Running a business is an exciting and highly rewarding experience, but business owners need to pay attention to taxation laws to ensure they are on the right track. Form 29B enables companies to disclose their book profits and is an integral part of maintaining tax compliance.

India’s taxation laws deal with all the business revenue and a business owner should know most of the taxation. Not filing the right forms and returns can make your company liable to pay penalties, and fines, and face legal prosecution. Hence, business owners need to constantly update themselves regarding such laws to ensure they stay compliant and operate smoothly. One of the many mandatory filing requirements that companies functioning in India have to meet is submitting Form 29B to disclose their book profits to the government. Here’s a look at everything you need to know about filing Form 29B the right way.

What is Form 29B of the Income Tax Act?

Form 29B is a crucial document in the Indian Income Tax Act, specifically related to Section 115JB. Here’s a breakdown of its key aspects:

Purpose:

Form 29B helps companies compute and disclose their book profits as per the Income Tax Act.

It enables them to claim the Minimum Alternate Tax (MAT) credit arising from the tax calculated using the Income Tax Act provisions.

Who needs to file it:

All companies where the income is less than 15% of the book profit (effective from Assessment Year 2020-21) are required to file Form 29B.

This means the company’s book profit must be more than 6.67 times its taxable income to be exempt from filing.

Who prepares it:

A Chartered Accountant (CA) appointed by the company must fill and certify the form.

What Is a Zero-Tax Company?

All companies must prepare their account books and other financial documents. The tax liability of companies depends on these accounts and the calculation is done based on the Income Tax Act guidelines. The profits that businesses show in their profit and loss statement are known as book profits, and this serves as the company’s income for taxable purposes. Many companies generate book profits but report nil tax as per income-tax provisions. Indian tax laws define such companies as zero-tax companies. These companies hold substantial book profits but claim deductions such as 80DDB deductions and exemptions under the IT Act, and hence reduce their tax liability to zero.

What Is the Minimum Alternate Tax?

Since having too many zero-tax companies reduces the overall revenue generated by the government, they are actively trying to bring these under the IT Act. The government introduced Section 115JB under The Finance Act, 1987 to bring such companies under the purview of the Income Tax Act. As per Section 115JB, companies have to pay a minimum alternate tax, better known as MAT, of 18.5%. Hence, book profits highlighted by the company are liable to a tax rate of 18.5%.

To better understand this concept, let us use an example. Imagine a company earns book profits of ₹10 lakhs before any deductions are allowed, such as depreciation. Accordingly, the company must pay 18,5% MAT, equated to ₹1,85,000 .

What to Know More About Form 29B?

- All companies that fall under the purview of Section 115JB have to file a Form 29B report. The company must hire a professional chartered accountant to fill and submit this form to the Income Tax department

- Form 29B is a document that helps certify that the company’s book profits are following Section 115JB. The description must be submitted or reported electronically before the company files the rest of its IT returns

- Companies must submit Form 29B in a format prescribed by the government. Hence, it is advisable to take professional help for the same to avoid errors and penalties at later stages. Service providers such as Vakilsearch can help companies file their returns on time. They prevent them from being liable to pay fines and penalties

- Form 29B must contain details regarding the name, address, nature, and PAN of the company. Additionally, the document must also mention the assessment year of filing and the amount of book profit declared by the company.

What Is MAT Credit?

As per Section 115JB, all companies need to pay the minimum alternate tax and they can avail of MAT credit on the tax paid. As a result, the MAT amount paid in one year can serve as credit in subsequent years. However, there could be a difference in the amount paid under MAT. And the company’s tax liability under regular taxation norms. In such cases, the excess MAT amount paid becomes MAT credit, which companies can carry forward for up to 15 financial years.

for instance Imagine your company paid MAT in excess of ₹2 lakhs in one year. In the second year, you had to pay MAT in excess of ₹1 lakh. In the third year, the excess tax paid by you amounted to ₹4 lakhs. Hence, by the end of four years, the company has accumulated a total MAT credit of ₹7 lakhs. Imagine that, in the fourth year, the company pays ₹5 lakhs as MAT, wherein the tax liability was ₹9 lakhs.

In such cases, the company can use its MAT credit to pay the additional tax liability they owe the government. As a result, the company saves a substantial amount by setting off its credit from past years. In the next year as well, the MAT amount is less when compared to the actual payable amount. Hence, the company can use its balance MAT credit to pay off its dues.

Looking for an easy way to compute your taxes? Try our income tax calculator. The salary income tax calculator is perfect for salaried individuals.

How is Form 29B to be filed?

The form can be filed online through the e-filing portal or offline using the offline utility provided by the Income Tax Department. It needs to be filed one month before the due date for filing the return under Section 139(1) or along with the return of income submitted in response to a notice under Section 142(1)(i).

Before you begin:

- Ensure you meet the eligibility criteria: Only companies where book profit is more than 6.67 times their taxable income need to file.

- Appoint a Chartered Accountant (CA): They will prepare, certify, and upload the form.

Online Filing:

- Log in to the e-filing portal: Using your user ID and password.

- Navigate to e-File > Income Tax Forms > File Income Tax Forms.

- Select Form 29B from the available forms.

- Assign a Chartered Accountant (CA): If you haven’t already, use the “My CA” service to assign a CA with a valid Digital Signature Certificate (DSC).

- Enter the Assessment Year for which you’re filing.

- Attach the necessary documents: This usually includes the CA’s report and any supporting documents mentioned in the report.

- Review and submit the form: Carefully review all information and digitally sign the form using your DSC.

- Track the status: You can track the processing status of your form on the e-filing portal.

Offline Filing:

- Download the Form 29B offline utility

- Fill out the form: Consult your CA for assistance in completing the form accurately.

- Prepare required documents: Similar to online filing, attach the CA’s report and any supporting documents.

- Validate the form: Use the offline utility to validate the form for any errors.

- Submit the form physically: Submit the validated form and documents at the designated Income Tax office.

- Acknowledge receipt: Obtain an acknowledgement receipt from the office for your records.

Important reminders:

- Ensure the CA’s DSC is valid and registered on the e-filing portal.

- File the form one month before the due date for filing the IT return under Section 139(1) or along with the return if submitted under Section 142(1)(i).

- Keep a copy of the submitted form and acknowledgement for your records.

Why File Form 29B

Companies must calculate the tax due under MAT and as per standard tax laws and pay the larger amount as their tax liability. If the MAT amount is comparatively higher, then the company must pay the MAT liability is calculated based on their book profits. Form 29B is the document that specifies the company’s book profits and hence is an integral part of staying tax compliant. Additionally, Form 29B is a critical report that helps companies claim MAT credit. Hence filing 80 DDB is mandatory as per the IT Act. It is beneficial for the companies as it helps them claim the MAT credit they are due.

What is the Penalty if I Fail to File Form 29B?

According to Section 271BA, if you fail to obtain the audit report and file Form 29B before the due date, you will be liable to pay a hefty penalty. The penalty for late filing of Form 29B can be as high as Rs 1,00,000 in some cases. However, Section 273B states that if you can state an appropriate reason for failing to file the form on the due date, you are not liable for any penalty under Section 271 BA.

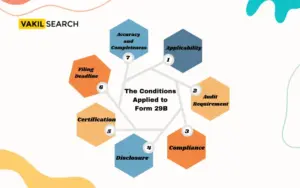

Which are the conditions applied to Form 29B?

Form 29B is typically associated with the Income Tax Act of India, specifically related to the audit report under section 115JB of the Income Tax Act, 1961. This form is required to be submitted by companies that fall under the purview of Minimum Alternate Tax (MAT). Conditions applied to Form 29B may include:

- Applicability: Form 29B is applicable to companies that are liable to pay tax under section 115JB of the Income Tax Act, 1961, which deals with the MAT provisions.

- Audit Requirement: Companies falling under the purview of MAT are required to get their accounts audited by a Chartered Accountant and obtain a report in Form 29B.

- Compliance: The form needs to be filed accurately and in compliance with the provisions of the Income Tax Act and relevant regulations.

- Disclosure: The form requires detailed disclosure of financial information, including computation of book profits as per section 115JB and reconciliation of the same with the financial statements prepared as per the Companies Act.

- Certification: The audit report in Form 29B needs to be certified by the auditor who conducted the audit of the company’s accounts.

- Filing Deadline: The form should be filed within the due date prescribed by the Income Tax Department, typically the due date for filing the company’s income tax return.

- Accuracy and Completeness: The information provided in Form 29B must be accurate, complete, and supported by relevant documents and explanations wherever necessary.

These are general conditions that may apply to Form 29B, but specific requirements may vary based on updates to the Income Tax Act and relevant regulations. To know the updated regulations, please feel free to contact our Vakilsearch experts.

How We Can Help

All companies that have a book profit need to pay minimum alternate tax: https://www.incometax.gov.in/iec/foportal/, and Form helps disclose this profit amount through an audited report. Not only is this a mandatory compliance requirement, but it also helps companies claim credit in subsequent years. Hence, business owners must ensure such filings occur accurately, routinely, and without any hiccups. Since ITR 7 form is of utmost importance to companies, most businesses rely on third-party service providers to ensure smooth filing and submission. Vakilsearch can help your business carry out this filing with ease, taking a load off your plate when it comes to maintaining compliance. To kickstart your filing, reach out to our representative, and schedule a meeting with our legal experts at the earliest!

FAQs

Is Form 29B mandatory in case of loss?

Yes, Form 29B is mandatory for companies, including those incurring losses, that fall under the purview of Minimum Alternate Tax (MAT) as per section 115JB of the Income Tax Act, 1961. Even if a company is incurring losses, if it is liable to pay tax under section 115JB, it needs to get its accounts audited and submit Form 29B.

What happens if Form 29B is not filed?

Failure to file Form 29B by the due date can lead to penalties and consequences as per the Income Tax Act. The company may be subject to penalties for non-compliance, and the Income Tax Department may take necessary enforcement actions.

Can I file Form 29B after the due date?

Yes, you can file Form 29B after the due date, but it is advisable to file it as soon as possible to avoid penalties and consequences for late filing. However, filing after the due date may attract penalties as per the provisions of the Income Tax Act.

What is Section 29B?

There is no Section 29B in the Income Tax Act of India. However, Form 29B is associated with Section 115JB of the Income Tax Act, which deals with the provisions of Minimum Alternate Tax (MAT) applicable to companies.

Is it mandatory to file Form 29B every year?

Yes, if a company falls under the purview of Minimum Alternate Tax (MAT) as per section 115JB of the Income Tax Act, it is mandatory to file Form 29B every year along with the company's income tax return.

What is invalid format for ARN in Form 29B?

The term ARN typically stands for Application Reference Number. An invalid format for ARN in Form 29B could refer to an incorrect or improperly formatted Application Reference Number. It's essential to ensure that all details provided in the form, including the ARN, adhere to the prescribed format to avoid rejection or processing delays.

What is convergence date in Form 29B?

The term convergence date in Form 29B refers to the date on which the financial statements prepared as per the Companies Act converge with the book profits computed as per section 115JB of the Income Tax Act. This convergence date is crucial for reconciling the financial information presented in the audit report.

Can Form 29B be amended once submitted?

Yes, Form 29B can be amended after submission. If errors or changes are discovered, you can submit a revised Form 29B to correct the information. It’s important to ensure the revised form is accurate to avoid issues with tax assessments.

Is UDIN required For Form 29B?

No, a UDIN (Unique Document Identification Number) is not required for Form 29B. This form, used for tax audit purposes, does not mandate a UDIN as part of its submission process.

What is the rule 29b of the income-tax Rules 1962?

Rule 29B of the Income-tax Rules 1962 pertains to the audit report under section 44AB of the Income Tax Act. It specifies the form and manner in which the audit report should be prepared and submitted by a Chartered Accountant for the purposes of tax compliance.

What is the tax audit clause 29B?

The tax audit clause 29B refers to the specific requirements outlined in Rule 29B related to the preparation and submission of tax audit reports. It ensures that the audit report is completed in accordance with prescribed guidelines and accurately reflects the financial status of the taxpayer.

What is Section 2(29B) of the Income Tax Act?

Section 2(29B) of the Income Tax Act defines 'tax audit report' as the report required to be furnished under section 44AB. This section details the obligations of taxpayers and auditors in ensuring compliance with tax audit requirements.