Employees of the Central and State Governments will benefit from the National Pension System (NPS), a government programme that was implemented. Read this blog to know more about the NPS login.

In the past, only government employees in India had access to a steady stream of pension funds to support their living standards after retirement. This was known as a “Pension-less” society. Professionals in the private sector and those who worked for themselves had to make retirement plans. The National Pension Scheme is the government’s effort to turn India into a “Pensioned” society and provide everyone with security during their senior years. This blog discusses about NPS Login in detail.

What is NPS or National Pension Scheme?

The acronym NPS stands for National Pension Scheme. It is a retirement savings strategy created especially for working individuals. The central government of India established the NPS scheme to address the financial needs of seniors in their post-retirement years.

Under the NPS programme, each participant must make a regular investment, which is subsequently placed in various marketable investment instruments. The invested collection is returned to the person as a pension payment once they reach retirement age, typically 60 years. During the employment period, participation in the plan is optional and more details would be available after NPS Login.

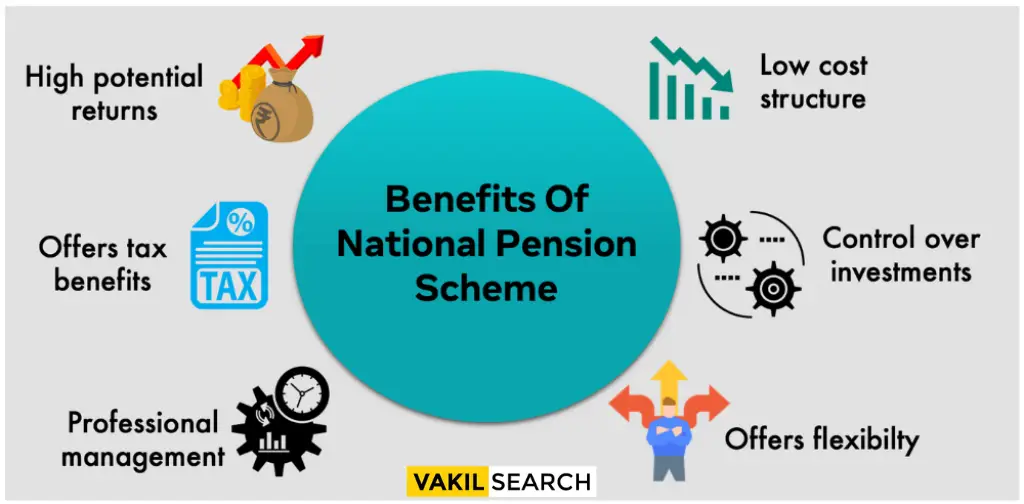

Benefits of NPS (National Pension Scheme)

The Permanent Retirement Account Number (PRAN), the cornerstone of the National Pension System (NPS), is given to each subscriber. To encourage saving, the government of India has strengthened the program’s security and offered some enticing benefits to NPS account users.

An NPS Account provides the following advantages:

- Regulated: PFRDA (Pension Fund Regulator, Ministry of Finance, Government of India), which provides transparent regulations governing the activities, regulates NPS. Regularly, NPS Trust checks to see if the guidelines are being followed.

- Voluntary: It is a volunteer programme available to all Indian nationals. You can invest any amount of money in one’s NPS account at any moment.

- Flexibility: Users can choose or modify the fund manager, POP (Point of Presence), and investment strategy. This guarantees that you may maximise profits based on your comfort level with different asset classes and fund managers (equity, bond funds, government securities, and alternative assets).

- Economical: NPS is among the most affordable investment options and all details about these can be viewed after NPS Login is done.

- Portability: Regardless of changes in work, city, or state, NPS accounts or PRANs will remain the same.

- Transfer of Superannuation Funds: NPS account holders are not subject to tax consequences when transferring Superannuation Funds to respective NPS accounts. (Following endorsement by appropriate authorities)

Click Here to Explore More About: NPS Calculator

NPS Registration Methods

Online Method

To open a new NPS account, you must include the following details on your NPS registration form.

- Choose the NPS Model you are registering for, such as Central Govt, State Government, Corporate, or as an individual

- All of your personal and professional information, including your identity, residence, date of birth, phone number, educational background, occupation, and income, must be provided

- Your bank account information must be entered, including the bank details, bank, branches, IFSC, MICR code, etc to obtain NPS Login after registration

- You must name and specify a beneficiary who might receive the funds in the event of your passing

- If you want to open an account, choose a Tier-II account. By default, a Tier-I account is created with an NPS registration

- Choose a manager for your pension fund. There are now eight alternatives available. You can decide to choose just one fund manager

- Select the investment ratio you want to use while buying various securities by clicking on it

Offline Method

- You must bring a properly completed NPS registration form, a recent photo, and a check or demand draft for said initial contribution to the closest NSDL office or PoP.

- You will get a PRAN after submitting your form offline to the NSDL (Permanent Retirement Account Number). Every transaction involving your NPS account must be completed using this number, which will serve as your identification for the account.

NPS Login

- You can now log in to your E-NPS account through various channels, such as the NSDL NPS site, the KARVY portal, or your online banking account, once your NPS registration is done, and your PRAN has been assigned to you.

- Here is a step-by-step tutorial to assist you in accessing your PRAN account.

Through NSDL NPS Portal

- Visit the NSDL NPS website at www.npscra.nsdl.co.in

- You should click the button that says “Open your NPS Account/Contribute Online”

- Select the “NPS Login using PRAN/IPIN” button

- You will now be brought to the log-in page

- Enter one’s PRAN and password into the appropriate fields, then click “Submit” to gain access to your E-NPS account.

Suppose this is your first time accessing your account. In that case, you must make a new password by complying with the steps listed below:

- Visit the NSDL NPS website at www.npscra.nsdl.co.in

- The “Open your NPS Account/Contribute Online” button should be clicked

- Select the “NPS Login using PRAN/IPIN” button

- You will now be brought to the log-in site

- To create a new password, click the option labelled “Password for e NPS”

- Your PRAN, birthdate, new password, confirm password, and a captcha must all be entered here. Once all the information has been input, press the submit button

- One Time Password will be sent to the registered mobile number. Input this OTP to validate your new password on the screen

- You can now use your PRAN and new password to sign into your E-NPS account.

Through Karvy NPS Portal

- Visit E-F.karvy.com to access the authorised Karvy NPS portal

- “NPS Login for existing subscribers” should be clicked

- The login screen will now be visible

- To access your E-NPS account, input your PRAN and password.

You must complete the following steps when signing in for the first time:-

- Click the “Click here to generate password/reset your password” option on the NPS login screen

- You will now be required to input your PRAN, birthdate, and captcha. You will get a Verification code on your registered mobile number after you click “Submit”

- Now that you have entered this OTP, you can change your password

- You can access your E-NPS account by using the new password you have set.

Through Internet Banking

Many banks allow you to use online banking to access your e-NPS account. To verify the information of your account, you must log into your online banking account and navigate to the NPS website. Using your internet banking screen after performing NPS Login, you may manage every aspect of your NPS account, including contributions, scheme selections, and other tasks.

FAQs on NPS Login

What happens if an NPS account holder dies after 60 years?

All the reserve in NPS accounts may be withdrawn by a subscriber's nominee/assignee. However, if an employee of the government dies, the purchase of a annuity plan is compulsory. The Nominee may not withdraw the full amount.

When can one withdraw funds from NPS?

One can withdraw funds from NPS as per the below-mentioned criteria:

--> Withdraw at Age 60/Retirement: Invest up to 60% of the corpus accumulated in the NPS and the remaining 40% of the corpus amount in monthly annuity purchases. You can withdraw 100% corpus of your NPS account if your accumulated assets are less than Rs. 2,00,000.

-->Withdraw Before Retirement: Only 20% of the corpus can be withdrawn and the remaining 80% must be invested to purchase monthly pension annuities.

-->Withdraw in case of death: Employees of the Government must purchase a annuity plan and can withdraw a certain amount. Other collaborators can delete the entire corpus of one's NPS account.