy and hassle-free transfer of funds between the NPS account and the linked bank account.

How to make Payment through UPI under NPS, APY

Under the National Pension Scheme (APY), subscribers can make payments through UPI.

To make a payment through UPI, the subscriber will need to have a UPI-enabled bank account and a mobile phone with internet connectivity. The subscriber will also need to generate a UPI PIN for their bank account.

Once these requirements are met, the subscriber can follow the steps below to make a payment through UPI:

- Open the app of the respective UPI-enabled bank on your mobile phone.

- Tap on the ‘Collect’ or ‘Pay’ option.

- Enter the details of the payee, including their name, registered mobile number and APY scheme ID.

- Enter the amount you wish to pay and tap on the ‘Submit’ button.

- Enter your UPI PIN to complete the transaction.

Big Change in Atal Pension Yojana, Income Tax Payer Will Not Be Given Benefit

- As per the latest changes announced in the Atal Pension Yojana (APY), those who are income tax payers will not be given any benefit under the scheme. This is a big change from the earlier scheme where all citizens were eligible for benefits

- The main aim of the APY scheme is to provide social security in old age, especially to those who are not covered by any pension scheme. Under the scheme, subscribers are required to contribute monthly towards their pension account. The government also contributes 50% of the subscriber’s contribution, up to a maximum of ₹1,000 per year.

- At present, there are more than 2 crore subscribers under the APY scheme. The government has so far contributed ₹6,716 crore as a matching contribution.

Total Number of Accounts Under Atal Pension Yojana Crossed 4 Crore 71 Lakh Beneficiaries Are Getting the Benefit of Atal Pension Yojana

As of 2019, the total number of accounts under the scheme had crossed 4 crore, with 71 lakh beneficiaries receiving the benefit of APY.

The scheme has been successful in providing a much-needed social security net to the working population of India, who are otherwise not covered by any formal pension system. It has also helped to increase financial inclusion in the country, as many APY account holders are from low-income households and rural areas.

Going forward, the government is aiming to increase awareness about the scheme and expand its coverage so that even more people can benefit from it.

Atal Pension Yojana Highlights

- Atal Pension Yojana (APY) is a defined contribution pension scheme with a guaranteed minimum pension of ₹1000/- per month, ₹2000/- per month, ₹3000/- per month, ₹4000/- per month or ₹ 5000/- per month, depending on the contributions made by the subscriber.

- The scheme is open to all Indian citizens having a savings bank account. The subscribers would have to contribute regularly for at least 20 years to get the guaranteed minimum monthly pension from their 60th year onwards. The Government of India would also co-contribute 50% of the subscriber’s contribution or ₹1000/- per annum, whichever is lower, to each eligible APY account holder for a period of 5 years to encourage them to join the scheme.

Membership is taken by more than 65 Lakh Citizens

More than 65 lakh citizens have enrolled in the Atal Pension Yojana (APY), making it one of the world’s largest social security schemes. Under the scheme, subscribers will receive a minimum monthly pension of ₹1,000 after retirement, depending on their contribution. The government has also set up a number of incentive schemes to encourage more people to join APY.

Get ₹10000 per Month Pension by Investing Under Atal Pension Yojana

- The Atal Pension Yojana (APY) is a government-backed pension scheme that offers a guaranteed monthly pension of ₹1,000 to ₹5,000 from the age of 60. To be eligible for the scheme, subscribers must be between 18 and 40 years of age and should have an active bank account.

- The APY was launched by the Government of India to provide social security to the unorganized sector workers. The scheme is open to all Indian citizens, including those working in the informal sector.

- Subscribers can enroll in the scheme through any participating bank or post office. The government contributes 50% of the subscriber’s monthly contribution, up to a maximum of ₹1,000 per annum.

The Atal Pension Yojana is administered by the Pension Fund Regulatory and Development Authority (PFRDA).

Tax Benefits Under Atal Pension Yojana

Atal Pension Yojana offers multiple tax benefits that can help you save money.

- Tax deduction under Section 80CCD(1): You can get a tax deduction of up to ₹1.5 lakhs on your contribution to Atal Pension Yojana. This deduction is over and above the ₹1.5 lakhs limit under Section 80C of the Income Tax Act.

- Exemption from tax on maturity: You will not have to pay any taxes on the maturity amount received from Atal Pension Yojana.

- Death Benefit: In case of your untimely death, your nominee will receive the entire accumulated pension corpus. This amount is exempted from taxes.

The Number of Shareholders in Atal Pension Yojana Has Crossed Three Crores

The number of shareholders in Atal Pension Yojana (APY) has crossed the three crore mark within three years of its launch. The scheme was launched with an aim of providing social security cover to the unorganised sector workers after their retirement.

As per the latest data, the total number of APY subscribers has reached 3.10 crore. Out of these, 1.95 crore (63%) are male subscribers and 1.15 crore (37%) are female subscribers.

The scheme has been successful in attracting a huge number of subscribers due to its attractive features like simple eligibility criteria, low minimum monthly contribution, and government co-contribution for those who joined the scheme before.

Increase in the Number of Account Holders

As per the latest data, the number of account holders under the Atal Pension Yojana (APY) has increased to 1.31 crore. This is a significant increase from the 1.03 crore account holders reported previously.

The APY is a government-sponsored scheme that was launched with the aim of providing social security to the unorganised sector workers in India. Under this scheme, subscribers are guaranteed a minimum monthly pension of ₹ 1000/- after reaching the age of 60 years.

Atal Pension Yojana Transaction Details

Under the APY, subscribers are required to make monthly contributions for 20 years. The maximum monthly contribution under this scheme is ₹ 1,454. The government will also make a matching contribution of 50% of the subscriber’s contribution, up to a maximum of ₹ 1,000 per year.

Atal Pension Yojana 52 Lakh New Subscribers

The APY has been very successful in its first year of operation, with 52 lakh new subscribers joining the scheme. This is a significant achievement, given that only about 10% of India’s population has access to formal pensions.

The APY is an important step towards ensuring financial security for India’s vast population of informal workers. It will help them save for their retirement and protect them from poverty in old age.

Registrations So Far Under Atal Pension Yojana

Nearly 1.6 crore subscribers have registered under the Atal Pension Yojana (APY). This is a social security scheme launched by the Government of India, aimed at providing a defined pension to the citizens of India who are not covered by any other similar scheme.

Objective of Atal Pension Yojana

The objective of APY is to provide social security in old age to all eligible subscribers of the scheme and to ensure that no subscriber is left without a pension. The scheme is also designed to promote financial inclusion by encouraging more people to join the formal financial system and save for their retirement.

Atal Pension Yojana Exit Before 60 Years

If you want to exit the APY before 60 years of age, you must do so before the scheme matures. You will not be able to receive any benefits from the scheme if you exit after the scheme has matured. To exit the scheme, you must submit a written request to the pension provider. The pension provider will then refund your contributions, minus any early withdrawal penalties.

Atal Pension Yojana Withdrawal

Withdrawal from the Atal Pension Yojana is allowed only after the completion of 60 years of age. The beneficiary can choose to receive the pension either monthly or quarterly. The withdrawal can be made through any mode – online, offline or through auto-debit facility from the account linked with APY.

Fee in Case of Default Under Atal Yojana

In case of default in payment of monthly contributions, a subscriber will be charged a suitable penalty. This penalty will be deducted from the subscriber’s account balance. In addition, if a subscriber fails to make contributions for 3 consecutive months, their account will be deactivated.

National Pension System Trust

The National Pension System (NPS) was introduced by the Government of India with an objective to provide old age income security to all its citizens. The NPS is a defined contribution pension scheme where both the employee and the employer contribute towards the pension account of the employee. The employee can decide the investment mix of their corpus in different asset classes as per their risk appetite.

The NPS trust is managed by a statutory body set up by an Act of Parliament.

Tax Benefits Under Atal Pension Yojana

1) The subscription to APY is eligible for deduction from gross total income under section 80CCD(1), up to 10% of basic salary + DA.

2) The interest accrued on the contributions made to APY is exempt from income tax under section 80CCD(2).

3) The maturity proceeds received from APY are exempt from income tax.

Atal Pension Yojana Apply Online

Any citizen of India between the age of 18 and 40 years can join the APY. The subscribers would contribute monthly towards their pension account based on their age and chosen pension amount. On attaining the age of 60 years, the subscriber would start receiving a fixed pension every month. In case of death of the subscriber before 60 years, their spouse would be entitled to receive 50% of the pension amount as survivor benefit.

The APY is a good retirement planning option for those who are not covered under any other social security schemes. It is a safe and secure way to provide for one’s old age needs.

- To join APY, subscribers need to have a bank account and Aadhaar Number.

- They can then visit their local bank branch or Common Service Centre (CSC) to fill up the application form and submit it along with KYC documents.

- The subscriber would also need to make an initial contribution towards their pension fund, which can be done through auto-debit from their bank account or through any other mode such as cash, cheque, or Demand Draft (DD).After submission of the form and initial payment, the subscriber will receive a confirmation message on their registered mobile number.

- They can then start making regular monthly contributions towards their pension fund.

Atal Pension Yojana New Update

In its latest update, the Government has decided to increase the APY contribution limit from ₹6,000 to ₹12,000 per annum. This will provide more flexibility to subscribers and allow them to receive a higher pension benefit upon retirement.

Investment in the Scheme

For starters, it is a very affordable scheme with a minimum monthly contribution. This makes it an ideal investment option for people with limited resources. Secondly, the scheme offers guaranteed returns and pension payments, which makes it a secure investment option.

Thirdly, the APY scheme offers tax benefits under section 80CCD (1) of the Income Tax Act. This means that the contributions made towards the scheme are eligible for deduction from total taxable income up to a maximum of ₹ 1 lakh per annum. This makes the scheme an attractive investment option for tax-savvy investors. Lastly, the APY is portable, meaning that it can be transferred from one account to another in case of job change or relocation.

Pradhan Mantri Atal Pension Yojana (APY)

- Pradhan Mantri (APY) is a government-backed pension scheme. It is open to all Indian citizens. Under the scheme, subscribers will receive a fixed monthly pension after retirement, depending on their contribution amount.

- The government has set aside ₹1000 crore (US$ 150 million) for the scheme’s initial phase.

- To encourage more people to join the scheme, the government has announced several incentives. For instance, subscribers who opt for auto-debit of their contributions from their bank account will get a 50% subsidy on their annual premium up to ₹1000 (US$ 15).

- The minimum monthly pension they can receive is ₹1,000 and the maximum is ₹5,000. The pension amount will be decided based on the age of the subscriber at the time of joining the scheme and their chosen contribution amount.

- The Pradhan Mantri Atal Pension Yojana was launched to provide social security in old age and improve coverage of India’s vast unorganised sector workforce.

Prime Minister Atal Pension Yojana

The Atal Pension Yojana (APY) is a government-backed pension scheme in India for the unorganised sector. The scheme is open to all Indian citizens. Under the scheme, subscribers will receive a fixed minimum monthly pension of ₹ 1,000/-, 2,000/-, 3,000/-, 4,000/- or 5,000/- at the age of 60 years, depending on their contributions.

The government has also set up a dedicated website for people to apply for the APY online. The website currently allows people to view the APY online application form and also provides an APY chart that outlines the amount of pension that subscribers will receive at different contribution levels.

Subscriber Information Alert

Individuals who wish to subscribe to the Atal Pension Yojana can do so by providing their personal information to the administrators of the scheme. This information includes the subscriber’s name, date of birth, contact details, and bank account number.

The subscribers will then be required to make regular contributions to their pension accounts. The frequency and amount of these contributions will depend on the pension plan that the subscriber chooses. The administrator will provide the subscriber with an account statement every year, detailing the contributions made and the interest earned on them.

When the subscriber reaches the age of 60, they will start receiving a monthly pension from the administrator. This pension will be based on the contributions made and the interest earned on them. The monthly pension amount will increase or decrease depending on whether the subscriber continues to make regular contributions after they turn 60.

Atal Pension Yojana Enrollment and Payment

To enroll in the scheme, subscribers can visit any bank branch or Common Service Center (CSC) with their KYC documents. The enrollment process is simple and can be completed in just a few minutes. Once registered, subscribers have to make monthly contributions to their APY account, which can be done through auto-debit from their bank account or through online/ offline mode at any CSC.

The government also provides a subsidy on APY contributions for those who are not income tax assessees. For every ₹1 contribution made by the subscriber, the government adds a 50 paise subsidy, up to a maximum of ₹1250 per year. This subsidy is credited to the subscriber’s APY account every quarter.

As more and more people enroll in the scheme, it is important to spread awareness about how easy it is to join and how beneficial the scheme can be in ensuring a secure retirement life.

Atal Pension Yojana Enrollment Agency

- Banks – All nationalised, scheduled commercial, and rural banks are authorized to enroll subscribers under the APY.

- Post Offices – Head post offices and selected sub-post offices offer APY enrollment facilities.

- Business Correspondents (BCs) – BCs are appointed by banks to provide financial services in remote or underserved areas. They can also help with APY enrollment.

- Common Service Centers (CSCs) – CSCs are village-level digital service delivery points set up by the government. They offer various e-governance services, including APY registration.

To enroll in the scheme, interested individuals must visit their chosen enrollment agency and submit the necessary documents, along with a self-attested photograph. They will then be required to make an initial contribution towards their pension account, which can be done via cash, cheque or bank transfer. Subsequent contributions can be made on a monthly or quarterly basis, depending on the subscriber’s preference.

Funding of Atal Pension Yojana

Under this scheme, subscribers would receive a minimum guaranteed pension of ₹ 1000/- per month, ₹ 2000/- per month, ₹ 3000/- per month, ₹ 4000/- per month or ₹ 5000/- per month, depending on their contributions, from the age of 60 years till death.

The scheme is open to all Indian citizens having a bank account who wish to join it voluntarily. The benefit of this scheme is not just restricted to the subscriber but also extends to their spouse and dependent children.

The subscribers have the option to exit from the scheme before attaining 60 years if they so desire and are free to make changes in their monthly contribution amount and choice of pension as per their convenience and affordability subject to conditions as may be specified from time to time.

Some Important Instructions of Atal Pension Yojana

- The minimum period of contribution under APY is 20 years.

- APY subscribers must have a savings bank account to enroll in the scheme.

- APY subscribers must provide their Aadhaar number at the time of enrolment.

- APY benefits will be paid out only after the subscriber reaches the age of 60 years.

- In case of death of an APY subscriber before the age of 60, the pension accumulated till date will be paid to the nominee/legal heir.

Atal Pension Yojana Key Facts

- The Atal Pension Yojana is a government-backed pension scheme in India.

- It was launched with the aim of providing social security to the unorganised sector workers.

- Under the scheme, subscribers are guaranteed a minimum monthly pension of ₹1,000/- (US$15) after retirement, which can go up to ₹5,000/- (US$75) per month depending on their contributions.

- The scheme is open to all Indian citizens who have a bank account and are not already covered by any other pension scheme.

- Contributions can be made every month and must be paid for at least 20 years to get the full benefits of the scheme.

- Subscribers can choose to exit the scheme at any time before they reach 60 years of age, but will only receive a partial refund of their contributions.

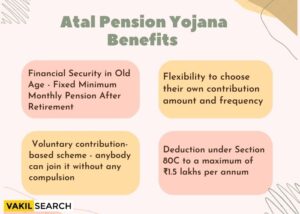

Benefits of Atal Pension Yojana

- It provides financial security in old age: The APY scheme ensures that the subscribers would receive a fixed minimum monthly pension after retirement, thereby ensuring financial security in their old age.

- It is a voluntary scheme: The APY is a voluntary contribution-based scheme and therefore, anybody can join it without any compulsion.

- It offers flexibility in terms of contribution amount and frequency: The subscribers have the flexibility to choose their own contribution amount and frequency (monthly/quarterly/half-yearly/yearly) as per their convenience and affordability.

- It comes with an attractive tax benefit: The contributions made towards APY are eligible for deduction under Section 80C of the Income Tax Act, 1961 up to a maximum of ₹1.5 lakhs per annum. This makes it an attractive investment option for taxpayers looking for avenues to save taxes.

Status of Non-contribution Under Atal Pension Yojana

As per the latest data released, more than 1.27 crore subscribers have registered under the Atal Pension Yojana (APY) since its launch. Out of these, only 24.55 lakh APY accounts are active, with a monthly contribution of ₹42.45 crore being deposited into them. This means that just 19.2% of APY subscribers are actually contributing to their pension accounts on a regular basis.

The low contribution rate under the APY is a matter of concern, especially given that the scheme is meant for people from lower-income groups who may not have adequate resources to save for their retirement.

It is therefore important for the government to take steps to increase awareness about the scheme and its benefits, as well as ensure that subscription rates remain affordable for those who are most in need of a regular source of income during their old age.

Who Is Not Eligible to Get the Government’s Co-ordination Under Apy

- The government coordination is not available for individuals who are already covered under the Employees’ State Insurance Corporation (ESIC) or the Central Government Health Scheme (CGHS).

- In addition, those who are employed with the state government or have subscribed to any statutory social security scheme are also not eligible for government coordination.

Important Documents of Atal Pension Yojana (Eligibility)

- Proof of identity: This can be in the form of a passport, PAN card, Aadhaar card, voter ID card, or any other government-issued photo ID.

- Proof of age: This can be in the form of a birth certificate, school leaving certificate, or any other government-issued document showing your date of birth.

- Proof of address: This can be in the form of a utility bill, bank statement, ration card, or any other government-issued document showing your current address.

- Proof of nationality: This can be in the form of a passport, voter ID card, or any other government-issued document showing your nationality as Indian.

- Bank account details: You will need to provide details of an active bank account in order to receive benefits under the scheme.

APY Scheme Contribution Chart

Age (In Years) |

Monthly Contribution Required to Get a Minimum Pension of ₹1000 |

| 20 | 42 |

| 25 | 60 |

| 30 | 78 |

| 35 | 96 |

| 40 | 114 |

| 45 | 132 |

| 50 | 150 |

| 55 | 180 |

How to Apply for Atal Pension Yojana?

- To apply for this scheme, you can visit any nearest Common Service Center (CSC) or Atal Pension Yojana Kendra.

- You will need to fill up an application form and submit it along with KYC documents like Aadhar Card, PAN Card, bank passbook etc.

- The application process is completely online and paperless.

- Once your application is approved, you will be enrolled in the scheme and will start contributing towards your pension fund.

Account Opening Process Under APY Without Mobile App or Net Banking

- Visit your nearest bank branch that offers the APY scheme.

- Fill out the application form and submit it along with the required documents.

- The bank will then open an account under the APY scheme and give you a passbook or statement of account.

- You will need to make an initial deposit into this account, which can be done through various channels such as cash, cheque, DD, etc.

- After this, you will need to regularly contribute to your APY account in order to keep it active. The amount and frequency of contributions will depend on the type of account you have chosen.

Process to Download Atal Pension Yojana Contribution Chart

- Firstly, visit the official website of Atal Pension Yojana

- On the homepage, click on the ‘Contributions’ tab given at the top of the page

- Now, select the option of ‘Download Contribution Chart’ from the drop-down menu

- A new page will open where you will have to enter your APY ID or PRAN number

- After entering all the required details, click on the ‘Submit’ button

- Your APY chart will be displayed on the screen which you can download and take a printout of for future reference

Process to View Endowment Details of Atal Pension Yojana

Endowment details of Atal Pension Yojana can be viewed in the following ways:

- Online:

-

- Visit the official website of Atal Pension Yojana

- Enter your APY number and registered mobile number

- An OTP will be sent to your registered mobile number

- Enter the OTP and click on ‘Submit’

- Your endowment details will be displayed on the screen

- Offline:

- Download the application form from the official website of Atal Pension Yojana

- Fill in the required details

- Submit the duly filled application form to the nearest APY office

Procedure for Receiving Information Related to Service Provider

- The first step is to contact your nearest Common Service Center (CSC). The center will be able to provide you with a list of service providers in your area.

- Next, you need to visit the website of the Pension Fund Regulatory and Development Authority (PFRDA) and select the name of your state from the drop-down menu.

- Now, you will be redirected to a page where you can select your district.

- After selecting your district, a list of all the service providers under Atal Pension Yojana in that district will be displayed on the screen.

- You can also get in touch with the Nodal Officer of PFRDA in your state for more information on service providers.

- The contact details of Nodal Officers are available on the PFRDA website itself.

Process to View Apy E-pran/Transaction Statement View

There are two ways to view your APY ePRAN or transaction statement – online and offline.

If you wish to view your APY ePRAN or transaction statement online, you will need to log in to your account on the official website of the Atal Pension Yojana. Once you have logged in, you will be able to view all your account details, including your ePRAN, transaction history, and balance information.

If you prefer to view your APY ePRAN or transaction statement offline, you can do so by visiting your nearest Common Service Center (CSC). At the CSC, you will need to provide your 12-digit APY identification number and registered mobile number. After verifying your identity, the CSC representative will generate a printout of your ePRAN and transaction statement for you.

Important Forms

- Several important forms must be completed in order to apply for the Atal Pension Yojana (APY). The first form is the APY application form, which can be downloaded from the official website of the scheme. This form must be duly filled and submitted to the concerned authority along with the requisite documents.

- The second form is the KYC (Know Your Customer) form, which is mandatory for all applicants. This form can be obtained from any bank or financial institution that offers pension schemes. The applicant must furnish all personal details in this form, such as name, address, date of birth, identity proof, etc.

- The third form is the NPS (National Pension Scheme) registration form. This form is available on the official website of PFRDA (Pension Fund Regulatory and Development Authority). The applicant must create an account on this website and then fill in all the required details in this form. After successful submission of this form, the applicant will receive a Permanent Retirement Account Number (PRAN).

- The fourth and final form is the Atal Pension Yojana contribution slip, which can be downloaded from the official website of APY. This slip must be duly filled and submitted to the bank or post office where you have opened your account under APY.

Quick Links

- Atal Pension Yojana Online Application: Apply for the scheme online through the official website.

- APY Chart: See the benefits you are entitled to under the scheme.

Important Downloads

Before you begin the Atal Pension Yojana online application process, there are some important documents and pieces of information you will need to have on hand. Collect these items in advance so that you can complete your application quickly and easily.

- Your bank account details: You will need to provide your bank account number and IFSC code so that the government can deposit your pension payments into your account each month.

- Aadhaar number: You will need to provide your Aadhaar number in order to complete the online application process. If you do not have an Aadhaar number, you can visit a nearby enrollment center to get one.

- Mobile phone number: You will need to provide a mobile phone number during the online application process. This mobile number must be registered with Aadhaar in order to complete the process.

- Details of your nominee: You will need to provide the name, date of birth, and relationship of your nominee during the online application process. Your nominee is the person who will receive your pension payments in the event of your death.

Myth Busters for This Scheme

- One of the most common myths about government schemes is that they are always late in getting delivered. But the fact is that the Atal Pension Yojana was launched on time and is being implemented as per schedule.

- Another myth about this scheme is that it is only for the poor and uneducated. But the fact is that anyone can join this scheme, regardless of their economic or social status.

- Lastly, there is a misconception that the scheme does not provide adequate coverage. But the fact is that it offers a minimum guaranteed pension of ₹1,000 per month, which can go up to ₹ 5,000 per month, depending on the subscriber’s contribution.

Why Vakilsearh

Vakilsearch is the best place to learn about this scheme because we provide accurate and up-to-date information. We have a team of business consulting experts who can guide you through the process and help you make the best decision for your future.

FAQs

How do I apply for Atal Pension Yojana?

You can apply for Atal Pension Yojana Online through the National Pension System (NPS) Portal or at any of the Common Service Centers (CSCs).

What are the documents required for Atal Pension Yojana Online Application?

The following documents are required for Atal Pension Yojana Online Application: - Proof of identity (Aadhaar, PAN, passport, voter ID etc.) - Proof of age (birth certificate, school leaving certificate, passport etc.) - Bank account details (bank passbook or statement) - If employed, NPS account number and swivel savings bank account number - Photographs

What is the eligibility criteria for Atal Pension Yojana?

The following individuals are eligible to join APY: All Indian citizens in the age group of 18 – 40 years Individuals who are currently not a member of any statutory social security scheme The same individual cannot have more than one APY account. However, an individual who has withdrawn from APY can rejoin subject to fulfillment of conditions prescribed.