Atal Pension Yojana, started by the Indian government in 2015, is a savings plan that helps low-income workers save money for a stable income after they retire. It's mainly for those who don't have formal jobs and is managed by the Pension Funds Regulatory Authority of India (PFRDA).

APY – Atal Pension Yojana

Atal Pension Yojana (APY) is a government-backed pension scheme in India that was launched in June 2015. It is named after Atal Bihari Vajpayee, a former Prime Minister of India. This scheme is aimed at providing a steady income to individuals in their old age, especially those working in the unorganised sector.

What is the Atal Pension Yojana?

APY is a pension scheme specifically designed to enable workers in the unorganised sector to voluntarily save for their retirement. The Indian Government provides a co-contribution to the subscriber’s pension fund for a period of 5 years. Under APY, the subscribers would receive a fixed minimum pension of ₹ 1,000 to ₹ 5,000 per month at the age of 60 years, depending on their contributions, which itself would vary on the age of joining the APY.

Atal Pension Yojana Information

- Eligibility: Indian citizens between the age of 18 and 40 years.

- Pension Amount: Fixed pension ranging from ₹ 1,000 to ₹ 5,000 per month.

- Contribution Period: The contributions are made till the age of 60.

- Government Co-contribution: 50% of the subscriber’s contribution or ₹ 1,000 per annum, whichever is lower.

- Mode of Payment: Automatically debited from the subscriber’s bank account.

- Premature Withdrawal: Allowed only in exceptional circumstances such as terminal illness.

Objectives of Atal Pension Yojana

The Atal Pension Yojana (APY) is a social security scheme launched by the Government of India with the objective of providing a sustainable pension to the citizens of India, particularly those working in the unorganised sector. The key objectives of the Atal Pension Yojana are as follows:

- Provide a fixed minimum pension: The primary objective of APY is to ensure a fixed minimum pension to eligible individuals in their old age. The scheme aims to provide a steady source of income after retirement, helping individuals meet their basic financial needs.

- Encourage voluntary savings for retirement: APY aims to promote a savings culture among individuals working in the unorganised sector. It encourages them to contribute a small amount of their income during their working years towards the pension scheme, ensuring financial security in their old age.

- Target the unorganised sector: The scheme specifically targets workers in the unorganised sector who are not covered under any formal pension scheme. This includes individuals working as labourers, maids, drivers, gardeners, farmers, etc. APY aims to bridge the pension gap and extend social security to this economically vulnerable segment of the population.

- Provide flexibility and portability: APY allows individuals to contribute at different levels based on their age and desired pension amount. It also offers portability, enabling individuals to continue their contributions and enjoy pension benefits even if they relocate to a different location within India.

- Encourage long-term savings: The scheme encourages long-term savings by requiring contributions from individuals for a minimum period of 20 years or until they reach the age of retirement (60 years), whichever is later. This ensures that individuals make regular contributions towards their pension fund, promoting financial discipline and stability.

- Government co-contribution: To incentivise participation, the government provides a co-contribution to eligible subscribers. Under the scheme, the government contributes 50% of the subscriber’s contribution or £1,000 per year (whichever is lower), for a period of five years for subscribers who joined between 1st June 2015 and 31st December 2015, and who are not covered by any statutory social security scheme.

How to Download the APY Form?

- Step 1: Visit the official website Go to the official website of the Atal Pension Yojana. In the case of the Indian Government’s APY scheme, you can visit the official website of the Pension Fund Regulatory and Development Authority (PFRDA) or any other authorised government website that provides the APY form.

- Step 2: Navigate to the APY section Look for the APY section on the website. It is usually found under the Pension Schemes or Downloads section. You may need to explore the website’s menu or use the search function to find the appropriate section.

- Step 3: Locate the APY form Once you are in the APY section, search for the APY form download link. It is typically labelled as ‘APY Application Form’ or ‘APY Form.’ Click on the provided link to proceed.

- Step 4: Choose the form format Depending on the website, you may have the option to download the APY form in PDF or Word document format. Select the format that is convenient for you and click on the corresponding download link.

- Step 5: Save the form After clicking the download link, a prompt will appear asking you to save the file. Choose a location on your computer or device where you want to save the APY form and click ‘Save’ or ‘OK.’

- Step 6: Access the downloaded form Once the download is complete, navigate to the location on your computer or device where you saved the APY form. Locate the file and ensure that it is accessible.

- Step 7: Open the form Double-click on the downloaded APY form file to open it. If it is a PDF, you can use a PDF reader application like Adobe Acrobat Reader. If it is a Word document, you can use any compatible word processing software.

- Step 8: Print the form (optional) If you prefer a physical copy of the APY form, you can print it using a connected printer. Ensure you have sufficient paper and ink or toner in your printer before initiating the print command.

- Step 9: Fill out the form With the APY form open, carefully fill in the required details as per the instructions provided. Provide accurate and up-to-date information to avoid any issues with your APY application.

- Step 10: Review and verify Once you have completed filling out the form, review all the entered information to ensure its accuracy. Double-check spellings, numbers, and other crucial details.

- Step 11: Submit the form Follow the submission instructions provided on the form. It may involve submitting the form physically at a designated office or mailing it to the relevant authority. Make sure to include any necessary supporting documents as mentioned in the instructions.

Process to Apply for the Atal Pension Yojana

- Step 1: Eligibility Check Verify if you meet the eligibility criteria for APY. The scheme is open to Indian citizens between the ages of 18 and 40.

- Step 2: Choose a Pension Amount Decide on the pension amount you wish to receive per month after retirement. APY offers various pension options ranging from ₹1,000 to ₹5,000 in increments of ₹1,000.

- Step 3: Approach a Bank or Financial Institution Visit a bank or financial institution authorised to offer the APY scheme. You can check the list of authorised institutions on the official APY website or inquire at your local bank.

- Step 4: Obtain the APY Application Form Request the APY application form from the bank or financial institution. They will provide you with the necessary form to apply for APY.

- Step 5: Fill out the Application Form Carefully fill in all the required details in the application form. Provide accurate information regarding your personal details, bank account information, nominee details, and pension amount chosen.

- Step 6: Attach Supporting Documents Attach the necessary supporting documents, such as proof of identity (Aadhaar card, PAN card, etc.) and proof of address (utility bill, passport, etc.), as per the requirements specified on the application form.

- Step 7: Submit the Application Submit the filled-out application form along with the supporting documents to the bank or financial institution. Ensure that you keep a copy of the filled-out form and the supporting documents for your reference.

- Step 8: Make the Initial Contribution Make the initial contribution towards the APY scheme. The bank or financial institution will inform you about the contribution amount and the payment mode (monthly, quarterly, or yearly).

- Step 9: Receive the PRAN and Statement of Transaction Once your application is processed, you will receive a Permanent Retirement Account Number (PRAN) and a Statement of Transaction from the bank or financial institution. The PRAN will serve as a unique identifier for your APY account.

- Step 10: Regular Contribution Ensure that you make regular contributions towards the APY scheme as per the payment mode selected. Maintain sufficient funds in your bank account to cover the contribution amount.

- Step 11: Review and Update Periodically review your APY account and ensure that your contact details, nominee details, and bank account information are up to date. Notify the bank or financial institution in case of any changes.

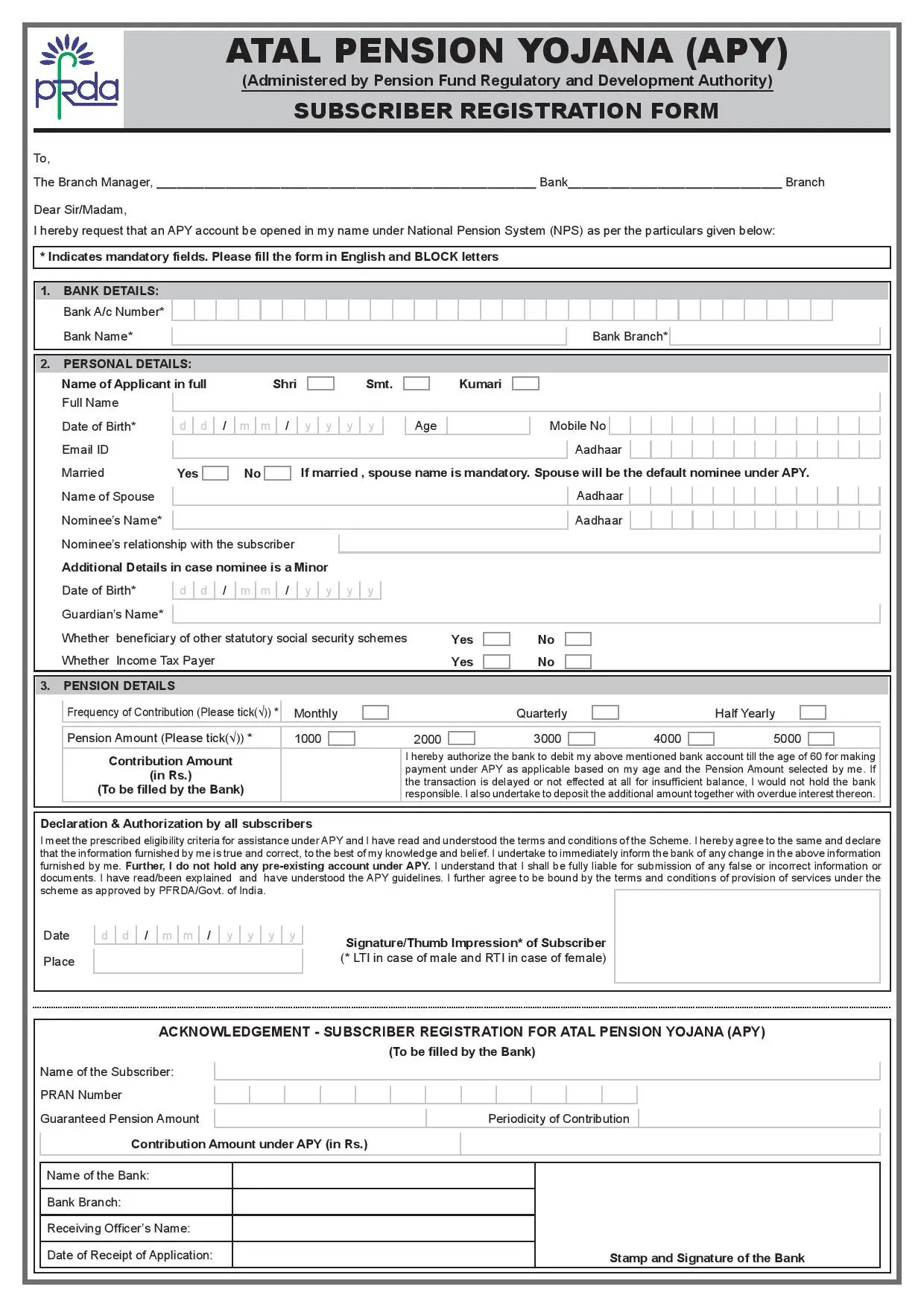

How to Fill the Atal Pension Yojana Form? (steps in detail)

- Personal Information: Enter your full name, date of birth, age, and contact details (phone number and email address) in the respective fields.

- Bank Details: Provide your bank account number and IFSC code of the bank branch.

- Identity and Address Proof: Fill in your Aadhaar number or other identity proof details, and your complete address.

- Nominee Information: Specify the name, relation, age, and Aadhaar number of the nominee, who will receive the benefits in case of your untimely demise.

- Pension Amount Selection: Select the monthly pension amount you wish to receive on retirement (ranging between ₹ 1,000 to ₹ 5,000). This will determine the amount you need to contribute regularly.

- Declaration: Read the declaration carefully and sign the form. Your Aadhaar card will generally be used for KYC authentication.

- Submission: After filling in the details, review it for accuracy, and submit the form to your bank along with photocopies of the necessary documents.

What Is the Investment Plan for the Atal Pension Yojana (APY)?

The investment plan for (APY) Atal Pension Yojana depends on the fixed pension amount you choose to receive upon retirement and the age at which you join the scheme. The earlier you join, the lower will be your monthly contribution. Contributions are made until the subscriber reaches the age of 60.

Contributions Towards the Atal Pension Yojana

Contributions are made on a monthly basis through auto-debit from your bank account. The contribution amount varies based on the chosen pension amount and the age at which the subscriber joins. The Government also contributes 50% of the total contribution or ₹ 1,000 per annum, whichever is lower, for a period of 5 years.

Atal Pension Yojana Withdrawal Procedure

To withdraw from the Atal Pension Yojana (APY), you need to follow the procedure outlined below:

- Application: Obtain an application form for withdrawal from the Atal Pension Yojana. You can either visit the bank branch where you have your APY account or download the form from the official website of the scheme.

- Form Filling: Fill out the withdrawal form with accurate and up-to-date information. You will need to provide details such as your APY account number, name, address, contact information, etc. Ensure that all the information is correctly filled in the form.

- Supporting Documents: Gather the necessary supporting documents to accompany your withdrawal application. This typically includes a copy of your APY account statement, proof of identity (such as Aadhaar card, PAN card, voter ID, etc.), and proof of address (such as Aadhaar card, utility bill, passport, etc.). The specific documents required may vary depending on the bank or financial institution where you hold your APY account.

- Submit the Application: Visit your APY account branch and submit the duly filled withdrawal form along with the supporting documents to the concerned authority or official. Make sure to keep a copy of the form and supporting documents for your records.

- Verification: The bank or financial institution will verify your application and supporting documents. They may contact you for any additional information or clarification if required.

- Processing: Once your application is verified, the bank will initiate the withdrawal process. The withdrawal amount will be calculated based on the accumulated pension corpus in your APY account.

- Disbursement: The withdrawal amount will be credited to your registered bank account through electronic funds transfer (EFT). It may take some time for the funds to be transferred, so be patient during this process.

Atal Pension Yojana Penalty Charges

- Late Payment: If you fail to contribute the required premium amount for a particular month, a penalty will be imposed. The penalty amount varies depending on the contribution amount and the duration of the delay. The penalty ranges from Rs. 1 to Rs. 10 per month, depending on the monthly contribution.

- Non-Payment or Default: If you do not make any contributions for a continuous period, your APY account will be classified as a ‘Defaulted Account.’ In such cases, the bank or financial institution may freeze your account and take necessary actions as per the terms and conditions of the scheme. The frozen account can be reactivated by paying the outstanding contributions along with the penalty charges.

Atal Pension Yojana Eligibility

- Must be an Indian citizen

- Should be between 18 to 40 years of age

- Should have a savings bank account

- Should not be covered under any statutory social security scheme

- Features & Benefits of the Atal Pension Yojana

- Fixed pension ranging from ₹ 1,000 to ₹ 5,000 per month

- Government co-contribution for eligible subscribers

- Provides financial security during old age

- Easy and low contribution amounts

- Option for increasing or decreasing pension amount annually

- Penalty for delayed payment is minimal

Recent Update on Atal Pension Yojana

Subscribers of over 5.25 crore have enrolled for Atal Pension Yojana

- The Atal Pension Yojana (APY) was introduced in 2015.

- Over 5.25 crore people have enrolled in APY since its launch.

- It aims to provide income security during old age, especially for those in the unorganised sector.

- Subscriptions have been increasing, with a 20% growth in FY23 compared to FY22.

- It generated an investment return of 8.92% in FY22.

Atal Pension Yojana enrollments surpass the 5.2 crore mark

- As of March 31, 2023, more than 5.20 crore people have enrolled in APY.

- There was an increase of over 20% in new subscribers during FY 22-23.

- The total assets under management (AUM) for APY are over Rs. 27,200 crores.

- Subscribers need to contribute between Rs. 42 and Rs. 1,454 per month to receive a monthly pension of Rs. 1,000 to Rs. 5,000.

- Nine public sector banks, including Bank of India, State Bank of India, and Indian Bank, have been significant in enrolling subscribers.

- These leading banks have sourced more than 100 APY accounts per branch.

- Get in touch with Vakilsearch experts for any further queries about this scheme.

FAQs

1. If I want to open an Atal Pension Yojana account, what is the procedure to be followed?

To open an Atal Pension Yojana account, you need to fill out and submit the APY registration form at your bank with the necessary documents.

2. Is it mandatory to submit the Aadhaar number while registering for this scheme?

As of my last knowledge update in 2021, an Aadhaar number was preferred but not mandatory for registering in the APY scheme.

3. Can I open an Atal Pension Yojana account without holding a savings account?

No, you need to have a savings bank account to open an Atal Pension Yojana account.

4. How is the due date for the monthly contribution decided?

The due date for the monthly contribution is usually based on the date of registration and is auto-debited from your bank account.

5. Is it mandatory for subscribers to give a nomination when they join the Atal Pension Yojana scheme?

Yes, providing a nominee is mandatory when joining the Atal Pension Yojana scheme.

6. How many Atal Pension Yojana accounts can a subscriber open?

A subscriber can open only one Atal Pension Yojana account.

7. Can I join the Atal Pension Yojana scheme without holding an Aadhaar number?

Yes, you can join the APY scheme with other valid identity proof if you do not have an Aadhaar number.

8. Can members of the Employees Provident Fund (EPF) enrol for the Atal Pension Yojana scheme?

Yes, members of EPF can also enrol for the Atal Pension Yojana scheme.

9. Can I change my monthly contribution amounts?

Yes, you can change your monthly contribution amount once a year.

10. How can I check my account balance?

You can check your APY account balance through the APY e-PRAN portal or by contacting your bank.

11. What will happen to my account if I become an NRI?

If you become an NRI after opening the APY account, your account will continue, but you will not be eligible for government co-contributions.